The inequality is too damn high. In the United States today, the richest 0.1 percent of the population owns as much wealth as the bottom 90 percent combined. And the chasm between our aristocracy’s fortunes — and those of the average Joe and Joanna — is only growing. Since 1980, the real annual earnings of the top 0.1 percent have grown by 343 percent; the poorest nine-tenths of the country, meanwhile, have seen their earnings grow by a mere 22 percent in that time span. Absent drastic reforms of our political economy, there’s every reason to think that this income polarization will continue apace in the decades to come.

And drastic reforms ain’t easy. In fact, even modestly reducing inequality (and/or ameliorating its most troubling effects) through tax and transfer programs poses major political challenges. For example, while raising taxes on the rich is very popular, transferring income away from the upper reaches of the middle class is less so. Even when broad-based tax hikes are pegged to overwhelmingly popular forms of redistribution, such as universal health care, voters often have trouble swallowing them. A recent Kaiser Family Foundation survey found that 56 percent of Americans favored Medicare for All — until they were told the policy would “require most Americans to pay more in taxes,” at which point support plummeted to 37 percent. The credibility of this finding is buttressed by the failure of movements for single-payer health care in Vermont and Colorado, where aversion to tax increases fueled opposition. And the unpopularity of tax hikes on the non-rich can also be seen in the reluctance of even the leftmost Democrats to present detailed plans for how they intend to finance their most ambitious redistributive programs.

Bernie Sanders appears to understand all this. Which is why the 2020 candidate is preparing to shift the focus of his economic message away from divisive “tax and spend” liberalism and toward more broadly popular approaches to reducing inequality — like, say, worker ownership of the means of production. As the Washington Post’s Jeff Stein reports:

We can move to an economy where workers feel that they’re not just a cog in the machine — one where they have power over their jobs and can make decisions,” Sanders said in an interview. “Democracy isn’t just the opportunity to vote. What democracy really means is having control over your life.”

Sanders said his campaign is working on a plan to require large businesses to regularly contribute a portion of their stocks to a fund controlled by employees, which would pay out a regular dividend to the workers. Some models of this fund increase employees’ ownership stake in the company, making the workers a powerful voting shareholder. The idea is in its formative stages and a spokesman did not share further details.

Sanders also said he will introduce a plan to force corporations to give workers a share of the seats on their boards of directors. Sen. Elizabeth Warren (D-Mass.), another 2020 presidential candidate, proposed a similar idea last year.

Sanders’s plan for giving workers at major corporations an ownership stake in their firms is by far the most “socialist” policy he has ever endorsed as a national politician. The idea is, in essence, a scaled-down version of the late Swedish economist Rudolf Meidner’s plan for gradually socializing ownership of industry by requiring employers to funnel a fixed percentage of their annual profits into collectively owned, trade-union-managed “wage-earner funds.” Meidner’s plan, and all other blueprints for “funds socialism,” is derived from a simple observation, deftly summarized by Matt Bruenig of the People’s Policy Project:

[C]apital ownership no longer takes the form of an individual business owner presiding over an empire, but instead takes the form of affluent families owning diversified portfolios of real estate and financial assets like stocks and bonds. The socialization of those assets into funds owned and controlled by workers or society would thus provide a relatively simple glide path into a kind of market socialism.

(For a rundown on the Meidner plan, and other approaches to “funds socialism,” check out Bruenig’s fascinating proposal for an American Solidarity Fund).

