One of the crucial prongs of Sam Bankman-Fried’s big con was his co-opting of the press, which turned out to be very easy for him. Manipulating journalists was a cinch — so few of us actually know how to write about anything having to do with crypto — and he threw money all over an industry that’s notoriously cash starved. Now, any members of the mendicant media who have ties to him or helped launder his phony philosophies are acting sheepish, pointing fingers, or insisting they barely knew the guy.

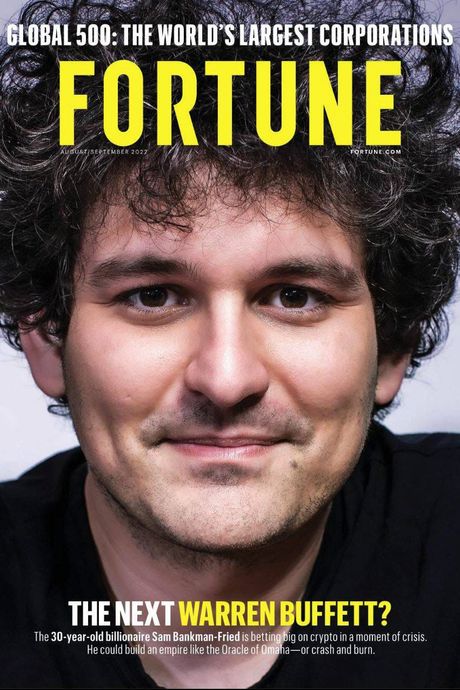

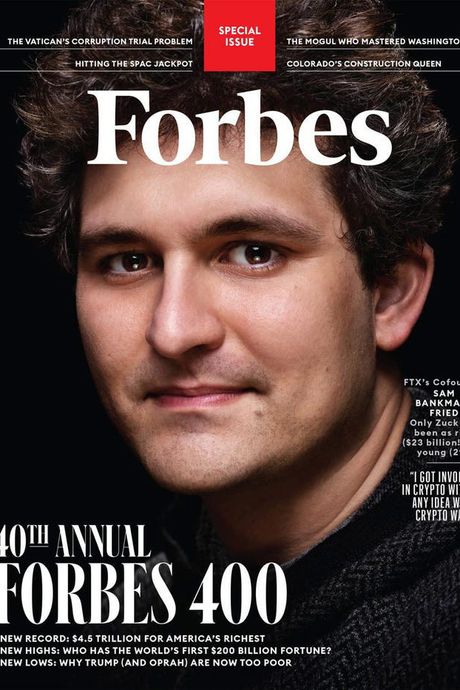

Fortune magazine put SBF on its cover this year asking, “The Next Warren Buffett?” Now the author of that story, Jeff John Roberts, confesses, “I was charmed by his nerdy affect as SBF, unkempt in a T-shirt and bushy hair, as he twirled a fidget spinner and rattled off tidbits about everything from M&A strategy to the macroeconomy to the importance of trust in business deals. It was all bullshit, of course, and I didn’t see through it.” (Fortune’s editor-in-chief, Alyson Shontell, says she has no regrets about putting him on the cover.)

SBF knew how to play reporters. He gave good quote, and he didn’t sell too hard, acting as though he too were a bit skeptical of the whole crypto thing. That posture stands in contrast to how most evangelizing crypto cranks speak to reporters. As Bloomberg’s Matt Levine (one of SBF’s favorites) wrote, “A wild-eyed crypto true believer is not the person to operate an exchange.”

Reporters covering crypto were desperate for someone in that world who was not a craven scammer. “People in the media wanted this to be the guy in crypto who is actually doing the right thing, and he was supposedly allied with regulators, supposedly on the right side of this,” says Davis Richardson, a Web3 media consultant, “but he’s actually doing the same shit that everybody else is doing in the industry.”

And SBF was different from Elizabeth Holmes. She used the legacy media and her flashy connections to con people into giving her money for something that didn’t exist. He made his money first, through real trades, then used it to score flashy connections and legacy-media praise. One media person who took an investment from SBFsays, “If you were raising money for anything in the first half of 2022, you would obviously talk to him.”

Vox Media, which owns this magazine, received a grant from his family foundation for a reporting project. And he invested in Semafor, which reported that he had tried to buy his favorite bloggers, Matthew Yglesias and Nate Silver, for a Substack-like publication he wanted to start.

“If he had any relationship with me, it was purely parasocial,” says Yglesias. He says they went for mocktails exactly once, at Doi Moi on 14th Street in D.C., and adds, “I feel like Semafor is the actual media organization that he actually invested in and got off the ground, which seems sort of more significant than the idea of hiring his favorite Twitter people for a publication with no business plan.”

But SBF does have a particular fondness for Yglesias types, those Twitterholic, progressive-lite pundits who looked fondly on (and could translate to readers) the high-minded philosophy — effective altruism — that supposedly was the impetus for his billion-dollar fortune. As Yglesias wrote in May, SBF’s “cryptocurrency businesses just exist to finance effective altruism.” While Bloomberg and Fortune provided him with a reputation for being a quirky League of Legends–playing, disheveled kind of Buffett, it was the wonkier voices in progressive media who fueled the narrative that he was also an exceptionally decent billionaire. The Nation’s Jeet Heer in mid-November slammed Yglesias, accusing him of “whitewashing a transparent con man.”

Zack Seward, a contributing editor at CoinDesk—the industry publication that first brought the house down on SBF with Ian Allison’s report exposing the lunacy of SBF’s balance sheets—said that, above all, SBF simply “craved mainstream legitimacy through whatever means necessary.” Others who knew him tell me he became obsessed with the press and the shiny image of himself it reflected back to him. One top media executive who regularly did business with SBF put it this way: “This is a very young person who, up until two years ago, had never had any interaction with the press, no notoriety, didn’t understand what it meant to be a public figure. Then he went on this big personal publicity tour, and he fell for it. But he didn’t understand the cardinal rule—that which the press builds up, the press tears down.”

More on sam bankman-fried

- The Effective Altruists’ Castle Is for Sale — and Has Become a Culture-War Meme

- Sam Bankman-Fried’s Final Trip to Court

- SBF Planned to ‘Come Out As Republican’ With Tucker Carlson