In the summer of 2012, Barack Obama informed America’s capitalists that they were not the sole authors of their success. “If you were successful, somebody along the line gave you some help,” the president explained. “Somebody invested in roads and bridges. If you’ve got a business — you didn’t build that. Somebody else made that happen. The internet didn’t get invented on its own — government research created the internet so that all the companies could make money off the internet.”

The Republican donor class recoiled in horror at this declaration of “class war.” In fact, Obama’s suggestion that the Mitt Romneys of the world hadn’t built their fortunes off gumption, alone — but rather owed some portion of their wealth to the existence of publicly financed infrastructure, technology, schools, and law enforcement — struck Paul Ryan’s party as so manifestly outrageous and out-of-touch, they made a refutation of it the centerpiece of their national convention.

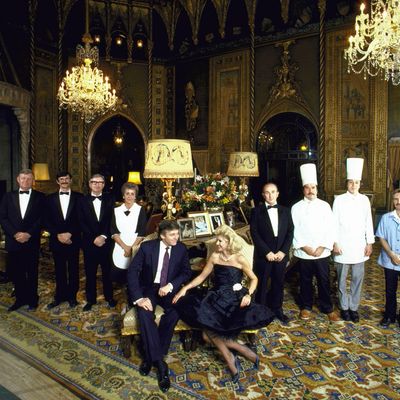

Four years later, the GOP’s billionaire standard-bearer developed a (characteristically) narcissistic variation on Romney’s mantra, telling crowds, over and over again, “I built what I built myself.”

On Monday, the New York Times revealed that this wasn’t just false in the Obamanian, “actually, social institutions made your entrepreneurial triumphs possible” sense, but in a much more literal one: Donald Trump “built what he built” with $413 million of his father’s money — much of which Fred Trump effectively stole from the federal Treasury.

Drawing on a “vast trove of confidential tax returns and financial records,” the Times demonstrates that Trump leaned on his father’s largesse for the entirety of his career. Shortly after he was out of diapers, Donald Trump was “earning” $200,000 a year from the family business. By the time he was 8, the mogul was a millionaire. From that point until his father’s death, Donald used his dad as a piggy bank, financing a series of failed business ventures with “loans” from Fred that he only occasionally repaid. And when his father went up to the great, garish penthouse in the sky, Trump used a variety of schemes to cheat the U.S. government out of roughly $500 million in estate taxes.

The Times investigation is, first and foremost, an indictment of an individual billionaire’s claim to self-made status. But in moments, the report hints that Trump’s approach to amassing wealth (like his approach to so much else) is just an unusually obscene variation on the one percent’s standard operating procedure. For example, one of the Trump family’s primary methods of tax evasion was to grossly underestimate the market value of their properties. To do this, they enlisted the services of a property appraiser who was willing to baldly lie to the government on their behalf. You might guess that this individual would have been one of Donald’s infamous Mob associates, or else, some sleazy mediocrity like Michael Cohen; in reality, it was Robert Von Ancken — the go-to appraiser for just about all of “New York City’s big real estate families.”

As Obama once noted, no billion-dollar fortune is ever fully earned by the person who amasses it. Many of our era’s great entrepreneurs built their empires by finding a novel application for technologies developed by the government — and then, using America’s aberrantly strong intellectual property laws to secure themselves a gargantuan stream of rentier income. Others found ways to extract wealth through socially useless financial chicanery, or socially cancerous white-collar dope-slinging.

That said, no small amount of the one percent’s wealth is unearned and ill-gotten in the most colloquial, uncontroversial sense. In the 2016 Survey of Consumer Finances, America’s one-percenters reported an average inheritance of $1.47 million. And that figure is based on solely on how much one percenters admit to inheriting — which, if Trump is any guide, is likely orders of magnitude less than they actually inherited.

Meanwhile, Trump is hardly the only fat cat in the U.S. who’s been dining out on the Treasury Department’s rightful dimes. Thanks in no small part to the congressional GOP’s tireless efforts to defund the IRS’s enforcement operations, American business owners evade roughly $125 billion in taxes each year — enough revenue to finance, for example, universal public day care and a child allowance large enough to lift 3.2 million American kids out of poverty.

And wealthy individuals evade even more. As of 2013, the global superrich were storing between $21 trillion and $32 trillion worth of hidden financial assets in offshore tax havens, according to a study authored by James Henry, the former chief economist at McKinsey & Co.

In this age of right-wing “populism,” Republicans take pains to cultivate a downward-looking class resentment in white Middle America. Trump and his allies rail against “the illegals” who run roughshod over our nation’s laws, and the shiftless “takers” who live off the toil of the forgotten man and woman. But such invective better describes the residents of Mar-a-Lago, than those of ICE’s tent prisons, or NYCHA’s public housing. And there’s reason to think that Democrats would benefit from giving Trump’s reactionary plutocrats a taste of their own demagogic medicine.

In no small number of swing states and districts in the U.S., the balance of power is settled by cross-pressured white voters — ones whose (upward-looking) class resentments pull them toward Democrats, even as their racial, social, and cultural antipathies draw them toward the Trumpen proletariat. When Democrats appeal to the former resentments — as Obama did in 2012, and Congressman Conor Lamb did in western Pennsylvania earlier this year — they often win enough of his demographic to secure a majority coalition. When Hillary Clinton chose to deemphasize class antagonism in 2016, resentment of the rich became much less predictive of voting behavior, and Trump painted the Rust Belt red.

The best way to activate a political identity is to offer voters an outgroup they can define themselves against. When Trump decries the violence of homicidal illegals, and the treasonous “globalism” of the liberal elite, he activates his voters’ identities as proud U.S. citizens, and working-class rural dwellers. If Democrats want more white, non-coastal voters to cast their ballots on the basis of their resentment of the rich, then they’re going to have to wage a little class war.

And the true story of Trump’s fortune provides a promising line of attack: Lawless takers like our president and his corporate donors run roughshod over our nation’s laws, take American jobs by hoarding capital that could be productively invested in new enterprises, leech off taxpayers’ rightful money instead of working for a living, and violate the sanctity of our nation’s borders by moving their ill-gotten gains illegally across it.

Encouragingly, Democratic messaging appears to be moving in this general direction:

Beyond the electoral utility of this populist rhetoric, such an appeal could also lay the groundwork for a future Democratic government to tackle the scourges of wealth inequality and mass tax evasion, head-on. Now, any serious policy for combating the latter would have to be international in scope. But the United States is still the world’s most powerful nation. If our government made cracking down on tax havens its top priority in trade negotiations (as opposed to its current priority of making life-saving pharmaceuticals less affordable for the global poor), and at various world economic summits, it could surely prevent significant amounts of revenue from escaping the public coffers. Of course, doing so would likely require the U.S. to crack down on its own internal tax havens, and cease allowing foreign oligarchs to launder money through American real estate. But that’s no skin off the “forgotten man” or woman’s back.

Once the landmark, international agreement on tax enforcement is inked, Democrats can turn their attention to increasing funding for IRS enforcement (a big-government program that would genuinely pay for itself); raising taxes on capital gains, financial transactions, and estates; and equalizing the distribution of wealth on the front-end, through the establishment of a social wealth fund, baby bonds, or some other instrument that allows ordinary Americans to enjoy some of the passive wealth that we, as a society, collectively build.