“Fiscally responsible” is one of the more Orwellian phrases in American politics. Lawmakers earn that coveted title by affirming the three tenets of the Beltway’s official budgetary orthodoxy: (1) Deficits are inherently undesirable, (2) all new spending (on things that cannot be used to kill foreigners) should be fully offset by new taxes, and (3) reducing America’s existing national debt should be a top-tier policy priority.

But these premises are rooted less in economic science than popular superstition. And, over the past decade, our political class’s indulgence of the public’s mythical intuitions about the national debt has imposed gargantuan costs on our collective prosperity. In the present context, validating the electorate’s economically illiterate fears of public debt is roughly as “responsible” as affirming the anti-vaccine movement’s conspiracy theories about the CDC.

Alas, Pete Buttigieg appears hell-bent on undermining our herd immunity to deficit hysteria. As NBC News reports:

Pete Buttigieg called on Democrats to get more serious about lowering the national debt, portraying himself as the biggest fiscal hawk in the presidential field and taking a shot at chief New Hampshire rival Bernie Sanders for being too spendthrift.

… “I think the time has come for my party to get a lot more comfortable owning this issue, because I see what’s happening under this president — a $1 trillion deficit — and his allies in Congress do not care. So we have to do something about it,” Buttigieg, the former mayor of South Bend, Indiana, said in a packed middle school gym, drawing cheers … “It’s not fashionable in progressive circles to talk too much about the debt, largely because of the irritation to the way it’s been used as an excuse against investment. But if we’re spending more and more on debt service now, it makes it harder to invest in infrastructure and health and safety net that we need right now,” he said. “And also this expansion, which I think of as, by the way, just the 13th inning of the Obama economic expansion. It isn’t going to go on forever.”

As far as paeans to “fiscal responsibility” go, Buttigieg’s isn’t exceptionally demagogic. And the former mayor is far from alone in endorsing the fiction that deficits are inherently bad; even Sanders officially maintains that his programs must be fully “paid for” and that Trump’s expansion of the national debt is cause for outrage.

But Buttigieg is exceptional in campaigning on a critique of progressives’ supposed indifference to deficits. And his remarks in New Hampshire Sunday affirmed dubious and dangerous ideas about the national debt. Specifically, Buttigieg suggests that Trump’s spending spree means the next Democratic president will “need to do something” about deficit reduction; that America’s rising debt-service obligations make it hard for our country to invest in infrastructure and the safety net; and that the looming threat of the next recession makes it all the more imperative for Democrats to embrace fiscal responsibility. The first two assertions fly in the face of empirical economic evidence, while Buttigieg’s third point actually underscores the hazards of endorsing deficit hawkishness.

To see why this is the case, we need to step back and take a broader look at how the politics and economics of public debt have evolved over the past decade.

In the wake of the 2008 financial crisis, governments across the West effectively conducted a natural experiment around the following question: Was the optimal policy for alleviating recessions to compensate for a shortfall in private demand with deficit-financed public spending (as conventional, Keynesian wisdom held), or could governments attract a surge in private investment by cutting spending and raising taxes, thereby gaining investors’ confidence in their fiscal probity?

The results were unambiguous. Nations like the United States, which embraced Keynesian stimulus, enjoyed stronger recoveries than European nations that pursued the phantom promise of “expansionary austerity.” Critically, the deficit hawks’ position did not merely fail in practice, but also in theory: The economic research that had lent some credibility to the concept of “expansionary austerity” did not withstand scrutiny; one profoundly influential study — which posited that once a nation’s public debt rises to equal 90 percent of its GDP, further deficit-spending will produce economic stagnation — proved to be premised on Excel-formula error.

And yet, even in the United States — where top economic policy-makers did not fall for the austerity fad — fear of the public’s superstitious anxieties about unbalanced budgets preempted a rational response to the Great Recession. In late 2008, Obama economic adviser Christy Romer calculated that offsetting the economy’s shortfall in private demand for goods and services — and, thus, returning the economy to full employment by 2011 — would require the federal government to expand the national debt by about $1.8 trillion over two years. Romer’s superior, Larry Summers, vetoed her proposal — not because he believed her estimate of the output gap to be inaccurate, but because he deemed it politically infeasible.

