When the Democratic presidential contenders square off in their first economic policy debate on CNBC Thursday, front-runner Howard Dean’s fiscal proposals will be on national display. Dean has sold himself to Democratic activists as a tough-minded money manager who will balance the federal budget. So far, he has relied on proposed tax increases to balance the budget and has not offered ideas for reining in spending on the three costliest budget items: Social Security, Medicare and the military.

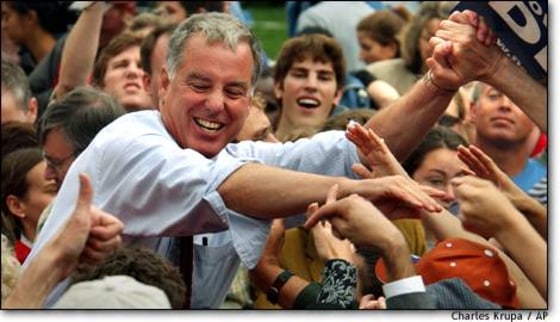

On the campaign trail, no line in Dean’s stump speech delights his Democratic audiences more than when he says, with a sardonic bite in his voice, “No Republican president has balanced the budget in 34 years in this country. If you want to balance the budget and trust your hard-earned money to the federal government, you had better hire a Democrat because you cannot trust the Republicans with your money.”

Dean does not mention that for 26 of those 34 years, his party held big majorities in the House of Representatives and that for 20 of those years Democrats controlled both the House and Senate.

Indeed, in some speeches, Dean promises to draw so many new voters to the polls that his coattails will sweep the Democrats into control of both House and Senate for the first time since 1994.

Dean stakes his fiscal credibility on his record of balanced budgets as governor of Vermont from 1991 until last January.

His record got some validation from his Republican successor, former state Treasurer James Douglas, who noted as he took office as governor last January, “Vermont still enjoys the highest bond rating in New England and has avoided the downgrades experienced by some states in the past year due to the economic downturn.”

But Douglas also said that “in order to maintain a balanced budget over the past two years, the state relied on shifting dollars among funds, depleting rainy day reserves and making rescissions.”

Under Dean, Vermont had one of the highest tax burdens of any state. According to the non-partisan Washington, D.C.-based Tax Foundation, Vermont ranked third among the states in tax collections per $1,000 of personal income.

From 1991 to 2001, a period that included most of Dean’s tenure, Vermont tax collections grew by an average of 7.6 percent a year, while income grew at an average annual rate of only 2.9 percent.

Dean tells his audiences that he will use the same techniques in managing the $2 trillion federal budget as he did in presiding over his state’s budget, which was about $3 billion when he left office.

“If you take care of the money during the good times, then you’ll have money in the bad times. And that’s the way the country ought to be run,” he said in Berlin, N.H., last week. “We ought to run the budget of the United States of America like any business, because that is going to lead to job creation and it is also going to lead to helping those folks who depend on government.”

Despite Dean’s reference to “taking care of the money during the good times,” the federal budget has no rainy day fund or mechanism for reserving revenue for use in future years, as states do in their budgeting.

Dean’s vow to balance the budget rests on two strategies: First, rescind the tax cuts passed by Congress in 2001 and 2003, and second, control spending.

TAX CUT REPEAL

Dean says the tax cuts are damaging to the economy. Moreover, he contends, they “are about starving Medicare and Social Security, undoing the New Deal, that’s what the president wants to do.”

Dean’s repeal of the tax cuts would result in substantial tax increases for middle-class workers.

According to CCH, a non-partisan tax consulting firm, a married couple with an income of $50,000 and two children under age 17, got a $1,133 tax cut from the tax bill passed by Congress in May.

But Dean maintains that “there aren’t any middle-class tax cuts” because legislatures have raised state university tuitions and local school districts have increased property tax assessments in order to get the money to pay for federally mandated special education programs and the testing required under the No Child Left Behind Act.

To his longstanding promise to rescind the tax cuts, Dean added a new and perhaps contradictory pledge last week: “We can have middle-class tax fairness, we’ll show you how to do that in a few weeks.”

RESTRAIN SPENDING

By repealing the tax cuts, Dean vows he’ll wipe out the $1.4 trillion in deficits forecast for fiscal years 2004-2008.

“We’re going to balance the budget and that means we’re going to have spending controls. It’s going to be tough,” Dean said last week. “We’re not going to be able to have huge increases in the budget.”

The three biggest spending items are Social Security, Medicare and the military, which together account for 52 percent of all outlays.

When asked last week how he would restrain the growth of those programs, Dean said, “You don’t have to deal with Social Security because it is a separately funded program. You can’t restrain spending on Social Security because it’s an entitlement, so what you do is you fund it properly.”

Under current law, the first $87,000 of income is subject to Social Security taxes. Dean has proposed making wage earners above $87,000 subject to the Social Security payroll tax.

On Medicare and defense outlays, Dean said, “I have said I would not cut either Medicare or defense. The question is what their rate of growth is going to be.”

Asked whether he’d cut Medicare’s growth rate, currently about 6.5 percent a year, Dean replied, “We have to wait and see. We haven’t looked at the balance sheets of Medicare yet.”

In the mid-1990s, Dean supported Republican attempts to cut Medicare’s growth rate, a stance that has drawn fierce attacks on him in recent weeks from his Democratic rivals, Missouri Rep. Dick Gephardt and Massachusetts Sen. John Kerry.

Speaking last week to a conference of family physicians in New Hampshire, Dean was questioned by a fellow doctor named Gary Sobelson who told him, “You were right when you were governor when you said Medicare costs were going up too fast.”

Referring to the money spent on the elderly under Medicare, Sobelson opined that “we as a society have an expectation we are going to spend as much as it takes to keep people alive and well for as long as they want.”

SPIRITUAL SIDE OF MEDICARE

Instead of addressing the fiscal side of Sobelson’s comment, Dean turned spiritual, saying “we need to somehow figure out how we are going to de-corporatize medicine. Somehow, we have to understand that making everything bigger, more corporate, and better-organized and more efficient does not lead to the kind of spiritual quality that we need in our lives.”

Dean was emphatic in opposing one idea that has drawn some bipartisan support in Congress: making higher-income retirees pay more for their Medicare coverage, an idea known as “means testing.”

“The cost of having somebody like Bill Gates in the Medicare system is very small compared to the cost of making Medicare a poor person’s program,” he told Sobelson.

If Medicare became means-tested and were labeled “a poor person’s program” it would, Dean predicted, be “vulnerable to every right-wing crackpot” who wanted to cut federal spending.

Dean’s defense of Democratic orthodoxy in opposing means testing came at a time when some Democrats are showing the willingness to break with conventional thinking.

Led by California Sen. Diane Feinstein, 11 Senate Democrats voted in June to impose means testing on upper-income Medicare recipients. Ultimately the measure was dropped under pressure from Sen. Edward Kennedy, D- Mass.

INCREASING FEDERAL SPENDING

While vowing to impose fiscal discipline Dean has also offered audiences a spate of new spending ideas.

The Dean initiatives include:

- Aid to small businesses so they could sell loan portfolios on the New York Stock Exchange just as student loan portfolios or mortgage portfolios are marketed by agencies such as Fannie Mae and Ginnie Mae.

- Investments in infrastructure such as roads, bridges, and subway systems.

- A new program that would pay part of the cost of public school construction.

- Subsidies for constructing broadband Internet connections to rural areas.

- Subsides for renewable energy projects.

On Tuesday, the Dean campaign did not have an immediate cost estimate for Dean’s proposals.