Today’s GOP is a working-class party that prizes law enforcement and fiscal responsibility. Which is why Republicans are rallying to defend the sacred right of the superrich to cheat on their taxes with impunity, an entitlement that contributes $175 billion to the deficit each year.

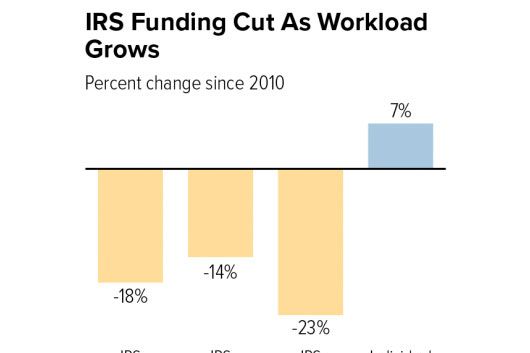

Over the past decade, conservatives have waged a highly successful campaign to defund the tax police. After retaking Congress in 2010, Republicans slashed the IRS’s budget, which fell from $14 billion that year to $11.5 billion in 2020, even as the number of individual tax returns in the U.S. grew by more than 7 percent.

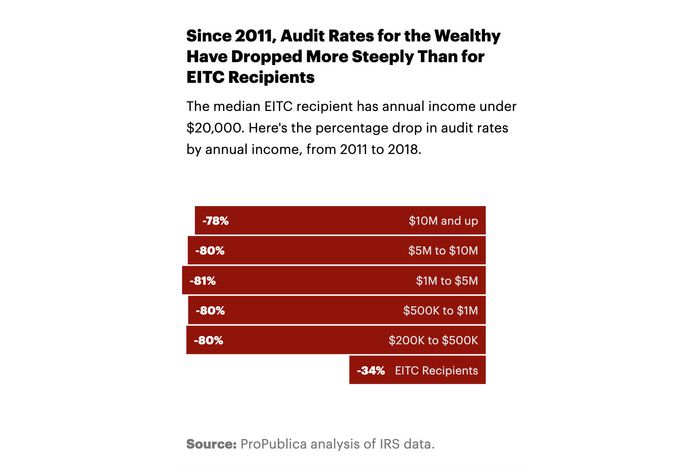

Meanwhile, the GOP pressured the agency to ramp up enforcement on the working poor, despite the fact that nailing low-income people for wrongly claiming EITC benefits doesn’t make much money for Uncle Sam. As a result of such austerity and regressive priorities, the IRS was forced to cut its enforcement staff by nearly a quarter, and the audit rate among America’s ultrawealthy fell by 78 percent. With few tax cops left on the beat, the rich took to looting the federal treasury: The top one percent of earners now hide more than one-fifth of their taxable income from the IRS each year.

Joe Biden wants to change this. Among the “pay fors” in the president’s infrastructure plan is an $80 billion investment in holding high earners and corporations accountable to American tax law. Due to the high rates of evasion among these groups, Biden’s refunding of the tax police is expected to generate $70 billion a year in revenue — money that Democrats hope to invest in jobs for blue-collar workers and home care for the elderly, among other things. Many of Biden’s proposed tax measures have attracted intraparty opposition on Capitol Hill. His IRS plan, however, has been warmly received by progressives and moderates alike. Last month, Joe Manchin lamented that “$400 billion to $1 trillion” in tax revenue is “not even collected” because “we have eviscerated the IRS. They don’t have the guts or basically the firepower they had before.” Meanwhile, Republican senators Shelley Moore Capito and Susan Collins have both praised Biden’s proposal, with the former saying, “Regular taxpayers can’t stand it when somebody is not paying their fair share.”

But Capito and Collins are Establishment elites who are too out of touch to understand that ordinary workers like it when the super-wealthy steal from the government. Fortunately, Donald Trump’s former legislative director, Marc Short, has formed an organization dedicated to standing up for working-class interests — and the Coalition to Protect American Workers is making the defeat of Biden’s IRS plan its top priority. As Politico reports, the group just launched a six-figure cable- and local-TV-ad blitz concentrated in competitive House districts.

