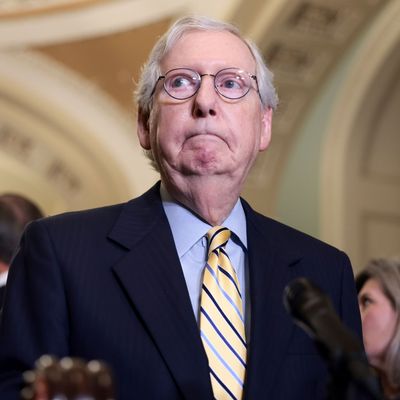

The good news for Democrats: Senate parliamentarian Elizabeth MacDonough says they can raise the debt limit via the budget-reconciliation process, meaning they can act without Republican support. The bad news: This is exactly what Minority Leader Mitch McConnell has been telling them to do since July.

McConnell’s irresponsible but predictable position has been that since Democrats control both the executive and the legislative branches and are in a socialistic tax-and-spend binge, they should bear sole responsibility for dealing with the debt limit, which is rearing its ugly head again because the suspension included in a two-year 2019 budget deal expired on July 31. Democrats have been pushing back, arguing that Republicans should share the burden of this unpopular chore, since (a) much of the debt involved was run up under Republican presidents and (b) Democrats accommodated Republicans on debt-limit relief during the Trump presidency.

So the House attached a debt-limit suspension to a stopgap spending bill necessary to avoid a government shutdown at the end of September, which Senate Republicans promptly filibustered. But even as Democrats bent to the inevitable by substituting a “clean” stopgap bill that Republicans would support, Majority Leader Chuck Schumer offered a stand-alone debt-limit suspension to force a second GOP filibuster, driving home the hypocrisy-irresponsibility point once again.

All this “messaging” activity by Democrats on the debt limit represented good clean partisan fun supported by underlying truth, but it didn’t leave a lot of time before the October 18 “cliff,” when temporary measures to stave off a debt default will expire, according to repeated warnings from Treasury Secretary Janet Yellen. So Schumer sought guidance from MacDonough, who confirmed the exact procedure Congress needs to follow. Because the Congressional Budget Act authorizes separate budget resolutions and reconciliation bills involving spending, revenues, and debt, says MacDonough, Democrats can pass a second FY 2022 budget resolution authorizing an increase in the debt limit and then an FY 2022 reconciliation bill that actually accomplishes this feat. (This legislation would be separate from the pending $3.5 trillion reconciliation bill still under contentious construction by Democrats.) As with the FY 2021 budget measures that enacted the American Rescue Plan stimulus bill back in March and the first FY 2022 budget resolution, which cleared Congress in August, Democrats can pass the new budget resolution and reconciliation bill on a strict party-line vote with no possibility of a filibuster.

The trouble is this takes some time, particularly since both budget resolutions and reconciliation bills must allow for so-called vote-a-rama periods of unlimited Senate votes on amendments, typically designed by the Senate minority to create embarrassing test votes for vulnerable members of the majority party. The only silver lining is that these amendments must be germane to the subject matter of the underlying measure — in this case, the debt limit — which probably means Republicans won’t get to offer a host of amendments involving Afghanistan or critical race theory (not that they won’t try).

There’s one other question not yet answered by the parliamentarian, which Punchbowl News explains:

It’s still not entirely clear … if Democrats could suspend the debt limit for a certain amount of time under this approach or whether they would have to increase the debt limit by a fixed number, say several trillion dollars. The second is a tougher vote politically and one of the reasons why Democrats don’t want to be forced into this maneuver.

Perhaps to place his personal signature on Democratic messaging on the debt limit, and maybe even to warn of a possible catastrophe, President Joe Biden publicly weighed in on Monday with a blast at the “hypocritical, dangerous and disgraceful” Republican dereliction of duty in failing to help lift the debt limit. He went on to point out the consequences of a debt default:

A failure to raise the debt limit will call into question Congress’ willingness to meet our obligations that we’ve already incurred — not new ones — we’ve already incurred. This is going to undermine the safety of US Treasury securities and will threaten the reserve status of the dollar as the world’s currency, that the world relies on …

The American credit rating will be downgraded, interest rates will rise for mortgages, auto loans, credit cards, and borrowing.

In any event, Democrats no longer have any margin for error. They have to get this done in two weeks or the sky will fall in the form of global financial-market turbulence or even a meltdown, which at this sensitive moment is the very last thing the Biden administration needs.