This article was featured in One Great Story, New York’s reading recommendation newsletter. Sign up here to get it nightly.

Contents

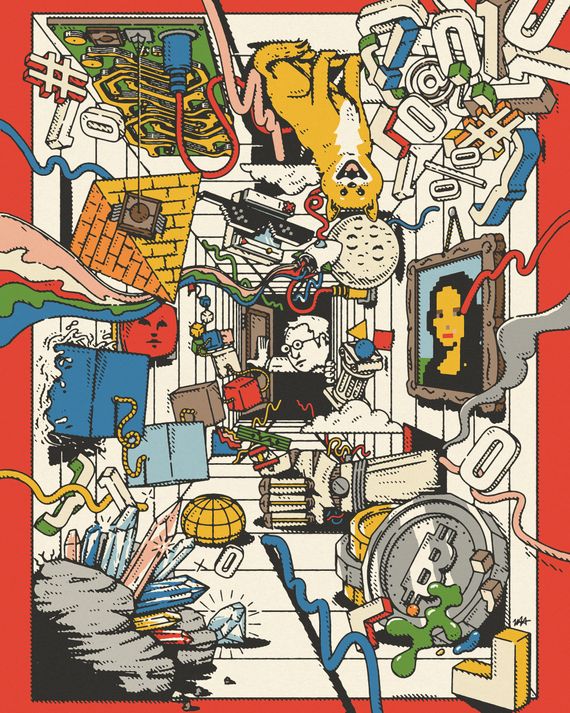

You’ve managed to willfully ignore crypto for the past some-odd years, but all of a sudden it may feel as if the blockchain is closing in on you. Your 401(k) provider is rolling out a bitcoin option, your friend just made an NFT in Microsoft Paint and sold it for $14,000, and even your mayor-elect is supporting a citywide cryptocurrency. (And did Dad just say “NGMI” in the family group chat?) To an outsider, crypto may mostly seem like a bunch of Patagonia-vest-clad bros out to make a quick buck at the expense of the environment. This is not entirely wrong, but the landscape today is unrecognizable from its inception in 2009 and even from before 2020, the year NFTs first exploded. While some corners of the crypto world are still toxic and absurd, it’s also a fascinating and (strangely) optimistic place — where a global army of people with competing philosophies, living mostly on Twitter and Discord, all in some way believe crypto will fundamentally remake the world (and, in the process, everything we believe about value, money, and the internet). This is a guide to actually understanding that universe, whether you simply want to sound literate at a dinner party, know the difference between a bitcoin maxi and an NFT scenester, angle for a promotion by showing off more tech fluency than your boss, or leave your PR job to become memer-in-chief at a new coin exchange.

1. At the very least, pick up some basic cryptospeak.

On December 18, 2013, a guy with the username GameKyuubi logged on to the then-four-year-old Bitcointalk forum and went on a whiskey-fueled rant. The value of bitcoin had just dipped 50 percent, but GameKyuubi, a self-admitted bad trader, was determined not to sell. He titled the post “I AM HODLING.” HODL, a fortuitous typo, would soon become a foundational part of cryptospeak; today it refers to not selling one’s crypto assets, even when the price becomes volatile. Since then, the lingo has grown even more unintelligible. Here are some basics to help you follow what people are talking about.

APE: To buy into a new coin or token — particularly when you don’t know much about it but feel driven by FOMO: “I need to ape into this NFT before the price shoots through the roof!”

BAGS: The coins and tokens in your portfolio. If you hold on to your coins until they become worthless, you’re unfortunately a bagholder.

DAO: At its most basic level, a DAO is just a decentralized way to organize a group of people — like a digital co-op with a shared bank account. There’s no leader or CEO who makes decisions; instead, you might bring a proposal to the DAO, and everyone who holds a token gets to vote. Some DAOs operate like start-ups, others invest in founders or NFTs, and others exist just to hang out. In November, ten friends created a DAO to buy a first-edition copy of the U.S. Constitution at a Sotheby’s auction. Within a week, they gathered 17,000 members and $45 million in funding, only to be outbid by the CEO of the hedge fund Citadel.

