Among close watchers of Wall Street drama, there have been two predominant questions about the recent parade of ills facing JPMorgan Chase. The first is: How expensive will the inevitable, all-inclusive government settlement over the bank’s crisis-era mortgage practices be? And two, will Jamie Dimon lose his job over it?

The answers to both questions are now all but written. The civil settlement looks to be shaping up in the range of $13 billion, and surprisingly, Dimon’s job appears to be secure, with the board and influential shareholders closing ranks around him even as outsiders call for his resignation. Unless something extraordinary happens, he’s not going anywhere.

But there are interesting angles to the deal that have nothing to do with Jamie Dimon’s job security or JPMorgan Chase’s stock price. The JPMorgan Chase settlement is basically in a class of its own, both in scale ($13 billion would be the largest private settlement in history) and in scope (it covers not only bad loans made by JPMorgan Chase, but also Bear Stearns and Washington Mutual, which JPMorgan Chase acquired during the crisis). And it has, I think, the potential to change the bank, and the financial sector, in some fairly significant ways.

Here are, in no particular order, a bunch of outcomes I think are more probable than not:

JPMorgan Chase keeps chugging along, at least on paper: The danger posed by a DOJ settlement was never that it would hurt JPMorgan Chase financially in the near-term. Even $13 billion will only dent the bank’s $23 billion litigation reserves, and shareholders aren’t fazed by the amounts being thrown around in the press. (The bank’s stock is up 3.4 percent in the last five days.) Mostly, this is because shareholders were waiting for the civil suits to resolve themselves. Now they know roughly what kind of punishment the bank is in for, and they don’t seem particularly troubled.

The feds move on to Bank of America: JPMorgan Chase isn’t in the legal clear yet. It still faces a criminal case in California over the crisis-era sale of shoddy mortgages in the state. But the FHFA, the regulator that sued JPMorgan Chase for losses Fannie Mae and Freddie Mac sustained as a result of bad loans the bank sold them, is now looking to its next target. The FT reports that it is likely to go after Bank of America next, from which it reportedly wants $6 billion in restitution. That’s a bigger chunk than JPMorgan Chase will pay for similar offenses, and since Bank of America doesn’t have JPMorgan Chase’s fortress balance sheet to soften the blow, it will hurt more from the penalties.

JPMorgan Chase suffers the Vampire-Squid Problem: Jamie Dimon’s bank will not go out of business over a $13 billion fine. That seems clear enough. But there are long-term problems associated with being Public Enemy No. 1 as a Wall Street bank. The flood of negative publicity Dimon and JPMorgan Chase are now facing won’t let up soon, and may even eclipse the negative treatment Goldman Sachs got in 2010 and 2011. That kind of attention creates low morale among workers, and hurts recruiting and retention efforts. Even on Wall Street, few people want to work for a firm that is hated by the general public, whose sins they have to explain away to family members and friends, and whose reputation threatens their own. Don’t expect a mass exodus from JPMorgan Chase, but don’t expect it to carry the same long-term cachet, either.

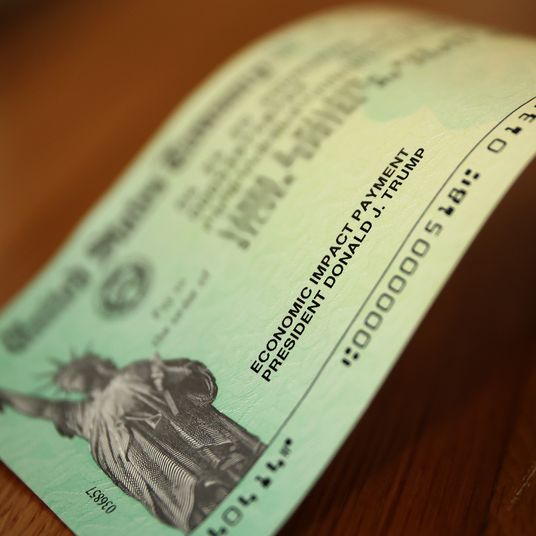

Homeowners get a bit more help: It’s not clear yet how the reported $4 billion in “consumer relief” included in JPMorgan Chase’s tentative settlement will reach actual homeowners. As with the earlier $25 billion global settlement, the help will probably come in the form of principal reductions, refinancing for underwater borrowers, and cash given to people who have already lost homes to foreclosure. Borrowers who were hurt by Bear Stearns, WaMu, or JPMorgan Chase mortgages will find a little more relief as a result of the settlement, but not much.

The big banks will get further away from the mortgage business: JPMorgan Chase is blaming most of its legal woes on things that happened at Bear Stearns and Washington Mutual, before JPMorgan Chase acquired them during the financial crisis. It’s not clear whether or not that’s true (some of the misleading underwriting practices appear to have happened post-acquisition), but regardless, it’s going to be much harder to convince a large Wall Street bank to acquire a mortgage-underwriting competitor, even at a favorable price or in a distressed situation. There’s hidden downside risk in these deals — a factor JPMorgan Chase doesn’t appear to have understood completely when it took over Bear Stearns and WaMu — and I wouldn’t look for many more like them.

The Feds get bolder: Eric Holder’s Justice Department has not been known, historically, for tough treatment of investment banks. But the wrangling over the JPMorgan Chase settlement seems to have lit a fuse under the department. The Times reports that it took a personal call from Jamie Dimon to one of Holder’s lieutenants to keep the DOJ from announcing a raft of embarrassing civil charges against the banks, and that, even during settlement talks, government negotiators kept pushing the price of a deal up, from $1 billion to $3 billion to $13 billion. The DOJ and other regulators have much more leverage in these kinds of negotiation than they often realize, owing to banks’ extreme aversion to be raked over the coals publicly and their willingness to overpay for a speedy, relatively painless settlement. And while JPMorgan Chase might privately complain that the DOJ inappropriately strong-armed it into such a huge payout, expect that arm to get stronger and stronger in future negotiations.