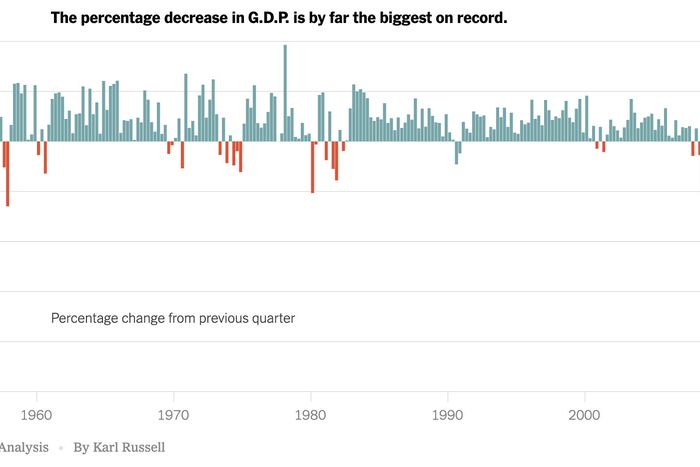

During the Great Recession, America’s economic output fell by 4 percent over a period of 18 months. During the second quarter of this year, our nation’s output fell by 9.5 percent. That is the steepest quarterly drop in U.S. GDP on record. As the New York Times illustrates, nothing in modern experience even comes close.

And that’s not even the worst economic news of the day.

Thursday’s GDP data was actually a pleasant surprise for close observers. It would have been bizarre if our economy hadn’t shrunk by a historic margin in the second quarter of this year: Throughout January, February, and most of March, the U.S. was at the peak of a long expansion; throughout April, May, and June, entire categories of commerce were effectively outlawed. Economists had actually expected GDP to fall by slightly more than 9.5 percent. So Thursday’s output data just confirmed what we already knew about our economy’s recent past.

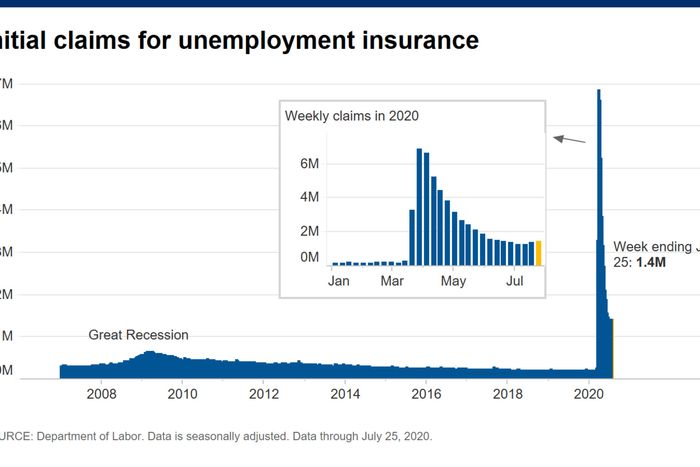

The morning’s data on jobless claims, by contrast, painted a darker than expected portrait of the economy’s near-term future. Although first-time unemployment insurance applications came in lower than anticipated (“only” 1.43 million Americans filed jobless claims, while economists had estimated that 1.445 million would), continuing jobless claims — the number of workers on the unemployment rolls for at least two consecutive weeks — rose by 867,000 to 17.018 million, decidedly higher than the consensus estimate of 16.2 million.

In previous weeks, the ranks of the durably unemployed had been falling. Most optimistic forecasts for the economy were premised on that decline continuing indefinitely, as America’s service sector gradually awakened from its lockdown-induced slumber. But the resurgence of the coronavirus throughout the Sun Belt has put many businesses back to sleep. As of this writing, it looks like COVID-19’s spread in Arizona, Texas, and Florida is slowing as new confirmed cases plateau. Even if these positive trends continue, however, the regional outbreak’s economic harms won’t be fleeting. Surely, many small businesses had the wherewithal to survive one shutdown but not two.

Even if the recent upsurge in cases had been avoided, the road to recovery would have been rocky. The substantial declines in the U.S. unemployment rate in May and June were fueled by reopened businesses rehiring their furloughed workers (permanent job losses actually increased last month). Yet even in parts of the country that have managed to keep the virus suppressed, many firms have reopened only to find that their business models remain nonviable. Office workers aren’t going to return to city centers en masse just because they have legal permission to do so. And as long as they remain cooped up at home, entire downtown economies will be starved of consumer demand. Which is to say: A lot of businesses were bound to go from temporarily closed to reopened to permanently closed, even if we had averted a COVID resurgence. For this reason, the robust pace of labor-market recovery witnessed in May and June is unlikely to resume if and when the Sun Belt gets the coronavirus under control.

In fact, unless the congressional GOP abandons its commitment to slashing unemployment benefits and blocking fiscal aid to states, economic conditions are likely to get much worse before they get better.

Last quarter’s drop in quarterly GDP occasioned a great deal of material hardship. In June, nearly 14 million U.S. children lived in food-insecure households; at the peak of the Great Recession, that figure was 5.1 million. In New York City, one-quarter of all renters haven’t paid their landlords since March. Nevertheless, massive government spending sheltered most U.S. households from the macroeconomic storm: Even as the economic output cratered in the second quarter, disposable personal income in the U.S. actually rose by 10 percent thanks to the combination of relief checks and enhanced unemployment benefits. In the absence of such fiscal supports, the economy would have contracted even more sharply — and, more important, that contraction would have had far more dire consequences for Americans’ personal finances. As is, enough U.S. households fell through the patches in the safety net to send child hunger skyrocketing. But if Republicans succeed in slashing unemployment-insurance benefits, the number of Americans who can’t afford groceries and rent is likely to rise rapidly. And that in turn will erode demand for nonessential goods and services, thereby increasing business failures and unemployment.

That said, the GOP at least supports sustaining a heightened federal unemployment benefit at some level. By contrast, the party has declined to endorse any new aid to states or municipalities, almost all of which are in fiscal crisis. In the second quarter, state and local government spending fell at a 5.6 percent annualized rate. Absent federal aid, that spending is likely to fall even more sharply later this year as governments exhaust their rainy-day funds and are (hopefully) able to reduce emergency spending on public health. An ongoing drop in state outlays will translate into job losses both directly (through public-sector layoffs) and indirectly (as private-sector firms that contract with the government lose business and other firms dependent on the patronage of public employees lose customers).

All of which is to say: In GDP terms, we just lived through the worst economic quarter in our nation’s recorded history; in human terms, the coming one is liable to be worse.