FUD: “Fear, uncertainty, doubt,” a catchall phrase for any kind of negativity, criticism, or bad news about a crypto-currency (even if it happens to be true). When powerful enough, FUD can cause panic sales of tokens: “Jamie Dimon is calling bitcoin a bubble that’s about to pop — he’s spreading FUD again.”

MOON: If a coin is mooning, that means its price is soaring.

NOCOINER OR NORMIE: A skeptic who has stayed out of the crypto market, either from sheer bewilderment or the suspicion that it’s a giant pyramid scheme. A tweet from @Gemsays: “A nocoiner normie friend found my Twitter & said ‘you look like a crazy person trying to start an internet anti-establishment cult.’ ”

PROOF OF WORK: The process by which the earliest crypto-currencies (like bitcoin) are mined. It’s extremely energy intensive, requiring powerful computers that race to solve elaborate sudokulike puzzles to compete for tokens.

PROOF OF STAKE: An alternative process that doesn’t require miners and uses much less energy. More and more new currencies are adopting proof-of-stake technology. Ethereum, the second-biggest cryptocurrency, has committed to migrating its entire network to proof of stake by 2022.

RUG PULL: A scam in which developers raise a lot of money for a crypto project, then disappear with all of it. One of the most notorious rug pulls took place in 2018, when a start-up called Prodeum, after receiving a modest amount of funding, disappeared with all of the users’ money and left only the word penis on its home page.

WAGMI: “We’re all gonna make it” is a rallying cry, an expression of camaraderie and optimism. Often used after something good has happened: “I bought this NFT early, and now it’s mooning. WAGMI.” Its opposite is NGMI, or “Not gonna make it,” which describes a person or entity that made a bad decision and is doomed to failure: “God, I missed out on this NFT drop! NGMI” or “Facebook’s Meta rebrand is so cringe. NGMI.”

WEB2: The internet as we know it today, which is dominated by a few large tech companies, like Facebook, Amazon, and Google, that provide services in exchange for personal data (and, in turn, control what happens to our data — how it’s stored, used, tracked, and monetized).

WEB3: Right now, it’s more of a utopian vision than a reality. Web3, a favorite buzzword of many crypto enthusiasts, is a decentralized version of the internet that runs on a blockchain. In this version, you would be a stakeholder in any entity you contribute to online (so if Facebook had started as a Web3 project, you might have been earning equity — tokens — for all those hours you’ve spent on it since 2006). Think of it as a rebrand of crypto.

WHALE: A person or institution that holds such an enormous amount of a certain crypto-currency that whenever they buy or sell, they’re able to move the market (when a whale makes a large crypto transaction, that’s known as a whale movement). Many whales choose to remain mysterious. Nobody knows, for example, the identity of the world’s largest dogecoin holder, who has collected 39.6 billion doge since 2019 (about 30 percent of the total supply).

WHITE PAPER: You can’t found a serious blockchain project or cryptocurrency without publishing a white paper, which serves as both a technical introduction as well as a manifesto for what problem you want to solve. Often long and dense.

2. Give yourself a crash course.

Lots of people will point you toward the white paper that Satoshi Nakamoto published in 2008 introducing bitcoin, or the one Vitalik Buterin wrote in 2013 laying out his vision for the ethereum blockchain. But as we’ve mentioned, the foundational texts of crypto are probably not the best place to start. “The barrier to understanding is too high,” says Chris Cantino, a partner at Color Capital. “They should be read after someone’s already been fully cryptopilled.” Instead, try these resources, ordered from least to most time-consuming.

Seven minutes

In 2016, Joel Monegro, then an investor at Union Square Ventures, wrote “Fat Protocols,” a 1,200-word blog post on USV’s website that talks about crypto’s place in the history of the internet and basically tries to answer the question “Why are things like bitcoin and ethereum valuable?” Although some argue that it’s out of date, it’s still one of the most-talked-about writings in the crypto world.

26 minutes

Grant Sanderson, who runs a beloved math YouTube channel called 3Blue1Brown, made a video called “But how does bitcoin actually work?” that explains the ledger system using simple pictures and diagrams.

