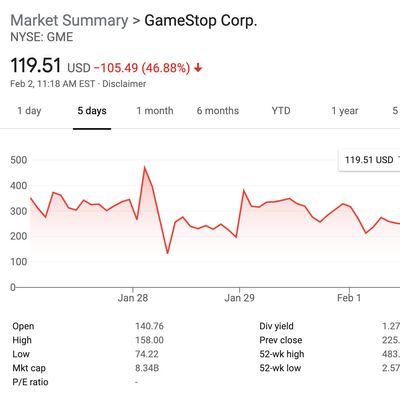

After several days of surreally high highs, GameStop’s stock has done the inevitable: plummeted. As the dust begins to clear from all the Wall Street weirdness, it’s difficult to untangle what actually happened from the many questionable narratives that quickly formed around Robinhood, Reddit, and other major players that have captured public attention over the last week. On the latest Pivot podcast, Kara Swisher and Scott Galloway discuss all the latest twists and turns, and why distinguishing good guys and bad guys here isn’t so easy.

Kara Swisher: We’re going to check back in on your favorite tale, the Robinhood saga. Since we left off, Robinhood severely limited users’ ability to buy more shares of GameStop after last week’s frenzy, and they’re still sort of doing it. Some users are joining a class-action suit against the company, and Elon Musk, in a rather boring interview on Clubhouse last night, actually got into it with the CEO of Robinhood, asking him if there was some secret group of people trying to make him do what he did. There’s been lots of backlash from lawmakers — Alexandria Ocasio-Cortez, Elizabeth Warren, even Ted Cruz called on Congress to investigate the company.

The SEC said it will “Closely review actions taken by regulated entities that may disadvantage investors or otherwise unduly inhibit their ability to trade certain securities.” Robinhood explained that it restricted stock buying not because they wanted to stop people from buying these stocks, but due to the volatility of the stocks. The company was required to come up with ten times the deposit requirements it had a week earlier in order to execute those trades. To do so, the company had to quickly draw on a number of credit lines. On Thursday Robinhood said it was raising more $1 billion from its existing investors. Meanwhile, GameStop stock is crashing. Elon was trying to put together this conspiracy that I don’t think is there. So who’s responsible here? The SEC wasn’t part of this. Who was it?

Scott Galloway: So there’s a lot to unpack. And let me be clear: I think Robinhood is a menace that treats their consumers as the product and ultimately I think leads them to dark places, I’ve made that clear. But in this instance, AOC and Senator Warren, and the class-action suit filed against Robinhood, really missed the mark.

Robinhood is guilty of not envisioning a scenario where 50 percent of their account holders would own one stock that ran to volatility of 50 percent up or 50 percent down. The people who clear your trades and the people who provide financing for your margin are constantly looking at the likelihood that the market could have a wild ride one day. Say you buy $100 worth of GameStop stock and someone finances $100 of margin. So you buy $200 worth, and it crashes more than 50 percent in a given day. What they say is, “Okay, if GameStop is only one percent of the stock that a brokerage is doing, then we’re not that worried.”

But when all of a sudden half your account holders own GameStop stock, the clearance guys and the people financing your margin basically call you and say, “You can no longer trade in this stock.” So the notion that Citadel conspired with Robinhood to support another hedge fund just isn’t true. This has happened before. They got caught in a capital squeeze. The more interesting thing here is who’s bailing them out. And their existing investors, including Andreessen Horowitz, Sequoia, I think NE — they’ve all come in, not for one and a half billion. I heard about this piece of paper circulating Thursday night where they’re raising another three and a half billion dollars.

Swisher: Wow.

Galloway: And it feeds to this bigger narrative around who is making money here. Who is going to make tens of billions of dollars? We all think they stuck it to the man, because this hedge fund lost $3 billion. The people who are going to make tens of billions of dollars are, quite frankly, the investors in Robinhood. Robinhood signed up a million new accounts on Thursday.

Swisher: They did more than that. Yeah.

Galloway: All of this craziness — “Oh, they did something wrong.” No, they do something wrong every day, but them having their clearance and their margin financiers pull stocks down for not letting them trade in certain stocks — that was poor scenario planning, but I would argue they really didn’t do anything wrong.

