This article was featured in One Great Story, New York’s reading recommendation newsletter. Sign up here to get it nightly.

The government hasn’t exactly nailed its response to the coronavirus crisis. The mistakes and miscues started with the president, but a host of critical entities have failed to contain the pandemic and its economic fallout. Look at the CDC’s shifting guidance on masks and the botched production of the first round of test kits; at the Small Business Administration’s chaotic rollout of the Paycheck Protection Program; at the refusal of Congress to replenish coronavirus aid to businesses and unemployed workers that ran out in the summer; at New York State’s decision to discharge COVID-positive patients into nursing homes at the height of the crisis this past spring.

The Federal Reserve, at least, did its job.

In March, as panic over the coronavirus caused stock prices to crash and made banks and bondholders skittish about lending, the Fed acted to support the economy by flooding it with extra cash it hoped would help keep normal what could be kept normal. It cut interest rates from 1.5 percent to zero, announced it would purchase $700 billion in Treasury bonds and other assets to push down long-term interest rates, and provided liquidity to keep corporations able to borrow and banks able to lend. The Fed’s actions have saved Wall Street — the Dow Jones Industrial Average, which bottomed out at 18,214 on March 23, regained half its losses by mid-April and returned to near-record levels in early September — and have also done a great deal to reduce the pain on Main Street by keeping consumer credit available and interest rates on mortgages and credit cards low. Through its swift and sensible action, the Fed helped forestall corporate bankruptcies and prevented the job losses of the spring from being even worse. The Fed did not — and could not — fix everything that was wrong in our economy with the tools it has available. But imagine if this year had featured a new financial crisis on top of over 220,000 deaths and tens of millions of job losses, and you can see what we have the Fed to thank for.

Even the president has been grateful, calling Jerome “Jay” Powell, the Fed’s chair, the “most improved player” in his administration — only months after asking whether Powell, who had obliquely criticized the president’s trade policies, was a “bigger enemy” of the U.S. than Xi Jinping.

To a large extent, the Fed’s success under Powell is a result of lessons it learned in the aftermath of the 2008 financial crisis and the tool kits it developed under chairs Ben Bernanke and Janet Yellen to respond quickly to the next one: massively expanding its crisis-response functions and focusing more on achieving maximum employment rather than limiting inflation. But the Fed also owes much of its current success to the fact that it is led by Powell — who is not an economist, unlike his three immediate predecessors, but a bureaucratic operator skilled at making friends and forging consensus. In the popular imagination, the Fed is a nonpolitical entity, almost godlike in its distance from electoral pressures. But, as at the Supreme Court, that is just a cover for a slightly different, more personal form of politics. At the same time the president was slamming him on Twitter, Powell was diligently building relationships in Congress, winning over skeptical stakeholders to his right and left, and building the political support he would need for an extraordinary crisis response when the pandemic hit.

It worked. Powell’s success runs counter to the populist political narrative of our era: The Fed’s wonky technocracy has succeeded while the theoretically more politically accountable arms of our government have failed. The Fed is explicitly designed to be insulated from elections — governors are appointed to terms of up to 14 years and cannot be fired by the president without cause, while the Fed’s regional-bank presidents are chosen in consultation with stakeholders like banks and businesses. The rationale for this design had long been that a too-politicized central bank would be tempted to prioritize short-term economic performance over long-term sustainability, keeping a temporary check on unemployment by allowing inflation to run too high.

But in recent years, too-low inflation and too-slack labor markets producing weak wage growth have become arguably the largest economic problems facing the U.S. And as outside groups have made that point to the Fed, Powell has listened — holding a series of public events literally called “Fed Listens.” His renewed commitment to engaging with Congress has also extended to public engagement; as chair, he has doubled the annual number of press conferences on monetary policy from four to eight. And at a time when members of Congress seem less interested than ever in pressure from constituents to work across party lines, Fed officials have become more attentive and more flexible. This openness has helped produce a real shift toward a looser, or more “dovish,” monetary policy.

