I have been called the devil by strangers and “the Facilitator” by friends. It’s not uncommon for people, when I tell them what I used to do, to ask if I feel guilty. I do, somewhat, and it nags at me. When I put it out of mind, it inevitably resurfaces, like a shipwreck at low tide. It’s been eight years since I compiled a program, but the last one lived on, becoming the industry standard that seeded itself into every investment bank in the world.

I wrote the software that turned mortgages into bonds.

Because of the news, you probably know more about this than you ever wanted to. The packaging of heterogeneous home mortgages into uniform securities that can be accurately priced and exchanged has been singled out by many critics as one of the root causes of the mess we’re in. I don’t completely disagree. But in my view, and of course I’m inescapably biased, there’s nothing inherently flawed about securitization. Done correctly and conservatively, it increases the efficiency with which banks can loan money and tailor risks to the needs of investors. Once upon a time, this seemed like a very good idea, and it might well again, provided banks don’t resume writing mortgages to people who can’t afford them. Here’s one thing that’s definitely true: The software proved to be more sophisticated than the people who used it, and that has caused the whole world a lot of problems.

The first collateralized mortgage obligation, or CMO, was created in 1983 by First Boston and Salomon Brothers, but it would be years before computer technology advanced sufficiently to allow the practice to become widespread. Massive databases were required to track every mortgage in the country. You needed models to create the intricate network of bonds based on the homeowners’ payments, models to predict prepayment rates, and models to predict defaults. You needed the Internet to sail these bonds back and forth across the world, massaging their content to fit an investor’s needs at a moment’s notice. Add to all this the complacency, greed, entitlement, and callous stupidity that characterized banks in post-2001 America, and you have a recipe for disaster.

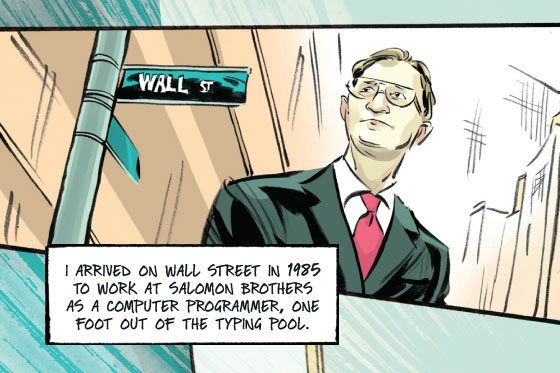

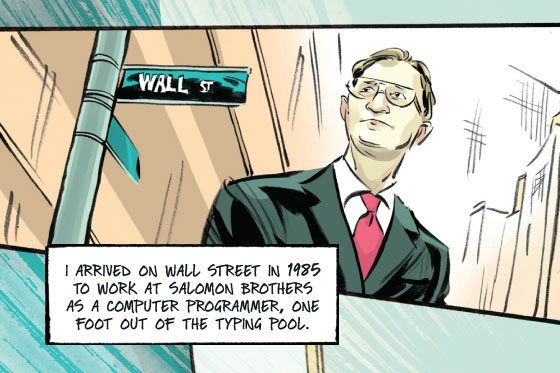

I started on Wall Street on October 5, 1985. I was 30 years old and had been writing software for six years. I originally got into it when my wife became ill and I took a job entering data, the bottom of the computer industry, at Emory University, so her rare kidney ailment could be treated. Before that, I had risked my life for $200 a week hauling shrimp 100 miles offshore from Cape Canaveral, and I had been the only white boy in my crew digging ditches in Alabama. Compared to all that, Wall Street was a country club. I recall my first day at Salomon Brothers, lingering at the windows by the elevator banks on the 25th floor of 55 Water Street. While groups of the well dressed and the professionally coiffed headed to their cubicles and offices, I stared out at the harbor, watching freighters, tankers, ferries, and garbage scows cross the great harbor. The perfection of the place was profound, the feng shui was palpable. As John Gutfreund, then the CEO, expected, I was ready to grab the balls of the bear.

