When I was a freshman college debater at Emory University in the fall of 1970, the national debate topic was not Vietnam, but the desirability of wage and price control. Little did we know that just months ahead a Republican president would impose a wage-price freeze, long the anti-inflationary prescription of the left wing of the Democratic Party. But the surprise known in financial circles as the “Nixon shock,” nearly a half-century ago (on August 15, 1971) showed how pervasive the fear of inflation — running at just over 5 percent in 1970 — had become.

That’s ancient history now, even to those of us who remember the double-digit inflation of the late 1970s, and the particularly horrid scourge of “stagflation” (high inflation and unemployment simultaneously). Inflation seems to have been tamed by wise monetary policies. The periodic warnings from 21st-century conservatives that low interest rates and federal budget deficits would create inflation didn’t much bother me. It was like hearing an old priest chant a forgotten litany in a lost language — just one among many ritualistic arguments for the tight credit and reactionary social policies these people favored instinctively as a sort of class self-defense posture.

The current surge in consumer prices doesn’t necessarily change that picture; the current post-pandemic (we hope) economic environment was sure to produce a spike in wages and prices that cannot be projected into a future where something approaching normalcy will surely return (though the real-estate bubble is indeed troubling). But now I am beginning to hear echoes of the inflation panics of the not-so-distant past, which make me tremble.

Like Tim Noah, I suspect there may be a generational lapse in understanding the politics of inflation:

I don’t care to be condescended to by a bunch of Gen Xers and Millennials about my ’70s-bred fear of inflation. It feels too much like the condescension we Boomers directed toward Depression babies whenever they warned us that we were playing with fire in deregulating the financial markets. Poor dears, we thought, traumatized for life by the 1929 crash and one-third of a nation ill-housed, ill-clad, ill-nourished.

The Depression babies turned out to be right, of course.

Noah makes it clear he’s not arguing inflation per se is bad for the economy. It is, however, bad for progressive politics, and not just because “stagflation” probably killed the Carter presidency and ushered in the Reagan era far more than the Iranian hostage crisis or other better-remembered Democratic foibles. The deflationary economic strategies of the 1980s weren’t called “austerity,” but rather a corrective for undisciplined policies that fed wage and price spirals which in turned hammered the value of savings, the living standards of those on fixed incomes, and the political case for federal domestic spending.

Most lethally for progressivism, the conservative supply-side tax-cutting when combined with inflationary fears can create enormous pressure for public disinvestment and the shredding of safety nets (which is why reactionaries happily labeled the intended result “starving the beast”). We are still living with some of the long-term consequences of anti-inflationary backlash. As Noah points out, California’s Proposition 13 ballot initiative in 1978 and similar “tax revolts” were a by-product of price spirals that boosted tax assessments on property and income alike.

But sometimes lost in an examination of the right’s exploitation of inflation fears is the abiding fact that the left has no clear prescription for dealing with it, either, other than by denying its existence or significance (sometimes rightly, sometimes wrongly). Ironically, that was made most evident by the supposedly illiberal Richard Nixon’s surprising use of the great liberal instrument for taming inflation.

The veteran ex-conservative economic and political analyst Bruce Bartlett has penned an exceptional explainer on the background and consequences of the “Nixon shock,” particularly its international dimensions, and the role played by Treasury Secretary John Connally, who like his boss and ally Nixon was more focused on short-term politics than on long-term economic realities. What’s clear is that Nixon was convinced a recession induced by the Eisenhower administration and its Federal Reserve Board appointees designed to kill inflationary pressures also killed his 1960 presidential candidacy. As prices spiked in 1970, he was terrified the same thing could happen in 1972.

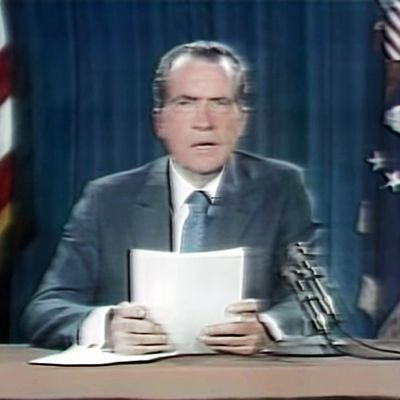

Nixon had inherited (and temporarily extended) an income-tax surcharge from LBJ that was designed to pay for the skyrocketing costs of the Vietnam War, but its effects were limited. So with his signature televised bombshell reveal (the one he deployed a month earlier to announce his trip to China), amid great secrecy, Nixon rolled out a combo platter of initiatives to fight inflation and international economic instability. They included a suspension of fixed currency exchange rates and the convertibility of the dollar to gold (to head off a raid on gold supplies triggered by a British demand for a major conversion); an import surcharge (to prevent a worsening of the trade balance); and most significantly for most Americans, a 90-day freeze on wages and prices to be followed by an indefinite period of controls by federal panels.

As political theater, Nixon’s speech announcing a “new economic policy” was, well, Nixonian. He began with dessert: an assortment of tax breaks and job-creation incentives balanced by mostly unspecified spending cuts; only then did he mention the wage-price freeze. After promising to “break the vicious circle of spiraling prices and costs,” Nixon moved on to his international proposals, which he downplayed as “very technical,” while assuring viewers that “if you are among the overwhelming majority of Americans who buy American-made products in America, your dollar will be worth just as much tomorrow as it is today.”

The wage and price controls were initially very popular (as polls had told the White House they would be) and did indeed hold down inflation through the reelection year of 1972, when Nixon won his famous landslide reelection over poor George McGovern, in part by goosing federal appropriations to create a mini-boom. By then the administration had moved on to a more discretionary system for regulating wage and price increases, which generated rumors of employers currying favor with generous donations to CREEP (the Committee to Reelect the President), the notoriously corrupt operation heavily complicit in the Watergate scandals that brought down the Nixon presidency. Between the suppressed and eventually unleashed inflationary pressures and the oil-price shock Nixon’s international economic policies helped create, the country paid a very high economic price for the brief respite from inflation the wage-price freeze earned him. He sowed the wind with even greater inflation, and his successors Gerald Ford (whose feckless “Whip Inflation Now” campaign was widely mocked) and Jimmy Carter reaped the whirlwind.

Before you dismiss these events from 50 years ago as irrelevant, consider how much Nixon’s short-sighted approach sounds like something President Donald Trump might have done if inflation had became a political problem during his tenure (or in, God help us, a future term). Indeed, any president mulling Nixon’s choice of recession-inducing fiscal or monetary policies might be tempted to resort to the easy-to-understand, if dangerous, strategy of wage and price controls in which the pain is mostly back-loaded, particularly in or near an election year. We old folks remember how it preceded Nixon’s landslide 1972 win, followed by a decade of economic pain and multiple decades of political misery for progressives.