The tax-reform proposal unveiled yesterday by Dave Camp, chairman of the House Ways and Means Committee, does something remarkable: It actually reforms the tax code. It doesn’t use the pretense of reform to shift the tax burden off the rich, as Republican “tax reform” plans usually do, and it does not use hand-waving to gesture in the direction of reform without following through. Camp has actually plunged his hands into the guts of the tax code and pulled out item after item. It may be the most impressive and ambitious domestic policy proposal crafted by a major Republican in a generation.

Granted, this is a low bar for a fanatical and brain-dead party, but it’s notable all the same. The criticism from the left is that Camp’s plan fails to increase tax revenue. “The politically driven aim of keeping the amount of overall revenue unchanged,” argues an anti-Camp New York Times editorial, “undermines virtually every useful idea in the plan.” Camp and his conservative allies would say that’s false. If you assume the plan will promote faster economic growth, it will generate hundreds of billions of dollars in higher revenue. Camp has persuaded the Joint Tax Committee to illustrate this cheerful scenario with a projection of what will happen if his plan does, indeed, encourage faster growth. A pro-Camp Wall Street Journal editorial urges Obama to accept that projection as fact and take the deal: “If Mr. Obama is shrewder than usual, he’ll pocket these dollars, call the Camp plan a tax increase on the rich to placate the left and bask in the political glow of more prosperity.”

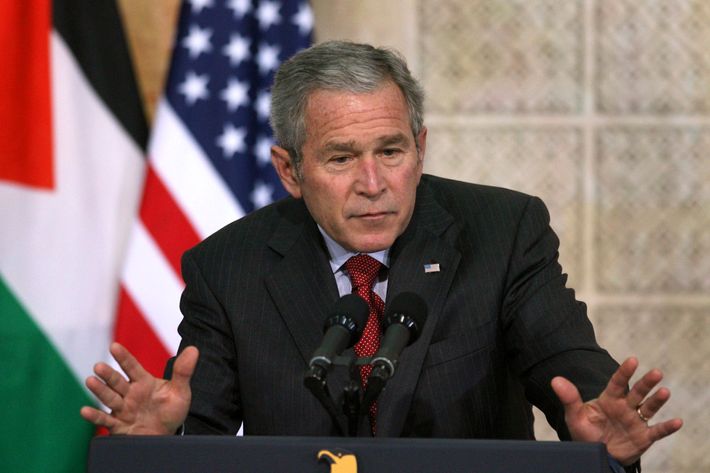

The prospect that tax reform will spur the sort of rapid growth envisioned by its advocates is highly optimistic. But it’s not delusional. Republicans traditionally insist that the incentive effects of cutting tax rates are so powerful they overwhelm conventional economic factors. The Journal editorial page has spent decades building a shrine to the spectacular wrongness of supply-side economics, fervently insisting that Bill Clinton’s 1993 tax hike on the rich would destroy the economy and fail to increase revenue, and then insisting with equal fervor that George W. Bush’s tax cuts for the rich would usher in a new age of prosperity and a gusher of new revenue.

The evidence suggests that cutting tax rates, financed by deficits, does little or nothing to spur economic growth. But Camp’s plan doesn’t do that. It instead reduces tax rates by eliminating preferences in the tax code. Subsidies for home mortgage debt and employer-sponsored insurance, among others, would be radically scaled back. And eliminating these kinds of favoritism encourages workers and businesses to instead follow market signals, and likely to make more market-friendly decisions.

It would surely be better if Camp agreed to draw up a plan that increased revenue, but let’s get real about this. Republicans were never going to agree to higher tax revenue for nothing. The Obama administration and various deficit hawks always hoped to use tax reform to leverage a deal: Republicans would agree to hand over higher revenue in return for cuts to retirement programs. That grand bargain is dead and buried. Liberals are not giving anything away by agreeing to a tax reform that holds revenue constant, unless that thing is a ride on the invisible unicorn of a grand bargain.

At some point, tax revenue will have to come up. Democrats will do that the way they did it when Clinton passed his deficit reduction plan in 1993, and when Obama passed his deficit-reducing 2010 health-care reform: by raising taxes on a party-line vote. Reforming the tax code now would make this prospect neither easier nor harder.

The flaws in Camp’s proposal lie in the details, not in its conceptual goal. It uses a host of timing gimmicks to produce short-term revenue gains that will fade over time. It spares some Republican constituencies, like oil drillers, while gleefully sticking it to green energy. The plan doesn’t appear to raise taxes on the poor overall, but early analysis suggests it raises taxes on some categories of poor families.

Camp’s plan appeals to Republicans because it reduces both the level and the number of tax rates. From the liberal perspective, those are pointless goals. They’re not worth giving up anything to achieve. On the other hand, they’re not incompatible with a useful reform of the tax code. If done right, those elements can bring along conservative support for elements of tax reform that liberals do want.

And Camp does accomplish some of those things. His plan would impose a new fee on large banks (which enjoy an implicit subsidy by virtue of being so large they’re apt to receive a bailout if they fail) and caps the value of tax deductions, both goals embraced by Obama. It eliminates the carried interest loophole. It sets the top tax rate at 35 percent, not the fantastical 25 percent rate proposed by Mitt Romney, Paul Ryan, and other Republicans. Camp is actually committed to the goal of reforming the tax code in a way that maintains (rather than reduces) revenue levels, and holds the relative burden on the rich and poor constant.

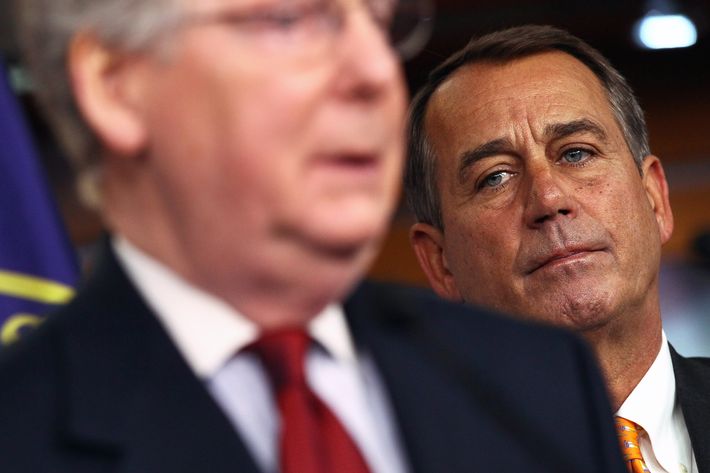

Republican leaders like Mitch McConnell (“no hope”) and John Boehner (“blah blah blah blah”) have dismissed Camp’s plan as a utopian exercise, both because they fear its specific provisions will be used against Republicans, and also because they are soulless hacks. Democrats have, interestingly, refrained from assailing it. If they decide to engage with Camp, they may actually discover a rare patch of agreeable ideological ground. Why not give it a try?