My first assignment was to write a “machine-to-machine interrupt handler.” That was not exactly sexy in the world of finance, or in any world, and I won’t bore you by trying to explain. It was plumbing. As was all the programming, which, on the firm’s hierarchy, ranked somewhere above the secretarial pool but well below, literally and figuratively, the trading floor. I didn’t mind. To me, it was good, well-paying work. My manager, a former mathematics professor named Leszek Gesiak, an immigrant from Poland, became a friend. Neither one of us was on track, but we both enjoyed the challenges and pace of the job. We lunched at either Yip’s, a Chinese culinary cul-de-sac, or on Front Street, in the seaport, where you could get fresh fish cafeteria style across the street from the market. It was a different New York, still picking itself up from the seventies. Drug dealers loitered at the door of the brokerages, and taxis often smelled of pot from their previous occupants. Just a few years before, Michael Bloomberg had been fired from Salomon. He had the crazy idea that the data was as valuable as the firm’s capital.

When I asked Leszek what the busy group did that sat next to us, he told me they created mortgage-backed securities. It was an instrument, he claimed, designed to keep programmers employed. Having started to overcome my aversion to the overpaid life—I had recently bought a suit at Barneys, the old one on Seventh Avenue—I asked him how the bonds worked.

“You put chicken into the grinder”—he laughed with that infectious Wall Street black humor—“and out comes sirloin.”

I wanted a piece of that. But first, I kept a promise to my wife—that if she recovered, we would backpack around the world.

Returning to New York a year later, I had an interview at Shearson Lehman’s mortgage-research department. Again, I sought advice from Professor Gesiak. I drove to his apartment in Greenpoint and confessed to him that I had never studied finance, and I had only taken one course in computers. Over the kitchen table, while his wife minded the toddlers, he gave me a quick tutorial on the “present value of future cash flows.” It was only freshman calculus, after all.

Out the back window, clotheslines on pulleys ran across the courtyard to adjoining apartments, like a scene from The Honeymooners. Once I demonstrated that I understood how to discount a cash flow, Leszek brought out the hard stuff. Over glasses of vodka chased by raw garlic and butter on rye, he recounted how he had black-marketed goods in communist Poland. Halfway through the bottle, he claimed that the Polish zloty had been on the vodka standard—that is, the conversion ratio of zlotys to dollars on the black market was always the same as the price, in zlotys, of a half-liter of vodka.

Heading back to Manhattan that night, I smashed my car on the ramp up to the BQE. But the good news was that I got the job. I was in the mortgage-packaging business.

At Lehman, I began a thirteen-year effort to streamline the process of securitizing home mortgages, as well as other forms of debt. That was 1988, around the time of the savings-and-loan crisis. Remember that one? Lenders had gone nuts with, what else, real estate, and as they went bust, the government was stepping into the breach. Mortgage securitization was the answer. Retail lenders could make the loan, take a fee, then sell the mortgage to an investment bank. The bank, after bundling thousands of the mortgages together, could, through a little software magic, issue bonds based on that bundle of loans. Now, an investor does not want a single person’s mortgage, much the same as you may not want to underwrite your sibling’s purchase of an overpriced McMansion. But when 1,000 similar loans are combined, and the U.S. government, through Freddie Mac and Fannie Mae, absorbs the default risk, you now have a nifty little AAA-rated piece of paper paying one or two points above Treasury bills. And if the value of the loans is in excess of the limit set by the government agencies, your savvy friends on Wall Street can create a class of subordinated bonds that will absorb all the defaults in the deal. With friends like these …

