After two roller-coaster weekends that have seen its price peak at $400, drop to $.10, and come back up again, Ethereum has become the hottest new currency since bitcoin — and is sparking the kind of ecstatic media coverage generally reserved for upmarket music festivals and ride-sharing giants. Yet details are scarce on what exactly people are buying into. What is Ethereum, and why should you care?

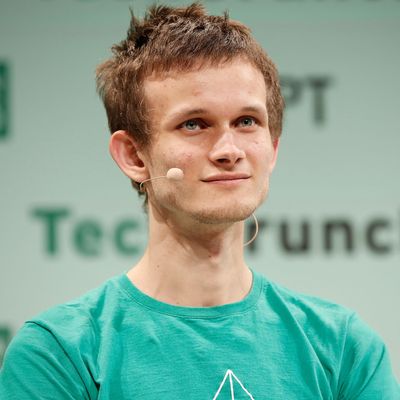

Ethereum was born out of many of the same philosophical inclinations as its peer and predecessor, bitcoin; at the time of its founding, Ethereum’s CEO, Vitalik Buterin, a 23-year-old Russian-born Canadian, was penning articles for Bitcoin Magazine. “The internet has brought us the first great wave of unprecedented global freedom … Now, either join us or we will continue the revolution without you,” he wrote in a 2014 article about the technical safeguards Facebook and Google could build into their systems if they actually cared about your privacy. Many of his stances then — a reflexive skepticism of centralized power, a messianic belief in the justness of code — would eventually be reflected in Ethereum.

Buterin noticed that while bitcoin had established that you could build a secure, peer-to-peer digital currency without the facilitation of any centralized financial institution, the same technological innovations that made it secure and decentralized could also be leveraged to do things far more interesting than just adding and subtracting bitcoin from people’s addresses. Rather than enumerate what all those things potentially were, Buterin allowed developers to experiment themselves, by building a platform — Ethereum — for decentralized apps, or “dapps.”

What’s an example of a dapp? If you want to use a “centralized” app, like, say Facebook, your browser has to make requests to Facebook’s servers in order to access your News Feed. Imagine, instead, your News Feed is kept in a local copy on your computer, and your computer is connected to every other computer in the world. Whenever another user posts a status update, or un-tags themselves from a bad photo, your local copy updates to reflect that change. To ensure that the changes are accurate, you and your computer verify each of these actions — if someone tries to tag a photo they don’t own, or write on the wall of a person they’re not friends with, you raise a red flag, which is propagated across the worldwide network of computers. Once a majority of the computers in the network have also raised this red flag, the action will be rejected, and not recorded on anyone’s local copy.

This decentralized Facebook has several theoretical advantages over the centralized one: A hacker trying to illegally change your personal details would have to take over 51 percent of the computers in a dispersed worldwide network, rather than only a few data centers somewhere in Guangzhou, making the application more resilient. Even better, Mark Zuckerberg would no longer have a strangle-grip on data, since everyone would have their own record of all the user actions that had taken place.

The underlying consensus and recording mechanism on a network like this is called the blockchain. First discussed in academic circles in the ‘90s, the blockchain was finally implemented in 2008 by Satoshi Nakamoto, the yet-to-be-unmasked creator of bitcoin. The blockchain is distributed data store — a transaction ledger of which everyone has a copy. Each “block” in a blockchain lists the transactions that have occurred since the creation of the previous block, like a page in a ledger. To ensure that the ledger is the same for everyone in the absence of a central authority, each block also contains a reference to that previous block, forming a “chain” of blocks back to the beginning of the system. The difference between the bitcoin and Ethereum blockchains is that in Bitcoin, the only action possible is the movement of units of currency: “Send 5 BTC to address XYZ”. In Ethereum, dapp creators can code up more complex actions called smart contracts. These contracts live on certain addresses in the network and are executed when you send the Ethereum currency, called Ether, to them.

To deter would-be thieves from rewriting blockchain transaction histories in their own favor, the process of creating new blocks — and therefore verifying all the transactions within — is purposely made difficult. In order for a new block to be accepted into the blockchain, it needs to contain the solution to a certain math problem which is hard to compute but easy to verify. This “proof of work” solution depends on the actual contents of the block, which in turn contains a signature from the previous block (and on back through the entire history, making the blockchain near impossible to modify. In the Facebook example, I could not change the relationship status of an ex-boyfriend, since other verifying computers would note that the ex-boyfriend was already in another relationship.)

The people who run the computers that perform these computations are collectively called “miners.” Miners download the entire Bitcoin or Ethereum blockchain onto their hard drive, continuously verify sets of new actions that occur in the network, and aim to create new blocks recording these actions. As incentive for their expensive efforts in helping to maintain the blockchain, miners receive a small amount of Ether for each successful block. This is the aspect of Ethereum and bitcoin that has arguably received the most attention, with reports of bitcoin and Ethereum farms in China running specialized hardware worth hundreds of thousands of dollars. But note that Ether itself is somewhat incidental to the conception of Ethereum as a world computer. When you watch videos of the Ethereum founders, there’s actually very little talk about the price of Ether or techniques to mine it — it is, from their perspective, just a byproduct or ingredient of the blockchain itself.

If Ethereum sounds abstract to you, rest assured that you are not alone. Part of the recent craziness in prices, I’m convinced, is because people don’t really even know what category to file Ethereum in. Is it a currency, a commodity, or a Silicon Valley startup? On the one hand, Ether is at least loosely pegged against an economically scarce resource — computing power — in the same way that the US dollar was long backed by gold. On the other hand, should Ethereum fulfill its ambition of being a worldwide distributed virtual computing machine, it stands to precipitate a platform revolution the likes of which has not been seen since the cloud. Financial institutions like J.P. Morgan, Credit Suisse, and BNY Mellon, which have the most to lose from a decentralization of the banking systems, are getting out in front of the threat by joining the Enterprise Ethereum Alliance, based in Switzerland, where Buterin now technically lives. For a hefty donation, Ethereum experts will teach the bankers how to build long-lasting dapps and use the Ethereum platform. Ironically, for a cryptocurrency couched in the language of anti-establishment, the news of institutional backers is one of the reasons why the price of Ethereum has shot up so much in the last couple of months.

Despite the hype in the market, though, Ethereum is still an immature product that has a long way to go before it can achieve the level of ubiquity required to replace traditional establishments of governance and commerce. In particular, it faces questions about security — it isn’t easy to write secure smart contracts, and the flexibility touted as Ethereum’s main advantage makes it much easier for attackers to exploit loopholes in users’ code. Just last June, Ethereum faced its biggest-ever crisis, when an attacker siphoned off nearly $60 million worth of Ether that was being held in a DAO (Decentralized Autonomous Organization — essentially a digital private equity fund), due to a vulnerability in a smart contract.

The attack split opinion in the cryptocurrency community. Hardliners argued that the DAO had approved the smart contract code, and the code was, according to Ethereum’s purported principles, holy writ. DAO stakeholders, on the other hand, wanted their money back. Ultimately, the decision was made to “hard-fork” the Ethereum blockchain — that is, to overwrite the sets of transactions in the blockchain that had constituted the theft. On Reddit, unflattering comparisons were made to the 2009 bank bailouts. Since the DAO had contained nearly 14 percent of all extant Ether at the time, it was, in essence, “too big to fail.” The incident revealed the inherent contradictions in trying to decentralize a society that has spent the last millennium centralizing into ever-higher hierarchies of profitability but also accountability: Crypto-anarchy, governed by nothing but the rule of code, sounds great, right until your code has a bug.