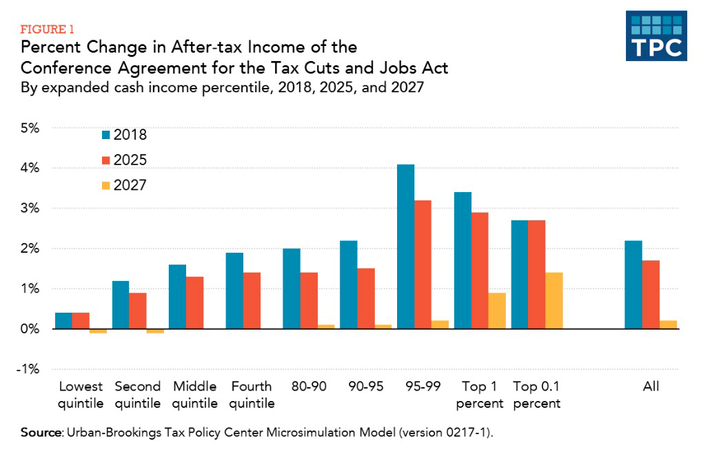

The Republican Party just passed a bill that gives an enormous, permanent tax cut to corporations — and a small, temporary one to middle class families. While that temporary cut is still in effect, the legislation will deliver as much tax relief to the richest one percent of Americans as it will to the entire middle class. After the middle-class tax cuts expire in 2025, the bill will actually raise taxes on most U.S. households, while preserving a large break for the wealthiest 0.1 percent of the country.

In light of these facts, mainstream media outlets have reported that the GOP tax bill primarily benefits the wealthy in the short term — and could actually raise taxes on ordinary Americans in the long run.

Conservatives find this outrageous. In their account, ostensibly “objective” journalists have no business emphasizing the distributional consequences of the bill, or what the legislation would do when it is fully implemented. On Tuesday, the Associated Press announced that the House had passed the Tax Cuts and Jobs Act thusly:

The right was incensed at this attempt to mislead the public by describing the bill’s primary effects.

The National Review’s Jibran Khan offered a more detailed rendition of the right’s complaint. In his column, Khan attributes the GOP tax bill’s woeful poll numbers to misleading, mainstream media headlines. Here are his examples:

CNN Money: “One-Third of Middle Class Families Could End Up Paying More Under the GOP Tax Plan”

New York Times: “Paul Ryan’s Middle-Class Tax Hike”

Washington Post: “Senate tax bill would cut taxes of wealthy and increase taxes on families earning less than $75,000 by 2027”

Newsweek: “Tax Reform: In the Long Run the Middle Class Will Be Taxed More”

“The predictable result [of these headlines] is that a false claim — Republicans are raising taxes on all but the very rich, full stop — has spread like wildfire across Twitter,” Khan writes.

And yet, of the four headlines that Khan cites, only one suggests that the bill raises taxes on the middle class without any qualification — and that headline adorns an opinion column from the New York Times op-ed page. All of the straight-news stories suggest, in their headlines, that the bill does not raise taxes on the middle class immediately.

Now, there is a kernel of legitimacy to the right’s frustration. Surveys suggest that many Americans who will receive a tax cut next year falsely believe that they will not. A recent SurveyMonkey/New York Times poll found only one-third of voters saying that the bill would lower their taxes in 2018. In reality, roughly 80 percent of U.S. households will see a tax cut in the immediate term. A significant portion of the public is genuinely misinformed about what this bill does.

Thus, conservatives have concluded that a majority of Americans would support the Republican tax bill if only the mainstream media had not misled them about its contents.

This conclusion is baseless.

Survey data suggests that the American public wants Congress to raise taxes on corporations and the wealthy, and to reduce the deficit. There is no reason to assume that most Americans would gladly support a bill that does the opposite of those things, simply because it also contains a modest tax cut for them.

In a Gallup poll from April, just 9 percent of respondents said corporations paid too much in taxes, while 67 percent said they paid too little; for “upper income people,” those figures were 10 and 63, respectively. Meanwhile, 61 percent of Americans said that their current income-tax burden was “fair” — the highest that figure had been at any point since 2009.

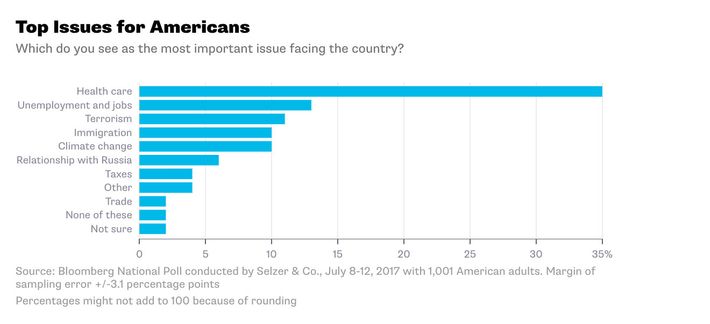

The notion that most Americans see no urgent need for their taxes to be cut is buttressed by a Bloomberg poll taken in July, which found that only 4 percent of Americans believed tax policy was the “most important issue facing the country” — less than half the percentage that picked climate change.

More recently, an October survey from Reuters found 63 percent of Republican voters want Congress to prioritize deficit reduction over tax cuts for corporations, while 75 percent said that lawmakers should prioritize the former over tax breaks for the wealthy.

The GOP bill does the very opposite. Assuming Congress allows the bill’s middle-class tax cuts to expire in 2025, it will add between $1 and $1.5 trillion to the national debt, according to various estimates from congressional scorekeepers and nonpartisan think tanks. If we assume that Congress will extend those tax cuts, then the legislation could add up to $2 trillion to the deficit by 2027.