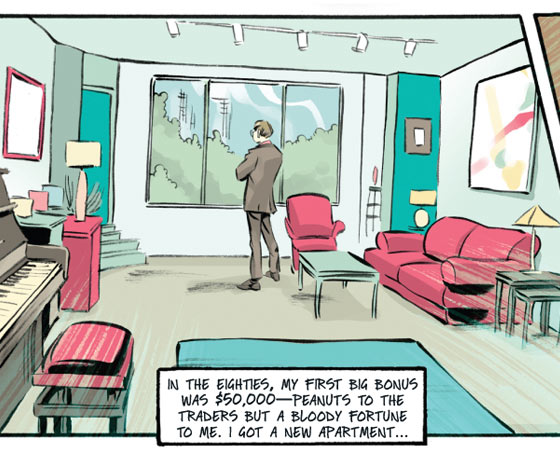

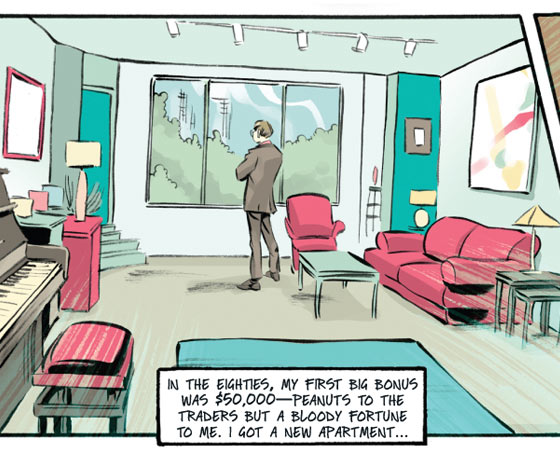

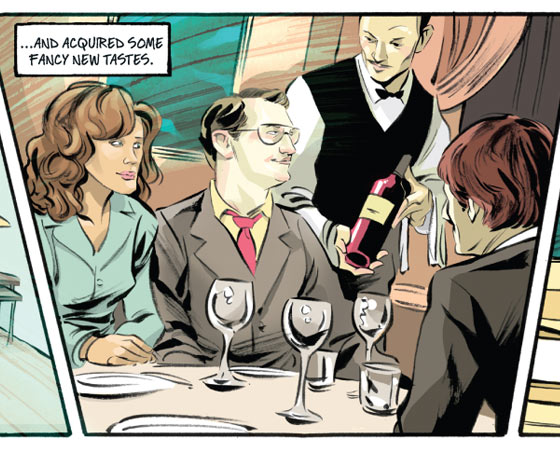

While I slaved away at the sausage grinder, CMOs took off—$6 billion were issued in 1983, and by 1988, the annual output had jumped to $94 billion. This was the era described in Liar’s Poker. Wall Street guys felt cool and funny; people who were getting ripped off were dumb and ugly and deserved it. I got a $50,000 bonus check, a 50 percent dollop on top of my salary. Peanuts to the traders, but a bloody fortune to me, for the easiest work I’d ever done. I could afford to rent a nicer place in Greenwich Village, go out to jazz clubs, bike in France. But even then, I was wondering why I was making more than anyone in my family, maybe as much as all my siblings combined. Hey, I had higher SAT scores. I could do all the arithmetic in my head. I was very good at programming a computer. And that computer, with my software, touched billions of dollars of the firm’s money. Every week. That justified it. When you’re close to the money, you get the first cut. Oyster farmers eat lots of oysters, don’t they?

