At just about any point during Thursday night’s presidential debate — say, while Donald Trump gave a stream of demonstrable bullshit about Roe v. Wade and Joe Biden stood there looking confused and moribund and glassy-eyed with his mouth wide open — anybody who wanted to confirm that the 46th president’s chances of getting reelected had plummeted could do so in real time. Online, there are a small number of offshore-betting markets, which allow bettors to make money off elections as if they were buying shares of a company in the stock market. They were brutal. Before the debate, Biden was a slight underdog in what would be mostly a toss-up election — reflecting the vast majority of polls. The debate went on only for a few minutes before it started to look like something else: a total bloodbath.

Political betting markets like PredictIt and Polymarket have been around for about a decade, and they tend to operate offshore, since political betting is something of a gray area in U.S. law. On these forums, people can bet on just about any political outcome, no matter how zany. (For instance, there’s always someone willing to take the fantasy bet that Hillary Clinton is once again the Democratic nominee.) In 2020, betting markets broke for Biden and, of course, turned out to be right. This cycle, it is very different. On the question of whether Biden will drop out, the chances more than doubled — from less than one in five odds to about 50 percent in the space of three hours, according to PolyMarket. (They’ve since fallen to about one in three.)

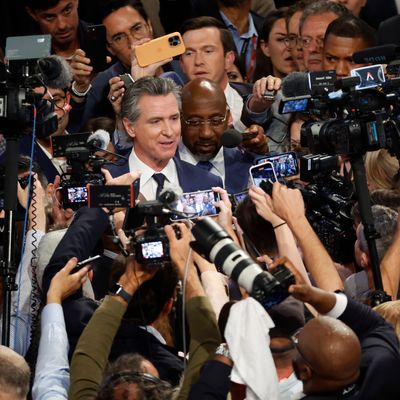

This, of course, led to other side bets. Shares of Trump’s media company — which pundits insist on being a proxy of his odds, even though this is untethered from reality — jumped about 10 percent before the market opened, only to fall lower in market trading. If not Biden, then who would be the Democratic nominee? To be clear, Biden has remained the odds-on favorite to be named as the nominee during the Democratic National Convention come August, and he has already said he won’t drop out. But that hasn’t stopped bettors from hedging, or at least hoping on a giant payout. The big winner here hasn’t been Vice-President Kamala Harris, though. Instead, the odds that California governor Gavin Newsom would end up being at the top of the presidential ticket this November tripled to a roughly one-in-four chance. (Harris’s went up, too, to about 13 percent.)

Still, there’s good reason to not buy into the wisdom of the betting markets here. Political-betting markets are really not so different from snap polls, except for the prospect of winning or losing big, and they could revert to the mean after the shock of Thursday’s debate wears off (or some other political catastrophe changes the race).

Arguably, what makes each betting contract a bit more substantial than a snap poll is that the views reflect enough of a conviction to put money on the line. There’s no telling if someone answering a poll will change her mind or not show up to vote, while bettors are probably pretty engaged with an election, and the chances of their voting increases their odds of winning. But, by their very nature, gambling markets might be a pretty bad way to gauge an election’s outcome, especially one that’s still four months out. In Las Vegas, most people lose against the house. In a democracy, it’s the opposite — most people, or at least most voters, win.