Two weeks ago, 60 Minutes put Alexandria Ocasio-Cortez on national television, and the congresswoman put soaking the rich back into our national political conversation.

And conservatives have been trying to put the cat back in the bag ever since.

The right’s first instinct was to shut the Overton window on the congresswoman’s fingers. The libertarian economist Tyler Cowen dubbed her push for a 70 percent top marginal tax rate “the Trump reelection campaign.” But the idea that Trump would relish the chance to campaign against tax hikes on the rich never made much sense — not least because, through much of 2016, he campaigned in support of them. And polling on AOC’s idea quickly affirmed the broad popularity of imposing confiscatory tax rates on multimillionaires.

Political concern trolling soon gave way to the substantive variety. Conservatives observed that, while Ocasio-Cortez’s proposal targeted high salaries, the superrich’s income derives primarily from capital gains. And anyhow, if you raise rich people’s taxes, all you’ll really do is divert more capital into offshore tax havens.

These arguments might have been compelling had Ocasio-Cortez’s proposal been a written bill, rather than an extemporaneous illustration of her general philosophy on tax policy. In reality, the congresswoman and her ideological allies are quite enthusiastic about raising taxes on capital gains, and cracking down on tax havens. The real debate here isn’t about how to most effectively soak the rich. It’s about whether the rich should be effectively soaked.

In recent days, the right’s finest minds have coughed up some arguments for why they shouldn’t be. The strongest of these rest on tendentious economic premises; the weakest, on fallacious ones. Meanwhile, none of the right’s contentions account for the possibility that extreme inequality is politically undesirable — and would remain so, even if it was economically beneficent.

To appreciate how poor the conservative case is against soaking the rich, let’s examine five of their arguments in turn.

One: If we heavily tax millionaires, no one will want to go to college.

Here’s how Michael Strain, director of economic policy at the American Enterprise Institute, phrased this point in Bloomberg:

[I]f the government will take 70 cents of every dollar you earn above a certain income threshold, why go to college? The threshold obviously matters, of course, but the basic point about the decision to acquire advanced skills remains.

A 70 percent top rate could negatively affect the careers people choose. A young person interested in health care might decide to become a nurse rather than a surgeon, because much of the income gained from being a surgeon will be taken by the government…There is not much empirical evidence on how important these longer-term considerations are, because sorting through the drivers of educational and occupational choice is very difficult. But just because economists can’t assign a magnitude to these effects does not mean that real-world tax policy should assume they aren’t important.

The trouble with this argument, as Strain euphemistically concedes, is that it has no evidentiary basis.

As Matt Bruenig of the People’s Policy Project notes, Sweden effectively has a 70 percent tax rate on labor income — and that rate kicks in at (roughly) $98,000. If Strain is correct that imposing a 70 percent tax on eight-figure incomes (or even high six-figure ones) would depress educational attainment — and leave America bereft of surgeons — then surely these effects would be visible in a nation that has long taxed high five-figure incomes at a similar rate.

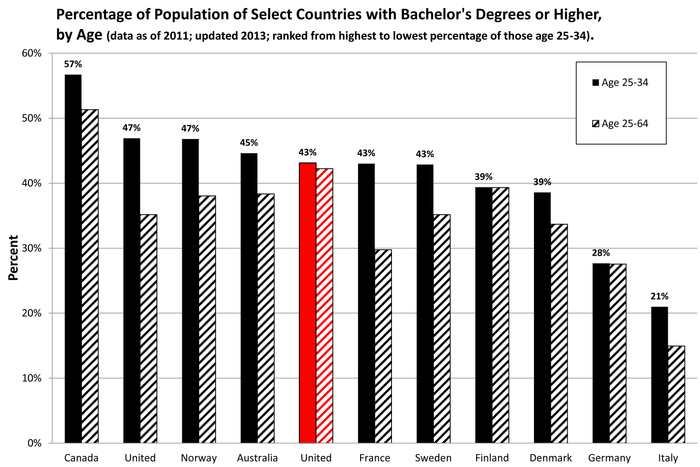

But they aren’t. As of 2013, 43 percent of Swedes between the ages of 25 and 54 were college graduates; among Americans of that cohort, the rate of college attainment was exactly the same, according to data compiled by the OECD (and visualized below by the Russell Sage Foundation). Meanwhile, high-tax Norway boasted a higher rate of tertiary education than the United States did. One wonders: If Strain’s objective is to maximize college attainment, wouldn’t supporting tuition-free college be a better expedient than opposing tax hikes on the one percent?