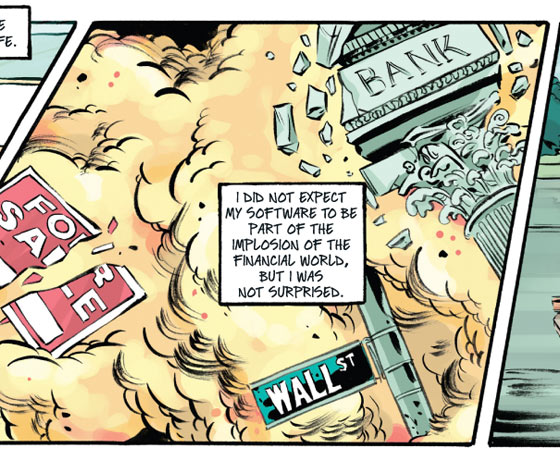

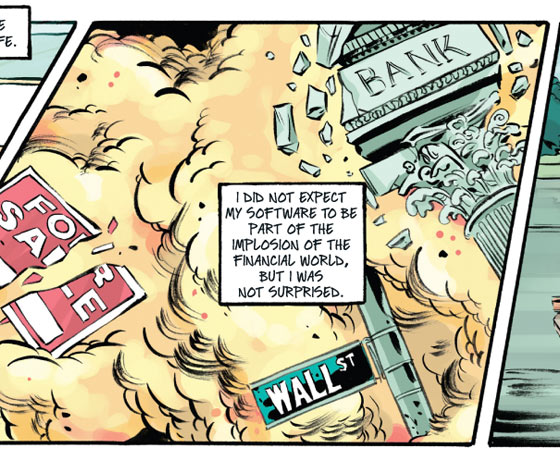

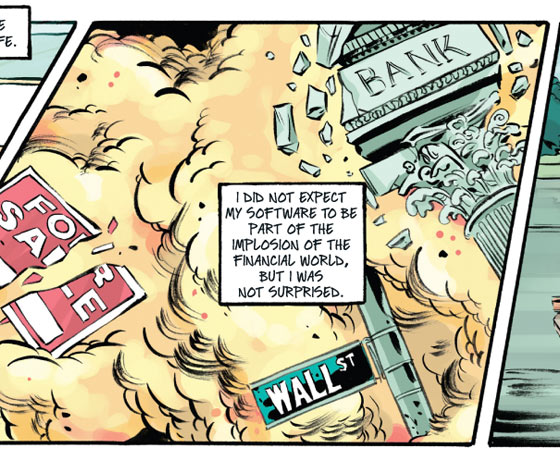

I never would have thought, in my most extreme paranoid fantasies, that my software, and the others like it, would have enabled Wall Street to decimate the investments of everyone in my family. Not even the most jaded observer saw that coming. I can’t deny that it allowed a privileged few to exploit the unsuspecting many. But catastrophe, depression, busted banks, forced auctions of entire tracts of houses? The fact that my software, over which I would labor for a decade, facilitated these events is numbing. Is capitalism inherently corrupt? I don’t think the free flow of goods in and of itself is the culprit. No, it’s the complexity masked by thousands of unseen whirring widgets that beguiles people into a sense of power, a feeling of dominion over the future.

As demand for mortgage bonds rose, mortgage rates went down. This was the late eighties. Through CMOs, the sheikhs whom we paid to fill up our SUVs could finance our mortgages, the core of the American Dream, as could the Chinese government—all the while getting an extra point or two above the Treasury. Ample financing allowed more people to buy their own homes. The world came full circle. Bonuses got bigger because the Wall Street boys were doing good for themselves and the world.

As CMOs became more complicated, my job was to make everything seem simple—to, in effect, mask the complexity that would’ve made the bonds difficult to trade. We invented a language for mortgage-backed bonds. I called it BondTalk. Lehman was a runner-up in CMO underwriting. I was told to rewrite the entire system. Make it all push-button. Flexible and faster. Traders told us what they wanted, and we wrote the software code to make it possible. We were on the cutting edge. When I finished that project, I approached my former boss to ask if I could move to the trading desk, to where the big money was.

“Mike,” he told me when denying my request, “can you really look for people dumber than you and then take advantage of them? That’s what trading is all about.”

Yes, I assured him, yes, yes. But no deal. The next month, after I pocketed my $100,000 bonus, I left Lehman for Kidder, Peabody, which was the No. 1 underwriter of CMOs but had outdated software.

Working with another programmer, I wrote a new mortgage-backed system that enabled investors to choose the specific combinations of yield and risk that they wanted by slicing and dicing bonds to create new bonds. It was endlessly versatile and flexible. It was the proverbial money tree.

Another recession began, which, in the perverse world of the bond market, was good for business. As the government lowered interest rates to stimulate the economy, bonds increased in price. With a drop in rates, more people refinanced. There was more product for the securitization process, more meat for the grinder. Our software was rolled out to ride the latest wave. Traders loved it. What had taken days before now took minutes. They could design bonds out of bonds, to provide the precise rate of return that an investor wanted. I used to go to the trading floor and watch my software in use amid the sea of screens. A programmer doesn’t admire his creation so much for what it does but for how it does it. This stuff was beautiful and elegant.

