I remember clearly the hair products I used when I first went natural eight years ago. There was Shea Moisture Curl Enhancing Smoothie, which I used for moisturizing and defining my curls. Carol’s Daughter’s Black Vanilla line was my go-to for shampooing and conditioning. And, eventually, I became so attached to EcoStyler Gel that I scooped a big olive-hued glob into a ziplock bag and schlepped it all the way to Spain, where I studied abroad for four months.

This product obsession isn’t me-specific. Hair-care products are and always have been essential to the natural-hair community. When the movement started in the early aughts, the obsession was fueled by a lack of options. Black women were making hair solutions in their kitchens. When Black-owned early-entry brands, like Kinky-Curly and Miss Jessie’s, arrived, naturals suddenly had effective products designed specifically for popping wash and go’s, twist outs, and braid outs.

It was inevitable, then, that I noticed when natural-hair products started looking very gold. About five years into my being natural, I started seeing bronze and metallic palettes and crown/queen motifs everywhere, particularly with legacy brands that had expanded their offerings to cater to natural hair. I felt uneasy about the look, but didn’t think much of it at first. Later, I realized the gold and crowns and queens were someone else’s concept of Black womanhood. Or as Erin Williams, director of marketing and product at TPH by Taraji, put it, when mass brands started making products for natural hair, they tried to reflect who they thought the consumer was. “They wanted to celebrate the textured-hair community. But they leveraged familiar, and often stereotypical, imagery that felt celebratory and luxurious.”

This gold rush was triggered by a rapid expansion of the natural-hair market. Relaxer sales fell 38 percent from 2012–2017, and have continued to decline since. Meanwhile, products like Carol’s Daughter Hair Milk and Shea Moisture Curl Enhancing Smoothie soared in popularity — in 2018, market-research firm Mintel valued the Black hair-care industry at $2.5 billion. Mass, conglomerate-owned brands like Pantene and Head & Shoulders wanted in. And with them came the gold palettes and royalty vibes. While well-intentioned, in practice it felt like a gimmick, and only pushed me (and the broader community) deeper into the arms of the brands who had seen and served us all along.

Presently, Black-owned brands lead in innovation and solving age-old hair concerns like tangling, weightless volume, and arduous wash days. Bread Beauty, for instance, founded by former brand manager Maeva Heim, launched a “lazy girl” wash-day kit in 2020 that employed a three-step system to allow for an easy, painless routine. Pattern’s Styling Cream has become a favorite for twist outs and wash and go’s, and Sienna Naturals, which relaunched with Issa Rae in 2020, is focusing on sustainable ingredients. All that and no gold packaging in sight.

It’s been nearly 30 years since Shea Moisture founder Richelieu Dennis sold shea butter in Harlem and 20 since Target opened its doors to natural-hair brands. There’s been thousands of products in between — the good, the gold, and the holy grails. To make sense of it all, we’ve put together a timeline — a (very) abridged history of natural-hair products and packaging.

Natural-Hair Products Through the Years

1991: Richelieu Dennis sells shea-butter shampoo from a table on 125th Street in Harlem. He’s inspired to add the ingredient because it’s widely used in his native Liberia.

1993: A few miles away in Brooklyn, Carol’s Daughter founder Lisa Price makes early formulations in her kitchen, selling them at flea markets at the urging of her mother. On her first day out, she sells out of almost everything.

1999: Ouidad, the first curly-hair salon, introduces the Climate Control collection. While it isn’t marketed exclusively to Black women, it marks a shift in the visibility of curly hair.

2002: Lisa Price and Carol’s Daughter appear on the Oprah Winfrey Show. “The Oprah Effect” boosts sales overnight and traffic on the Carol’s Daughter site went from 17 people to over 10,000 in four minutes. “It was as if we had arrived,” Price has said. Her Black Vanilla line and Lisa’s Hair Elixir become staples in natural-hair routines and the line is later endorsed by Black celebrities like Solange and Jada Pinkett Smith.

2002–2003: DevaCurl and Kinky-Curly launch within months of each other. The brands’ most popular products, no-poo cleanser and curling custard, address two major priorities in the natural-hair community: Cleansing without stripping, and defining coils and kinks.

2004: Miss Jessie’s launches with Curly Pudding. The bright-lavender formula and vintage-looking, text-heavy packaging is unlike anything else in the marketplace. Sisters and founders Titi and Miko Branch said the packaging was inspired by their grandmother and her love of baking, along with old-school, vintage beauty products.

2010: Design Essentials, a longtime Black-owned hair-care brand, launches Design Essentials Naturals — its first sulfate-free, mineral-oil-free line.

2010: Target is the first mass retailer to sell natural-hair brands like Miss Jessie’s, Curls, the Jane Carter Solution, and Shea Moisture.

