It's the definition of "failing upwards." It's become almost rote that when executives resign in disgrace they get to walk away with massive paydays.

This time around, though, there may be some small measure of comeuppance after Wells Fargo CEO John Stumpf, under fire after his bank was caught creating 2 million accounts that may not have been authorized by customers in order to rack up fees, announced he will forfeit $41 million in stock awards.

Although Stumpf has yet to resign, the bank's independent board of directors is reportedly livid with his handling of the scandal — and the knives are clearly out.

The news comes a day before Stumpf was to testify to Congress, and a week after he was grilled in a Senate hearing on Wells Fargo's questionable cross-selling practices.

The move may be "more about optics than substance," according to Isaac Boltansky, an analyst at Compass Point Research & Trading, who told Bloomberg the clawback would do little to mollify irate lawmakers or their constituents. And it's only a portion of the total $200 million he stood to receive, should he resign in the fallout.

Related: Wells Fargo CEO to Forfeit $41M in Stock

Executives who are shot out of the cannon after a crisis only to float down on a golden parachute galls the public's sense of righteous indignation, but experts say there are some very good business reasons for the robust severance pay.

"Taking a risk might be right for shareholders, but the CEO might not do it if it could cost him his job,” Wharton finance professor Luke Taylor told a university publication. “Somehow, with this cushion, a CEO is willing take risks.”

When a leader is nudged to walk the plank, it can "facilitate a smooth and efficient transition from the previous CEO to a new one," wrote Indiana University professors Eitan Goldman and Peggy Huang in a 2010 study. Their research found that prior to a CEO's exit, severance contracts were in place for only 13 percent of Fortune 500 top executives who stepped down between 1993 and 2007 — but 47 percent got a bonus when they left. In other words, some of these CEOs were encouraged to go quietly.

Here are some other times when an executive's fall from grace was cushioned by a big pile of cash:

Roger Ailes, $40 million

POSITION: Chairman, Fox News

WHAT: Sexual harassment claims and a lawsuit alleged that Ailes demoted and fired female anchors and other employees who rejected his overtures.

WHERE ARE THEY NOW: Ailes has been advising Donald Trump's presidential campaign.

Jeff Smisek, $29 million

POSITION: CEO, United Airlines

WHAT: A federal investigation found the airline had added back a money-losing flight between Newark and Columbia, South Carolina. An official with Port Authority, which oversees Newark airport, happened to own a weekend house near Columbia, and had whinged about the flight being dropped.

WHERE ARE THEY NOW: Smisek's initially reported severance of $8.4 million was later found out to be $20 million higher, on the condition that he cooperated with investigators following his resignation.

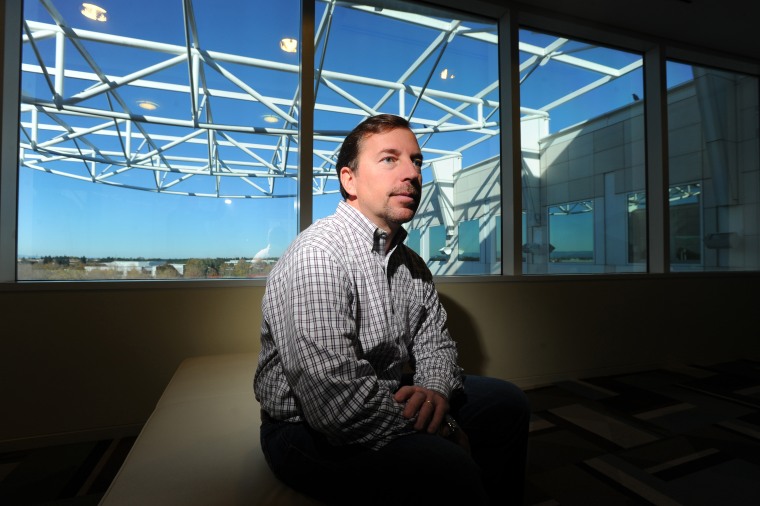

Scott Thompson, $7 million

POSITION: CEO, Yahoo (for four months)

WHAT: Claimed he held a bachelor's in computer science and accounting, but he only had the second one. Was able to keep his signing bonus but got no severance.

WHERE ARE THEY NOW: Thompson is the CEO of ShopRunner, an online shopping service.

Mark Hurd, $35 million

POSITION: CEO, Hewlett Packard

WHAT: Stepped down amid sexual harassment claims by an adult movie actress, who claimed Hurd had hired her as a company hostess and then made advances on her his hotel room. Hurd's replacement was ousted after 10 months on the job — and received $10 million in severance.

WHERE ARE THEY NOW: Hurd is the CEO of Oracle Corporation.

Robert Willumstad, turned down $22 million

POSITION: CEO, AIG

WHAT: His firm sold financial instruments that underpinned the mortgage bubble and was bailed out by the government in the 2008 crash. In a marked contrast to other ousted execs, Willumstad wrote in a letter to his successor, "I prefer not to receive severance payments while shareholders and employees have lost considerable value in their AIG shares."

WHERE ARE THEY NOW: Willumstad is an adviser to a private equity firm he founded in 2007, and chairman of the board of trustees of Adelphi University, which named its business school after him, following his $9.5 million donation.