The aim of software is, in a sense, to create an alternative reality. After all, when you use your cell phone, you simply want to push the fewest buttons possible and call, text, purchase, listen, download, e-mail, or browse. The power we all hold in our hands is shocking, yet it’s controlled by a few swipes of a finger. The drive to simplify the user’s contact with the machine has an inherent side effect of disguising the complexity of a given task. Over time, the users of any software are inured to the intricate nature of what they are doing. Also, as the software does more of the “thinking,” the user does less.

I made $125,000 in my bonus that year and bought an apartment on Gramercy Park. I had first-tier seats to the ballet, but I still rode my bike to work. The traders pocketed multiple millions. I wasn’t poor, but I wasn’t a plutocrat. I could live with myself. If there was a deception going on, I was but a small cog, I thought.

The world around me, though, had become bizarre. At the time, I had an odd sensation that mortgage traders felt they had to outdo the loutish behavior in Liar’s Poker. The more money they made, the more juvenile they became. What do you expect from 30-year-old megamillionaires whose overwhelming aspiration was something vaguely called Hugeness? They had wrestling matches on the floor. Food-eating contests. Like little kids, they scrambled to hide the evidence when the head of fixed income paid his rare visits to the floor.

Now that I was spending more time on the floor, I wondered why the men’s room always stank. Then one afternoon at three, when I was in there taking a leak, I discovered the hideous truth. Traders had a contest. Coming in at eight, they never left their desks all day, eating and drinking while working. Then, at three o’clock, they marched into the men’s room and stood at the wall opposite the urinals. Dropping their pants, they bet $100 on who could train his stream the longest on the urinals across the lavatory. As their hydraulic pressure waned, the three traders waddled, pants at their ankles, across the floor, desperately trying to keep their pee on target. This is what $2 million of bonus can do to grown men.

The economy improved. The Feds raised rates. Kidder was in trouble. We had no risk management. According to an internal report, there were management deficiencies across the board. If I remember correctly, one top executive had a contract stipulating that he would only work one day a week for his seven-figure wage. So Kidder was in bad shape when it was hit by the scandal involving the infamous Joseph Jett, who allegedly fabricated hundreds of millions of dollars in trades, more or less taking down the whole firm. Back then, a major Wall Street failure didn’t panic the entire country. Kidder may have handled a fifth of the country’s mortgage-backed securities, but in the wake of its demise, the American economy did not wither. Though securitization slowed to a crawl, breadlines weren’t forming. Homeowners made their payments. Bonuses, if you got one, were halved. People stood pat. Paine Webber cherry-picked traders and programmers. G.E. sold the assets of the firm. One of those assets, to my great surprise, was my software, purchased by Intex Solutions in Boston.

During the transition, I used the time to extend our structuring model to subordinated bonds. Allow me to expand Professor Gesiak’s analogy a bit: For deals with non-agency loans—that is, not Freddie or Fannie—in addition to the sirloin that comes out of the grinder, there is a small percentage of offal. By running that offal through the grinder again, in effect bundling together all the pieces from various deals that absorbed the default risk, we then created some andouille and some real dog food. The rise in price of the sausage over the offal more than compensated for the unsalable leftovers. That junk typically couldn’t be sold and stayed in-house, eventually becoming known as a “toxic asset.”

Times were lean at Paine Webber. The mortgage market, notoriously illiquid in bad times, petered out. Mortgage refinancings dwindled. The supply of raw material, new mortgages, disappeared. We had to lay off half of research. After a day of bloodletting, one of the bosses cornered me in the hallway. Did I get a sexual thrill out of firing people, he wanted to know, because it had always worked for him, big time.

That was 1995. I had been on Wall Street for ten years. I was fed up with the life, all day staring at a screen, the jockeying for bonuses. I wanted something different. I biked up to Boston and proposed to the people who had bought the Kidder software that I run it for them. “Don’t pay me a cent,” I told them. “I’ll integrate with your existing software, market it, maintain it, and enhance it. We’ll split the money, if any comes in, 50-50.”

They sent me a five-year contract with a subsequent five-year noncompete. That noncompete would retire me if enforced. I stared at it. Another five years was all I could take. Without consulting my lawyer, I signed it. Those pen strokes effectively capped my Wall Street career. Now it was up to me to chop some wood.

