President Bush’s plan to pump more money into hydrogen fuel cell research, outlined during his State of the Union address this week, piqued the interest of investors and consumers alike, but analysts warn it might be too early to bank on a new era in the energy business.

In his speech before a joint session of Congress earlier this week, President Bush promised a “new national commitment” to take hydrogen-powered automobiles “from laboratory to showrooms” so that “the first car driven by a child born today could be powered by hydrogen, and pollution-free.”

Bush said his administration, if it receives Congressional approval, will spend $1.2 billion to develop the technology needed for commercially viable hydrogen-powered fuel cells to power vehicles, homes and businesses that produce no pollution and no greenhouse gases.

The aim, the President said, is to “promote energy independence for our country, while dramatically improving the environment.”

For its proponents, hydrogen-powered fuel-cell technology is the power source of the future: an innovation that will reduce U.S. consumers’ reliance on overseas oil and replace the polluting internal combustion engine with nonpolluting, battery-like fuel cell.

How fuel cells work

Unlike traditional methods of power generation — burning oil, coal or gas — fuel cells use hydrogen as fuel. An electrochemical device turns hydrogen and oxygen into water, producing electricity and heat in the process. That electricity can then be harnessed to drive vehicle engines or residential and commercial power applications.

The President’s speech sparked a rally in the shares of companies that develop hydrogen fuel cells — potentially prime beneficiaries of the proposed research funding.

Shares of Ballard Power Systems, Plug Power and Hydrogenics rallied 12.6 percent, 30.6 percent and 21 percent, respectively on Tuesday and Wednesday. Interest in these firms had erupted ahead of the President’s speech as news leaked out that Bush would endorse extra funding for the experimental technology.

But despite the interest caused by the President’s speech, analysts advise caution before rushing out to invest in alternative-energy firms. Most companies in the sector are in the development phase, with few rolling out commercially-viable products. And most of the stocks in the sector are down sharply from their highs of three years ago.

“This is a volatile sector and it has fallen out of favor lately,” said John Quealy, an analyst at Adams, Harkness & Hill. “Most of these companies are in the early stages of development and they are burning a lot of cash.”

A case in point is Ballard Power Systems, a maker of fuel cells for the auto industry and the group’s leader in terms of market capitalization. The Canadian firm’s stock price hit a high of over $100 in the first quarter of 2000, but has since lost 90 percent of its value.

Some analysts skeptical

Still, Gary Holdsworth of Wedbush Morgan Securities sees some value in Ballard Power, albeit short-term. He recently upgraded his bearish “sell” position on the company to a more neutral “hold,” but added his revenue and earnings estimates for the firm remain unchanged.

“Although just a proposal at this stage, [the President’s initiative] serves as a much-needed sentiment boost for fuel cell and hydrogen stocks,” he wrote in a research note, adding that he continues to view Ballard skeptically “as far as its fundamentals are concerned.”

Holdsworth notes that there might be some value in the long-term growth possibilities in the sector, but adds that alternative-energy firms face an uphill battle trying to supplant the internal combustion engine and challenge the entrenched fossil-fuel industry.

David Schoenwald, co-manager of the New Alternatives Fund, which currently has $36.5 million under management and invests in companies in the solar-power and alternative-energy industries, is skeptical that the President’s initiative will have much of an impact.

“Time will tell how this proposal translates into dollars and where they will be allocated,” Schoenwald said, adding that companies in the sector are unlikely to recover until the power market recovers from its current slump caused by overcapacity.

Of the $1.2 billion Bush proposed, $720 million will reflect new spending, adding to the government’s FreedomFUEL project, which aims to develop technologies for hydrogen production and distribution infrastructure. The investment will be spread over five years.

Another initiative, dubbed FreedomCAR, will fund research and development of fuel-cell driven vehicles, according to the Energy Department’s Web site.

Alternative energy may be developing slowly, but there are still some early adopters.

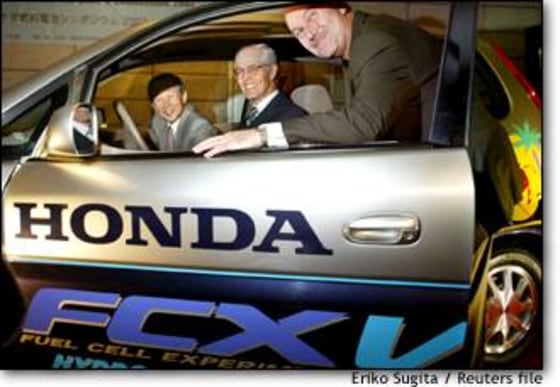

Honda recently delivered a fleet of its FCX car, a fuel-cell powered vehicle with a 170-mile range, to the city of Los Angeles. And both General Motors and Ford are introducing hybrid gasoline-electric powered versions of their most popular automobiles that are low-emission but are not as clean as fuel cells.