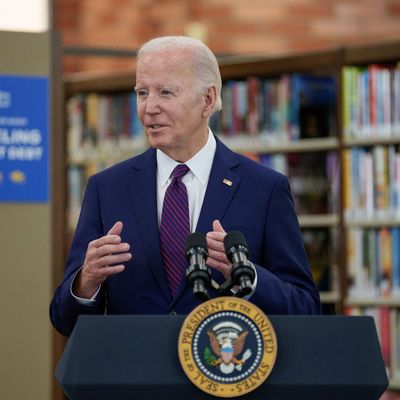

While President Joe Biden has already forgiven billions of dollars of student loans for nearly 5 million Americans, his administration’s biggest efforts to offer wide-scale student-debt relief have been consistently stymied by Republican legal challenges. His original plan to forgive at least $10,000 to most borrowers was blocked by the Supreme Court in 2023. Since then, the Biden administration has had some success forgiving debt at a smaller scale with its “Plan B” efforts, but several of its biggest initiatives have also faced significant legal roadblocks. Here’s where those efforts stand.

.

Biden’s newest student-relief effort was blocked before it could be rolled out

As part of a plan initially announced in April, the Biden administration was poised to offer automatic student-debt relief to roughly 30 million Americans starting as soon as next month, using the Higher Education Act. The administration sent out emails to borrowers in August offering them the opportunity to opt out of the cancellation plans if they wanted (by August 30). On September 5, however, a federal judge in Georgia granted a temporary restraining order against the plan after a group of seven GOP-led states filed a lawsuit challenging the effort and once again accusing the Biden administration of exceeding its authority to forgive the loans.

A hearing on the lawsuit challenging the plan is scheduled for September 18. The Biden administration has decried the efforts to block the plan, but the U.S. district judge who granted the restraining order against it said the Republican legal challenge seemed likely to succeed.

The debt-relief plan, if it clears the courts, would benefit four groups of people with student debt:

Borrowers whose loan balance, because of interest, has exceeded the amount that they were initially loaned

The new plan would cancel up to $20,000 in interest for 25 million borrowers who are enrolled in an income-driven repayment plan and now owe more than what they originally borrowed because of runaway interest. For individual borrowers who make up to $120,000 or families earning $240,000 or less, the plan would erase all of their interest, without the $20,000 maximum limit.

Borrowers who have been in repayment for more than 20 years

Biden’s new plan aims to automatically cancel the undergraduate debt of anyone who has been repaying their loans for 20 years (since July 1, 2005) and forgive the graduate-school debt of anyone who has been in repayment for 25 years (since July 1, 2000).

Borrowers who attended “low-financial-value programs” like those offered by shady for-profit universities

The new plan would also automatically cancel the debt of Americans who took out student loans to attend colleges that have since been stripped of their certification or barred from taking part in the Federal Student Aid program — making degrees earned at those institutions unmarketable.

Borrowers who already qualify for forgiveness but haven’t yet applied

The plan would automatically cancel the student-loan debt of 2 million low- and middle-income Americans who are already due forgiveness but have yet to apply for it, either because they don’t know about it or have had trouble figuring out how to submit an application.

.

The SAVE plan is stuck in legal limbo, too

In the summer of 2023, Biden launched his Saving on a Valuable Education (SAVE) plan, an income-driven repayment (IDR) program that can halve or zero out monthly payments for many student-loan borrowers as well as offer a quicker path to loan cancellation. Many Americans subsequently signed up for the plan, at least until earlier this year when legal challenges by Republican-led states led to the temporary suspension of the program.

On August 28, the U.S. Supreme Court refused to suspend a temporary halt of the SAVE program ordered by the U.S. Court of Appeals for the Eighth Circuit, while it considers a case against it. If the Eighth Circuit rules against the plan, the Biden administration could appeal to the Supreme Court again.

In the meantime, the Department of Education has placed the loans of those already enrolled in the SAVE program under temporary forbearance.