Powell characterizes this increased engagement with stakeholders not just as the right thing to do but also as an effort to earn the bank’s independence at a time when there is deep suspicion of technocrats and elites. “We’ve done a ton of things to open ourselves up, welcoming input from the outside, welcoming criticism,” he told me. “I think it’s a better way to run things. I do think if you’re not doing that right now, then you may or may not know it, but you’re about to go over the falls. It’s a world where you’ve got to be aggressively seeking transparency and accountability if you want to have democratic legitimacy.”

Powell was born into an affluent Catholic family in Washington, D.C. His mother was a statistician and his father was a labor lawyer; they had six children, of which Jay was the second oldest. He attended Georgetown Prep, the same elite Catholic day school that Neil Gorsuch and Brett Kavanaugh would later attend. The Powells were well-to-do, but not well-to-do enough for Powell’s father to quit his law practice and take a sub-Cabinet job in the Nixon administration. So after college, Jay Powell resolved to follow the kind of career track he saw as exemplified by Republican George Shultz and Democrat Cyrus Vance: building a successful private-sector career that would make it financially feasible to serve at intervals in government.

Powell lives in Chevy Chase Village, a very wealthy Maryland suburb of some 2,000 residents just outside the D.C. border. His wife is the chairwoman of the village board, a thankless role in which she oversaw an acrimonious fight last year over a dog park that was constructed and then dismantled because neighbors complained of excessive noise; the Washington Post covered the controversy under the headline “Barking Dogs at Chevy Chase Dog Park Divide the Rich and Powerful.” Powell’s neighbors are overwhelmingly Democratic: Trump took just 19 percent of the vote in the village’s precinct in 2016.

Personally, Powell has a reputation for being amiable and likable without being too interesting. When I asked G. William Hoagland, his friend and former think-tank colleague, whether he could offer me any personal color on Powell, he told me that Powell would sometimes bike to work. In the course of my reporting, I have also learned that the Fed chair plays the guitar.

There are two big things you should know about Jerome Powell. One is that he is, essentially, an accidental Fed chair. A decade ago, Powell was an obscure think-tank fellow who had recently left a career that had taken him to the upper levels, but not the pinnacle, of the financial industry (including a stint as a partner at the Carlyle Group). He had served as undersecretary of the Treasury for finance in the George H.W. Bush administration but had been out of government since 1993. In his think-tank role, Powell was a useful partner to economic officials in the Obama administration, who spent much of 2010 and 2011 talking Republicans out of letting the U.S. government default on its debt payments and crash financial markets. So in 2011, when Senate Republicans vowed to block Obama’s nominations to the Fed’s board of governors unless he picked a Republican for one of the seats, Obama tapped Powell as his best option. Powell was confirmed to the Fed in 2012.

Powell also owes his promotion to Fed chair, in 2018, to a president’s set of constrained choices. One of Trump’s few relatively consistent positions over his decades of commenting on American politics is that he is a monetary dove — or, as he puts it, “a low-interest-rate person.” In other words, he likes there to be more money floating around rather than less. For several decades, the traditional position for Republicans has been the opposite: to worry that low rates will push up inflation and cause asset-price bubbles (and hurt the incomes of wealthy bondholders). But Trump has the perspective of both a real-estate developer who likes to borrow money and a politician who knows low rates will juice the economy as he seeks reelection. So when he faced the choice about whom he should nominate to run the Fed, some of the names that might have been obvious choices for another Republican president — such as economist John Taylor and former Fed governor Kevin Warsh — were too out of step with Trump on monetary policy, because they were too likely to raise interest rates.

The president could have renominated Obama’s choice to run the Fed, Yellen, whose views on monetary policy are closer to Trump’s. There is precedent: Reagan, Clinton, and Obama all renominated Fed chairs who had originally been chosen by a predecessor of the rival party. But Yellen is a Democrat, and she was Obama’s pick, and Trump is notoriously suspicious of “Obama holdovers,” and also she is only five feet tall. I mention her height because in 2018, the Washington Post reported that Trump had repeatedly remarked to aides that Yellen seemed too short to run the central bank.

