WASHINGTON — As summer travel season begins and gas prices are spiking, Americans aren't happy, and many are looking to Washington for help.

But consumers hoping for a quick fix may be in for a rude awakening. Bringing gas prices down in 2022 isn't simply a matter of "opening the spigot" or drilling for more oil. There's a long list of problems out there pushing prices up, and they seem to defy an easy fix that would bring them back to Earth.

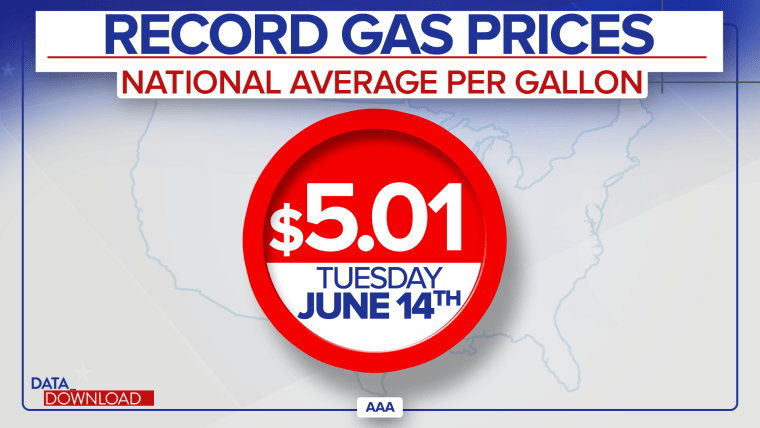

Let’s start with the big headline last week: The average price for a regular gallon of gas in the U.S. hit an all-time high last week of $5.01.

That price, recorded Tuesday by AAA, came after the average price hit $5 a gallon for the first time ever on June 11. The numbers spawned a long list of reports about despondent and angry motorists standing at the pump shaking their heads in disbelief.

But if you look closely at the amount of crude oil being produced, you’ll find the price increases are being caused not only by a shortage of supply. Oil prices have actually been higher than they are today. In fact, the cost of acquiring crude oil for refiners was higher all the way through 2011, 2012 and 2013 and most of 2014 than it is today, according to monthly averages from the U.S. Energy Information Administration.

One of the biggest culprits in the latest price spike is a decline in the ability to process oil and turn it into fuel, which is driving up refining costs.

The International Energy Agency found that the global capacity to refine oil declined by 730,000 barrels a day last year, the first time that capacity had dropped in 30 years. At the same time, Reuters estimates that Russia has idled 30% of its refining capacity this year because of sanctions for its war with Ukraine. And the U.S.'s refining capacity has declined by about 1 million barrels a day since early 2020, just before the Covid-19 pandemic, according to the Energy Information Administration.

Add it all up and you have a costly problem. Some of that refining capacity may come back “online” in the months ahead, but many operators are worried about creating too much capacity as fears of a recession grow. And those concerns may be compounded by the fact that automakers are shifting away from gasoline engines to electric motors.

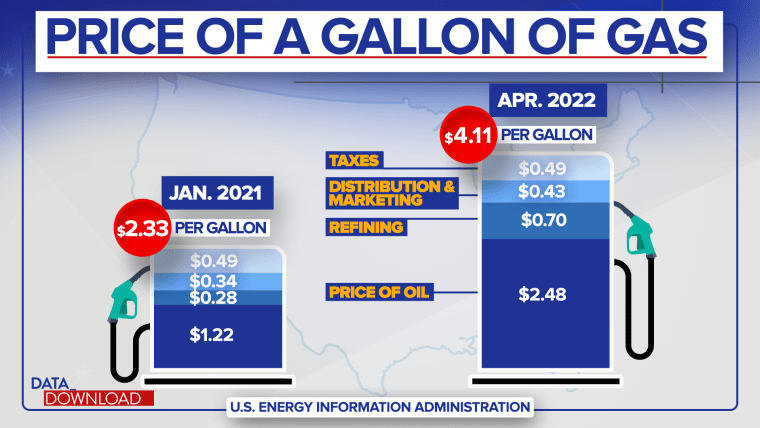

When you look at how the price of a gallon of gas is broken up, you can see how the impacts of higher crude prices and more expensive refining costs have combined to create the record AAA numbers.

Back in January 2021, when the economy was still largely asleep, the price of an average gallon of gas was still a relatively low $2.33 a gallon, according to the Energy Information Administration. Of that, $1.22 was the price of the oil, taxes were 49 cents, distribution and marketing were 34 cents, and refining was only 28 cents.

Flash forward to April 2022 and these were the numbers: A gallon of gas was $4.11, of which $2.48 was the cost of the oil, taxes were again 49 cents, distribution and marketing were 43 cents, and refining had climbed to 70 cents, according to the Energy Information Administration.

So the price of oil doubled in that time, but the price of refining it has more than doubled.

If the refining price had largely held steady, gas would still be expensive, but the benchmark $5-a-gallon figure wouldn't have been breached — at least not yet. That’s not to say that motorists would be cheerily forking over $4.60 or $4.70 for a gallon of gas, but the experience at the pump would likely feel different.

And as you head to the gas station this week or next there is one other point to keep in mind. That $5 record sounds incredibly high, but in terms of “real” spending, you have likely paid more at the pump. Gas prices don’t just drive broader inflation — they're also affected by it.

When you adjust the current average price at the pump for inflation, you are paying about $3.51 per gallon using constant 2010 dollars, according to the Energy Information Administration. (That was as of June 7.)

That’s up significantly from last year, when the average price per gallon in June was $2.51 in 2010 dollars. But in 2011, the average cost per gallon was $3.61 when adjusted for inflation. And back in June 2008, it was $4.14 in 2010 dollars.

In other words, that $5-a-gallon number may be psychologically traumatizing, but the idea of a “record price” is relative. Remember, $5 doesn’t buy what it used to anywhere these days, and that’s true even at the pump.