It is true that Sweden has fewer doctors than it would like. But that is also true of the United States. And anyhow, the former nation’s high tax rates haven’t prevented its health-care system from routinely outperforming America’s on virtually every metric.

Two: Soaking the rich will reduce innovation, which will itself hurt the poor.

This argument comes courtesy of the (aforementioned) George Mason University economist Tyler Cowen:

[T]he focus should be on designing a 21st-century tax system that can jump-start innovation in the U.S. once again. Surely that is not going to require confiscatory rates for some of the most creative Americans.

Let’s table Cowen’s normative argument (that when evaluating the tax code, our objective should be to maximize innovation, not progressivity). We’ll get to that later. First, let’s ask: Do we actually know that soaking the rich reduces innovation?

The short answer is no. In fact, there are sound reasons to suspect that high top tax rates do not depress productivity, and may even increase it.

One implicit assumption of Cowen’s argument is that there is a (reasonably) tight correlation between a worker’s market income and the social utility of her labor. This premise appears dubious when applied generally — and outright absurd when applied to America’s highest earners.

The financial sector offers the highest wages of any industry in the United States. It is also much too large for our economy’s own good, according to research from the OECD and IMF. Thus, if we assume that America’s most innovative minds are motivated primarily by avarice (as Cowen does), then keeping top marginal tax rates low is actually directing precious human capital into a sector we need to shrink.

Which does America need more of: Exceptionally creative high-school teachers and environmental engineers, or exceptionally creative high-frequency traders and white-shoe lawyers? Would we rather have innovations that help children learn better — or ones that infinitesimally increase the speed at which hedge funds can make financial transactions? If we’d prefer the former, then wouldn’t reducing the wage differential between teachers and hedge-fund quants — by heavily taxing the latter’s high incomes — increase desirable forms of innovation, by more rationally allocating human capital?

Research from the economists Benjamin Lockwood, Charles Nathanson, and Glen Weyl suggests that high top marginal tax rates can produce small gains in welfare by promoting a more optimal allocation of talented individuals between professions (though profession-specific taxes and subsidies were far more effective in achieving such ends). Cowen might quibble with these findings, but he has no dispositive, empirical evidence confirming that high marginal tax rates reliably depress innovation.

By contrast, those pesky Nordic social democracies have produced significant empirical evidence disputing Cowen’s. For example, high-tax Sweden has fostered so much high-tech innovation, the Financial Times dubbed Stockholm the “unicorn factory” in 2015:

In the past decade, this city of 800,000 inhabitants has churned out more billion-dollar tech companies than any in Europe, beating metropolises such as London and Berlin. According to a study by Atomico, “on a per-capita basis, Stockholm is the second most prolific tech hub globally, with 6.3 billion-dollar companies per million people compared to Silicon Valley with 6.9.”

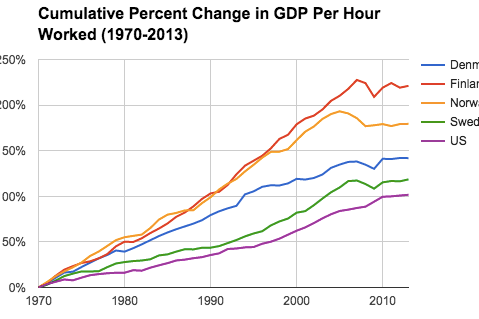

Meanwhile, as Bruenig has documented, the Nordic countries have seen much higher growth in GDP per hour worked (a.k.a. productivity) since 1970 than the U.S. has.

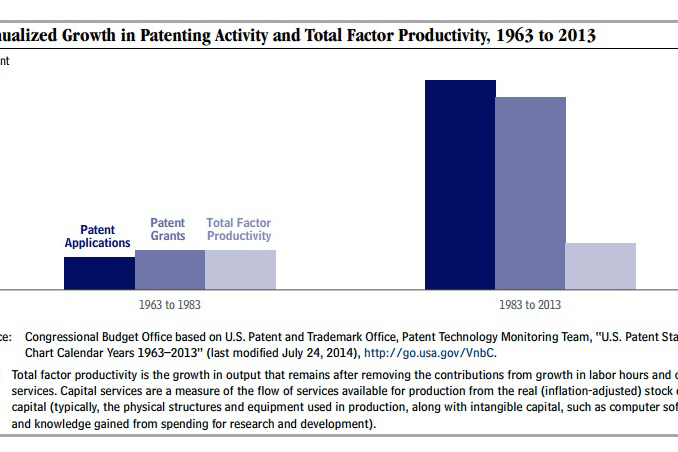

It is true that America produces far more patents per capita than Scandinavia does. But that probably says more about the flaws in our patent laws than it does about those in Sweden’s economy. After all, there has been no correlation between patent production and productivity growth in the United States, according to data from the Congressional Budget Office.