We had a deal. Intex was the largest supplier of cash flows on existing CMOs, but the company could not create new structures. That’s why Intex had bought my software from G.E. But it could not get it to run, much less sell it. I spent six months in my apartment, over the phone with one of the Intex programmers, integrating the two softwares. Within a year, we had sold it to four large investment banks; by the end of 1997, we had fifteen. We were it! By the end of ’98, we had 25. If a firm wanted to be in the mortgage business, they needed us. Instead of hiring a large staff to write the software, you could buy it from us, at half what it would cost you to create it from scratch. Price per copy was $500,000, plus annual maintenance. Not only did the big banks buy, but major mortgage servicers decided they could end-run the banks by taking the loans and ramming them through the grinder themselves.

For a decade, every firm had written its own proprietary structuring tool for securitizing mortgages. Now we had commoditized it. Firms liked using the same piece of software. Intex became the King of Mortgages. Bonds were traded without showing up on the Bloomberg screens!

Up until that point, almost all my securitization work had involved prime mortgages—those mortgages given to people who had an extremely high probability of paying them back. When a client wanted me to enhance my software to include “subprime” debt, well, that was something new, and I have to admit, I was kind of excited. This would greatly enlarge my universe of clients, because the subprime market was then split among many smaller players, each of whom needed my software.

I quickly learned how fishy this world could be. A client I knew who specialized in auto loans invited me up to his desk to show me how to structure subprime debt. Eager to please, I promised I could enhance my software to model his deals in less than a month. But when I glanced at the takeout in the deal, I couldn’t believe my eyes. Normally, in a prime-mortgage deal, an investment bank makes only a tiny margin. But this deal had two whole percentage points of juice! Looking at the underlying loans, I was shocked.

“Who’s paying 16 percent for a car loan?” I asked. The current loan rate was then around 8 percent.

“Oh, people who have defaulted on loans in the past. That’s why they’re called subprime,” he informed me. I had known this guy off and on for years. He was an intelligent, articulate, pleasant fellow. He and his wife came to my house for dinner. He had the comfortable manner of someone who had been to good schools—he was not one of the “dudes” trying to jam bonds into a Palm Beach widow’s account. (Those guys were also my clients.)

“But if they defaulted on loans at 8, how can they ever pay back a loan at 16 percent?” I asked.

“It doesn’t matter,” he confided. “As long as they pay for a while. With all that excess spread, we can make a ton. If they pay for three years, they will cure their credit and re-fi at a lower rate.”

That never happened.

In 2001, when my five-year contract expired, Intex let me go. I guess I had become too expensive, and Intex thought they’d be fine without me. Why I had been able to retire at 45 for simply writing a computer program befuddled me and aggravated others who felt they had worked as hard. Life is not always fair, I told them. Right place at the right time. Besides, I explained, the mortgage market is as big, if not bigger, than the stock market. When they screwed up their faces in disbelief, I told them to look around. Every house, every building, every car, plane, boat, and piece of plastic in your wallet has a loan tied to it. It’s all about cash flow.

Within a few months, the World Trade Center was attacked. The country became single-minded in its concerns. As segments of the economy weakened, the American home carried the day. Prices soared, more homes were built, everyone bought granite countertops, new plumbing, new mortgages. Home equity was the piggy bank. It kept Main Street working and Wall Street gorging. By 2003, more than $1 trillion in CMOs were being issued annually.