Keynesian macroeconomics is difficult for ordinary voters (and/or senators) to understand. By contrast, the notion that it is bad for any entity to spend more money than it collects is intuitive, and resonant with personal experience. A large percentage of the American people have either been debt-burdened at one point in their lives, or have had a friend or family member whose life was derailed by excessive borrowing. Thus, fallacious analogies between household debt and national debt have broad resonance, as they render economic downturns intellectually and morally legible to lay voters: Your cousin fell on hard times because he borrowed more than he earned; now, the same thing is happening to our country.

But when politicians acquiesce to this folk wisdom (and/or the reactionary special interests who reinforce it), they commit acts of gross cowardice and irresponsibility. In deference to the congressional Democrats’ terror of large numbers, the Obama administration proposed a stimulus package that it knew was too small. This, combined with the administration’s retreat to austerity following the Republican Party’s triumph in the 2010 midterms, led the United States to reduce annual spending between 2009 and 2016, even as private investment and spending remained inadequate for bringing economic growth back in line with its prerecession trajectory.

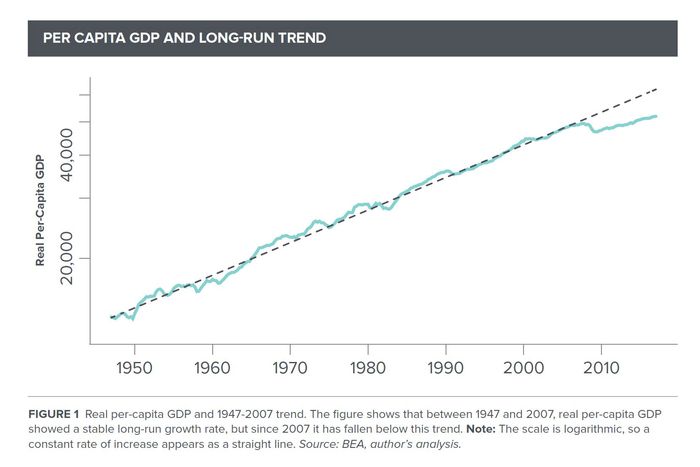

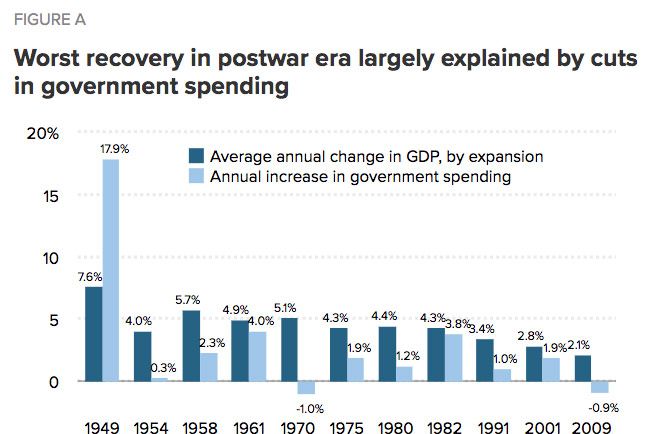

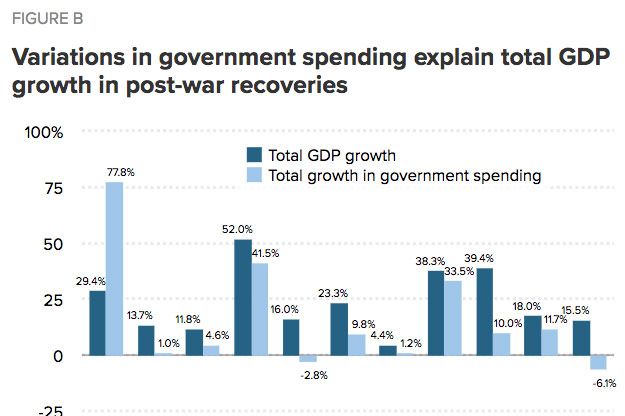

The significance of that last point is worth unpacking. Between 1947 and 2007, the U.S. economy fell into recession ten times. During each of these downturns, America’s GDP — the total value of goods and services produced by the economy — dipped far below the level it had been on pace to reach before the hard times set in. But none of those recessions permanently reduced our economy’s productive capacity. And so, when the recovery arrived, America always enjoyed a period of accelerated growth that allowed it to reach — and exceed — its prerecession potential. In all but one of these cases, the arrival of catch-up growth was abetted by a steady increase in government spending throughout the recovery period.