One hour

In 2017, Linda Xie, an early Coinbase employee who now runs a crypto hedge fund, published on Medium a series of beginner’s guides to crypto assets that aren’t bitcoin. Her guide to ethereum goes down particularly easy and very simply lays out scenarios for how the technology can be used — for example, how ethereum can eliminate the need for lawyers and escrow agents when you’re buying a house.

Two and a half hours

Listen to “The Quiet Master of Cryptocurrency,” a 2017 episode of The Tim Ferriss Show featuring the investor Naval Ravikant and the cryptographer and computer scientist Nick Szabo. This was the podcast that got Justine Humenansky, who works at Stanford’s Future of Digital Currency Initiative, interested in crypto. “I went to a wedding in 2017 and sat at the same table as an early Coinbase employee who told me to listen to this,” she says. “After listening to it, I was like, Wow, this can be more than money. This can be a new internet.”

One semester

Gary Gensler, the current chair of the SEC, once taught a course about the blockchain at MIT’s business school, and all 24 lectures can be found on YouTube. When people ask how to start learning about crypto, the videos are the first thing Sam Dealy, a software engineer at MobileCoin, recommends. “Gensler’s able to talk about the big picture — which you’d normally get from, like, a Medium article — but he also gets down to technical details, what things actually mean in terms of computers.”

And if these aren’t enough

Venture-capital firm Andreessen Horowitz, an early investor in Coinbase, has compiled on its website an enormous crypto canon: nearly 160 podcast episodes, Medium articles, blogs, and academic PDFs divided into categories like “Foundations,” “Governance,” and “Practical Guides.”

3. Find a scene.

The Crypto Scene

The world of crypto began as a small island of misfits, but in the past 13 years, it has evolved into an enormous ecosystem of different subcultures and (sometimes warring) factions. Below, see where you might fit in.

.

Bitcoiners

The earliest bitcoiners weren’t in it for the money — instead, they were drawn to the cypherpunk vision of a currency free from government oversight. Because it was the first blockchain and cryptocurrency, bitcoin is the most popular crypto in use today. It’s also one of the last holdouts using the energy-intensive proof-of-work algorithm (other blockchains are shifting to more ecofriendly methods).

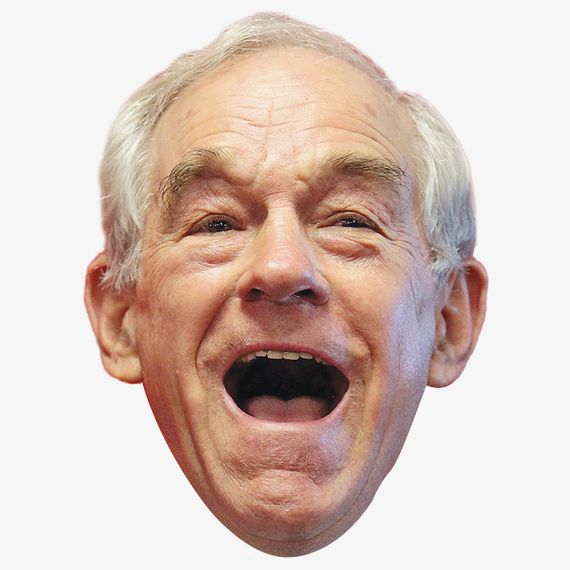

You voted for Ron Paul …

You could be a bitcoin libertarian, especially if you love talking about monetary policy, inflation, and self-sovereignty (and hate the Federal Reserve).

You’re a political dissident …

Find the anti-authoritarian/anti-imperialist bitcoiners, like the Nigerian anti-police-brutality activists who, in 2020, fund-raised with bitcoin when they were shut out of local banks.

You like a legacy brand …

Many people into bitcoin aren’t in it for political reasons; they simply see it as a store of wealth (or “digital gold”). Bitcoin is the most trusted name in crypto, and the system, which has never been hacked, is considered the most secure blockchain. That may be why it’s gaining favor with Wall Street banks and pension funds.

