Congressional Republicans are cruisin’ for a bruisin’. In competitive districts across the country, Democrats are out-recruiting, out-fundraising, and outpolling their opponents. The GOP is losing more incumbents to retirement (and/or the #MeToo movement) every week. Team Blue leads the generic ballot by 8 percent, and have overperformed by double digits in nearly every special election held in the past year — notching state Senate victories in deep red parts of Wisconsin and Oklahoma in the process. Meanwhile, Donald Trump remains more unpopular than any previous president at this point in their tenures.

When GOP operatives wish to dismiss these ominous signs (and/or sleep at night), they tell themselves the following: Once the public learns what the Trump tax cuts actually do, they will rally to the Republican cause.

There is a sliver of plausibility to this claim. When congressional Republicans passed the Tax Cuts and Jobs Act last fall, polls showed that the bill was the single most unpopular piece of tax legislation offered by either party in the past four decades. But those polls also showed that many Americans falsely believed that the bill did not cut their taxes. While roughly 80 percent of U.S. households will see their tax burdens fall this year, only about one-third of voters told pollsters that they expected their after-tax income to increase.

And some Americans have begun to realize their mistake: Recent surveys have found that the number of voters who expect to benefit from the tax law is rising, along with the legislation’s approval rating. Earlier this month, a New York Times SurveyMonkey Poll showed 41 percent of the public expected a tax cut this year, up from 33 in December — while 46 percent approved the law, up from 37 percent the month before. Polls from HuffPost and CNN recorded similar trend.

While a plurality of Americans still disapproves of the law, Republicans can point to the trend line — and the fact that the tax cuts haven’t actually taken effect yet, but will next month — and predict that vindication will soon be theirs.

But this is (almost certainly) wrong, for at least two reasons. First, while most Americans will materially benefit from the law in the immediate term, for most, that benefit will be microscopic.

As Politico’s Brian Faller writes.

The average person earning between $50,000 and $75,000 will see a roughly $30 increase in their checks, assuming they’re paid biweekly. Some may not notice the increase, especially when all sorts of other things can affect people’s take-home pay, from pay increases to hikes in premiums for employer-sponsored health insurance.

Meanwhile, the GOP’s attempts to brand any and all positive economic developments as consequences of their tax legislation is failing miserably. A Reuters/Ipsos poll released Monday shows that a mere 2 percent of Americans believe they received a raise or benefit increase as a product of the Republican tax law. This is a devastating result, given how much time and energy Republicans have invested into promoting the idea that their law has produced widespread wage increases — and the consequent incentive for stalwart GOP partisans to find some pretense for believing that they received one.

The second, and more fundamental reason why voters are unlikely to celebrate the tax law — once they better understand its substance — is that the law’s substance is deeply unpopular. The Reuters/Ipsos poll, like virtually every survey before it, finds that an overwhelming majority of Americans (58 percent) believe that Trump’s tax cuts primarily benefit the wealthy and corporations, while a tiny minority (13 percent) say they mostly help the middle class. This assessment is entirely accurate. And the past year of public-opinion polling suggests that most Americans oppose large tax cuts for the rich more than they support small ones for themselves.

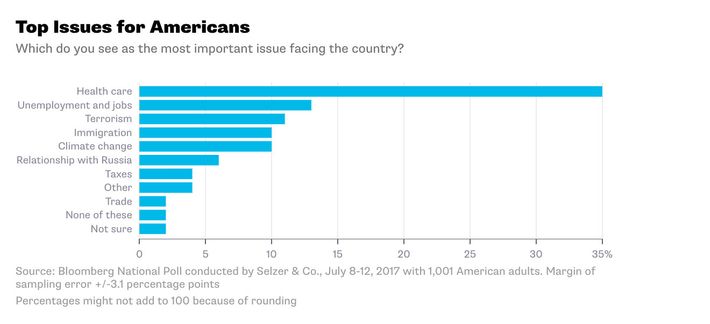

Last April, 61 percent of Americans told Gallup that their income-tax burden was “fair.” When Bloomberg asked voters to name the “most important issue facing the country” three months later, just 4 percent said tax policy.

So: Most Americans did not express an urgent desire for their taxes to be cut last year. But they did tell Gallup, Quinnipiac, the Washington Post — and every other pollster that thought to ask — that taxes should not be reduced on big business or the rich. Meanwhile, other surveys showed more than 80 percent of voters agreeing with statements like “there are different rules for the well-connected and people with money,” and “the wealthy and big corporations are the ones really running this country.”

Given these results, one might conclude that most Americans would object to legislation that slashed taxes on the economic elite, even if it also trimmed rates for the middle class. But no assumption is required. In December 2016, 57 percent of voters told Hart Research that they would disapprove of a tax package that resulted “in very large tax cuts for millionaires and much smaller tax cuts for the middle class.” A subsequent survey by Global Strategy Group found 67 percent of respondents disagreeing with the sentiment, “I do not mind if the wealthiest Americans get a bigger tax cut than I do, as long as I also get some kind of a tax cut.”

All of which is to say: The tax law may get marginally more popular, but there is little reason to believe it will ever become a tailwind for Republicans in 2018 — except, of course, as a proof of concept to the party’s plutocratic investors. In fact, Reuters’s findings suggest that, among voters, the tax law remains a net liability for the GOP:

A quarter of those surveyed, including more than half of Republicans, said they were more interested in voting for Republicans because of the law. Just 8 percent of Democrats and 16 percent of independents said the same.

About a third of respondents, including 62 percent of Democrats, said they were more interested in supporting Democrats due to the tax legislation; just 9 percent of Republicans and 19 percent of independents.

It remains possible that Republicans will hold the House this fall, and even grow their majority in the Senate. The GOP has a massive structural advantage in both the House and Senate maps. But if they do hang on, it won’t be because voters were grateful that — in the face of an opioid epidemic, decaying infrastructure, and rising health-care costs — Republicans decided to make a giant, regressive tax cut package their top policy priority.