But we never caught back up after 2008. And, as the Economic Policy Institute persuasively argues, our government’s aberrant decision to cut spending is largely responsible for that fact. “If government spending had increased by 11.7 percent, as it did during the Bush recovery of 2001–2007, the present expansion, which was constrained by a 6.1 percent decline in government spending, would easily have exceeded the size of the Bush expansion,” EPI economist Robert E. Scott writes. “If government spending had increased by 33.5 percent, as it did during the Reagan recovery (1982–1990), then the Obama recovery would surely rank as one of the strongest on record.”

The costs of our government’s failure to expeditiously plug the giant demand hole that the Great Recession ripped into our economy are myriad and extravagant. It can be measured in trillions of dollars worth of lost output, and the incalculable psychological, emotional, and financial tolls that needless unemployment and underemployment took on America’s working people.

Critically, the past decade has not only exposed the insanity of slashing public spending in periods of recession or fragile recovery. It has also revealed that the downside risks of running high deficits in ordinary times are much lower than hawks had led us to believe. Between 2000 and 2019, the U.S. went from running a $236 billion budget surplus to a $984 billion budget deficit. Had you described this fiscal trajectory to a mainstream economist circa the turn of the century, he or she would have likely predicted that such a development would doom the United States to devastatingly high inflation and borrowing costs. Instead, we’ve seen the opposite. Thanks, in part, to growing global demand for safe assets like U.S. treasury bonds, our government can borrow money at historically low rates, while consumer price inflation has remained lower than the Federal Reserve deems desirable.

In these circumstances, refusing to make high-return investments in infrastructure, early childhood education — and above all, carbon-emissions reduction and climate readiness — unless Congress can find mutually agreeable revenue hikes to offset those investments is the opposite of responsible. Putting deficit reduction on a list of top policy priorities for the next president, meanwhile, would be madness. But don’t take my word for it; take former IMF chief economist Olivier Blanchard’s. Last year, Blanchard authored a paper arguing that nations should not make a priority of deficit reduction, so long as the interest rate they can borrow at is comfortably below their rate of GDP growth. Which is to say: If your capacity to service debt is growing faster than your debt, then your debt is not a big problem. Yes, America’s national debt has been steadily rising and is now an intimidatingly high number; but the other side of our national balance sheet is growing faster.

For these reasons, Buttigieg’s assertion that our current debt obligations limit our capacity to invest in infrastructure is false, as is his suggestion that the next Democratic administration must “do something about” Trump’s deficits. His final point about the expansion’s eventual end is somewhat ambiguous. If his intention was to say that the United States would be better off forgoing giant tax cuts for the wealthy in times of expansion, so as to preserve more fiscal capacity for stimulus during the next downturn, he’d have a defensible argument in economic terms. But politically, the fact that the present expansion is likely to end at some point only underscores the irresponsibility of Buttigieg’s debt fearmongering.

When the next recession hits, the obstacle to an adequate policy response will not be Congress’s excessive tolerance for deficit spending. And this will be especially true if a Democrat is in the White House when growth turns negative (for some strange reason, Republicans are consistently more hostile toward the creation of public debt when they are out of power). One can raise reasonable qualms about Modern Monetary Theory, or insist that some on the far left have taken deficit dovishness to indefensible extremes. But in Washington, the conventional wisdom about debts and deficits remains drastically more hawkish than the conventional wisdom among mainstream economists. For this reason, any politician who promulgates the idea that Congress has been excessively open to deficit spending over the past decade — rather than catastrophically averse to such spending — is making it less likely that our government will do what’s required to avert needless destruction to our economy and working class when this long expansion finally expires.

Donald Trump’s $1.5 trillion tax cut was a scandalous waste of our nation’s borrowing capacity, which could have been more beneficially invested in a wide array of public needs. And yet the fact that the current president’s giant deficits have not brought runaway inflation, or high interest rates, or a slowdown in growth — but, rather, historically low unemployment and a resilient expansion — underscores the scandalousness of the fiscal regime that preceded his own. It is now clear that the United States could have easily afforded to run higher deficits than it did during the Obama years. Which means that our political leaders subjected the American people to years of unnecessary economic hardship for no good reason, while the Democratic Party needlessly preserved $1.5 trillion in fiscal space (that could have been used to accelerate clean-energy development or eradicate child poverty) for Obama’s Republican successor to fill with giveaways to the rich.

Any politician who does not understand that this is the true lesson of Trump’s deficits — or else, who pretends not to understand in deference to popular prejudice — has no business being our next president.