On December 21, 1954, a woman named Dorothy Martin thought the world was going to end. Martin, a Chicago housewife, claimed to have received a message from aliens, warning her of an impending flood that would kill everyone on earth except for true believers, who would be carried away to safety on a flying saucer. For months, Martin had been gathering a band of followers who called themselves the Seekers and quietly prepared for their alien abduction. The Seekers left behind family and friends, sold their possessions, and on December 20, they waited. When midnight came, they waited some more.

When they realized the flying saucer wasn’t going to come, and that Martin’s prophecy had been wrong, something odd happened: Rather than giving up, the Seekers began furiously calling up newspapers and trying to spread their message as widely as possible. In order to overcome the cognitive dissonance of their situation and convince themselves their sacrifices had been worthwhile, they needed to proselytize.

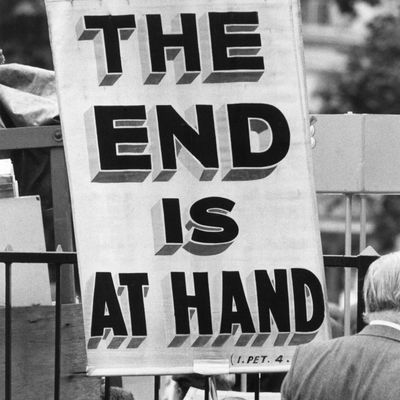

This is, we now know, a psychologically normal response for prophetic groups whose central predictions fail to come true. And today, you can see something similar going on with another group of failing zealots. I’m talking about the cult of Bitcoin.

For months now, Bitcoin soothsayers have proclaimed that the virtual currency is going to Change Everything. The mass adoption of Bitcoin, they told us, would utterly transform the way the world stores and exchanges value. Government-backed currency would become obsolete. Farmers in Kenya would use the same Bitcoin-based payment systems as cafés in the Mission. With the future of money in the hands of Satoshi Nakamoto’s brilliant protocol, inexact central planning would be replaced by algorithmic decentralization.

Of course, none of that has happened. And it’s exceedingly likely that none of it will.

You’ve probably heard about the bankruptcy of Mt. Gox, a former Magic: The Gathering card exchange that morphed into Bitcoin’s largest trading floor before being wiped out by a nearly $500 million heist. But even before that, new knocks to Bitcoin were coming fast and furious: the arrest of Bitcoin prodigy Charlie Shrem; the consolidation of Bitcoin mining operations in a way that threatened to undermine the rules of the currency itself; the successive (and utterly predictable) shutdowns of Silk Road and Utopia. Today, another nail hit the coffin courtesy of Flexcoin, a so-called “Bitcoin bank” that announced that all its users’ accounts had simply vanished.

These may seem like isolated incidents, but together, they add up to a massive, damning breach of trust. I don’t doubt, as Nobel laureate Robert Shiller put it last week, that “something good can arise from [Bitcoin’s] innovations.” But Bitcoin itself will never recover from these initial pratfalls. Partly this is because lawmakers and regulators, spooked by early hype and the Mt. Gox disaster, are never going to afford Bitcoin services the kind of autonomy they’d need in order to flourish. Partly it’s because there are conceptual problems with the Bitcoin architecture itself. And partly it’s because Bitcoin’s anarchic roots are too fringe to draw in the masses. In the mind of the average American, the currency is now synonymous with theft, drugs, and techno-wizardry. These impressions do not a global currency make.

As Bitcoin stumbles, the community growing up around it has only become more fervent. Their beliefs are barely falsifiable. Their leaders give lengthy sermons and call fellow adherents “brothers.” It has never been enough for this group to have supported the rise of a nifty new experimental currency – what they want, and what they believe is coming, is the dawn of an entirely new age.

You can find many of the loonier Bitcoin proclamations on the r/bitcoin subreddit. (One recent call-to-arms, written by Bitcoin entrepreneur Erik Voorhees, included lines like “We are building a new financial order, and those of us building it, investing in it, and growing it, will pay the price of bringing it to the world.“) But they appear in more mainstream places as well. Investor Marc Andreessen’s Bitcoin manifesto (in which he said that “the consequences of [Bitcoin] are hard to overstate”) appeared on the New York Times’s DealBook. Bitcoin Investment Trust founder Barry Silbert

is quoted in places like The Wall Street Journal extolling the virtues of the virtual currency. (“2014 will be the year of bitcoin on Wall Street,” he said.)

Ask any of these Bitcoin believers about any of the recent incidents, and they will defend the currency with religious fervor. It’s good when black-market drug peddlers and money launderers are taken out of the system, they say, because it makes room for more legitimate Bitcoin operations. Charlie Shrem was a naïf who got ahead of himself. Mt. Gox was taken down by “transaction malleability.” The problem is with the immature Bitcoin architecture, not with Bitcoin itself.

But these are head-fakes, meant to distract from Bitcoin’s disastrous move to the mainstream while consoling believers about the current state of affairs. There are already horror stories from those who have entrusted their life savings to Bitcoin, only to lose most or all of it when an exchange collapsed. Emin Gün Sirer, a computer science professor at Cornell who has studied the crypto-currency, sums up the state of Bitcoin in a way that almost makes you feel sorry for the remaining faithful:

Bitcoin, at the moment, is in a slump, with a community that has become its own parody … The Bitcoin masses, judging by their behavior on forums, have no actual interest in science, technology or even objective reality when it interferes with their market position. They believe that holding a Bitcoin somehow makes them an active participant in a bold new future, even as they passively get fleeced in the bolder current present.

Watching some of my friends and colleagues fall under the Bitcoin spell has been dispiriting. It’s one thing for Andreessen, whose venture-capital firm has millions of dollars invested in Bitcoin projects like Coinbase, to spend his time talking his book. It’s another for right-thinking people to conclude that Bitcoin has some kind of real-world potential, based solely on the wide-eyed, group-think-y opinions of the people around them.

The uncomfortable fact for Bitcoin believers is that every major prediction they’ve made has yet to come true. And as time passes and the inevitable fizzle-out of Bitcoin becomes visible, those believers will splinter. More will drop out of the cult. And the ones who remain will only grow more convinced, more zealous, more eager to share the good news.

After all, the difference between the Seekers’ apocalyptic prediction and the Bitcoin dream is that the latter can self-fulfill. The nature of a speculative commodity like Bitcoin is that it essentially runs on hope – the more people who buy the hype, the higher the value goes, and the more firms like Andreessen Horowitz are willing to pump money into strengthening the Bitcoin ecosystem. Wish for the UFO hard enough, and it might actually arrive.

But the Bitcoin dream is all but dead. Now the true believers are trying to cope with their setbacks by increasing their numbers. And if history is any guide, they’ll keep telling you the bright future of Bitcoin is just ahead, long after they’ve ceased to believe it themselves.