Bitcoin is at it again. Last month, the price of the virtual currency quietly breached a new all-time high, cruising well past its prior peak of $19,600 set in 2017, and has been hovering around $36,000 at the time of writing. This follows a nearly 90 percent decline from those previous highs early in late 2018. It did so initially with such little fanfare that its renewed strength was dubbed the “quiet rally.” Perhaps most interesting about this price action — bitcoin is up nearly 1,000 percent from its March lows — has been the relative lack of mainstream enthusiasm. In the weeks following bitcoin’s first new all-time high in three years, Katy Perry did not paint her nails with crypto icons. Floyd Mayweather did not flamboyantly promote a crypto offering. The New York Times did not run an article titled “Everyone’s Getting Hilariously Rich, and You’re Not.” Google searches for “bitcoin” are still well below their 2017 peak. Entrepreneurs have continued building the financial infrastructure surrounding the asset — but they have done so in relative obscurity, basically ignored lately by the general public.

So what has been quietly going right with the internet’s native currency while conventional wisdom had consigned it to the tulip heap? Technologically, not much. The last major update to the core protocol — the actual rules for sending bitcoin — was accepted in July 2017. A new update to the protocol looks likely to be adopted by the community, but it carries only incremental improvements to privacy and efficiency. Implementing even these minor changes on the live protocol could take years.

The fact that, from a technical perspective, bitcoin is pretty static is one of its defining paradoxes: While its creation was a major technological leap — a dramatic recombination of elements from cryptography, computer science, economics, and p2p networking — the protocol itself is meant to be fairly rigid. As its pseudonymous creator Satoshi Nakamoto said, “Once version 0.1 was released, the core design was set in stone for the rest of its lifetime.”

It’s not bitcoin that has changed over the last three years, but rather the world around it.

As a venture capitalist in the space, I invest in start-ups building the core financial infrastructure necessary to support bitcoin and the public blockchain industry, giving me a front seat to the progress of the asset class. The entrepreneurs working to make cryptocurrency easier to acquire, hold, and transact with have been working diligently to improve this financial plumbing in anticipation of a full-scale monetization event. Today, it seems that this moment may be upon us.

Here are some of the key reasons I think bitcoin’s current bull run isn’t a fluke or a bubble.

For professional investors, there’s no longer career risk in buying bitcoin

This notion of stripping human discretion from a monetary system is so completely contrary to the way that central banking operates today that bitcoin is absolutely reviled by Establishment economists (see Paul Krugman’s and Nouriel Roubini’s Twitter feeds). Despite that, it keeps winning over waves of new converts. In its earliest days, bitcoin was embraced by venture capitalists and entrepreneurs like Mark Andreessen, Fred Wilson, and Chamath Palihapitiya, all of whom understood the explosive potential of network effects based on their experiences investing in software. Today, however, a new set of enthusiasts has emerged: veterans of the markets with decades of experience, more familiar with commodities and interest rates than tech startups.

These hedge-fund luminaries have lately been quite explicit with their reasons for allocating to the asset. Former Legg Mason CEO Bill Miller pointed to the unprecedented pace of money printing by the Federal Reserve and said of bitcoin: “It’s a technological innovation like we’ve never seen before, and it’s gaining acceptance every day.” Investor Stanley Druckenmiller, who famously participated in George Soros’s bet against the Bank of England, compared bitcoin favorably to gold and cited its 12-year track record and growing credibility. Hedge-fund icon Paul Tudor Jones, known for his currency bets, said in an interview: “I came to the conclusion that bitcoin was going to be the best of the inflation trades — the defensive trades.” So if you think governments and central banks around the world might be successful in their attempts to create higher inflation, and you take Tudor Jones’s analysis to heart, you just might find yourself investing in bitcoin.

Former high-profile skeptics on Wall Street have begun to reconsider their stance. Larry Fink, CEO of BlackRock, which manages $7 trillion, had previously dismissed bitcoin. He now concedes that it could evolve into a global asset, potentially taking the place of gold — which in aggregate is worth nearly $10 trillion — in investor portfolios. JPMorgan CEO Jamie Dimon called bitcoin a “fraud” in 2017, but more recently he has backed away from those comments and started getting involved with players in the space. And Ray Dalio, who runs the world’s largest hedge fund, has tempered his prior skepticism of bitcoin, saying in a recent Reddit AMA, “I think that bitcoin (and some other digital currencies) have over the last ten years established themselves as interesting gold-like asset alternatives.”

When it comes down to the level of human decision-making at financial institutions, bitcoin now enjoys something it has never had in the past: You probably aren’t risking getting fired just for buying some. Herding is very common on Wall Street. Being wrong in an unconventional way can be career suicide. But now that bitcoin has begun to be accepted as a valid monetary asset in its own right on the Street, analysts and traders can consider buying it without risking embarrassment. Full-throated endorsements by respected commodities traders do something the bitcoiners on Crypto Twitter could not: They made bitcoin acceptable in the world of high finance.