The 30-second spot shows an army of shadowy IRS agents — all apparently clones of the same bespectacled man — stalking anxious middle-class taxpayers with surveillance drones. This is “the new America,” the voice-over warns, “where congressional Democrats want to defund the police, and Biden wants to add thousands of IRS agents.” To prevent their nation from becoming a dystopian hellscape in which criminals murder with impunity — while IRS agents arrest small-business owners for math errors — viewers must call their representatives now. (How this organization wants the U.S. to fund the police, given that it considers tax enforcement a nigh-totalitarian enterprise, is left unclear.)

Short believes this line of attack just might kill Biden’s infrastructure plan in its entirety. “As we polled multiple districts on multiple different messages, the one that polled best for us was the notion of opposition to $80 billion in hiring more tax collectors,” he recently told Politico. “So that’s why I say I still think this is an Achilles’ heel for the overall plan.”

One should never underestimate the conservative movement’s ability to persuade the median voter that she’ll be pauperized if the billionaire class is inconvenienced; after all, estate-tax repeal often wins majority support in opinion polls. And the right’s gift for promulgating its lies in mainstream media remains formidable: Politico’s article on Short’s ad-buying repeatedly invokes the Obama-era “scandal” in which the IRS targeted conservative groups for heightened scrutiny — without ever informing readers that the IRS did not, in fact, target conservative groups for heightened scrutiny.

Nevertheless, Short’s claim here is dubious.

A supermajority of Americans consistently tells pollsters that “the wealthy” and “corporations” “don’t pay their fair share in taxes.” Presumably, these voters would deem “rich people even paying what they legally owe under a tax system skewed in their favor” to be an example of the wealthy not paying their “fair share.” But there’s no need for presumption. Late last month, the left-wing pollster Data for Progress asked voters whether they supported “$80 billion for increased IRS enforcement and auditing of wealthy Americans to ensure they pay their taxes in the full amount they owe.” Sixty percent of voters said yes.

Short’s group isn’t alone in waging war on our nation’s hardworking tax cops. Americans for Tax Reform and Heritage Action for America have both mobilized against Biden’s plan in recent days. “The best way to ensure compliance with the law,” Heritage wrote in a recent report, would be to “reduce incentives for avoidance by reducing the tax burden.” In other words, since a tiny minority of miscreants refuses to follow our laws, we should rewrite those laws to make them more favorable to criminals.

Notably, Heritage takes a somewhat different perspective on tax cheats when the cheats in question are poor people. In 2016, the Heritage Foundation released a report alleging that low-income Americans were frequently claiming EITC benefits they had not actually earned. The think tank did not conclude from this that lawmakers must reduce the incentive to illegitimately claim the EITC by guaranteeing all low-income households a basic income. Rather, it called on the IRS to subject EITC claimants to automatic mini-audits. (Conservatives will insist this reflects no hypocrisy. After all, the superrich are just trying to keep a higher percentage of their own money, while EITC applicants are attempting to secure a handout funded by taxpayers. But this perspective is premised on the idea that the pretax distribution of income and wealth is inherently just. Which is difficult to reconcile with a great many realities about how that distribution came to be, centuries of chattel slavery among them. In truth, the U.S. government delivers far more benefits to the superrich than it does to welfare recipients; the former’s wealth would not exist in absence of the legally constructed economic order that Uncle Sam’s monopoly on violence maintains.)

Thus, the conservative movement’s reverence for law and order is strictly delimited by its commitment to plutocracy. Republicans’ empathy for superrich super-predators, and contempt for the humble tax cops who constitute the thin blue line between civilization and anarchy, make them unfit to govern. The GOP may oppose the “broke mob.” But it wants the Koch mob to rule us all.