How the SAVE plan is supposed to work

The plan calculates payments based on a borrower’s income and family size — not on their loan balance — and forgives remaining balances after a certain number of years. Borrowers have to sign up for SAVE unless they were already in the government’s Revised Pay As You Earn (REPAYE) program, in which case they’re automatically enrolled.

Under SAVE, single people earning no more than $32,800 and with no discretionary income see their monthly payment plunge to $0 and get credit for a payment they otherwise would have made — forgiveness in disguise. The same is true for a family of four with an annual income of $67,500. SAVE also forgives any unpaid interest that accrued since your last timely payment. For borrowers earning discretionary income above 225 percent of the federal poverty level (this year, $33,885 for a single person and $70,200 for a family of four), monthly payments are lowered based on that discretionary income, meaning higher earners can also qualify, though the more you make, the less relief you get.

The White House says the typical borrower will see about $12,000 of interest payments waived and upwards of 95 percent of their principal forgiven under the program — a boost that it says creates “sizable potential lifetime wealth benefits.” The typical graduate of a four-year public university will save nearly $2,000 a year.

Last February, SAVE made it possible for people who borrowed no more than $12,000 to see total loan forgiveness in as few as ten years rather than 20 to 25 years. Borrowers with debt above that level see one additional year to forgiveness for each $1,000 borrowed with the maximum time 20 years for undergraduate loans plus another five years for graduate loans. Come July, undergraduate-loan payments under the program drop to 5 percent of discretionary income from 10 percent with payoff within 20 years. Graduate loans fall to 10 percent with payoff in 25 years. Borrowers with both types of loan will pay between 5 to 10 percent of their free income.

On April 12, the Biden administration announced that it was forgiving $7.4 billion worth of student debt for roughly 277,000 borrowers who have been repaying their loans for at least a decade — including $3.6 billion worth of loans for nearly 207,000 borrowers enrolled in the SAVE plan. The administration said it had informed the borrowers via email. And, on May 22, the White House announced an additional $7.7 billion in loan forgiveness, with $613 million of that going to borrowers enrolled in the SAVE plan; $5.2 billion stem from fixes to the Public Service Loan Forgiveness (PSLF) program, whereas $1.9 billion came from changes to IDR payment counts, per the U.S. Department of Education.

.

What about the new and improved forgiveness program for public servants?

People who work full-time for a nonprofit (excluding labor unions and political organizations) or a federal, state, local, or tribal government have additional options under PSLF, which erases a borrower’s federal student debt after 120 monthly payments over ten years. The program also covers some teachers, doctors, nurses, firefighters, social workers, U.S. Armed Forces members, and lawyers working for the government, among other low-paying not-for-profit jobs.

The PSLF program has been around since 2007, but was in an administrative quagmire until the Biden administration implemented reforms. Borrowers rejected in earlier years, generally due to the type of repayment plan they are enrolled in, got a second look under an Education Department review. In July, the Biden administration announced that it was forgiving a new round of $1.2 billion of loans for some 35,000 borrowers eligible for the program.

As of March 21, 871,000 borrowers had been granted $62.5 billion in relief under PSLF since October 2021. Prior to that, only 7,000 borrowers had ever received forgiveness.

To enroll in PSLF, tell your current loan servicers — either through a phone call or through the government’s PSLF Help Tool — that you plan to apply for PSLF. When using the tool to complete your application, you either choose an IDR or let MOHELA — a Missouri-based company that is the government’s official servicer for PSLF applicants — choose one for you. Loan servicers will transfer your loans to MOHELA.

Even with the Biden administration’s improvements, however, that hasn’t always gone smoothly. The Student Debt Crisis Center has first-person horror stories but also a wealth of helpful links to the various federal programs, along with free web-based workshops, definitions of terms, and helpful Q&A sections. The Education Department, which sanctioned MOHELA last October for sending borrowers delayed or faulty statements, is continuing to monitor the situation.

This post has been updated.