Consumer prices are high and rising, and so is disapproval of Joe Biden. In recent days, the president’s net-favorability rating has hit new lows in FiveThirtyEight’s aggregation of polls. Meanwhile, America’s headlines are full of testaments to economic discontent. By all appearances, Biden is suffering blowback from grave failures of economic management.

But those appearances are deceiving. The U.S. economy has real problems, and inflation is certainly one of them. At the same time, America is enjoying an exceptionally swift economic recovery, rising household wealth, falling income inequality, a resurgence in labor’s economic power, and soaring capital investment. In these respects, Bidenomics has proved to be a smashing success.

The achievements of Biden’s program are significant for both their substantive consequences and their theoretical implications. As such, they should not be obscured by an inflation problem that derives largely from forces beyond the president’s control.

Bidenomics 101.

Political debates over macroeconomic policy generally revolve around two basic questions: Who deserves more income and economic power? and How can policy increase our collective prosperity?

Answers to these questions tend to be intertwined. Those who believe that business owners and high-earners are entitled to every cent of their market incomes – and thus, that taxation is akin to theft – also tend to believe that tax cuts on the wealthy will increase productive investment, and thus, societal prosperity. That latter claim has been especially integral to Republican orthodoxy. GOP politicians rarely bother trying to sell the electorate on Charles Koch’s intuitions about the immorality of his tax burden. Instead, they’ve perennially defended regressive fiscal policies on the grounds of economic necessity: Low taxes and low social spending are simply prerequisites for high levels of business investment and thus, plentiful jobs and economic growth. The rich might be the immediate beneficiaries of Republican policy. But inequality is a small price to pay for abundance. And, in due time, the benefits will trickle down.

Biden’s macroeconomic vision inverts the logic of Reaganomics. In the president’s conception, America’s working class deserves a higher share of income and economic power. As he put it in May, “We’re creating a new paradigm — one that rewards work, the working people in this nation, not just those at the top.” Biden insists that a more equitable economy will also be a larger one since “trickle-down economics has never worked” and the economy actually grows “from the bottom and the middle out.”

The theoretical premises behind Biden’s rhetoric are fairly simple: Contra conservatives, the primary driver of business investment is not low taxes but high aggregate demand. When firms see high and rising consumer appetite for their wares, they invest in greater productive capacity. When they perceive persistently weak demand, they hoard cash (no matter how low you set their tax rates).

Furthermore, it’s not that innovation generates jobs so much as full employment generates innovation. As long as firms have access to cheap, exploitable workers, they have little incentive to invest in labor-saving technology. By contrast, in a tight labor market — where employers must bid against each other for access to scarce workers — investing in productivity-enhancing machines starts to make economic sense.

From these two premises, a third follows naturally: Public spending does not “crowd out” private investment, as bipartisan orthodoxy long held, but can actually catalyze it. This is because progressive fiscal policy increases consumer demand. Working people have a greater propensity to spend their income than the rich do. As a result, policies that increase working-class purchasing power — whether through deficit-financed cash payments or social benefits financed by taxes on the wealthy — also increase overall demand for goods and services in the economy, which then increases business investment.

Of course, the bulk of Biden’s economic program has yet to be enacted. But the American Rescue Plan, signed into law in March, already operationalized the president’s macroeconomic paradigm.

On a superficial level, the ARP was almost indistinguishable from the COVID-19 relief packages that preceded it: It consisted largely of extensions and restorations of policies found within the CARES Act. But CARES had been drafted at the dawn of a historic crisis. Financial markets had just plummeted. Prohibitions on in-person commerce were commencing. One did not need to dissent much from Reaganomics to support the legislation: “When a pandemic forces the state to engineer mass unemployment for a brief period of time, the government should try to keep hard-hit households and firms solvent through cash transfers” is a principle that’s perfectly reconcilable with a conservative view of how to best support economic growth under ordinary conditions.

The ARP, by contrast, could be justified only through a negation of post-Reagan fiscal orthodoxy. It was drafted at a time when the total net worth of U.S. households was $12 trillion higher than it had been before the pandemic. Most American families were, in strictly financial terms, doing unusually well. U.S. households had less debt and more disposable income in March 2021 than they’d had at the peak of the Trump-era expansion. America’s unemployment rate was falling, shots were going into arms, and stocks were hovering near record highs.

Enacting a $2 trillion relief package in that context was a very different proposition than doing so a year earlier. Before the bill’s passage, Democratic economist Larry Summers lamented that the ARP was set to inject three times as much demand into the economy as the Congressional Budget Office deemed necessary to close the “output gap” — the gap between how much stuff our economy could produce if it fully employed our nation’s labor and resources and how much we were poised to produce absent a policy change. The ARP was therefore a large bet that our economy’s productive capacity was much higher than the CBO had recognized because large-scale fiscal spending would lead to higher private investment, thereby raising the ceiling on America’s growth potential.