Three: If you heavily tax high incomes, you will actually solidify the existing aristocracy’s economic supremacy.

For a more interesting bad argument against soaking the rich, let’s turn to the Niskanen Center’s Samuel Hammond:

Sweden’s strict egalitarian commitment to income equality comes at a cost: levels of wealth inequality that remain notably higher than in the United States. The reason goes back to high marginal tax rates. As a hereditary monarchy, Sweden still has a formal nobility with protected titles and dynastic wealth. While high marginal taxes soaked the top 0.1 percent, they have essentially crystallized the nobility’s privileged position by making it hard for outsiders to displace them by accumulating wealth from scratch.

There’s a valid point here: Introducing steep taxes on income — while leaving wealth alone — does strengthen the existing aristocracy’s grip on the top rung of the economic ladder.

Nevertheless, this fails as an argument against the progressive vision for taxation for two reasons. First, Ocasio-Cortez and her allies are quite comfortable with increasing taxes on inheritances and other forms of concentrated wealth. Second, while Sweden’s high marginal taxes have preserved wealth inequality among private citizens, they have succeeded in closing the gap between the collective wealth of the Swedish people, and that of the Swedish superrich.

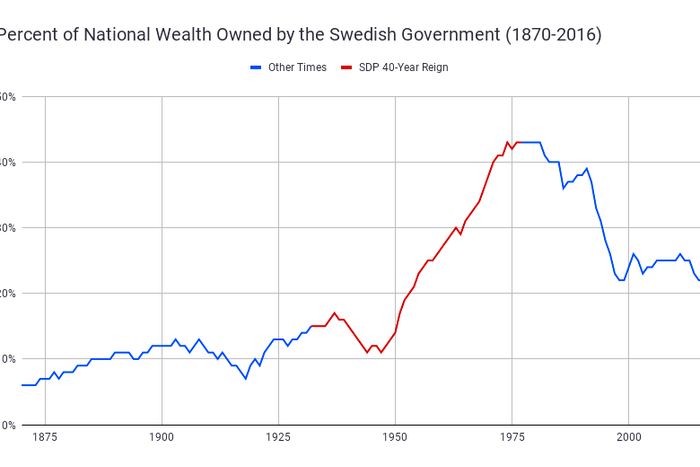

Generally speaking, progressives do not dislike concentrated wealth because it makes it harder for creative destruction to replace the old rentier class with a fresher-faced version. Rather, they oppose such wealth because it gives unaccountable private individuals too much power over society as a whole (more on that point in a minute). And, as the People’s Policy Project illustrates below, Sweden’s tax policies have been very effective at shifting the balance of economic power away from the formal nobility, and toward the demos. By the end of the Social Democratic Party’s era of dominance, more than 40 percent of national wealth was owned by a democratic government — which used said wealth to provide the Swedish working class with a historically unprecedented degree of social insurance and economic security.

Four: Many superrich people earned their wealth. The “Dream Hoarders” of the upper-middle class are the real parasites.

Here is Hammond’s other main argument against confiscatory taxes on high earners:

The focus on the super-rich is a red-herring. To the extent that the American economy is genuinely and unfairly captured, be it through special tax advantages, zoning restrictions, or elite education tracks, the blame lies with what Richard Reeves of the Brookings Institution calls “Dream Hoarders.” Some Dream Hoarders are in the top 0.1%, to be sure, but their ranks extend throughout the upper middle class.

…[H]ow wealth is created and transferred matters much more than whether some individuals happen to have more than others. Liberal theories of distributive justice thus focus on what philosophers call the “cooperative-surplus” of a society, redistributing the private benefits of wealth creation in order to keep the social system positive-sum and thus secure cooperation across its members. Wealth acquired through real estate appreciation, for example, is treated much differently than wealth acquired through productive entrepreneurship, both because such wealth represents a form of zero-sum rent seeking, and because it can easily lead to the creation of status divisions in society that are difficult to disrupt.

