It’s an occupational hazard: When you are the business columnist for a general-interest magazine and the stock market shits itself for three weeks straight, you will be asked to discuss why the market keeps shitting itself.

Unfortunately, like the people who go on financial television to explain why the market has been shitting itself, I do not know the answer to this question.

But I can look at the theories.

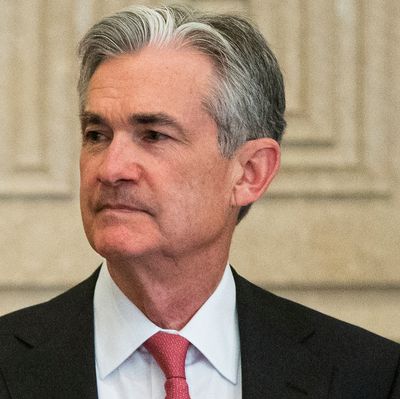

Another person who doesn’t know why the market has been shitting itself is Federal Reserve Chairman Jerome Powell. At a Wednesday press conference following the Fed’s announcement it was raising its short-term interest rate benchmark by a quarter-point for the seventh time in two years, Powell acknowledged “the tightening in financial conditions” — that is, falling stock prices and a shrinking gap between short- and long-term interest rates, among other negative financial market indicators — as a sign of “a sense of concern among business people and market people about global growth.”

But the Fed does not share that sense of concern. Powell noted that the turmoil in the financial markets is not yet matched by a weakening in data about things like wages and economic growth. And while the Fed slightly reduced its forecasts for inflation and economic growth in 2019, the bank’s forecast still calls for “solid growth next year, declining unemployment and a healthy economy,” he noted.

So, there’s a disconnect between the Fed and Wall Street on growth projections.

Some investors are also concerned that the shrinking of the Fed’s balance sheet — bonds it bought as part of the years-long quantitative easing efforts continue to mature, and the bank doesn’t replace them with new ones — is combining with rate hikes to produce more monetary tightening than the Fed really intends, pushing up interest rates and making it too costly for businesses to borrow and invest.

Powell, for his part, doesn’t think the balance sheet issue is important “(if you just run the quantitative easing models in reverse, you would get a pretty small adjustment in economic growth and real outcomes”) nor is he very worried about economic risk from tariffs (“if you just mechanically drop into a model of the U.S. economy tariffs, you don’t see very large effects”) nor is he concerned that the recent drop in stock prices will hurt the real economy by reducing business and consumer confidence (“a little bit of volatility, speaking in the abstract, some volatility doesn’t probably leave a mark on the economy.”).

The stock market had an agitated reaction to Powell’s calm talk; the Dow lost hundreds of points during his press conference. Why? Because if the central bank isn’t buying the markets’ view of deteriorating economic conditions, it’s not going to loosen monetary policy to counteract an expectation of deteriorating economic conditions.

Or at least, it’s not going to loosen monetary policy very much: Powell’s statement said members of the bank’s Federal Open Market Committee, which sets short-term interest rates, now expect to impose just two more interest rate hikes in 2019 — down from the three they predicted at their September meeting, when their economic forecast was slightly stronger. But markets were hoping for a clearer signal that the Fed was about done hiking rates, for now.

So that’s one of the theories of what’s wrong with stocks: That they’re not getting the support they need from the Fed. You may even have heard this theory from the president on Twitter.

On the other hand, interest rates are still pretty low, and the Fed’s recent actions have been consistent with the stable policy views its board members have long expressed. While one can quibble with the exact number of rate hikes we need next year — and I share the view that it would have been good for the Fed to back off a little more than it did — a 2.5 percent short-term interest rate does not seem grievously high in the ninth year of an economic expansion with unemployment around 4 percent.

That leads us to another reason the stock market may be shitting itself: Problems in the real economy that are not yet reflected in the economic data.

This could be a matter of data being a lagging indicator: If I tell you yesterday’s weather, you’ll be able to predict tomorrow’s weather better than if you guessed randomly, but you still won’t see an approaching hurricane. Maybe the markets have aggregated information out there in the world that reflects a deteriorating business environment, and we won’t be able to read about it in the economic data reports until months from now.

Or the markets could be reacting to intensifying risks that aren’t hurting the economy yet, but might in the future. You can make a list: U.S.-China tensions, civil unrest in France, the possibility of a hard Brexit, Italian fiscal disputes with the E.U. (resolved, for now), an increasingly erratic Trump administration. The market fell a little more Thursday afternoon when President Trump made clear he wanted a government shutdown. None of these events seems to have knocked global growth off its course — yet. But they could.

Or — and by placing this possibility last, I do not mean to suggest it is the least likely — the stock market might simply be wrong. All the way back in the 1960s, the economist Paul Samuelson wrote in Newsweek that financial markets had predicted “nine of the last five recessions.” Sometimes, investors get spooked, the market falls, nothing bad materializes, and then it goes back up.

Sometimes.