You’re a purist …

Bitcoin maximalists believe that bitcoin will be the only crypto needed in the future and that all the other crypto assets are worthless.

You’re a full-time day trader …

Because their markets are so active and liquid, bitcoin and ether are the most popular currencies among day traders. Bitcoin is especially popular because it affects the price of all coins.

Beware the white supremacists.

Some use bitcoin to evade the law. Alt-right figures Richard Spencer and Stefan Molyneux are into bitcoin, as is Weev, one of the biggest Nazi leaders worldwide.

.

Ethereans

Launched in 2015, the ethereum blockchain (and its native token, ether) was designed as an improvement on bitcoin. Unlike the bitcoin network (which can be pictured as a database of wallets), ethereum was conceived as a World Computer. It allowed users to do more than just transfer money; it was also a platform on which people could create new apps and currencies. Many of the first people to arrive were technical developers.

You dream in Python and Java …

Ethereum is still regarded as a kind of playground for software geeks and is home to the biggest developer population in crypto.

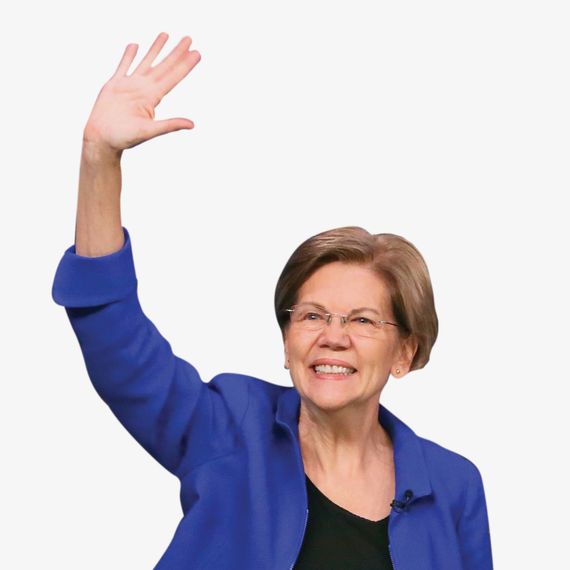

You voted for Warren or Bernie …

Ethereum tends to attract those progressives (and even socialists) who believe that crypto can enable lefty policies — that it can help redistribute wealth to build a more egalitarian and transparent society.

You’re a hedge-fund quant with a radical streak …

Fall into the decentralized-finance, or DeFi, crowd, whose members want to build a new financial system that doesn’t rely on middlemen like banks and brokers. There’s also pocket of the DeFi world that runs pump-and-dump scams; they’re known as “the DeFi Degenerates.”

You’re a next-door millionaire …

Join the ethereum whales, who hold troves of ether and double as the blockchain’s angel investors, funding a bunch of developers and projects, especially during bear markets.

You went to art school …

NFTs, most of which are bought and sold with ether, boomed in early 2021, spawning a new art scene overnight and attracting everyone from obscure digital artists to institutional heavyweights from Sotheby’s.

Or you love a luxury item …

NFTs are powerful status symbols in Crypto Land. Mel Vera, who works at DoinGud, compares owning the hottest NFTs to wearing “Yves Saint Laurent, Prada, and Goyard.”

.

The Solana Crowd

You’re a former derivatives trader, but indie …

Backed by billionaire crypto entrepreneur Sam Bankman-Fried, the solana blockchain is trying to build an ethereum rival that has much faster transaction speeds (and is cheaper). It’s currently ranked as the No. 3 blockchain and cryptocurrency, though many people believe solana will one day overtake ethereum.

.

The Smaller Coins

There are about 4,500 cryptocurrencies in circulation, many bitcoin and ethereum spinoffs. Here are some worth knowing.

You’re the scholarly type …

Find the cardano heads. In 2017, a founding member of ethereum split and launched cardano. The vibe is pretty academic; the group is really into using the peer-review system and the scientific method to build its blockchain. It was very hyped but, after years of delay, ended up being kind of a disappointment.

You’re just here for the jokes …

Join the Doge Army. Launched as a joke in 2013, dogecoin is the first “meme-coin,” a token whose value comes solely from its LOLz. A fun-loving, meme-sharing community with die-hard fans that attracted a bunch of new speculators during its recent spike.