Who else is making money? What about the Winklevoss twins? Billionaires from Harvard who say, “Let’s go into silver.” All right. That’s your movement? The wealthiest man in the world, Elon Musk, and a guy who made all his money at Facebook. Those are our William Wallaces around this movement? You have hedge funds or big, established players here, venture capitalists, making tens of billions of dollars in equity value.

Swisher: Yeah. They’re thrilled to do it, and they don’t care how Reddit makes money. You know what I mean? These are the exact same people who are in Robinhood that have been in all the others. Uber, Facebook, etc. I should do a chart of the ownership of all these what you call menace companies, and they’re all the same. It’s a lot of the same people.

I interviewed Steve Huffman of Reddit. I don’t necessarily blame them for it. These are just message boards where people are talking. I don’t know necessarily if Reddit’s at fault in this case.

Galloway: I personally don’t think Reddit’s done anything wrong. I’m just saying the people who own Reddit are the ones who are going to make billions here. The people who own Robinhood are the ones who are going to make billions.

Swisher: And I think hedge funds were on both sides of these trades. That’s what Steve and I talked about — this idea of a David-versus-Goliath thing.

Galloway: Oh, that’s ridiculous. A couple things. One, who else is going to make a shit ton of money? Goldman Sachs, who’s out saying that there’s froth in the market, but they’re taking Robinhood public. They’ll raise $3 billion. They’ll get a quarter of a billion dollars and manage all their money. They’ll get all sorts of trust-planning fees. But meanwhile, they’re concerned about froth in the market. Yeah, right.

And this falls into a much larger narrative, which is the same construct that has always existed in society, back to the Middle Ages. And that is when you see a movement, sometimes it’s a righteous movement. Black Lives Matter, the civil-rights movement, these are righteous movements. But most movements are a bunch of older men trying to get wealthier using the call sign of God or Christianity, or of “Stick it to the man, and buy more silver, and oh, there’s weapons of mass destruction, so let’s go get them, such that Halliburton can rebuild these fields. And as the vice-president, I own shares in Halliburton, and what do you know? My shares end up at $60 million.” Society is consistently reinforcing the same narrative. And that is, “You young people go do something for us. Let’s stick it to the man.” But you know what you are? You’re the man stick. And the same thing is happening here.

Swisher: They’re sticking it to a different man. And I think that what was interesting is listening to … I didn’t listen to it last night, because I’m not part of Clubhouse, but I’m reading about it. Elon questioning the CEO of Robinhood is not precisely the kind of accountability we want here. Figuring out who has the real accountability here is going to be almost impossible.

In some cases, yes, it is these investors being just as smart as hedge funds, 100 percent. And it’s good that more people are in the market. But you can have that thought, and at the same time realize you may be being taken advantage of by far wealthier people in the shadows.

And that’s my issue with this is, is that there’s all kinds of rich people involved. And they’re all talking about, “Off with their heads.” Well, they’re the richest people on Earth. That’s I think the problem we have going forward. And where it’s going, I don’t know. I don’t even know where GameStop is today …

Galloway: It’s down.

Swisher: They’ll pick another thing. It’s just a game. And maybe you, the individual retail investor, can catch it, But the people who can really catch it are the rich people. I’m sorry to give you that piece of news, unfortunately.

Galloway: The rage is warranted. There was a study that just came out saying that billionaires have increased their wealth from $1.9 trillion to $4 trillion since 2010. Whereas, the federal minimum wage has gone from $7.25 to $7.25. These bailouts are largely nothing but an attempt to maintain the wealth of older people, such that the gale-force winds of creative destruction that benefit young people don’t blow. There is nothing but a massive transfer of wealth that our society has promoted, especially over the last 30 years, from young people to old people. Their rage is warranted.

The question is, how are you deploying that rage? And if you think that a movement is worthwhile, then fine. But movements typically cost money. If you’re learning here, that’s fine too. If you’re all over this all day, and you think you have some sophistication, and you’re learning about trading, then fine. But be clear: The question is who are you fighting the war against? Are you being heavy-handed with the wrong people?

Pivot is produced by Rebecca Sananes. Erica Anderson is the executive producer.

This transcript has been edited for length and clarity.