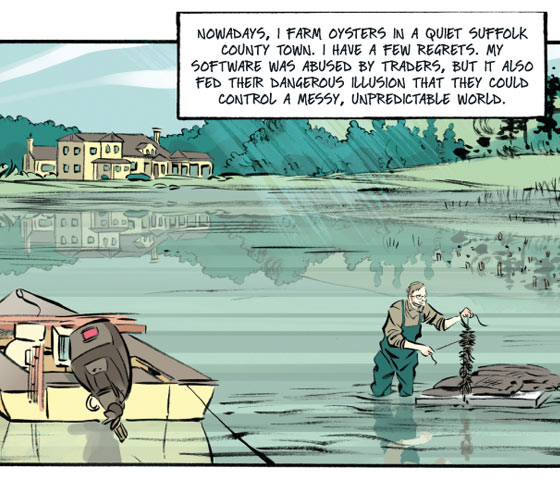

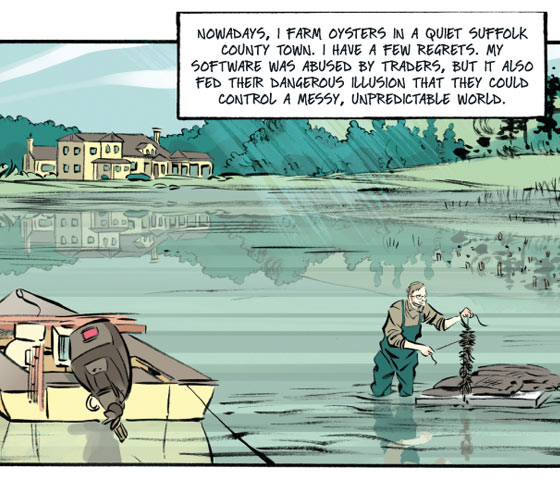

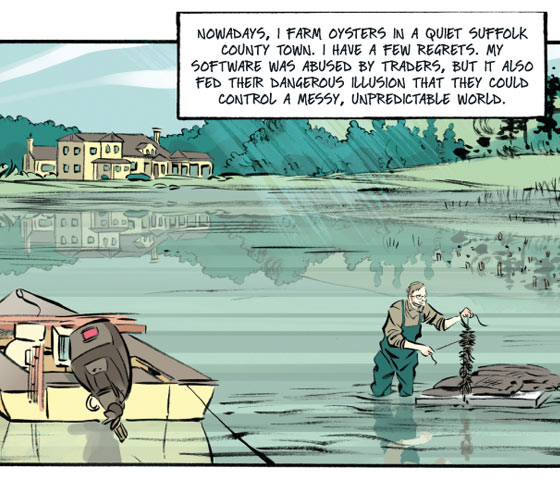

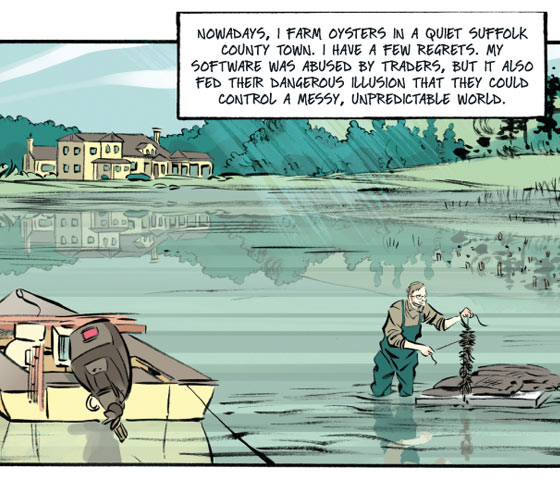

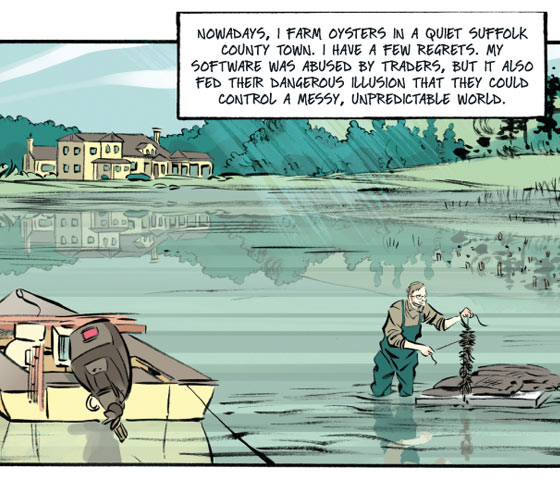

Banned from Wall Street, I discovered that my summer house, on the North Fork of Long Island, included five acres of underwater land. I applied for permits to grow oysters. I had something to do. In many ways, farming oysters is more difficult, demanding, and frustrating than writing software. Errors take seasons and years to emerge, whereas software is instantaneous. Nature does not give you explicit warning messages; her ways are more subtle and take a lifetime to penetrate. I forgot the day of the week but knew instinctively the tide and the phase of the moon.