You’re trying to avoid a paper trail …

Monero, an untraceable blockchain designed to provide privacy and anonymity, draws a fairly subversive grassroots crowd: cypherpunks, ransomware groups, darknet users. John Murphy, a moderator of the r/cryptocurrency subreddit, describes this community as “somewhat more Bitcoin-y than Bitcoin in terms of non-collaboration with the state.”

.

The Suits

You’re obsessed with cap tables and go-to-market strategy …

You just may be the dreaded investor that so many crypto people — at least the most purist ones — remain wary of.

That’s why VCs feel so much pressure to signal that they have cred. “VCs will come in and be like, Oh crap, I need to win business,” says Jimmy Chang, who works at the DeFi company Aave. “So they’ll buy a Bored Ape and say the same words as us and share the same memes. And after a while, we’re like, Oh, this investor’s actually kind of cool.”

Now it’s time to get to Twitter.

4.

Find the public intellectuals.

The crypto hive mind, for better or worse, lives on Twitter, which functions as this world’s public square. You probably don’t want your feed to turn into a Tower of Babel, so to find a starting point, we polled dozens of people and asked them to name their favorite accounts. A selection:

Chris Dixon, @cdixon

The philosophy student turned investor (and head of Andreessen Horowitz’s crypto fund) is known for his musings on the history of technology and his theorizing about the inevitability of Web3 (a.k.a. his investments).

The Defiant, @DefiantNews

One of the most trusted crypto-news organizations, launched as a newsletter in 2019 by former Bloomberg journalist Camila Russo. Evin McMullen, who works at ConsenSys, loves its explainer-y videos, particularly its 90-minute movie The Greatest NFT Film Ever Made.

Dame, @damedoteth

A community manager at the wallet company Rainbow (scroll to section 7 to see how he got the job in the first place), Dame often shares step-by-step breakdowns on wallets and NFTs for beginners, as well as philosophical doozies like “Psychology plays a significant role in not just NFTs, but also in every element of society … language & communication happen at the mind level, & words are just collective hallucinations that have power cuz of network effects — language & communication are a great example of the non-physical being so critical to everyday life.” Not too proud to shitpost.

Kinjal Shah, @_kinjalbshah

A blockchain investor who often tweets about getting economically underserved people onto the blockchain and the ways crypto is falling short.

Linda Xie, @ljxie

Xie regularly tweets reading recommendations, beginner’s guides, commentary on crypto news, and job tips and opportunities. (She once even shared the cover letter she used to cold-apply to Coinbase in 2014, when she was working at a large insurance company.) Often invites newbies to DM her.

Punk6529, @punk6529

This anonymous NFT collector is known for sharing some of the most contrarian (and epic-length) Twitter essays in the crypto-influencer scene. In October, they tweeted a sweeping, 31-part treatise about NFTs, using no fewer than five different metaphors, including a stockbroker, a wheat silo, and a bagel shop.

Michael Saylor, @saylor

The CEO of MicroStrategy, a corporate-software company, Saylor became a crypto celebrity last year when he pivoted his business model to plowing all software profits into bitcoin. He frequently tweets versions of his core message: Bitcoin is going to take over the world. (Or as he put it in an interview that inspired a popular meme: “It’s going up forever, Laura.”)

5.

