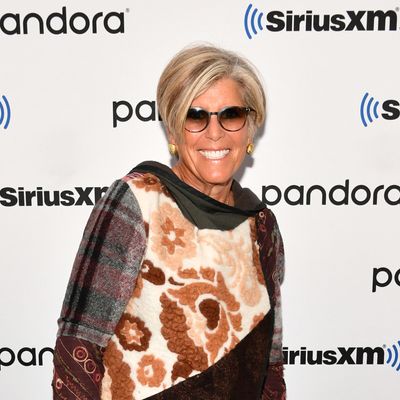

Before the coronavirus pandemic hit, Suze Orman was easing into retirement at the Bahamas home she moved to in 2015. Then a health crisis begat a financial crisis and the personal finance expert was once again in high demand. On the latest Pivot podcast, Kara Swisher and Scott Galloway discuss the personal financial crisis looming for many Americans, the future of the U.S. economy, and why there is absolutely no reason to have your money anywhere near bonds.

Kara Swisher: I am so thrilled to have Suze Orman on the line. Suze is a No. 1 New York Times best-selling author, two-time Emmy winner, host of the popular Women & Money podcast, a columnist, a writer, producer, one of the top motivational speakers in the world today. Suze, welcome to Pivot.

Suze Orman: Thank you. Happy to be here.

Scott Galloway: We were off mic, and Kara and I were saying how inspiring you are. And we never agree that the same people are inspiring. Anyway, quick question. You follow the markets and investing. I think there’s this fascinating trend, and I’m curious what you think of it. It appears that a lot of new investors are looking to the stock market to get the same sort of reward or dopamine hit they get from gambling. Because Vegas has shut down, because sports betting is off, we have this influx of young people into the market who may be looking at the market more as gambling versus investing. Do you see the same trend and do you think it’s troubling?

Subscribe on:

Orman: I see the same trend and you betcha, I think it’s troubling. When somebody buys a stock like Hertz that’s basically bankrupt, where their bonds are selling for 40 cents on the dollar, the stock has no value whatsoever, and yet somebody is bidding it up. And the somebody who’s bidding it up happens to be somebody who doesn’t know what they’re doing on any level. They’re all joining this game right now. The other thing that’s really interesting is that many people right now, younger people, have more money than they’ve ever had. They’re actually earning more money on unemployment, especially with the $600 a week that the feds are giving them, than they’ve had in a long time.

So you can talk to credit unions and banks that have their deposits go up a billion dollars a day. That’s from all the people getting unemployment, and the stimulus checks, and everything else. They don’t know what to do with that money. They’re not having to pay many of their bills. So what are they doing? They saw the market going up, and up, and up, and they joined in, which is why you’re seeing these wild fluctuations.

Galloway: And Tesla at a thousand bucks.

Swisher: Is Tesla a thousand? Oh, crazy. This has been one of your long- standing refrains, that people should reduce their debt in order to save. What do you imagine people should do now?

Orman: It’s all I talk about. And the reason it’s all I talk about is that — let’s think about what just happened a few months ago. You had people making $150,000 or $200,000 a year. They were spending every single penny they were making. They had no savings at all. Do you know that 60 percent of the people in the United States, before COVID, had $400 or less in their savings account? So you have people who were making money. They were going on vacation. They were buying cars. Then COVID hits. Not only do they lose their jobs, everything else went too. Those were the same people that you saw standing in the food lines. You had people making $200,000 a year standing in food lines.

On the other hand, if you had listened to me, you had eight months of an emergency fund. I know because I’ve gotten thousands of emails.. You had millions of people applying for unemployment, when normally only 200,000 people a week apply. The system broke down, everything broke down. Everybody was like, “I need my money. I need my money.” But if you had an eight-month emergency fund, you didn’t have to worry about it. This is the main lesson that I hope everybody has learned from what we’ve all just been through. Eight months — so that at times like this, if you lose your job, you don’t have income, nothing’s coming in anymore, you can still pay your bills and you don’t have to freak out.

Swisher: Would you up it any? Would you up it from eight months or do you think eight months is plenty?

Orman: It depends who you are. I think eight months is absolutely fine unless you’re in retirement. As soon as you’re approaching retirement, you need a three-year cash cushion. On average, Kara, it will take 3.1 years for a market to go from its top to its bottom and back again. When you’re in retirement, and you’re living off of your retirement funds, meaning you’re taking money out of your IRA, your 401k — most of the time that money is invested in stocks, because you’re not getting a return on interest rates anywhere right now. And you have to be crazy, if you ask me, to be in bonds at this point in time. You don’t want to be selling out of the stock market to take money out to live on when you are in a bear market. If you have a three-year cash cushion, that can get you by before you then have to touch money that’s in the stock market.