This bet has paid off substantively. But at least thus far, it has backfired politically.

This year’s recovery has validated “trickle-up” economics.

The Biden economy is no workers’ paradise. The headline unemployment rate remains near 5 percent. Those who remain jobless recently saw their federal unemployment-insurance benefits expire at the president’s behest. Rising prices are eroding nominal wage gains, and as the financial-market recovery outpaces the labor one, wealth inequality is rapidly increasing.

So Bidenomics has yet to deliver the economy it promised. And with the president’s Build Back Better agenda still tied up in Congress, one might argue that real Bidenomics has never been tried.

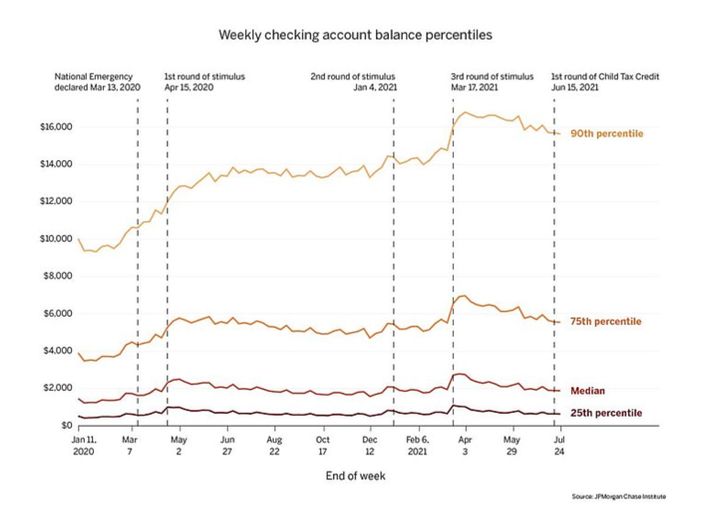

Nevertheless, if Biden’s economic vision hasn’t been fully realized, its core theoretical premises have been roundly confirmed. As expected, the ARP’s $1,400 checks and enhanced UI benefits bolstered household balance sheets and turbocharged consumption. This increased labor’s leverage over capital in two respects. First, it rendered employers more desperate for hired help to keep pace with rising demand. Second, it enabled workers to accrue a cushion of personal savings — and therefore the power to hold out for more-favorable employment opportunities without risking hunger or eviction. In July 2021, America’s unemployment rate was roughly two points higher than it had been on the eve of the pandemic, yet the median worker’s checking-account balance was higher than it had been before COVID.

The result is an exceptionally tight labor market. In August, the U.S. had more job openings than at any time in history. Employers that had refused to interview “unskilled” workers started “offering gift cards to applicants who show up for interviews, along with sign-on and retention bonuses, and sometimes immediate employment before drug screenings and background checks,” according to The Wall Street Journal.

Workers secured more income and economic power. Wages are rising faster for laborers in the bottom quartile of the income distribution than for those in the top quartile. Americans are quitting jobs at an unprecedented rate, confident in their capacity to find new and more-remunerative employment opportunities. October has witnessed America’s biggest strike wave in a generation with some unions using their newfound leverage to avenge past defeats and seek the restoration of pre-Reagan compensation standards.

These developments demonstrate that progressive fiscal policy can generate tight labor markets and, through them, rising wages and worker power. But that fact won’t necessarily discomfit a conservative economist. Many Reaganites would concede that public spending can reduce inequality. Their contention is that such spending will inevitably deliver workers a slightly larger slice of a much smaller pie. Equality, they contend, comes at the cost of abundance.

The Biden economy has proved otherwise.

For years, Republicans lamented America’s lackluster rate of business investment and attributed it to excessively high tax rates and/or to investors’ fears that high deficit spending would necessitate future tax hikes. The Trump tax cuts were sold as a means of cajoling the private sector into channeling savings toward productive investment. Yet by May 2019, even Republicans like Marco Rubio were forced to acknowledge that the $1.5 trillion tax cut had failed at its core objective.

