Last month, Senator Ted Cruz appeared at CPAC and declared that their party had become the authentic representative of the proletariat. “The Republican Party is not the party of the country clubs,” he boasted, “it’s the party of steel workers and construction workers and taxi drivers and cops and firefighters and waitresses.” Republicans have been saying things like this for many years, but with special emphasis since Donald Trump became their standard-bearer.

Oddly enough, many observers who are not Republicans have been making similar suggestions. There is a reason the reporting genre of interviewing Trump voters is called “diner journalism” rather than “country club journalism.” Matt Karp, writing in Jacobin last month, claimed the election was characterized by “a party system entirely decoupled from the politics of class … with Republicans winning larger and larger chunks of the non-college-educated working class, while Democrats gain more and more votes from affluent professionals and managers.” The left-wing version may not credit Republicans with advancing the cause of the working class, but it denies that Democrats are advancing any important class-based interests.

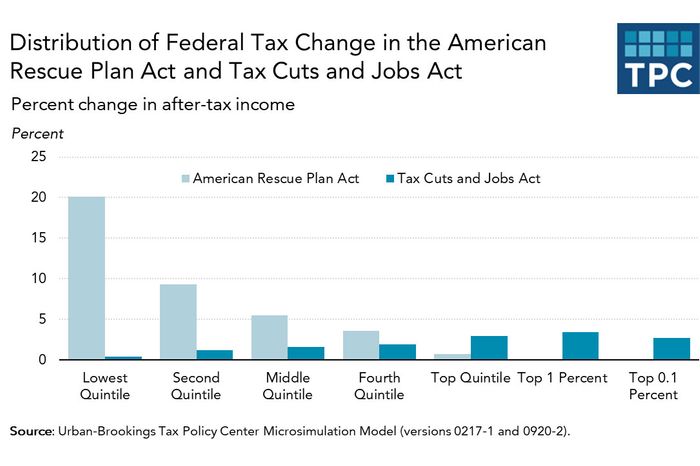

And yet, the Biden administration is already refuting these claims. Among other things, the American Rescue Act is a platform for historically large transfer of resources to the poor and working class. The Tax Policy Center has a chart comparing the income effects of the law to Donald Trump’s signature legislation:

Trump and his party used their legislative majorities to redistribute income up the income ladder. Biden and his party are using theirs to distribute it down.

What’s more, there is no indication that the Republican Party is moving toward some kind of working-class agenda. Just yesterday, 25 Senate Republicans introduced a bill to repeal the estate tax. To understand how few people would benefit from this measure, begin with the fact that the estate tax currently exempts completely any transfer worth $11 million — per spouse. That means a couple can pass on more than $22 million to their heirs tax-free, without any estate-planning maneuvers at all.

And, of course, that only begins to describe the other ways to avoid taxes. The largest is the “stepped-up basis” loophole, which allows heirs to avoid any tax at all on the capital gains accrued before the estate is transferred. This is not a small loophole. Among estates worth $100 million or more, 55 percent of the value is composed of unrealized capital gains — income that will be taxed at a rate of 0 percent.

The estate-planning industry has innumerable other ways to minimize or avoid taxation. All told, the effective tax rate (that is, the percentage actually paid to the IRS) on inheritances is well under half the 40 percent statutory rate.

Why are Republicans so obsessed with repealing a tax paid exclusively by people who inherit massive fortunes? They think it’s unfair to make them pay anything.

“The estate tax may be the most unfair tax on the books,” explains Finance Committee ranking member Mike Crapo. They’re not making an economic argument. They’re making a moral argument. They are — as far as I can tell — genuinely disgusted by the burden faced by people who inherit vast stores of wealth.

It is true that political rhetoric does not focus heavily on the class-based implications of partisan voting decisions. It is also true that partisanship has become less polarized by income than it used to be and more polarized by education and race.

But even though class does not divide the parties cleanly by their voters, it does divide them cleanly by their agendas. The Republican Party’s agenda is centered on protecting the after-tax income of the very wealthy. The Democratic Party’s agenda is focused on increasing after-tax incomes of the bottom half of the income distribution.

Republicans like to say they’re a workers’ party because “We’re the party of people who inherit estates exceeding $23 million” is not a terribly appealing slogan. But the rest of us aren’t obliged to repeat their propaganda.