Yesterday, Republican leaders unveiled the preliminary version of their tax-cut plan. Today, the Tax Policy Center, the most credible analytical source, published its study of the plan. And the findings are not good.

The first and largest problem for the Republicans is that their plan overwhelmingly benefits a tiny number of extremely affluent people. In 2018, 53 percent of the benefit of the tax cut would go to the highest-earning one percent of taxpayers. In 2027, when more provisions would be fully phased in, the proportion would rise to nearly 80 percent.

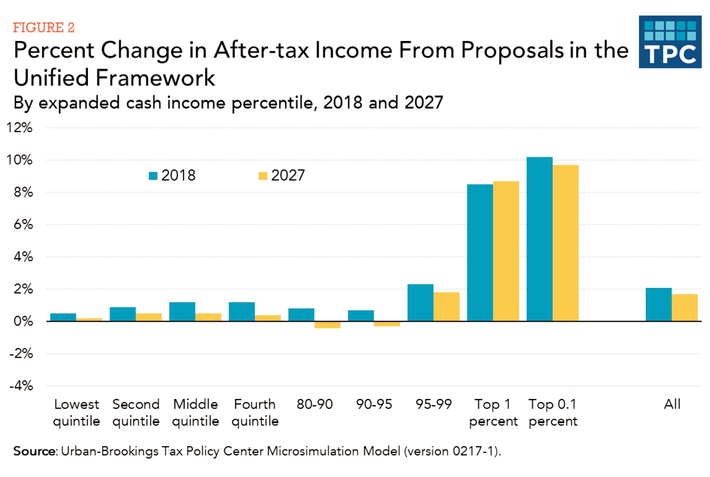

A tax cut that mostly benefits the richest one percent is not going to be popular. Looked at a slightly different way, the richest people in the country would get a huge increase in their living standard — an 8-to-10 percent raise in after-tax income. Almost everybody else would enjoy a negligible increase on the order of one percent of their income.

And that’s not counting the costs of the spending cuts that would have to eventually offset the lower revenue.

Secondarily, the plan also has a total-cost problem. Republicans negotiated a budget agreement allowing for $1.5 trillion in lost revenue over the next decade. That’s a hefty-sized tax cut, but not hefty enough to accommodate all the tax reductions Republicans want. The plan would lose $2.4 trillion over the next decade, TPC calculates.

In theory, that is not an intractable problem, if the GOP can come up with some ways to raise more revenue. The trouble is, their plan already imposes more pain on more constituencies than their slender majorities can probably bear. The largest single revenue-raising element of their plan, raising $1.4 trillion over a decade, is an elimination of the federal tax deduction for state and local taxes — a provision of special importance to residents of states that have income taxes. Eliminating that deduction would create big tax increases for upper-middle-class filers in those states.

Republicans in Congress representing those states are already in an uproar over that provision. Yesterday, National Economic Council director Gary Cohn backed way off the proposal, conceding it was “not a red line” for the administration. But while eliminating that provision would mitigate the “raising taxes on the middle class” problem, it would exacerbate their revenue problem. If they lose the $1.4 trillion this provision would buy them, they need to find it somewhere else, and they’re already short.

The easiest way to solve the problems is not to give rich people a big tax cut. But since giving rich people a big tax cut is the motivation for the entire exercise — indeed, the entire reason many Establishment Republicans have put up with Trump’s grossness — they’re going to absorb a lot of political pain in order to make it happen.