2010: Popular relaxer brand Mizani rolls out True Textures, a five-product hair-care line formulated specifically for natural hair. Maria Cerminara, the vice-president of marketing at the time, tells WWD that they developed the line in response to a growing trend of women wearing their hair natural. The line includes a sulfate-free shampoo, a hair mask, conditioning wash, cream gel, and curl-defining cream. It’s only available in the salon.

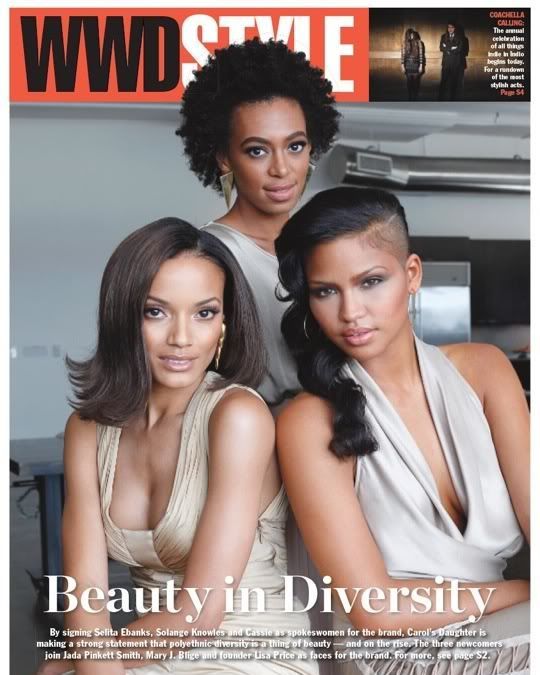

2011: Carol’s Daughter announces Cassie, Solange, and Selita Ebanks as spokeswomen for the brand on the cover of WWD Style.

2012: Cantu, founded in 2004 by AB Brands, releases the Leave-In Conditioning Repair Cream, and is marketed to women with natural and relaxed hair. The formula is thick and deeply nourishing, which is appealing to tighter, coilier textures. It takes off thanks to its affordability (most products were under $10) and accessibility, and is reviewed frequently on natural-hair forums, sites, and YouTube channels.

2013: Naptural85, along with other beauty gurus of the time, document its use of apple cider vinegar as a natural-hair cleanser, popularizing its use. Not long after, several apple cider vinegar natural-hair-care products appear on the market, like Shea Moisture Apple Cider Vinegar line, Txtr by Cantu, and Creme of Nature Apple Cider Vinegar Rinse.

2013: Pantene launches Truly Natural. The shampoo, co-wash, conditioner, and curling custard are packaged in bronze bottles. Unlike the leading Black-owned and -operated brands of the time (e.g., Carol’s Daughter and Curls), the products contain sulfates and silicones.

2014: Curls debuts a “clean” shampoo, conditioner, and curling jelly that are sulfate-, paraben-, and mineral-oil-free.

2014: The Jamaica Black Castor Oil line from Shea Moisture includes all the popular ingredients of the time: peppermint oil, apple cider vinegar, castor oil, shea butter, and coconut oil.

2015: Relaxer brands like Dark and Lovely and ORS introduce their collections for natural hair. Their packaging is reminiscent of their perm packaging, but with colorful, silhouetted Afros, and an emphasis on ingredients.

2018: Pantene quietly phases out Truly Natural and launches the Gold Series, which is meant for all Black hair — including chemically processed and transitioning hair. Head & Shoulders launches the Royal Oils collection, its first collection specifically designed for natural hair. Both lines are criticized online for their gold packaging, which is billed as “dated.”

2019: Tracee Ellis Ross launches Pattern Beauty and kicks off a year of natural-hair-care brands founded by Black celebrities. It’s lauded as fresh and innovative. The packaging is graphic and elevated, and it’s available at an accessible price, with products starting at $20.

2020: TPH by Taraji debuts a few months later in January 2020. Flawless by Gabrielle Union (founded in 2017) relaunches in August 2020. Issa Rae becomes co-owner of Sienna Naturals and the brand relaunches in fall 2020. TPH has bright-colored, custom packaging with focused nozzles to get products directly into the scalp. Sienna Naturals uses shades of green and features topographical-looking lines inspired by the shapes of curls.

2020: Bread Beauty Supply introduces the Wash Day Kit at Sephora and is only the third Black-owned hair-care brand sold by the retailer. Bread’s “effortless, lazy girl” ethos cut down traditionally laborious wash days to three simple steps. “In the textured-hair space, having a face visual on products is actually quite common and old-school. I wanted a face visual to not only signal to this customer that this product was for her, but also for it to be a nod to a design style that’s extremely nostalgic, but modernized for today’s consumer,” says founder Maeva Heim.

The Strategist is designed to surface the most useful, expert recommendations for things to buy across the vast e-commerce landscape. Some of our latest conquests include the best acne treatments, rolling luggage, pillows for side sleepers, natural anxiety remedies, and bath towels. We update links when possible, but note that deals can expire and all prices are subject to change.