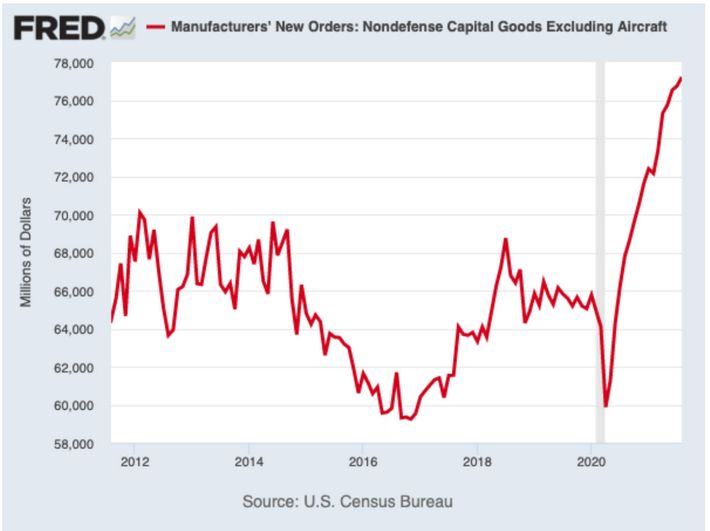

Now, in a context of high deficit spending and the widespread expectation of impending tax increases, U.S. investment in nondefense capital goods has hit its highest point on record.

Wall Street analysts have attributed this boom to the high-demand conditions fostered by progressive fiscal policy. As Ian Shepherdson of Pantheon Macroeconomics wrote in July, “A combination of rebounding earnings and support from the federal government, coupled recently with clear evidence of acute labor shortages, is pushing companies into raising capex” — that is, capital expenditures — “in order to expand capacity and remain competitive.”

To be sure, the boom in business investment cannot be credited to Biden’s policies alone, not least because it began in summer 2020. Yet the development’s Trump-era start date doesn’t actually make it less validating for Bidenomics, broadly defined. After all, the CARES Act was itself a fiscal policy that increased working-class purchasing power through deficit spending. If Trump inaugurated today’s boom in capex, he did so not by slashing taxes on corporations but by massively increasing welfare spending on working people.

In any case, the critical point from a theoretical perspective is that America has attained the GOP’s long-sought goal of high business investment amid the very macroeconomic conditions that allegedly forbade it: high deficits, the expectation of imminent corporate-tax increases, labor militancy, and elevated inflation.

If these factors had a detrimental impact on growth, that harm was overwhelmed by the benefit of heightened demand. The GOP’s alibi for upward redistribution has therefore been falsified. By restraining workers’ bargaining power and reducing their social benefits, Reaganomics directed income up the economic ladder. And since wealthy households have a lower propensity to spend than working-class ones, this regressive macroeconomic policy depressed consumer demand and businesses investment. Low demand begat low supply. Republican economic orthodoxy does not offer high growth at the cost of inequality but inequality at the cost of low growth. In truth, it is the right — not the left — that wishes to subordinate the pursuit of abundance to its peculiar conception of class justice.

Inflation threatens Biden politically. But it doesn’t discredit Bidenomics substantively.

If Bidenomics is theoretically sound, it’s looking politically dicey. Even as U.S. consumers evince economic confidence through their rampant spending, they express economic anxiety in their survey responses. A majority of Americans expect the economy to get worse over the next 12 months. Voters have started listing inflation as their No. 1 concern, and more than 60 percent of the public blames Biden for rising prices.

For these reasons, conservative readers will surely take exception to the idea that Bidenomics has been vindicated and Republican critiques of it discredited. After all, haven’t conservatives always warned that fiscal liberalism leads to ruinous inflation? And is that not what the American people are complaining of to any pollster who’ll ask?

These are reasonable objections. Without question, the U.S. economy is experiencing elevated prices, and the American Rescue Plan bears some responsibility for that fact. Biden’s high-demand macro policy is growing the supply-side of the economy. But expanding productive capacity takes time.

One implication of a demand-driven theory of economic growth is that policymakers must be willing to tolerate heightened inflation during periods of adjustment: If businesses are commonly reluctant to make large capital investments until they’re confronted with a level of consumer demand that strains their existing capacity, then inducing high business investment requires permitting demand to temporarily outstrip supply.

