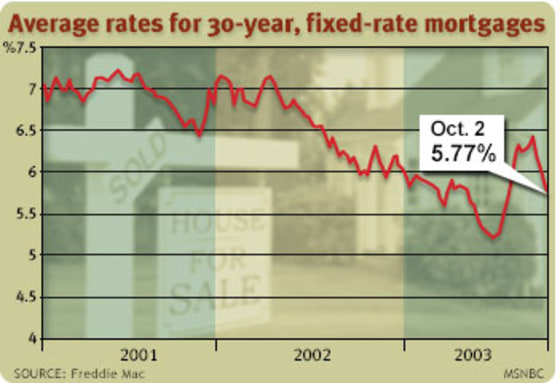

Fixed-term mortgage rates fell by about a quarter-point this week to their lowest levels since July, as concern about the economy roiled bond markets, financing giant Freddie Mac said Thursday.

Thirty-year mortgage rates averaged 5.77 percent this week, down from 5.98 percent last week, the mortgage company said in its weekly survey. Buyers paid an average “point” fee of 0.6 percent of the loan.

It was the lowest level on the 30-year benchmark since mid-July, as rates headed back toward the record lows they achieved in June.

“Plummeting consumer confidence in September led markets to believe that the lack of job growth is wearing on the economy,” said Frank Nothaft, Freddie Mac chief economist. “That brings about the fear that the lack of growth could trigger another lull in the recovery, causing interest rates to tumble this week.”

Mortgage rates are tied to the bond market, where interest rates have been falling sharply this week on the latest mixed economic indicators.

The continued low mortgage rates have been supporting record home sales, as well as a slight resurgence in refinancing activity, which had been moribund.

An index of refinancing activity edged up 3.2 percent in the latest week, according to the Mortgage Bankers Association of America.

Jay Brinkmann, the association’s vice president of research and economics, said that while the latest drop in rates is unlikely to trigger a new wave of refinancing, “it has nevertheless given some borrowers another chance to take advantage of some very attractive rates.”

According to the Freddie Mac survey, the average for 15-year fixed-rate mortgages fell to 5.10 percent this week, with an average 0.6 point, down from last week’s 5.30 percent.

One-year adjustable-rate mortgages averaged 3.72 percent, down from last week’s 3.77 percent, also with an average 0.6 point.

In mid-June, mortgage rates hit the lowest levels ever recorded in the 32 years that Freddie Mac has been conducting the weekly survey. At that time the average for a 30-year, fixed-rate mortgage was 5.21 percent.

Nothaft said the upcoming release of monthly unemployment figures Friday could provide a new view of economy’s status and “potentially alter the momentum of mortgage rate change in the near future.”

Freddie Mac is a mortgage finance company chartered by Congress that buys mortgages from lenders and packages them into securities for investors or holds them in its own portfolio.