When Marco Rubio proposed his massive tax-cut plan a few months ago, he left the details so vague it could not be analyzed. (Robert McIntyre of Citizens for Tax Justice, which measures which income groups benefit from a given tax cut or increase, told me Rubio’s plan was “impossible to model” because it was “incoherent.”) The incoherence has been a boon to Rubio, who has been able to portray his plan as a departure from Republican orthodoxy, without any hard numbers that could (and surely would) disprove his spin.

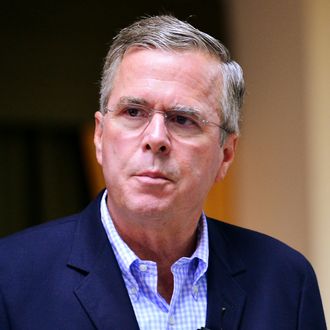

And last week, when Jeb Bush released his own proposal, it appeared at first he would follow suit. But Bush has filled in enough details that his plan’s impact could actually be measured. He’s made a huge mistake.

Citizens for Tax Justice has run the numbers, and it turns out a whopping 53 percent of the benefit of Bush’s plan would accrue to the richest 1 percent of taxpayers. By contrast, his brother’s tax cut in 2000 gave 40 percent of its benefit to the richest 1 percent — which is a lot, but less than an outright majority. Bush spent his campaign denying and dodging this fact, and a bored, vapid campaign media made fun of Al Gore for trying to pin Bush down on it rather than point out that Bush was lying.

Matthew Yglesias sees the same dynamic recurring, but I think the landscape has changed enough that Bush will have a hard time wriggling out of this one. “Most of your tax cut goes to the richest 1 percent” is a really damaging attack line, especially when you’re personally a very rich person named Bush.