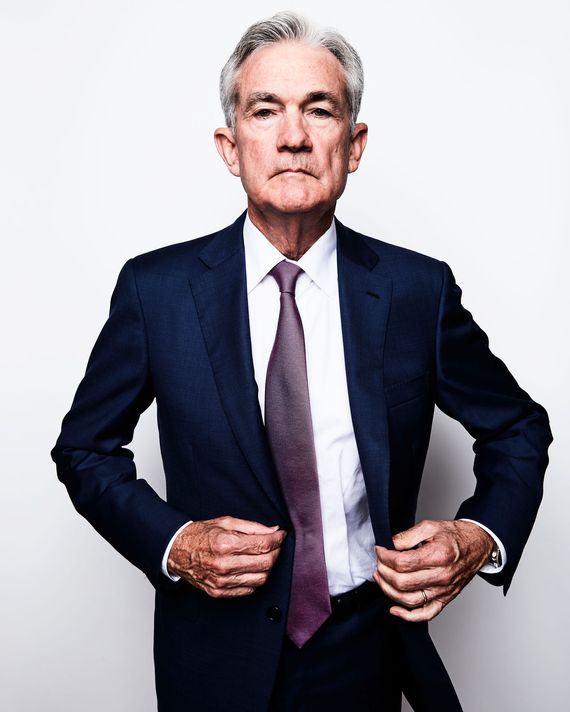

Instead, Trump turned to Powell, who had been sitting on the Fed board for nearly six years. Powell offered Trump the option of Yellen without Yellen: near-total continuity of the monetary policy she had shepherded, yet he was a Republican with somewhat more libertarian views on bank regulation. Technically, he was an Obama appointee, but only because he was forced on Obama. Plus he was five-foot-ten with silvery hair. He looked like central casting’s idea of a banker — in part because he was a banker.

That logic won out, and Powell, who just a few years earlier had been on nobody’s list of likely Fed chairs, became chair. He may not even have been on his own shortlist — Powell told me that, early in his career, his dream job was to be Treasury secretary. That he was twice the only option for the Fed who checked all the boxes is a demonstration of how short the list of reasonable Republicans available to serve in key economic-policy roles actually is. There is a reason that two of the most competent economic officials who have served in Trump’s administration — Steven Mnuchin and Gary Cohn — have long-standing ties to the Democratic Party.

The other thing you should know about Powell is that his success as Fed chair has not been accidental or merely political. He has also worked very hard to get up to speed. While running the Fed requires extensive expertise in monetary economics, it doesn’t really require being a monetary economist. If you are diligent, you can learn the material you need. So when Powell got to the board, he set about learning everything he needed to know about monetary policy, drawing on the Fed’s staff of over 400 economists. He read extensively and didn’t give his first public speech until eight months after he took his seat on the board.

“He recognized explicitly and told everyone he had a lot to learn, and he set about doing so in a very thoughtful and methodical way,” said Yellen, who was vice-chair of the Fed when Powell joined the board and is now a fellow at the Brookings Institution. “There was nothing arrogant about the way he went about doing this; it was just a flat-out recognition: If he was going to be helpful, he needed to make sure he had a good foundation, and he set out to acquire it. That was very impressive to me.”

Powell took on unglamorous assignments, from work on the payments system that moves money between banks to overseeing the renovation of the Fed’s headquarters. “Jay was willing to do anything he was asked to do,” Yellen said. He served as the board’s administrative governor, which gave him responsibility for overseeing HR and employee compensation — work that helped him build relationships inside the building that would pay off when the Fed, like so many institutions, faced challenges over diversity and inclusion. And since becoming chair, he has focused more than his predecessors on building external relationships, especially on Capitol Hill.

“I had very little interaction or communications with either Bernanke or Yellen,” said Senator Pat Toomey, a Republican member of the Senate Banking Committee, which oversees the Fed and votes on confirmations for its chair and board members. Powell, by contrast, “has reached out regularly. It’s not at all unusual for me to have a conversation with him, separate and apart from his obligated testimonies to the committee. That’s been a very big change.”

