Senate Republicans are desperate for cash. Right now, the Senate GOP tax bill would likely add more than $200 billion to the deficit, annually, in the second decade after it’s passed. But due to arcane Senate rules, Republicans can’t pass their tax plan out of the upper chamber — without Democratic cooperation (which they aren’t going to get) — unless their bill adds $0 to the deficit, annually, in the second decade after it’s passed.

This is not a small problem. The single most expensive provision in the GOP tax plan is a 15-point reduction in the corporate tax rate. Republicans could scrap that entirely — leave the current corporate rate at 35 percent, while keeping every loophole closure currently in their plan — and the bill would still add $45 billion to the deficit in 2027, according to estimates from Congress’s Joint Committee on Taxation.

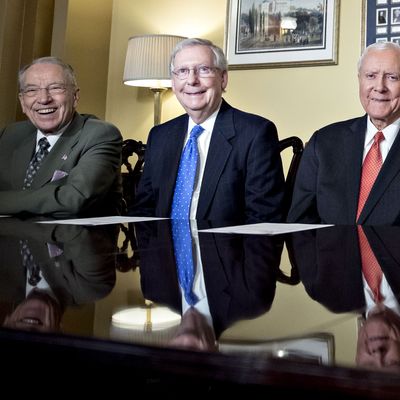

On Tuesday, top Senate tax writer Orrin Hatch plans to introduce an amendment to cover that gargantuan gap. But all signs suggest that Republicans haven’t begun to appreciate how severe their money problem is. Observe this dispatch from Bloomberg:

[H]ow the revised version would bridge the gap remains a mystery.

Even Hatch seems unsure: “I know what’s in it but they may change it on me,” he said after his committee recessed Monday evening.

Senator Susan Collins of Maine offered some ideas for changes late Monday. They included setting the corporate rate at 21 percent, not 20, and keeping the current top individual rate of 39.6 percent for married taxpayers filing jointly who earn $1 million or more. The Senate bill proposes cutting that rate to 38.5 percent. The proceeds from those adjustments could go to providing a refundable childcare tax credit or preserving property tax deductions, according to Collins, who cast a pivotal vote to block an Obamacare repeal bill earlier this year. [my emphasis]

So, Collins’s idea for offsetting an annual revenue shortfall of more than $217 billion is to raise the top individual and corporate rates by a single percentage point … and then invest the new revenue into bigger middle-class tax cuts, thereby offsetting $0 of the annual revenue shortfall.

This is a recurring — and, potentially fatal — problem for Republican tax writers: As soon as they come up with an idea for new revenue, they immediately remember a new tax they’d like to cut.

On Monday, President Trump suggested that the Senate should end Obamacare’s individual mandate, a move that would generate $338 billion in revenue, by decreasing participation in the Affordable Care Act and, thus, the amount the government needs to spend on health insurance subsidies.

But the moment he was done typing this revenue proposal, Trump starting tapping out a plan to spend the money on bigger tax cuts.

Rand Paul offered the same proposal Tuesday, arguing that repealing the individual mandate would allow more than $300 billion in additional tax cuts — a claim that suggests the Kentucky senator hasn’t even begun to reconcile himself to the reality that his party’s tax cuts need to get smaller, not bigger.

Hatch, for his part, wants to both massively cut the cost of the Senate tax bill and “ease the double taxation of corporate income.” In other words, he (reportedly) wants to radically reduce the plan’s price tag … while also making its giant corporate tax cuts even bigger.

And then there’s this little detail: Republican senators are currently assuming that the final GOP tax legislation will completely eliminate the state and local tax (SALT) deduction. But in order to pass their bill out of the House, the GOP leadership is assuring Republicans from high-tax states that the deduction will be partially preserved. As Bloomberg reports:

The Republican whip team reported that the tally for the tax bill was in a good place on Monday night, according to two House members briefed on the vote counting who were not authorized to speak publicly. Conservatives are mostly on board, and the focus is now on convincing members from high-tax states that the compromise to preserve the deduction for state and local property taxes will be included in the final bill, the two Republicans said. [my emphasis]

The difference between eliminating SALT completely and the House compromise is about $60 billion in annual revenue.

The Senate GOP can’t make up that gap without writing a completely different bill. Unless Mitch McConnell has the votes to abolish the filibuster — or is sitting on some Nobel Prize–worthy piece of creative accounting — Senate Republicans don’t really have a tax plan, at all. And they don’t seem to have any clue that this is the case.