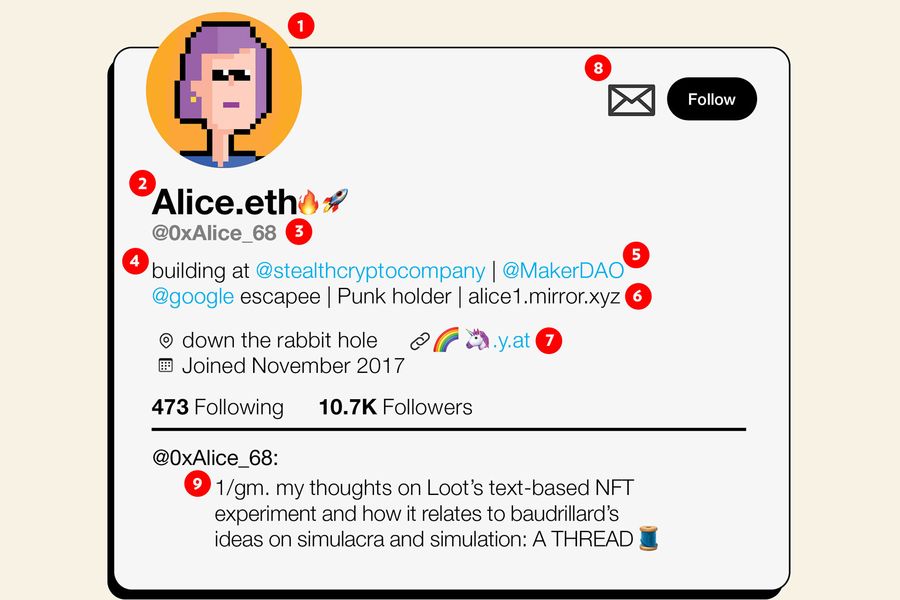

Learn to read a crypto profile.

To navigate Crypto Twitter with confidence, you’ll want to be able to quickly size up a stranger (who, in some cases, may be pseudonymous). Luckily, all kinds of clues are hiding in plain sight.

1.

The profile picture

“In Crypto, Twitter is your LinkedIn, and your profile picture matters a lot,” says Noah Davis, head of NFTs at Christie’s. “I’ve been hardwired where if I see a human face, I’m immediately skeptical.” Instead, it’s cool to use your NFT as your profile picture. “If you have an NFT that’s valuable, you signal one of two things,” explains Jimmy Chang, a product manager at Aave. “One is: I’m rich and I can afford this.’ And the second is: ‘I was really early, and I believed in something that you didn’t.’”

The only exception to the no-human-face rule is if the person is pictured with red laser beams shooting out of their eyes (that means they’re into bitcoin).

2.

The display name

If you see something followed by “.eth,” that’s a unique domain name from Ethereum Name Service, or ENS, for that person’s crypto-wallet address. These are sometimes won via public auction, and it’s an especially big flex if you can get [your first name].eth.

When you know someone’s ENS name, you can look inside their wallet and see everything they own or have transacted.

3.

The handle

In their handle or display name, Ethereans may also include “0x” (the two characters at the start of an ethereum wallet address) or Ξ (the symbol for ether).

4.

The bio

Think of the bio as a pedigree for crypto — a place people list their day jobs, the crypto projects or communities they’re a member of, and what tokens or NFTs they own. Jimmy Chang describes his Twitter bio as “basically my résumé of DAOs.”

5.

DAO-dropping

On Crypto Twitter, people love to show off which DAOs they’re in. Here are some of the sexiest:

Friends With Benefits: A social DAO that throws parties around the world. The current price of membership is more than $9,000.

PleasrDAO: An application-only DAO created to pool money for collecting NFTs. Owns the NFTs of Edward Snowden’s face made from pages of a U.S. appeals-court decision.

Seed Club: Like a start-up incubator for community-centered crypto projects.

6.

The newsletter

If you’re a crypto thought leader (or a wannabe thought leader), you probably have your own newsletter hosted on mirror.xyz (kind of like Substack but decentralized and crypto based).

7.

The Yat

If they have a string of emoji in the website field, they probably purchased a Yat. Yat is a platform that lets you buy a unique emoji-based URL, which can double as a payment address for your crypto wallet. Yats containing significant emoji, like “rocket moon,” can fetch hundreds of thousands of dollars.

8.

The open DMs

If you DM a famous crypto figure, they just might respond. “They could literally be a billionaire,” says Zachary Nelson of the UW Blockchain society. “But they’ll get back to you just because they’re there.”

According to people we polled, bigwigs who have responded to DMs include Peter Vessenes, a crypto billionaire who got into bitcoin when one cost 5 cents; Brad Garlinghouse, CEO of Ripple (“This is probably before the lawsuit, Nelson says); and Hayden Adams, the founder of Uniswap.