Powell’s attention to Congress has paid off. The president, who in general regards the federal bureaucracy as an arm of his reelection campaign, seems to have realized in the second half of 2018 that appointing Fed officials like Powell with a broad openness to low interest rates wasn’t getting him everything he wanted on monetary policy. So in addition to yelling at Powell on Twitter, Trump proposed a series of political hacks for the Fed board, some of whom had zero experience in monetary policy. In 2019, for instance, Trump announced he would name former Wall Street Journal editorial-board member Steve Moore and pizza businessman Herman Cain to the board.

But thanks in part to the relationships Powell has forged, the Republican–controlled Senate has been uncharacteristically resistant to the president’s out-of-the-box Fed picks. Moore and Cain never got confirmation hearings, and Judy Shelton, a longtime gold-standard advocate who was only a slightly less ridiculous choice for the Fed board, hasn’t received a full Senate vote because opposition from some Republicans, including Mitt Romney and Susan Collins, means there aren’t enough votes to confirm her. This is remarkable: While Senate Republicans often acquiesce to the president’s unqualified nominees in other critical areas, from national intelligence to the federal judiciary, they have covered Powell’s (and the market’s) flank by blocking Trump’s weird picks for the Fed.

Powell has also earned the confidence of Democrats in Congress, building bipartisan support that strengthened the Fed’s role in responding to the pandemic. “Because Powell is actually willing to listen to a lot of people in Congress — give them the time of day, fill up his schedule with meetings with them, try to make sure they feel comfortable with what the Fed is doing — that’s kind of why the Fed ended up with a lot of authority under the CARES Act,” said Skanda Amarnath, director of research at Employ America, a left-of-center group that pushes the Fed to focus on promoting full employment. “Democrats really believed that Jay Powell was going to be a fair actor.”

There have been three key aspects of Powell’s growth from an inoffensive pick seen as keeping the lights on to a leader who’s reshaping how the Fed meets a unique and historic moment.

First, in late 2018, the stock market swooned to an extent that seemed greater than warranted given prevailing economic conditions. Instead of treating the market’s plunge as an indicator of economic trouble to come, the Fed stayed more focused on actual economic conditions — such as data on employment and wages that looked broadly fine — and continued a campaign of modest interest-rate hikes aimed at normalizing interest rates as the economy got closer to maximum employment. In December 2018, Powell spooked the markets with a statement that the Fed’s program to reduce its holdings of bonds and other assets was on “automatic pilot,” causing investors to worry the Fed would continue to tighten monetary policy even if economic conditions deteriorated. This led to a self-fulfilling crisis in the stock market that culminated with Treasury Secretary Mnuchin calling bank CEOs just before Christmas Eve to discuss their liquidity. Powell and other central-bank officials hastily shifted their rhetoric, saying they would be “patient” about future rate hikes. Then, midway through 2019, the Fed shifted course and cut interest rates by 0.75 percent in what it termed a “mid-cycle adjustment” to support the economy as trade disputes continued to intensify. Trump effectively got the lower interest rates he had been demanding on Twitter — though it was the stock market, not his tweets, that forced Powell’s hand.

Second, early this year, the COVID pandemic caused huge damage to the real economy, forcing shutdowns of wide swaths of economic activity and throwing tens of millions of Americans out of work. It also caused significant problems in “financial conditions” — with people terrified to lend money to each other, the stock market fell by almost 40 percent while corporate- and municipal-bond yields rose sharply. But the Fed responded quickly and massively: At an unscheduled meeting, it cut interest rates to zero and announced its intention to buy enormous quantities of both government and mortgage bonds. These actions — and the Fed’s promise to buy more as necessary — gave market participants confidence about the availability of credit, bringing interest rates for private borrowers back down and pushing stock prices back up. It may not have been a perfect fix, but it was about as effective as the Fed, with its limited economic levers, could engineer on its own. Powell was able to take swift action in part because Bernanke’s tenure had demonstrated that the Fed could keep interest rates low without driving up inflation and in part because he was fighting a financial crisis that wasn’t caused by the financial sector. (However you feel about COVID, the banks didn’t cause it, so action to keep them in business doesn’t sit as badly with politicians or the public as it did after the mortgage crisis.) But Powell also benefited from the trust he had painstakingly built on Capitol Hill, which made it easier for him to sell massive Fed action to officials like Senator Toomey, whose disposition is to be suspicious of massive Fed action.

