Jonathan Gruber’s candid video commentaries have unleashed the latest in a never-ending round of conservative denunciations of Obamacare, the evilest, sneakiest, failing-est, and most unconstitutional assault of freedom ever. Getting in his licks today is Tevi Troy, former Bush administration health official, who takes to the Wall Street Journal editorial page to denounce Obamacare’s “Cadillac tax.” This insidious levy, writes Troy, has a “creeping reach” and a “deceptive design.”

The Cadillac tax is an excise tax on high-cost health insurance. As Gruber has explained, most economists would like to completely eliminate the tax deduction for employer-sponsored health insurance and replace it with a fairer and more efficient way to subsidize health care. But since this would be experienced as a tax hike by tens of millions of employees, Obamacare instead created a more moderate and politically palatable version of this idea. It only removed the tax deduction for the most expensive health-care plans, thus giving employers an incentive to avoid the more expensive insurance plans. And by imposing the tax on insurers, it allowed advocates to frame it as a tax on insurers rather than on employees. The “tax that starts out hitting only 8% of the insurance plans essentially amounts over the next 20 years [to] essentially getting rid of the exclusion for employer-sponsored plans,” explained Gruber.

Troy’s column does not mention that the Cadillac tax — or, usually, even more stringent versions of it — have been a mainstay of Republican health-care plans as well. As a presidential candidate in 2008, John McCain proposed not merely to cap the employer health-care deduction but to eliminate it entirely. (Obama attacked his plan as a tax hike.)

Troy’s op-ed also fails to mention that he himself used to oppose the tax break for employer-sponsored health insurance. In a 2007 speech, he explained that Bush proposed to cap the health-insurance tax deduction to exclude the more expensive plans:

The President’s proposal would allow every taxpayer with health insurance that meets certain basic criteria – it can’t be a health insurance in name only, it has to provide certain services – but every taxpayer who has a health insurance that meets the criteria would be able to deduct $15,000 for a family or $7500 for individuals from their income for health insurance. These numbers we’re pretty confident are large enough to cover all but the most expensive Cadillac-type plans. If you wanted to buy a more expensive plan obviously you could purchase that out of your own pocket. But $15,000 for families, $7500 for an individual, that would be a tax deduction right off their taxes right at the beginning. So that would incentivize people, individuals, to buy health insurance as opposed to having to go just through the employer.

Obama’s Cadillac tax kicks in at a threshold of $30,000 per year, compared to the $15,000-per-year threshold Troy endorsed under Bush.

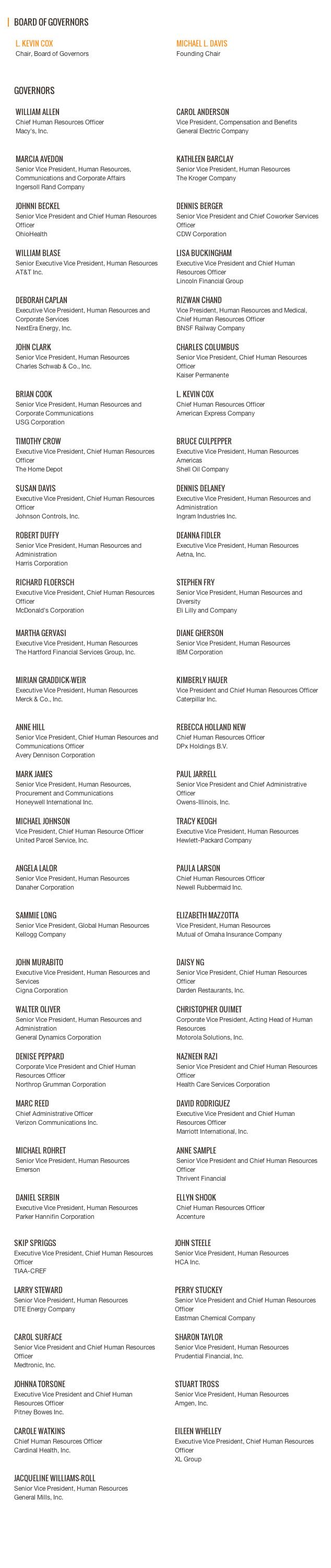

Troy has more recently changed his thinking on the issue. As the president of the American Health Policy Institute, Troy’s work now focuses on warning America about the dangerous burdens of the Cadillac tax he once endorsed. The American Health Policy Institute also has a board of governors (shown below) consisting entirely of representatives of companies that just might have a vested interest in opposing this onerous tax.

Troy’s op-ed doesn’t mention that either. Instead it concludes with a rousing denunciation of Gruber’s sneaky elitism:

The all-too-candid MIT economist is not likely to have a hard time paying for his own health care—Mr. Gruber reportedly received $400,000 for advising the Obama administration on the Affordable Care Act. But he is having a hard time explaining his unguarded comments about the law. His views may be obnoxious, but Mr. Gruber has performed a public service by finally telling the truth about ObamaCare and providing a glimpse of the mind-set of those who foisted it on the country.