9.

“gm”

One of the most baffling but sacred touchstones of cryptospeak, gm (short for “good morning”) is the default way folks greet one another online — regardless of the time of day. “It seems so simple,” says Alisha.eth, the community manager at ENS. “But there is something so galvanizing about it, especially when you’re trying to organize people spread out across time zones and continents.” This fall, a VC named Sam Lessin tweeted that gm was stupid, prompting thousands of outraged responses from Crypto Twitter, many of which began with gm.

6. Make your Discord debut.

The instant-messaging app popular among gamers hosts the more intimate watering holes of Web3. Most are focused on a specific crypto community; some Discord servers function as pop-up study groups (if your study group had 3,000 members across multiple time zones); others exist for people to work on projects together as a DAO, complete with town halls and public forums; while others are exclusive to members who hold a certain NFT (for tips on how to get your first NFT, see below). Here’s how to survive your first Discord:

Make sure it’s not just you and a bunch of bots.

When you join, Evan Shirreffs, director of business development at NFTy Labs, recommends scanning the chat to make sure you’re talking to real people. “If it’s a lot of people saying, ‘Hi, hi, hi, good project, good project, good project,’ those are bots that were either paid for or joined because the project was getting attention,” he says. He also likes to ensure there’s a large number of members, at least in the thousands, conducting organic (humanlike) conversation. Alisha.eth has another metric for gauging whether the Discord community has good vibes: if people wake up in the morning and post “gm” in it.

Though you might not know who anybody is.

The crypto world is big on anonymous and pseudonymous usernames — likely as an homage to Satoshi Nakamoto, the pseudonymous founder of bitcoin. On Discord, you can have entire conversations with people without knowing their real names, where they live, where they work, or even what their voices sound like (when people do live chats, they may use a voice changer).

If you’re interacting with someone new, Chris Cantino, an investor who often tweets out advice for newbies getting into crypto, recommends making sure the person has some kind of paper trail online, whether it’s a LinkedIn with a work history or an active public Twitter account. “Or if they’re connected to a friend of a friend,” he says. The fact that you can look inside someone’s wallet is another way to do a gut check. “You can see all the stuff in my wallet: how many eth and NFTs I own, what projects I’m in. So if you see a bunch of scammy, untraceable stuff, the trust level goes way down.”

People are generally nice and willing to help.

“Strangers are totally willing to hook each other up with information or things they bought,” says Isha Kasliwal, a technical designer turned crypto enthusiast. “I once minted two of an NFT when it dropped, and there was a person in one of my Discord servers who didn’t get one. So I traded one of my two NFTs with him because he felt a lot of FOMO.” Still, if you have a question about something, do at least the bare minimum to find the answer before you ask for help.

If you meet someone in a Discord and hit it off, ask for their Telegram handle. “If someone were to ask for my LinkedIn, that’s an outsider sign,” says Justine Humenansky. And if you really find people you vibe with, you may want to start a smaller group chat, which can end up being the best way to get the lowdown on what’s legit. “It’s also where you get the lay of the land on people’s personalities,” says Cathy Mulligan, a professor of computer science at the University of Lisbon. “Like, Is this person just trying to make money, or are they actually interested in this particular coin?”

But don’t be gauche.

“When you meet people, do not ask, ‘What is the next crypto I should buy?’ Do not ask, ‘What is the next NFT I should buy?’ ” says Mel Vera. Instead, you should ask questions about the project: Who’s doing it, and what are they trying to accomplish?

Or you can say nothing at all.

To get acclimated, Alisha.eth endorses “lurking for as much time as you need. You’ll be shocked at how much you can pick up,” she says. “There’s no expectation for you to say anything. There’s thousands of people — it’s not like anyone’s going to call you out.”

And take a break if you need to.

Once you start tumbling down the crypto rabbit hole, it can be pretty hard to leave. “It’s just too consuming,” says Jimmy Chang. “There’s been dialogue around what balance looks like. Like, I should leave my home, I should talk to my IRL friends.” Brittany Pierre, a photographer who got into NFTs earlier this year, was, at one point, a member of 27 different servers. She now turns off her phone notifications after 8 p.m. “And I have made it a point to sometimes go outside and touch grass,” she says.