That means institutional money is starting to pour into bitcoin

As recently as 2013, if you wanted to buy bitcoin, your best bet might have been wiring money to an unregulated exchange in Japan that began as a venue for swapping and selling Magic: The Gathering cards. (Not shockingly, that exchange was hacked — the circumstances are murky — and hundreds of millions of dollars worth of bitcoin was pilfered.) Which is to say, it was not the kind of investment that professional money managers would have ever considered. Even during the rather disorganized run-up to $20,000 in 2017, there was very little institutional money going into bitcoin. The price spike was mostly driven by retail investors piling into bitcoin, either with the expectation that they were front-running Wall Street, or as a vehicle to speculate on other tokens. But retail investors tend to be reactive, and when the price started to fall in 2018, a lot of them sold their bitcoin, licked their wounds, and moved on. By contrast, institutional investors — hedge funds, mutual funds, endowments, pensions, insurance companies, family offices, sovereign-wealth funds, and so on — represent a pool of money worth tens of trillions of dollars that is more behaviorally reliable. One massive change afoot in the world of crypto is that institutional investors are, for the first time ever, getting involved in bitcoin.

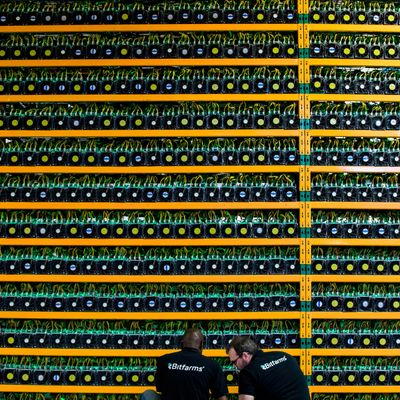

The biggest reason for that is that there have been massive advancements in the past three years in bitcoin’s financial infrastructure — particularly on the matter of custody. Which is to say, if you are an institutional investor and you want to buy some bitcoin, who is holding onto it for you? Unlike a retail investor, you aren’t going to keep the digital asset on a device in your desk drawer or access it through Coinbase’s iPhone app. Bitcoin exchanges like the soon-to-IPO Coinbase and the Winklevoss brothers’ Gemini were initially built mostly for retail cryptocurrency users, without taking the needs of institutions into account. But since 2017, a number of institutional-focused brokers and custodians have emerged: Coinbase launched a Prime offering; my former employer Fidelity — a multitrillion-dollar asset manager — launched Fidelity Digital Assets, focused on Bitcoin custody and execution for institutions; and many other big-money players have entered the game. Pension funds, endowments, and sovereign-wealth funds may not trust a crypto exchange, but they will find comfort in the familiar brand and large balance sheet of a counter-party like Fidelity. Here’s how this looks in practice: Recently, NYDIG, a subsidiary of the $10 billion asset manager Stone Ridge, facilitated a $100 million bitcoin purchase by insurance firm Mass Mutual; meanwhile, Coinbase helped the Virginia-based enterprise-software company Microstrategy buy and safeguard more than $1 billion worth of bitcoin.

As a consequence, large pools of capital have not only the justification, but also the tools to buy in. The $27 billion asset manager Ruffer Investment Company, which bills itself as an all-weather allocator, allocated 2.5 percent of its portfolio into Bitcoin, explaining: “Negative interest rates, extreme monetary policy, ballooning public debt, dissatisfaction with governments — all provide powerful tailwinds for bitcoin at a time when conventional safe-haven assets, particularly government bonds, are perilously expensive.” On December 16, Scott Minerd, the CIO of Guggenheim Investments, told Bloomberg that his analysis showed bitcoin had a value of $400,000 per coin — more than tenfold higher than current levels. And you can be sure that there are many more high-net-worth individuals, hedge funds, trusts, and family offices quietly allocating to the asset without explaining their reasoning on CNBC.

The U.S. government is flashing a green light

On top of the infrastructure questions, a lot of investors have been wary of bitcoin over regulatory concerns. If you’re an institution, there’s no point in owning an asset that might one day be illegal. But there’s been a lot of good news for bitcoin bulls on this front too. In the U.S., the Office of the Comptroller of the Currency (OCC), a top bank regulator, clarified that banks can store bitcoin private keys for their clients. With this newfound dispensation, it is just a matter of time before major banks begin offering bitcoin investment vehicles to their clients. You may not trust start-up crypto brokerages, but you almost certainly trust your global bank. Additionally, the OCC recently granted a federal bank charter to a dedicated “crypto bank” named Anchorage, paving the way for tighter integrations between the financial system and the cryptocurrency world.

In light of crypto startups entering the somewhat unfamiliar territory of regulated banking, established banks are seeing the opportunity in digital assets and have begun a rapprochement. As many entrepreneurs in the crypto space are aware, obtaining banking relationships in the U.S. was borderline impossible in the past. Today, multiple banks vie for the attention of crypto firms, as the crypto ecosystem is increasingly being seen as a market opportunity. Long gone is the mantra of 2017 naysayers, “Blockchain, not bitcoin.”

