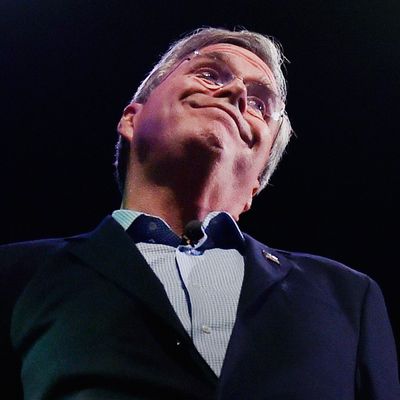

The highly respected, really truly nonpartisan Tax Policy Center is out with a comprehensive analysis of Jeb Bush’s tax plan, and it finds that his proposal would reduce federal revenues by $6.8 trillion in its first ten years, ignoring the effect of any stimulus or drag it would have on growth.

That’s more than the $5 trillion or so that Mitt Romney wanted to add to the deficit, if less than the $10 trillion or so that some wonks think Donald Trump might add to it. And on top of that, the plan is very regressive: The top 0.1 percent of earners would get a tax cut worth $800,000 in 2017, boosting their post-tax income by 12 percent. The bottom 20 percent of earners would get a tax cut worth $185 that year, increasing their post-tax income by just a little more than 1 percent.

But Bush, like Romney before him, also wants to balance the budget, even supporting a balanced-budget amendment. How on Earth do you balance the budget if you are starting from such a deep hole? Jeb’s campaign argues that its tax cuts would only cost $3.4 trillion, assuming no effect on growth, and just $1.2 trillion once you presume a miraculously sped-up economy. This is made-up math not worth considering. The answer is that you do not balance the budget after you cut taxes that much, as anyone who lived through Jeb’s brother’s presidency remembers. (Jeb’s plan goes way further than W.’s ever did, in terms of slashing taxes and benefiting the superrich.)

The Republican candidates thus far have engaged in a dreamy, manic competition over who would slash taxes more, so much so that the Tax Policy Center’s dry analysis of Jeb’s plan feels a little like, say, Harold Bloom trying to write something intelligent about the Twilight novels. But the future seems pretty clear. If any Republican wins the presidency, Congress will pass and the White House will approve gigantic tax cuts that primarily benefit the rich. Then Congress and the White House will try to trim the budget, and they’ll either fail, or they’ll succeed by cutting programs vital to growth and to low-income families. The deficit will probably explode, with relatively little stimulative effect on the economy.