If Hammond’s contention were that a truly egalitarian economic agenda must include the abolition of exclusionary zoning, the equalization of public-school funding (so that the value of your property doesn’t determine the quality of your child’s education), and the repeal of upper-middle-class tax breaks, then it would be unobjectionable.

But his argument isn’t that confiscatory taxes on the superrich are insufficient; it’s that they’re undesirable. And the reason they’re undesirable is that the superrich haven’t “unfairly captured” our economy, only the (disproportionately upper-middle class) “Dream Hoarders” have.

It is difficult to comprehend how anyone concerned by rent-seeking — let alone “the creation of status divisions in society” — would see the top 0.1 percent as “a red herring.” After all, that red herring increased its share of economic growth by orders of magnitude more than the upper-middle class did over the past four decades — a period that saw relatively tepid growth in our nation’s overall productivity. These figures alone should be enough to establish that the superrich are raking in more value than they could possibly be producing. Meanwhile, the top 0.1 percent now lay claim to 90 percent of all of America’s wealth. Can anyone honestly argue that wealth monopolization of that magnitude is not likely to create durable status divisions in society?

Perhaps Hammond’s contention is that the superrich typically invest their wealth in productive enterprises, while the upper-middle class primarily speculate on real estate. That might be true in relative terms. But it’s patently false in absolute ones. The superrich invest an enormous amount of wealth in bidding up the price of luxury properties. As of November, Tiger 21 — an investment club for speculators with at least $10 million to invest — had nearly 30 percent of its holdings in real estate.

Hammond’s one explicit argument for why the merely affluent are the real rentiers is that they have more votes than the superrich, and thus, can extract more favors from the state. But this naïvely presumes that policy is shaped primarily at the ballot box. In reality, a great deal of public policy is made without the electorate’s notice. Ordinary voters — even upper-middle-class ones — do not have time to monitor the fine print in every congressional funding bill or trade agreement or piece of regulatory guidance. But the 0.1 percent’s lobbyists do. A moment’s glance at America’s existing tax code (which taxes a doctor’s labor income much more heavily than billionaire investors’ capital gains) — and polling on the American public’s views on tax policy (which shows overwhelming support for raising taxes on the Über-wealthy) — should be enough to establish that the superrich enjoy at least as much undue influence over the state as the merely affluent do. And that conclusion is further affirmed by the sheer difficulty of effectively taxing the 0.1 percent at all: The upper-middle class isn’t responsible for America’s failure to make combating tax evasion one of its top goals in international diplomacy; the superrich titans of American industry are.

Five: Extreme inequality is fine, so long as it’s compatible with economic growth and poverty reduction.

Hammond makes this point explicitly. But the idea that extreme economic inequality isn’t a problem in itself is implicit in every conservative argument against aggressively taxing the one percent. Conservative economists take it as a given that there is no inherent value in reducing inequality, and thus, that if a redistributive policy would reduce the absolute material well-being of the median American even marginally, then said policy is unjustifiable.

But for (small d) democrats, this truth is far from self-evident. As indicated above, shaping public policy requires investments of time, money, and attention. Wealthy individuals and corporations can easily shoulder such expenses; ordinary voters can’t. This simple reality — that economic power is easily converted into the political variety — is an inherent constraint on popular sovereignty under capitalism. But it is a constraint that can be more or less restrictive, depending on how unequally wealth is distributed, and how politically organized ordinary, working people are. Political science research (and American history) indicates that, in periods of exceptionally high economic inequality, American policy-making grows exceptionally detached from majoritarian preferences, and hostile to labor unions (i.e. the most effective vehicles for mass, class-based political organization).

Conservative intellectuals often cite individual liberty — defined as the freedom of contract and from arbitrary coercion — as the guiding principle of their politics. But Americans will never enjoy such liberty if they cannot meaningfully influence their contractual obligations to the state; which is to say, the laws that they are coerced into obeying. As the great American political scientist Robert Dahl once wrote, “one of the most fundamental of all human freedoms” is “the freedom to help determine, in cooperation with others, the laws and rules that one must obey.” America’s present level of economic inequality is incompatible with that freedom.

All of which is to say: There is no reason to assume that taxing the wealthy at Nordic rates would make America less economically productive — and good reason to think that, even if it did, doing so would enhance our collective liberty.