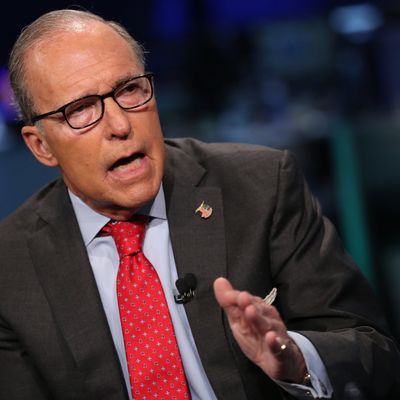

Distasteful or even alarming though he may be, Donald Trump has presented a tantalizing possibility of a Republican who would take “a wrecking ball to many of his adopted party’s orthodoxies, proposing a vision of right-wing politics far more mercantilist, nationalist and statist than anything we’ve seen from the post-Reagan, post-Goldwater G.O.P.,” as Ross Douthat, among many others, put it. But the emerging cast in Trump’s administration, from the appointment of Tom Price to run the Department of Health and Human Services to the slew of bankers and other millionaires, suggests something different: On domestic policy, he has not wrecked his party’s domestic platform, but continued and even intensified it. And the single most emblematic development is the report that Lawrence Kudlow is the leading candidate to run his Council of Economic Advisers.

The CEA chair is typically an economist. Kudlow is not, a fact on his résumé that qualifies rather than disqualifies him for his job. Kudlow is a fanatical adherent of supply-side economics. While many conservative economists believe that, all things being equal, lower tax rates can produce faster growth, Kudlow believes it with a religious intensity. No serious body of economic work could substantiate his beliefs. Indeed, even hard-core conservatives in academia — like Greg Mankiw, a Republican economist with a deep moral disdain for progressive taxation — have nonetheless described the arguments used by Kudlow as those of “charlatans and cranks.” And yet his views have come to dominate the Republicans Party despite decades of unremitting failure. What is remarkable about Kudlow is not just how flamboyantly and demonstrably wrong he has been, but that his influence over the Republican agenda has actually increased.

Kudlow’s core doctrine is that upper-bracket tax rates are the primary driver of economic growth, and that even minor changes in the level of taxation on the rich have enormous consequences on growth. In 1993, when Bill Clinton proposed an increase in the top tax rate from 31% to 39.6%, Kudlow wrote, “There is no question that Presdient Clinton’s across-the-board tax increases…will throw a wet blanket over the recovery and depress the economy’s long-run potential to grow.” This was wrong. Instead a boom ensued. Rather than question his analysis, Kudlow switched to crediting the results to the great tax-cutter, Ronald Reagan. “The politician most responsible for laying the groundwork for this prosperous era is not Bill Clinton, but Ronald Reagan,” he argued in February, 2000.

By December 2000, the expansion had begun to slow. What had happened? According to Kudlow, it meant Reagan’s tax-cutting genius was no longer responsible for the economy’s performance. “The Clinton policies of rising tax burdens, high interest rates and re-regulation is responsible for the sinking stock market and the slumping economy,” he mourned, though no taxes or re-regulation had taken place since he had credited Reagan for the boom earlier that same year.

By the time George W. Bush took office, Kudlow was plumping for his tax-cut plan. Kudlow not only endorsed Bush’s argument that the budget surplus he inherited from Clinton — the one Kudlow and his allies had insisted in 1993 could never happen, because the tax hikes would strangle the economy — would turn out to be even larger than forecast. “Faster economic growth and more profitable productivity returns will generate higher tax revenues at the new lower tax-rate levels. Future budget surpluses will rise, not fall.” This was wrong, too. (I have borrowed these quotes from my 2007 book on the rise of right-wing economic crackpots, in which Kudlow plays a prominent role.)

Kudlow then began to relentlessly tout Bush’s economic program. “The shock therapy of decisive war will elevate the stock market by a couple-thousand points,” he predicted in 2002. That was wrong. He began to insist that the housing bubble that was forming was a hallucination imagined by Bush’s liberal critics who refused to appreciate the magic of the Bush boom. He made this case over and over (“There’s no recession coming. The pessimistas were wrong. It’s not going to happen. At a bare minimum, we are looking at Goldilocks 2.0. (And that’s a minimum). Goldilocks is alive and well. The Bush boom is alive and well.”) and over (“The Media are Missing the Housing Bottom,” he wrote in July 2008). All of this was wrong. It was historically, massively wrong.

When Obama took office, Kudlow was detecting an “inflationary bubble.” That was wrong. He warned in 2009 that the administration “is waging war on investors. He’s waging war against businesses. He’s waging war against bondholders. These are very bad things.” That was also wrong, and when the recovery proceeded, by 2011, he credited the Bush tax cuts for the recovery. (Kudlow, April 2011: “March unemployment rate drop proof lower taxes work.”) By 2012, Kudlow found new grounds to test out his theories: Kansas, where he advised Republican governor Sam Brownback to implement a sweeping tax-cut plan that would produce faster growth. This was wrong. Alas, Brownback’s program has proven a comprehensive failure, falling short of all its promises and leaving the state in fiscal turmoil.

Any economic forecaster is bound to make some wrong predictions. But Kudlow hasn’t made a handful of failed guesses. He is in the grips of a comprehensively failed worldview. His devotion to upper-bracket tax-cutting is a theology, and incorrect prediction has been met with denial or a shifting of the original predictive grounds.

But Kudlow’s crank theories have a key advantage over the crank theories propounded by, say, the Jim Jones cult: They confer massive windfall benefits upon society’s richest individuals. His unwavering fealty to supply-side theology is the very characteristic that proves his ideological bona fides and qualifies him to give Trump advice — and the content of Kudlow’s advice can be known in advance with absolute certainty, and it will not waver no matter what happens in the world. And so, even in the face of failure after failure, Kudlow has retained his place in Republican politics, and the Republican Party is as devoted as ever to its doctrine of upper-class tax reduction. The sales pitch may change, and other aspects of the product may change, too, but the core strategy never does. If you put Republicans in office, the Kudlows of the world will be designing their policy agenda, and the agenda will be designed around lower taxes for rich people. And Kudlow will insist it worked.