Galloway: Sure, you never want to be a forced seller. You talk about how people need to think differently about debt and savings, that they need a new gestalt, a new approach to their financial health. What it is about Americans — I don’t know if it’s our optimism — where if you’re making a quarter of a million dollars a year, you still put yourself in a vulnerable position? How do we change that mentality? Do you think there’s a concern that when we bail out small businesses, when we provide some people with more money than they would have if they were working, we are just propagating this mentality because we’re creating moral hazard that people believe they’ll be bailed out?

Orman: I don’t know if people believe they will be bailed out. I think the government, as of late especially, has a need to bail people out. But look at what many people have done with the stimulus money. Rather than saving it and building up an eight month emergency fund, they’ve been putting it into the stock market. They could not wait. Recently, I did a podcast on the patience of poverty. When you’re impatient, it will create poverty for you. Many people now are so impatient. They have to get out of the house. They have to go eat again. They can’t stand being in the house anymore. All that’s going to backfire on everybody, I’m sorry to say —in my opinion anyway. But I agree with you, Scott. I have people who wrote in and said to me, “Suze, why should I go back to work? I’m making twice now what I used to make. Why would I do that?”

Which, by the way, caused a big problem for the Paycheck Protection Program, because prior to them changing the formula, you had to spend at least 75 percent on your employees. They had employees who didn’t want to go back to work. That put a lot of businesses in trouble because they couldn’t meet the formula that they were supposed to meet to get that small business loan to be a grant, which I think probably benefited a lot of very wealthy businesses. I think in the long run, it’s really going to hurt the small business that took out that loan and thought it was going to be a grant.

Swisher: What do we do to get out of this? Do we need to add more unemployment insurance? How do you look at the economy going forward, especially if there’s another coronavirus outbreak?

Orman: Well, remember, the stock market is not the economy. The economy is not the stock market.

I think, relatively, we’re going to be fine in the stock market. I think we’re going to trade, on the Dow anyway, between 22,000 and 25,000. It’s going to go back and forth for a while. When you’re looking at the stock market — what else does somebody do with money when they have it? People are almost being forced to put money, those that do have money, into the stock market because where else are they going to put it? Are they going to put it in a 10-year treasury at 0.76 percent? The possibility of negative interest rates? They’re forced to go into the stock market where they could at least get good returns in many dividend paying stocks. That’s one thing.

In terms of the economy, I think it’s going to be rough and I don’t care what anybody says. More than the big picture of the entire economy, I think people’s personal economic life is going to get hit, and I’ll tell you why. People live in this fantasy world. As long as they have money to pay their bills right here and right now, they don’t think about the future. They never think they’re going to get sick. They never think they’re going to get older. They’re in a situation right now where student loans are deferred until September 30th, there’s 90-day deferrals on mortgages, on car payments, and car insurance, on all these things.

So they haven’t had to pay any of their bills. Do you think that they’ve actually saved money? I doubt it. All of a sudden, the moratorium is going to be over. Their rent is going to be due, and if they don’t pay their rent and the back rent, they’re out. All of this is going to come at the exact same time that the $600 extra a week in unemployment runs out. Unemployment, in most States, like in Florida, is $275 a week. With the $600, it’s $875 a week. That $2,400 a month is a big difference. You take that away, how are these people going to pay for anything? I think you’re going to see a lot of repossessions in cars, a lot of foreclosures on real estate, 40% of the jobs are not going to come back.

The big boon of all this is for the corporations. Are you kidding me? They are going to make a killing off of all of this, because they’re going to be able to reduce their workforce. They’re going to be able to reduce their expenses by not having these big buildings that they’ve had to fund. The economy, eventually, is going to come back, and it will be okay, but the personal economy for people is going to be very rough for a long time to come. Those who made money and they have money, they’ll be fine. But people who don’t have savings, they’re going to be in really bad shape.

Galloway: For those people who have started saving and started investing, does this change your portfolio strategy in terms of a mix between equities and bonds, or do you just stay the course and focus on that eight-month buffer?

Orman: I personally would not be in bonds on any level, in any way, shape or form right now. It makes absolutely no sense. Why would you do that? You would be far better off keeping your money in a savings account that’s giving you a higher interest rate than a 10-year treasury.

