It was the tics that made Sam Bankman-Fried compelling. The fidgets, the eyes flickering around during TV interviews, the nasally nerd voice. Then there was that garden of dark, curly hair around his chubby face. Crypto was strange drug-dealer money until this Silicon Valley Paddington Bear came along, talking about how he was going to give away his fortune, save the world from pandemics and nuclear war, maybe one day buy Goldman Sachs. And it worked. By the end of 2021, his net worth was somewhere around $26.5 billion; the year before, he hadn’t even made the Forbes billionaires list. What made his success palatable, what gave it a veneer of legitimacy, were these strange little habits of his, each of which signaled eccentricity, brilliance, a childlike innocence.

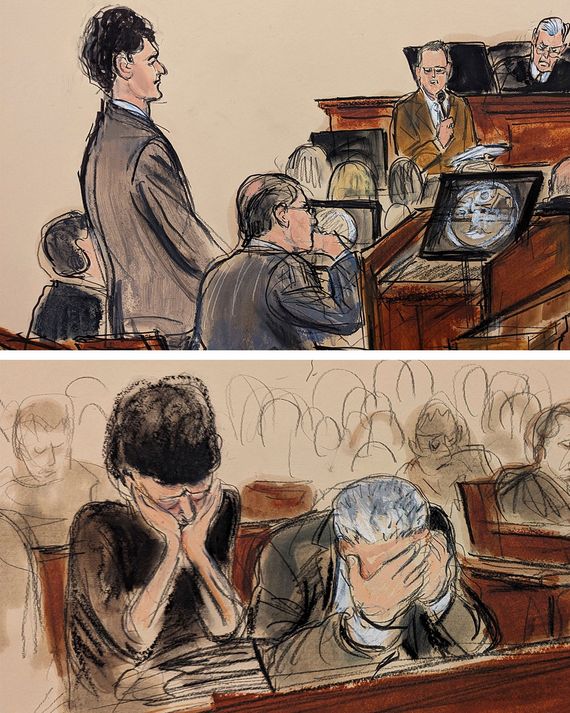

On November 2, a federal jury in Manhattan found this seemingly harmless creature guilty of seven counts of fraud and conspiracy. It took the jurors less than five hours — an astonishingly swift indictment given the overwhelming amount of evidence they had to consider. This included 10 million pages of documents and testimony from three co-conspirators, his company’s former lawyer, friends, and experts who singled him out as the mastermind of the $9 billion fraud that led to the collapse of his crypto exchange, FTX, and his hedge fund, Alameda Research.

The case was almost comically open-and-shut given not only the legend that Bankman-Fried established at the pinnacle of his fame but also the attempts by his supporters and certain journalists to paint him as a complicated, tragic figure in the run-up to the trial. Foremost among the former were his parents. “Sam will never speak an untruth,” his mother, the Stanford law professor Barbara Fried, told The New Yorker. “It’s just not in him.” The latter were led by the mega-best-selling author Michael Lewis, who was still suggesting he was a guileless savant with the best of intentions even after the trial started. We now know that Bankman-Fried, in fact, can tell a lie just like the rest of us — that he is the simplest of criminals.

Fraud is a nasty betrayal. Dante stuck the likes of Bankman-Fried in the eighth circle of hell, nearer to Satan than all but the most treacherous. At the height of his scheme, he had stolen $14 billion of funds from customers who trusted him to keep their money safe. Alameda was secretly siphoning that money from FTX customer accounts through a Rube Goldberg machine of secret computer code and an undisclosed $65 billion line of credit.

And FTX was, in all important aspects, Bankman-Fried. He owned a majority stake, and he was the mascot. “I hadn’t intended to be a public face of anything,” he said on the witness stand on October 27. “I’m somewhat introverted, naturally. I took a few interviews, and those ended up going better than I thought they would.”

The money he brought in paid for naming rights for the Miami Heat’s arena; political donations; luxury condos for him, his parents, and his employees; private jets; and venture-capital investments. It propped up the value of his related companies and was used to buy back an ownership stake in FTX from his biggest rival. Prosecutors said that he had six chances from 2021 to 2022 to make things right and give back the money. Each time, he went deeper into the fraud.

Nothing about this was all that complex. “When I started working at Alameda, I don’t think I would have believed you if you told me I would be sending false balance sheets to our lenders or taking customer money, but over time it was something I became more comfortable with,” Caroline Ellison, the former CEO of Alameda and Bankman-Fried’s ex-girlfriend, told the jury, whose members included a nurse, a librarian, an unemployed social worker, and a Metro North conductor.

The trial also revealed that even the “genius” part of his persona was something of a fiction. He gave Alameda an exemption from losing money on the exchange, which meant that customer deposits from FTX were essentially being funneled into the hedge fund to keep it afloat. “He told me a few times to make sure that Alameda’s account is never liquidated on FTX,” Gary Wang, the co-founder and former chief technical officer at FTX, said on the stand. The cover-up, in particular, was downright shambolic. He used Signal to auto-delete his messages but had Ellison write fraudulent balance sheets on a Google spreadsheet where the evidence of the theft was there for all to see. When Danielle Sassoon, the prosecutor, produced the metadata showing Bankman-Fried had viewed the documents, he could no longer deny having no knowledge of them.

By the time Bankman-Fried went before the jurors in late October, they had already heard about his hair, his eccentricities. They had also heard that this persona was part of the scam. Ellison testified that Bankman-Fried told her his unruly appearance would help make him more money. The jurors also saw a news article where he said it was “important for people to think I look crazy.”

His own defense mostly came down to a story about being a little spacey and making some bad decisions, but not doing anything intentionally — this is, criminally — wrong. His attorney, Mark Cohen, argued that “good faith is a complete defense,” and that was the extent of his strongest argument for innocence. You could call this the Michael Lewis defense, leaning into his pretrial reputation. (His other, worse defense was saying that the “Terms of Service” actually gave him permission to take customer money, despite it not saying anything like that. He also made promises under oath before Congress that customer money would not be used improperly. That defense amounted to SBF saying, “I’m innocent because my customers were dumb enough to believe me.”)

But by making the catastrophic decision to testify, Bankman-Fried not only compounded his troubles but laid bare how thin his persona had always been. He was difficult, condescending, and seemingly incapable of answering questions clearly. He also appeared to be able to control his fidgeting, and his eyes were focused and clear — all the endearing tics had suddenly disappeared.

Stripped of his billions, his accolades, and his reputation for brilliance, Bankman-Fried seemed small. “Mr. Bankman-Fried, would you agree that you know how to tell a good story?” Sassoon asked him on cross-examination. “I don’t know,” he replied. “It depends on what metric you use.” Picture him in court as a man bound, wearing a gray and baggy suit, his face somber. The biggest change was the hair. Gone were the wild curls that had given him that aura of a twitchy California genius. What was left was mangled and buzzed at the sideburns, like a helmet. Without all that hair, he looked like a kid too goofy to take seriously, much less trust with a few billion dollars. At that point, though, there was nothing left to hide.

More on sam-bankman-fried

- The Effective Altruists’ Castle Is for Sale — and Has Become a Culture-War Meme

- Sam Bankman-Fried’s Final Trip to Court

- SBF Planned to ‘Come Out As Republican’ With Tucker Carlson