Conservatives are furious that the media hasn’t made the latter assumption. The right’s core complaint about how the tax bill has been covered is that the press should not be reporting on the bill’s effects in 2027 — because “everyone knows” that Congress is never going to let the bill’s middle-class tax cuts expire. After all, congressional Republicans only put an expiration date on those cuts as a gimmick to evade the Senate’s budget rules.

There is some evidence for one piece of this argument: Barack Obama could have allowed George W. Bush’s middle class tax cuts to expire; instead he treated the prospect of their expiration as a fiscal crisis. Thus, there’s reason to think that a future president — Democratic or Republican — won’t allow something as unpopular as a middle-class tax hike to happen on his or her watch.

Nonetheless, there are several problems with the conservatives’ case. First, the future is ultimately unknowable, and timeless political realities often prove to be contingent. Surely, few political observers in 2007 would have predicted that the ensuing decade would see Americans electing an African-American — and, then, the star of The Apprentice — to the presidency. What’s more, multiple Democratic 2020 hopefuls currently support single-payer health care — an expansion of the welfare state that would almost certainly require raising taxes on the middle class. It isn’t all that difficult to imagine a future Democratic government allowing the Trump Tax Cuts to expire, for the sake of expanding social services.

Second, there is a contradiction in the right’s logic: On the one hand, they concede that the GOP tax bill is unpopular because most Americans believe it raises taxes on the middle class. On the other, they argue that everyone knows Congress would never pass a bill that raises taxes on the middle class because that would be unpopular. The fact that congressional Republicans just passed legislation with a 23 percent approval rating — that most Americans believe raises taxes on them — proves that public opinion does not inevitably constrain congressional action in the way conservatives want us to believe.

Given these facts, it’s perfectly reasonable for news outlets to analyze the bill on the basis of its text, rather than on the median pundit’s projection of future political events. This approach might produce some confusion about exactly what the bill will do — but Republicans have no one to blame for that but themselves.

If congressional Republicans wanted to pass a large, permanent, middle-class tax cut, they could have done so. In 2012, Mitt Romney campaigned on a plan to cut the corporate tax rate by 10 points, to 25 percent. If today’s GOP had decided to fulfill Romney’s dream — instead of slashing the corporate rate down to 21 percent — they could have given the middle class $400 billion more in tax cuts. They decided not to.

Congressional Republicans could have passed a budget resolution allowing them to spend more than $1.5 trillion on tax cuts over the next decade — and thus, to cut the corporate rate to 21 percent while also giving the middle class larger, longer-lasting tax relief. They decided not to.

Fifty-one Republican senators could abolish the rules of budget reconciliation, and thus, empower their party to pass enormous, permanent tax cuts for both the middle class and corporate America. They decided not to. Instead, the congressional GOP voted to put budget restrictions on itself — and then, to pass a giant corporate tax cut despite those restrictions, by raising taxes on the middle class in the long term. It is not the mainstream media’s responsibility to tell voters that the bill Republicans chose to pass isn’t actually the one that they wanted to pass.

But the biggest problem with conservatives’ theory that the media poisoned the public’s perception of the tax bill may be this: If news outlets did as conservatives are asking — and analyzed the legislation on the basis of Republican lawmakers’ stated intentions for future policy — the bill would look even more regressive than it does on paper.

It would be one thing if conservatives had all embraced Modern Monetary Theory. If Paul Ryan was publishing op-eds every day about how the deficit doesn’t matter, and spending cuts are unnecessary, then the conservative complaint might make some sense. But Ryan is (of course) claiming the opposite.

For decades, Republicans have argued tirelessly that deficits are a threat to our grandchildren — one that can only be mitigated by large cuts to social spending. And in their official budget documents — and recent public statements — the Congressional GOP has said, unequivocally, that Medicare, Medicaid, food stamps, TANF, and other welfare programs need to be (collectively) cut by trillions of dollars to combat the ever-growing national debt. House Republicans are already (reportedly) working on “welfare reform” legislation that they hope to pass next year.

So, let’s take Republicans at their word: Their bill’s middle-class tax cuts will last forever — and every penny that the broader legislation adds to the debt will (eventually) need to be offset by spending cuts.

In 2019, the GOP tax bill gives 23 percent of its benefits to middle 50 percent of American households (those making between $20,000 and $100,000 a year). The bulk of the rest go to corporations, the affluent, and the superrich. According to Republicans, the funding for all of these cuts will have to come from reductions in social spending that wealthy individuals and corporations do not rely on, but that many middle-class families do for basic sustenance.

So: If we stipulate the right’s preferred assumptions, the middle class will get less than a quarter of the tax bill’s cuts, while paying for the bulk of its costs through forfeited health care, food assistance, and other public benefits. Clearly, if ordinary Americans fully comprehended the congressional GOP’s vision, they would unanimously celebrate such trade-offs.

In his lamentation of the media’s unfair treatment of the GOP tax bill, Jibran Khan warns that “it will become a disaster for our civic culture if outright dishonesty becomes the marker of every policy debate.”

In reality, the mainstream media’s emphasis on the bill’s distributional implications — and the way it prioritizes corporate cuts over middle-class ones — was a direct response to the Republican Party’s “outright dishonesty” on both these points. President Trump has claimed, over and over again, that middle-class Americans will be the primary beneficiaries of his tax bill, while he and his billionaire friends will see little-to-no benefit. The GOP’s congressional leadership has echoed these claims (albeit in less hyperbolic form).

If conservatives find it less objectionable for the president to tell blatant lies about major legislation, than for the press to write headlines spotlighting the ways that legislation contradicts the White House’s claims, then the object of their ire isn’t “dishonesty,” and our “civic culture” is not what they are trying to protect.