7. Actually pivot to crypto.

You don’t need to be a technical genius to work in the field. In fact, it’s probably better if you’re not: More and more crypto companies — from giant exchanges like Coinbase to smaller start-ups — are trying to hire people from traditional industries who know how to whisper to normies. We talked to three people who, in the past year, transitioned to the blockchain.

The marketer who tweeted his way into a new role:

“In February, I started using the Rainbow wallet. I followed one of the co-founders, Mike, on Twitter, and he followed me back for some reason. I would tweet memes about ethereum or Rainbow, or I’d tweet about my experiences learning this stuff. Rainbow was definitely not hiring at the time, but I messaged them. It was very brief, just like, ‘Hey, you’ve seen my tweets and I love the app.’ We had a call the next day to chat, and I met the other co-founders a day later. The hiring process took place over a span of a week and a half, and it was all conducted via Twitter DMs.

“I come from a marketing and communications background, and I started my career working in churches doing communications and design work. I knew relatively very little about crypto. But I think what caused them to hire me was that they saw the persona I had online was the persona they wanted their brand to have. A lot of people ask me how to get a job in crypto, and the No. 1 thing I always recommend is ‘Make sure you’re on Twitter and understand how to navigate it effectively.’ Especially if you’re going to be in a public-facing role, like I am.

“Monday through Friday, I spend most of my workday either on Twitter or I have Twitter open in the window next to me as I’m writing support content or answering messages from our Twitter account. It helps me keep a pulse on what problems customers are experiencing, the hurdles new users are having. I actually am not paid in crypto, surprisingly. I think I’m cool with that.” —Dame, content creator and ambassador at Rainbow

The art specialist who became an in-house crypto guy:

“As the head of online sales in the contemporary department in New York, I was the guy to evaluate the Beeple consignments when it came to Christie’s. That was my entrée to NFTs and crypto — I was familiar but on a surface level (I didn’t even buy any ethereum or bitcoin until after I sold the Beeple NFT). It was an interesting moment in early 2021. We had just spent the last six months doing things for the first time, like running auctions off-site. And I think Christie’s was more tolerant of doing something brand new, like selling art that doesn’t exist. The legal department had to give me permission to do a lot of things, but the first one was publishing ‘estimate unknown’ on the piece because I had no idea what to put there. I recently hired for a coordinator role here, and the person I hired doesn’t come from a traditional art background but is somebody who’s already in the NFT space and had already been engaging with me on social media. That was so much more compelling than someone who interned for a random art gallery.” —Noah Davis, head of digital sales at Christie’s

The newcomer who got hired without a legal name:

“I’m not technical by profession. I worked in tax law for a while, then I left that to work in e-commerce, which I was doing for the last decade. I was exposed to bitcoin for the first time in 2015, after Shopify added BitPay as a payment option. But I didn’t really think about it again until 2017, when I got swept up in the hype of that bitcoin bull run. Still, I realized very quickly that the financial aspect — the speculating and investing and especially trading — didn’t align with me. I didn’t see it as sustainable.

“I came back into crypto at the end of last year with this recent bitcoin bull run, and around February, I discovered the ethereum community. One thing people were talking about was Kernel, which was a Web3 learning community: They have three cohorts a year with 250 fellows. I said to myself, Okay, it’s eight weeks long. I’m going to give myself eight weeks to throw myself into the deep end. And in March of this year, I bought my ENS name, Alisha.eth.

“While I was doing Kernel, I had started a podcast called Crypto Native—just a way for me to talk to different people. One of the guests I had interviewed was Nick, the founder at Ethereum Name Service. They’d been looking for a community manager, and he encouraged me to apply. When I submitted my application and CV, I used Alicia.eth instead of my legal name. The thing is, we have no idea where this world will go, but we do know everything is on chain and it is public. So using this name preserves some anonymity. And it has given me a confidence that, for whatever reason, I do not have when using my full name. —Alisha.eth, community manager at Ethereum Name Service