The Commodity Futures Trading Commission has also expressed an unambiguous view that digital assets like bitcoin and ethereum are commodities, putting them on firm footing in institutional portfolios and paving the way for regulated derivatives markets — just like those used to trade oil or gold or wheat futures. The Chicago Mercantile Exchange, which launched a bitcoin futures product on December 17, 2017 (the precise peak of the rally during the last cycle) subsequently launched options trading and has announced the launch of a futures product for ethereum, the second-largest cryptocurrency. Open interest in the bitcoin CME futures market reach at all-time highs in recent weeks. When players like $110 billion hedge fund Renaissance Technology seek exposure to bitcoin — whether long or short — it tends to be through these kinds of derivatives.

Bitcoin has a breakout new evangelist

Perhaps the most ardent recent bitcoin convert is Microstrategy CEO Michael Saylor, who deployed over a billion dollars of corporate assets into Bitcoin, making his firm the first publicly traded company to hold bitcoin as a balance-sheet asset. He did so out of the belief that “bitcoin will provide the opportunity for better returns and preserve the value of our capital over time compared to holding cash.”

Saylor followed up his massive commitment to bitcoin using both personal assets, corporate treasury assets, and the proceeds of a new debt offering by embarking on a podcast and media tour to promote the virtues of bitcoin. He has called bitcoin “the most efficient system in the history of mankind for channeling energy through time and space”; lambasted traditional measures of inflation, arguing that they are significantly understated; called the dollars held in Microstrategy’s corporate treasury a “melting ice cube”; and characterized his bitcoin position as a prudent hedge rather than speculation.

And while Saylor’s proclamations may sound hyperbolic at times, his mammoth financial commitment to his ideas lends him the standing to opine freely on the asset. It has also worked out well for him so far: Microstrategy stock traded around $120 before the company announced it was putting some of its reserves into bitcoin; now shares trade at nearly $600.

Billionaire converts like Saylor, Fidelity’s Abigail Johnson, and Twitter’s Jack Dorsey, among many others, lend the asset meaningful credibility — replacing to some extent the fringe libertarians and crypto-anarchists who for years were the loudest proselytizers. Listen to these new investors and themes repeat throughout. Bitcoin’s continued resilience in the face of protocol forks, bugs, exchange hacks is frequently cited. It boasts a near 100 percent record of uptime since inception and has settled trillions of dollars worth of transactions without reversal. In a monetary regime where negative real interest rates seem entrenched, and likely to go lower yet, zero-yield monetary assets like gold and bitcoin hold new appeal. Many former skeptics cite its recovery from the crash of 2018 as evidence for its strength as a store of value. And indeed, it’s often the second rally that convinces. The first time, your interest may be piqued, but you are wary of buying into something that looks like a bubble. The second time, you realize that what you mistook for a bubble was in fact a cyclical process in a longer-term trend.

A lot of people are nervous about the global monetary system — especially the dollar

A major difference between bitcoin’s prior rally in 2017 and its resurgence this year: Three years ago, bitcoin appreciated sharply (and gave up its gains nearly as quickly) owing to its role as the reserve currency for the cryptocurrency industry. This was a largely self-contained phenomenon, mostly insulated from the world at large. The bitcoin rally beginning in 2020, by contrast, has its roots in widespread concern that massive amounts of money printing and debt spending taking place around the world will lead to currency instability or debasement.

The COVID crisis — and its associated economic fallout — gave central banks license to accelerate their rate of money creation to finance sharply higher deficits. The U.S. Federal Reserve, the world’s most important central bank, has been particularly aggressive on monetary stimulus, and U.S. money supplies have spiked. Meanwhile, the dollar has started looking wobbly to a lot of investors. When measured against a basket of other sovereign currencies, it initially rallied in spring 2020, but then entered a long slide in value over the rest of the year. Dollar bears (and there are many), see a landscape of more and more U.S. debt, fewer natural buyers for it, and diminishing faith in the dollar as a global reserve currency — and other major currencies facing their own major issues.

This ebbing faith in the dollar and the stability of the current global monetary system has brought a lot of new interest and money into bitcoin, plausibly described as the world’s hardest currency, with a predictable monetary issuance rate trending to zero. And while there are many inflation hedges available to allocators seeking to preserve their wealth, bitcoin also offers a growth bet on a new transactional system — analogous to buying stock in a growing tech giant. In a sense, it’s two bets in one: a sound, unimpeachable monetary protocol and the reserve asset for a rapidly expanding crypto-financial network.

Despite bitcoin’s banner year, it still commands a minute portion of the world’s assets and has been adopted by relatively few. Credible estimates from the Cambridge Center for Alternative Finance peg the global cryptocurrency user base at just over 100 million individuals — or barely over one percent globally. At its current market capitalization of $650 billion, bitcoin is still only worth about 6 percent of the value of aboveground gold and 2 percent of the value of U.S. Treasuries, the world’s premier store of value asset. But it is also true that it has quadrupled in the last several months. As ever with bitcoin, there will be those who point to the latter fact and say that there is danger ahead. Personally, I think the story is far from done and that this revolutionary digital asset still has a long way to run.