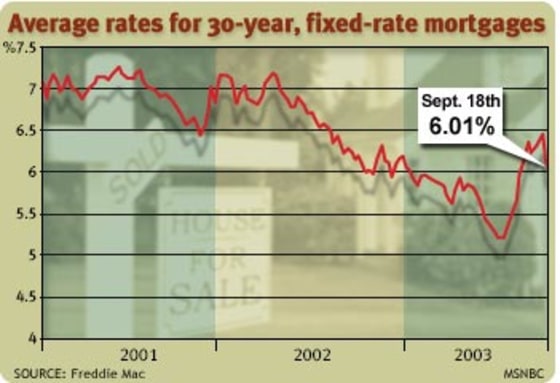

Average interest rates on 30- and 15-year fixed-rate mortgages fell in the latest week to their lowest averages in almost two months, Freddie Mac said Thursday.

Thirty-year mortgage rates averaged 6.01 percent this week, the lowest since 5.94 percent in the week ended July 25 and down from 6.16 percent a week ago, Freddie Mac said.

Fifteen-year mortgages also inched downward in the latest week, to an average of 5.30 percent, also the lowest since the July 25 week, when they stood at 5.27 percent. Last week’s rate averaged 5.46 percent.

One-year adjustable rate mortgages followed the downward trend, dropping to an average of 3.81 percent from 3.87 percent last week.

A year ago, 30-year mortgages averaged 6.05 percent, 15-year mortgages 5.47 percent and the ARM 4.28 percent.

“Although refinancing has fallen off somewhat, home buying activity remains vigorous, unfazed by market chatter that the end of the housing boom is near,” Frank Nothaft, Freddie Mac chief economist, said in a statement.

“Financial markets are feeling more confident that the Fed will not raise rates any time soon. Add to that the fact that recent economic data shows core inflation is less than the market expects, and we see mortgage rates drop once again,” he said.

The Fed on Tuesday opted to keep interest rates at 45-year lows and said rates could remain low for “a considerable period.” Also Tuesday, the Labor Department said U.S. August consumer prices rose 0.3 percent. Excluding food and energy, prices were up 0.1 percent.

On Wednesday, the Commerce Department said U.S. August housing starts fell 3.8 percent to a 1.820 million unit annual rate.

Freddie Mac said lenders charged an average of 0.5 percent in fees and points on 30- and 15-year mortgages, both down from 0.6 percent last week. They charged 0.6 percent on the ARM, unchanged from last week.

Freddie Mac is a mortgage finance company chartered by Congress that buys mortgages from lenders and packages them into securities for investors or holds them in its own portfolio.