“Sam,” as he’s known to his crypto peers, seems to have a big new plan: buying up Wall Street’s plumbing.

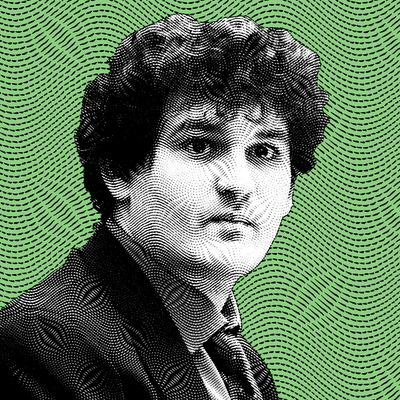

Maybe you saw Sam Bankman-Fried before you really knew his whole deal. He’s the zhlubby guy onstage with Gisele Bündchen and Bill Clinton in the Bahamas, looking perfectly comfortable in a T-shirt, shorts, tube socks, and running shoes — a power move by way of his ostentatious display of informality:

Maybe you knew he was a billionaire, the 30-year-old CEO of one of the world’s largest crypto exchanges, FTX. Maybe you knew he was planning to spend up to $1 billion on political donations for the 2024 election. That is after being Joe Biden’s second-largest donor in the 2020 cycle (though he also has a mixed record of success). And perhaps in all that you saw just another crypto billionaire, doing cringey things at an unimaginable scale — like raising $420,690,000 from 69 investors in a deal that valued his company at $25 billion last year.

But yesterday, Bloomberg broke the news that executives at Bankman-Fried’s exchange have been “deliberating internally” about buying up Robinhood, the online brokerage that fueled the meme-stock craze of early 2021. (He told the outlet that no offer has been sent over to Robinhood, but he didn’t exactly shoot the story down, either.) At first glance, there’s something of a category error here — why would the crypto guy want the meme-stock app? This crypto billionaire has long had his sights on the most rarified tranches of traditional world of finance, quipping last year that he might buy Goldman Sachs.

A Robinhood deal appears to be just another chip that Bankman-Fried is laying down as part of his growing bet on the traditional world of Wall Street. But while the curly-haired guy in white socks has been able to seize the throne of crypto king, even becoming something of a meme himself, it’s not clear how far that will take him in a world that’s heavily regulated, deeply complicated, and more than a little skeptical of new money into the entrenched world of old finance.

The biography of Bankman-Fried makes that case much clearer. He was, in his own words, “a bit of a math nerd,” an MIT graduate with a physics degree who went to trade traditional exchange-traded funds at the hedge fund Jane Capital. Crypto came later, he’s said, largely because of the huge price differences between what it was trading for in the U.S. and in South Korea, where it could be as much as 50 percent higher, thanks to the higher demand and the constraints on the country’s currency. Alameda Research, his hedge fund that propelled him to his roughly $10 billion fortune (and a lesser-known part of his empire than FTX), has been purpose-built to take advantage of the vast and uneven plumbing of the crypto markets, even when that has gotten it accused of market manipulation.

His background in the mechanics of how things work is really what’s key here. Traditional Wall Street is, at its core, a big, complicated series of companies that skim money as it flows through the system. (Tom Wolfe immortalized the job of a trader as collecting the “golden crumbs” that fall off a slice of cake in his novel The Bonfire of the Vanities). To trade even the simplest stock isn’t as simple as handing over money for a certificate of ownership in, say, Apple. In order even to be attached to that investment, money (i.e., numbers in a vast complex of databases) goes through a winding series of exchanges, dark pools, brokers, designated market makers, high-frequency traders, clearing corporations — all manner of middlemen who perform some kind of market function. Are they all economically useful? Of course not — but try doing something about it.

Well, that’s where Bankman-Fried comes in, because he actually is doing something about it. In the past year, he’s been on nothing short of a spree when it comes to the stock market. His own exchange has offered stock trading to some customers, and he’s taken a stake in IEX, a small but influential exchange whose founder, Brad Katsuyama, was the hero in the Michael Lewis book Flash Boys. Last week, he bought the clearing firm Embed. (Clearing companies take on the risk that transactions fall apart before they’re actually settled, a process that takes a day or two.) Bankman-Fried has also personally taken a small but significant stake in Robinhood. Like that other acquisitive and meme-loving billionaire, Bankman-Fried filed paperwork that said that he had no intention of exercising control over the company before apparently entertaining the idea that maybe he just wanted to go ahead and buy the whole thing.

Bankman-Fried’s logic here is, not shockingly, solid. Robinhood already trades crypto and stocks, and it has about 23 million users as of last quarter, while FTX has about 1 million. It’s also trading way (way) below its all-time high, and has been mired in all kinds of operational problems — not least of which was the revelation that it only survived the meme-stonk frenzy because it got a waiver from posting collateral.

To put it another way, a billionaire who has stakes in two exchanges, a hedge fund, a brokerage, and a clearing corporation is now mulling buying the brokerage outright. This all gets to the question of whether regulators, like the Securities and Exchange Commission, will actually allow Bankman-Fried to do this. And right now, that’s up in the air. “The problem with the SEC at this point is, who’s regulating crypto?” Joe Saluzzi, partner at Themis Trading, told me. SEC Chair Gary Gensler singled out crypto exchanges last month for trading against their customers and making markets, which complicates how regulators would even look at a theoretical purchase of Robinhood by Bankman-Fried. “Under what grounds could they even say it if it’s a brokerage firm buying another brokerage firm?” said Saluzzi.

This points to a real issue right now on Wall Street, in that, by the time different federal regulators figure out how they’re going to divvy up responsibility for the crypto industry, the bubble will have been long ago burst and the survivors with the most money are going to remake the industry how they see fit.

Bankman-Fried’s unruly hair and bulky T-shirts may give him the look of a tourist on holiday, but he’s throwing money around like he’s planning on being a Wall Street fixture.