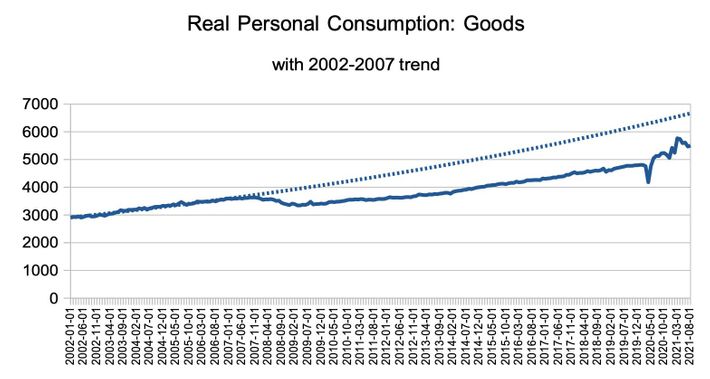

The alternative is acquiescence to tepid growth. As the economist J. W. Mason has emphasized, even with this year’s spike in consumer spending, demand remains well below where it would have been had pre-2008 consumption trends continued. The financial crisis — and the inadequate stimulus that followed it — led to persistently weak demand. As a result, U.S. economic growth never returned to its pre-crisis trajectory. There is little reason to think the 2008 crash irrevocably reduced America’s productive capacity. But getting the economy up to its full potential will require challenging its existing capabilities.

This said, today’s elevated prices cannot be blamed on Bidenomics alone. The ARP may have increased Americans’ purchasing power, but it did not encourage consumers to devote an unprecedented share of their spending to goods instead of services. The COVID pandemic did that. And consumers’ overwhelming preference for goods is a large part of the inflation problem. If Americans had maintained their pre-pandemic spending patterns — devoting a larger share of their incomes to yoga lessons, live events, gym memberships, etc. — then our nation’s ports wouldn’t be quite so clogged with shipping containers and overall price pressures would be somewhat reduced.

COVID has exacerbated inflation in myriad other ways. The pandemic simultaneously increased demand for semiconductors and limited their production. It discombobulated the global shipping industry. And it inspired millions of 60-something Americans to opt for early retirement while it restricted immigration flows (thereby shrinking the supply of laborers in the U.S.).

The biggest driver of inflation fears among U.S. voters, however, is the rising cost of energy. The surging prices of natural gas, coal, and oil have little to do with Biden’s economic policies. Rather, they derive from years of depressed investment in the fossil-fuel sector combined with collusion between Russia and OPEC to limit global oil output. Investors pulled back from oil and natural-gas extraction after the commodity-price collapse that transpired between 2014 and 2015, and the COVID crisis further reduced such extraction. This development would have been wholly benign had global governments made sufficient investments in green energy to compensate. But they didn’t. As a result, when the global economy began shaking off COVID this year, surging demand for energy met an insufficiently elastic supply of natural gas. And this mismatch was further exacerbated by droughts in multiple regions reliant on hydropower as well as below-average wind speeds in Northern Europe, which together reduced renewable-energy generation.

As gas prices spiked, power plants began turning to oil and coal, sending the price of the latter to heights unseen since 2001. The energy crunch is all but certain to get worse in the coming months as winter descends on the Northern Hemisphere and home-heating demand spikes. Since energy is a critical input in all production, a prolonged energy shortage would put upward pressure on a wide range of prices. Agriculture is reliant on fertilizers derived from natural gas, so food prices are rising. High coal prices have forced China to ration electricity, slowing production of its exports and driving up their prices.

What’s worse, there’s reason to fear energy prices could remain above pre-pandemic levels for quite some time. With a green transition looming, fear of stranded assets is limiting investor appetite for fossil-fuel developments. It is grimly ironic that Senator Joe Manchin has cited inflation as an argument against fully funding Biden’s proposed investments in clean energy since inadequate investment in renewables may well be the biggest threat to price stability in the medium term.

All of which is to say: High prices are a genuine problem in the U.S. today, and may well weigh on the recovery for some time to come. But many factors wholly external to Biden’s economic policies have contributed to this year’s modest inflation, a reality that is reflected in its ubiquity throughout the Global North.

Bidenomics has certainly put upward pressure on prices. Yet absent years of underinvestment in energy, a chip shortage, or a pandemic-induced shift of consumer spending towards durable goods, inflation would be far lower than it is today. And there’s little reason to believe that the median U.S. household would be better off in a world where it had received less in aid from Uncle Sam, the unemployment rate was higher, and business investment was lower – but prices were rising at a somewhat slower pace.

There’s reason to hope that the soundness of Bidenomics – which is to say, of a growth model centered on high demand and full employment – will eventually be recognized. The International Monetary Fund expects energy prices to moderate by next spring. At that point, many businesses that are currently straining in the face of high demand will have secured greater capacity. An unimpeachable boom might ensue.

Alternatively, an inflation panic might lead the Federal Reserve to prematurely raise interest rates and Congress to underinvest in renewables. The energy crisis could persist longer than the IMF anticipates, and a “red wave” midterm election could be heralded as a mandate for austerity.

If the media gives short shrift to the ways the Biden economy has falsified conservative orthodoxy while lending credence to the GOP’s claims of validation on inflation, then that second scenario will become a bit more likely.