Third, in August, Powell announced a revision to the Fed’s framework for monetary policy that had been in the works since before COVID hit — a profound generational shift in the way the central bank thinks about inflation. For much of the decade following the financial crisis, the Fed nominally had a target that inflation should be around 2 percent. In practice, though, it seemed to treat the target as a cap — meaning inflation was sometimes 2 percent and sometimes less, underheating the economy at a time when jobs and wages were still struggling to recover from the Great Recession. Now, to give markets confidence that 2 percent would no longer be treated as a cap, Powell announced a subtle-sounding but significant change: The Fed would begin targeting an average inflation of 2 percent. Periods of lower inflation would be offset by later periods of higher inflation, so the target would be achieved over the long run. Powell also made it clear that the Fed will be more reluctant in the future to raise interest rates as the economy improves: It won’t do so just because the unemployment rate is low but will wait for clear signs that inflation is actually rising above its target level. The shift in policy — which drew on the lessons of 2018 and 2019, when the economy achieved low unemployment alongside low inflation for a sustained period — means that the Fed believes unemployment can be brought even lower without causing undue inflation or investment bubbles.

While Powell is a Republican, all three of these shifts are victories for the mostly left-leaning crew of Fed watchers who spent the past decade pushing the central bank to focus less on inflation and more on employment. This movement has included organized groups, like Fed Up, that exist to lobby the bank and make it more accountable to the public. It also includes academics and journalists who seemed a decade ago to be mostly a bunch of borderline cranks talking about nominal GDP targeting in op-eds and on Twitter. But you never know who you’ll reach on Twitter — and Powell, like Romney before him, has a secret Twitter account, and he pays attention to what is being said there.

Claudia Sahm, a former Fed economist who is a fan of Powell’s but has written critically about the Fed’s policy-making and culture, told me about a briefing she had with him early in his tenure on the Fed board. At the end of the session, Powell turned to her and said, “Claudia, you had such a big day today.”

“Well, yeah,” Sahm replied. “I’m in your office.”

“No,” Powell told her. “Noah Smith retweeted you.”

Smith was then a little-known blogger with a Ph.D. in economics. “I almost fell over,” Sahm recalled. “I was like, First, you follow Noah Smith. Second, you’re on Twitter, and you’re on Twitter during the day.”

Of course, a key question about the Fed’s changes is whether they go far enough. The Fed’s rhetorical shift in recent years has been huge, with an increasing emphasis on maximum employment and a stronger commitment to tolerating inflation in pursuit of it. Fed policy-makers from Powell on down talk extensively about the problem of inequality and how it’s exacerbated when monetary policy does not support a tight labor market, creating more competition for workers. The Fed is increasingly examining nontraditional economic indicators, like African American unemployment, that emphasize how broad economic conditions don’t necessarily flow to every demographic group — an analytical approach that supports more dovish monetary policy in pursuit of lower unemployment and stronger wage growth.

But if you ask economists like Sahm, they will note that the Fed’s actions have not yet fully matched its rhetoric. While the bank says it is now committed to average-inflation targeting, it’s not clear whether members of the Federal Open Market Committee, which sets interest rates, agree on what that means. When the committee released a policy statement on September 16, saying it would keep interest rates near zero until “inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time,” two members dissented in opposite directions — one wanted a firmer commitment to keep rates low for longer, while another wanted to give the Fed more room to raise rates sooner.

The committee also released economic projections showing that despite the promise to boost employment by letting inflation rise above 2 percent at times, that is unlikely to actually happen until 2024. That — coupled with the Fed’s expectation to keep interest rates at zero—implies a long, slow economic recovery. It also calls into question how big a deal average-inflation targeting really is. If the Fed is willing to let the economy run hot to tighten the labor market but doesn’t think that will happen for another three years, that’s a long time for workers to be waiting for a return to a competitive labor market, even if everything goes according to plan.