In terms of the stock market, most people don’t have the ability or the desire to say, “What stock should I buy? What sector should I be in? How should I diversify?” No, no, no. Everyday people, those who have credit card debt and don’t know what to do and need help — the only money they’re saving is in their 401K plans or 403Bs or Roth IRAs. All they buy are index funds. The only change that I’ve made for them is that rather than buying a Standard and Poor’s 500 index fund, or ETF, buy the Vanguard total stock market index fund, or ETF, which is the entire stock market, so that you get more diversification. Obviously, if you have a lot of money, you should be in individual stocks. You should be doing all kinds of things.

For many people, it’s stay the course. The main thing, really, is this: Please, if you have the ability to do a Roth 401K, 403B, or a TSP, or a Roth IRA, those are the type of retirement accounts that you want to be in. Stay away from the traditional ones. That’s what they’re called: Traditional IRAs or 401Ks, where you get a tax writeoff today, but in the long run, when you go to take your money out, you’re going to have to pay taxes on it. With a Roth, you pay taxes today, and in the long run, when you take it out, it’s tax-free. Why? Do you really think that tax brackets aren’t going to have to go up five, 10, 15 years from now in order to pay for all the debt that we’re carrying? Of course they’re going to have to. When you put money in a retirement account, the government knows exactly how much money you have in there.

The government knows you have to start taking required minimum distributions out by the time you’re 72. Given that everybody’s going to get there sooner than later, I’m telling you, I would rather pay the taxes today when we’re in the lowest tax brackets for a long time, and let the money grow tax-free versus tax-deferred.

Swisher: If you were running the Treasury Department right now, if you were running the United States and deciding what to do next, what would be your first two or three moves, really quickly?

Orman: Boy, I don’t know. The reason that I don’t know is that there’s a really big difference between an economist and a personal finance expert. I can tell you exactly what to do, given any situation that’s happening in the economy and in your personal life. There’s no way for me to really know what’s really happening in this economy though, because I don’t believe anything they’re are telling me. When I see Larry Kudlow, and I love Larry from our CNBC days — good guy — when I hear him get on and say, “Steven Mnuchin is doing a really good job…” Are you kidding me? I still believe, to this day, that everything that is happening is really happening to benefit those who have a lot of money. Those corporations that are really huge contributors to campaigns really, are the crux of everything.

I don’t think they really care about what the average Joe is doing, or the average Jane, or the people that don’t have educations. If the government really cared about those people who don’t have money, do you really think that the highest interest rates out there would be for student loans? Although they just lowered them to 2.75 percent starting July 1st. But for all these years, they’ve been at 4, 5, 6 percent — really? Making money off of students?

Galloway: It’s a money maker.

Orman: You can’t even bankrupt them? What’s that about? Why is it that you can’t bankrupt a student loan, but you can bankrupt IRS debt, you can bankrupt home loan debt or car debt? What is that about? I feel really sorry and confused as to what I would do if I were them, because I have no idea what they’re dealing with, truthfully.

Galloway: Suze, last question. I don’t know you, but by all exterior measures you appear to have had this exceptionally rewarding professional and personal life. You give a lot of financial advice. But what personal advice would you give to your 25-year-old self for a rewarding life? What one piece of advice can you share with young people?

Orman: I would tell them to have faith. That everything happens for the best. You have to remember that when I was 25 I was a waitress at the Buttercup Bakery making $400 a month. I was a waitress, all the time, from 23 till 30. My life just changed at that point.

Galloway: What was the catalyst for that change?

Orman: The catalyst for the change was losing all the money that the customers at the Buttercup Bakery gave me. They gave me $50,000 to open up my own restaurant, and they told me to put it at Merrill Lynch until they could help me open it up. I went to Merrill Lynch, I didn’t know what that was at the time. I did exactly what they told me to do — put it in a money market account. Except my broker, Randy, said to me, “Suze, how would you like to make a quick $100 a week?” And I said, “That’s more than I make as a waitress. How do you do that?” To make a long story short, within three months, all $50,000 was lost because he was playing the options market with it.

I didn’t know what to do because these people that gave me money — they didn’t have money. They were salespeople — one gave me $1,000. I’d just been waiting on them for all those years. And so, I thought, “I know, I can be a broker, they just make you broker.”

Galloway: So Randy has made the world a better place, that’s the bottom line. That scheming Randy has made the world a better place.

Orman: Randy, right? And before you knew it, I had a job at Merrill Lynch because they needed to fill their women’s quota. I was told women belong barefoot and pregnant by the manager at the time.

Swisher: You said in the New York Times profile that you were trying on retirement before COVID hit and now you’re back. I’ve got to say, I’m glad you’re back. Don’t go away.

Pivot is produced by Rebecca Sananes. Erica Anderson is the executive producer.

This transcript has been edited for length and clarity.