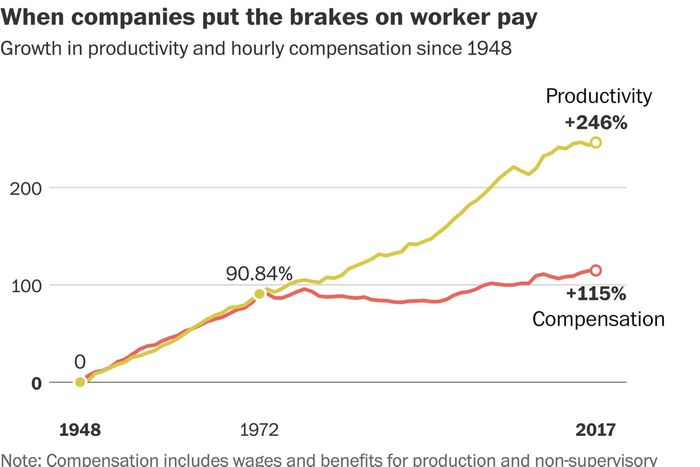

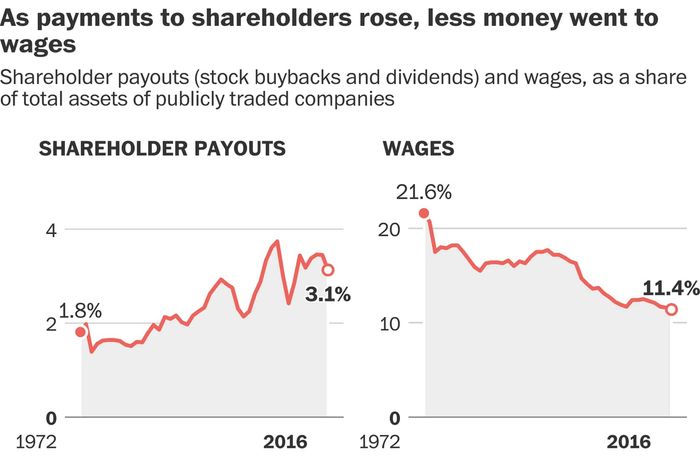

Sanders’s wealth-fund plan would do far more than any of his other policies to reduce the vast disparities of wealth and income that he’s made his name decrying. The fundamental challenge in combating inequality is that wealth begets more wealth. Those who can afford to invest in bonds get to collect annual interest payments; those who invest in stocks or real estate typically see their capital assets annually appreciate. Thus, most years, our nation’s collective capital stock directs loads of passive income to America’s wealthiest citizens. Which means that, even if wage growth hadn’t been tepid for the past four decades, the rich still would have pulled ahead of everyone else, buoyed by the rising tide of compound interest. To put a serious dent in inequality, then, you need to equalize the distribution of capital income (or, ya know, launch a world war).

And yet if Sanders’s plan for worker wealth funds is his most radical and socialistic, moderate voters may actually find it more palatable than his conventional redistributive policies. As mentioned above, raising taxes on the non-rich isn’t superpopular in the contemporary United States. Over the past half-century, conservative Republicans (and, to a lesser extent, neoliberal Democrats) have given Americans plenty of cause for doubting that Uncle Sam will be a faithful steward of their tax dollars. Asking voters to believe that the federal government knows how to invest their income better than they do can be tough. But asking them to believe that they know how to invest their employer’s income better than their bosses? That’s usually an easier sell.

We have few details about Sanders’s wealth-fund plan, let alone polling data. But in March, YouGov and the Democracy Collaborative found majority support for a similar policy. Asked whether large companies should be required to “put 2 percent of their shares into a workers fund each year, up to a maximum of 50 percent,” 55 percent of respondents said yes, while just 20 percent opposed the idea.

And the other component of Sanders’s forthcoming proposal — forcing corporations to give their workers representation on corporate boards, a policy known as “worker co-determination” — is extremely popular. Like a worker wealth fund, co-determination can redistribute significant amounts of income without raising taxes by helping workers secure a higher share of their employers’ profits. Last year, Wisconsin senator Tammy Baldwin introduced a bill requiring large companies to dedicate one-third of board seats to worker-elected representatives. Elizabeth Warren’s co-determination plan sets that minimum at two-fifths.

Shortly after Baldwin unveiled her proposal last year, the data-science firm Civis Analytics teamed up with the progressive think tank Data for Progress to poll the idea — and found that “mandating that large companies allow employees to elect representatives to their board of directors” had a positive approval rating in 100 percent of the nation’s states and congressional districts. Remarkably, this result held even when the pollster informed respondents that Republicans opposed the plan because they believed it “makes companies less efficient and would be bad for the economy.”

With the public as a whole, the policy boasted net support with likely voters who are Asian-American (+40), black (+38), college educated (+31), Latino (+32), white (+28), and not college educated (+28). No demographic group registered a net-negative opinion of the idea. And in many critical regions of the country, a majority of Trump voters endorsed it.

In many instances, the American public’s suspicion of centralized authority creates problems for economic egalitarianism. But when the question ceases to be, “Should the government have more control over the distribution of income?” and becomes “Should bosses have less?” that latent antipathy for authority starts to work in progressives’ favor.

To be sure, once conservative media gets to work on co-determination and worker wealth funds, support for the ideas will likely decline. Further, at the end of the day, combating inequality through post-tax redistribution may be more politically tenable than shifting the balance of power within firms — even if the latter is more popular with voters — because co-determination and worker wealth funds would likely inspire the impassioned, unified opposition of all major employers (who have more powerful lobbies than ordinary voters do). Meanwhile, on a substantive level, care would need to be taken to structure these policies in a manner that didn’t encourage firms to contract out more of their labor needs, so as to evade sharing profits and control with their “employees.”

But the core premise of Sanders’s proposal — that true democracy requires giving ordinary Americans some power over the institutions where they spend the bulk of their waking hours — has real political promise. And if we’re serious about reducing inequality, there’s no (desirable) alternative to confronting it at its source.