The Fed’s COVID-related lending activities have also been a disappointment to some, even as they represent an expansion of the Fed’s economic tool kit. While the central bank has purchased enormous amounts of Treasury and mortgage securities as well as some corporate debt, several of the programs the Fed set up under the CARES Act have been lightly used. That doesn’t necessarily mean the programs are a failure: The Fed is hoping that its promise to lend its own money as necessary through the CARES facilities will be enough to calm lending markets. This appears to be what has happened in the market for corporate debt. But smaller businesses — often underwhelmed by the support offered through the PPP loans and facing more than a year of disruption, especially in the restaurant and travel industries — have good reason to feel they lack the support they need.

Some voices on the left, such as Mike Konczal of the Roosevelt Institute, have urged the Fed to shoulder fiscal activities ordinarily conducted by Congress, with a greater willingness to lend money and accept the risk that it won’t get paid back. But Fed insiders have obvious reasons to be nervous about taking on additional powers that would inevitably draw them deeper into political disputes. After all, they’ve already led a major expansion of the central bank’s authority, even coordinating with foreign counterparts to do the same. And if Democrats win unified control of government next month, lawmakers will have the option to conduct those operations in a more traditional manner — Congress appropriating funds and executive-branch agencies administering them — without leaning on the Fed. The central bank could then be left with its already expanded mandate, while following Powell’s mantra that the Fed exerts its influence through “lending powers, not spending powers.”

Late next year, whoever is president will face a choice about whether to renominate Powell for another four-year term. Either Trump or Biden will have reason to consider looking elsewhere. Trump clearly wishes he had a yes-person in charge of the Fed, one who would deliver whatever interest-rate policy he wants at any moment. His nomination of Shelton to the board is widely viewed as an effort to position her as a possible successor to Powell. Biden will face pressure to pick an actual Democrat to run the Fed, someone with more stringent views on how to regulate banks.

But both will also share the same good reason to consider giving Powell another term, the reason that Obama put him on the board and Trump made him chair in the first place: They are unlikely to find anyone better. Trump can’t even get a Republican Senate to put Shelton on the Fed board, let alone make her its chair. And even if Biden nominated a Fed chair to Powell’s left, that person would likely lack the strong rapport with congressional Republicans that has given Powell the political cover to implement many of the left’s desired policies at the Fed. (The most obvious Democrat who could replace Powell — Lael Brainard, the only other Obama appointee currently serving on the Federal Reserve Board — is widely expected to be Biden’s nominee for Treasury secretary.)

Powell’s success as chair also provides a case study for Biden’s theory of policy-making. Throughout the campaign, Biden has told skeptical Democrats that his hands-on deal-making approach to Congress will help him forge bipartisan deals to move legislation even in the increasingly polarized environment of Washington. Liberals look at the obstructionism that Barack Obama faced at the hands of Mitch McConnell and John Boehner and reject that claim. But Biden and Powell have roughly the same approach to Congress — put in the face time, listen, make sure people know you understand their concerns, build political capital, get them to like you personally.

Biden won’t be able to translate those tactics into Republican acquiescence to his agenda any more than Powell can translate it into carte blanche for the Fed. Toomey, who gives the bank “high marks” for its response to COVID and calls its extraordinary intervention in the market “all necessary,” is already talking about putting an end date on the Fed’s new lending powers. There’s a limit to how much intervention in the market Republicans will tolerate, even if they like the guy who’s doing the intervening. But Powell’s overall strategy — and his remarkable success — does offer Biden a model for getting more of what he wants, more of the time. And he may have an easier time of it if Powell is still in charge at the central bank, soothing Republican fears as the Fed continues to take expansive action to support the economy. In the midst of a global pandemic fueled by government ineptitude and in-action, it might help to hold on to the one person in Washington who seems to be able to get something done.

*This article appears in the October 26, 2020, issue of New York Magazine. Subscribe Now!