America remains mired in the worst crisis of unemployment and mass bankruptcy it has seen since the Great Depression — and the worst pandemic it has confronted since 1918. And yet, taken together, U.S. households are wealthier than they have ever been.

The dizzying contradictions of the COVID-era economy have long been visible in the disconnect between the rally on Wall Street and shuttered storefronts on Main. But the stock market isn’t the only indicator that seems out of place in this period of historic economic hardship. In recent months, thousands of small businesses have blinked out of existence, the unemployment rate has remained in double digits, more than 28 million Americans have been brought to the threshold of eviction, and the number of U.S. children who don’t have enough to eat has shot up well past its Great Recession high. And yet: Retail sales have already rebounded to their pre-pandemic level, the housing market is booming, home prices are at all-time highs, and inflation is more stable than many had feared.

One explanation for this dissonance is that the Federal Reserve’s energetic support for capital markets has rescued America’s rich, even as the 90 percent of Americans who own little-to-no equities muddle through hard times. And this is absolutely part of the story. But affluent Americans aren’t the only ones who are financially better off now than they were before the pandemic.

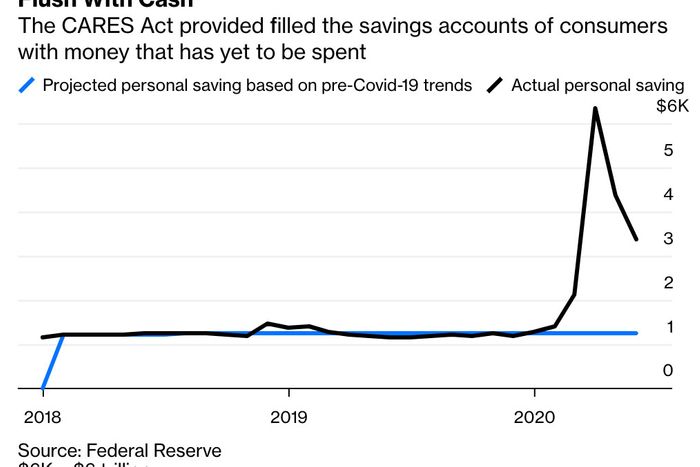

Thanks to the CARES Act’s historic fiscal relief — which provided America’s unemployed with $2,400 in monthly income support, and a majority of Americans with $1,200 checks — personal income growth hit a historic high in April. And since this unprecedented influx of government aid coincided with an unprecedented contraction in consumption opportunities — as much of the service sector went on hiatus — the majority of Americans who retained their jobs through the crisis ended up saving their earnings at a historic rate. As a result, in the aggregate, U.S. households are in much better financial shape than they were pre-pandemic. According to Bloomberg’s Tim Duy, in the months of March through June, Americans collectively saved roughly $931 billion more than they had been on pace to save before the COVID-19 outbreak began.

These data points reflect an important fact: The scale of the $2 trillion CARES Act’s income support for U.S. households was more than sufficient to ensure that all Americans remained whole through the end of July. The problem is that it’s not logistically feasible for the government to concentrate aid on every individual who absolutely needs it. Beyond all other hurdles to such micro means-testing, many of the people who ultimately needed government aid to make ends meet in July looked perfectly comfortable in March. Thus, getting money into the hands of the truly desperate required delivering a lot of aid to Americans who were not at risk of eviction or hunger or unemployment, and were thus in a position to save their money or invest it. Meanwhile, for many of the truly desperate, the CARES Act’s limited, temporary relief proved insufficient — or else, never arrived, as the needless logistical obstacles we’ve erected between unemployed people and their benefits kept them from accessing aid. The end result of all of this is that we now simultaneously have a large population of non-rich Americans who (for the moment) have more money in the bank than ever before, even as a large minority of the country is suffering from nightmarish material hardship.

Of course, now that congressional Republicans have allowed enhanced-unemployment benefits to expire — and condemned states and cities to fiscal crisis — American households could end up burning through their newfound stockpiles of cash in a hurry.

Still, the savings spree that we accidentally engineered through the CARES Act and economic lockdowns could form the foundation of a robust recovery in 2021, if our government would only implement a few sane, humane fiscal and public-health policies. If we bail out the large minority of Americans who’ve been completely left behind — by covering their back-rent, replacing their lost wages, subsidizing their temporarily inoperable small businesses, and accelerating the return of full employment through public investments in the green and care-work infrastructures our nation sorely needs — all while making rapid COVID-19 testing widely available, then with a little epidemiological luck (or an effective vaccine), pent-up demand could propel our nation back to shared prosperity faster than most of us have dared to dream.

Or, we could remain on our present course, under our current political leadership, and descend into neo-feudalism.

There are a lot ways for this cookie (and/or republic) to crumble.