Finance, however, is a larger drama. The daily tango of interest rates, money supply, and government debt continued to have an irresistible allure. By 2003, a financial-data firm approached me about writing a structuring tool for collateralized debt obligations, or CDOs. I asked my colleagues, what was a CDO exactly? Like CMOs, they were structured products, but the underlying collateral was not limited to home mortgages. They could be anything—corporate bonds, subprime-mortgage bonds, swaps, or simply air, like the synthetic CDOs: They could be CDOs underwritten by the bonds of other CDOs, CDOs squared. Chicken, pork, offal, chitterlings, tofu salad, fish guts—anything could be run through the grinder. “Diversity of collateral” was the pitch. Some things could go bad, but not everything at once. It never has, except during the Depression, and we’re so much smarter now. That could never happen again.

With prime mortgages, the complexity of the structure is on the bond side: tweaking and fitting hundreds of different bonds from the same bundle of mortgages. But when the underlying collateral is subprime, or the subordinated bonds are supporting several subprime-mortgage deals, then the difficult task is deciding when and if these loans will go under. Default models were the rage. Throw some epsilons and thetas on a paper, hoist a few Ph.D.’s behind your name, and now you’re an expert in divining the future.

As much as anyone, I had already chased that. Why was I doing it again? As crude as it may sound, I can’t say I was motivated by anything more than the opportunity to make more money. It was sitting there, for me to take, and even for a relatively private person like me, who never dreamed of building my own castle in Greenwich or anything like that, it was hard to resist.

Fortunately for me, Intex threatened to sue. They claimed that CDOs were so similar to CMOs that my noncompete applied. To take the job would mean a legal battle. In a sense, I was saved from my own base instincts. But my oystering permits had been approved. When I looked at myself in the mirror, after working all day hauling 400-pound cages of oysters off the bottom, I looked healthier and more satisfied than I ever remember being when I wore $3,000 Versace suits and thought of myself as a Wall Street success story.

So that’s where I was when the world I had helped create started falling apart. I hadn’t anticipated it, but at the same time, nothing about it surprised me.

Last month, my neighbor, a retired schoolteacher, offered to deliver my oysters into the city. He had lost half his savings, and his pension had been cut by 30 percent. The chain of events from my computer to this guy’s pension is lengthy and intricate. But it’s there, somewhere. Buried like a keel in the sand. If you dive deep enough, you’ll see it. To know that a dozen years of diligent work somehow soured, and instead of benefiting society unhinged it, is humbling. I was never a player, a big swinger. I was behind the scenes, inside the boxes. My hard work, in its time and place, merited a reward, but it also contributed to what has become a massive, ever-expanding failure. For that, I must make a mea culpa. Not a mea maxima culpa, mind you, but some measure of responsibility, a few basis points of shame. Give my ego a haircut.

It hurts when people say I caused this mess. I was and am quite proud of the work I did. My software was a delicate, intricate web of logic. They don’t understand, I tell myself. Perhaps it was too complicated. But we live in a world largely of our own device. How to adjust and control these complexities, without stifling innovation, is the problem.

The other day, Professor Gesiak brought me a pitcher of his basement-brewed beer, bartering for oysters. He mused that the U.S. government would, like Poland’s, make the currency worthless. What do we have, I wonder, that like the vodka in communist Poland, can be counted on to hold its value in this age?

Watch the Video

My Manhattan Project

How I helped build the bomb that blew up Wall Street.

By Michael Osinski Illustrations by Kagan McLeod Read the article »

My Manhattan Project

How I helped build the bomb that blew up Wall Street.

By Michael Osinski Illustrations by Kagan McLeod Read the article »

My Manhattan Project

How I helped build the bomb that blew up Wall Street.

By Michael Osinski Illustrations by Kagan McLeod Read the article »

My Manhattan Project

How I helped build the bomb that blew up Wall Street.

By Michael Osinski Illustrations by Kagan McLeod Read the article »

My Manhattan Project

How I helped build the bomb that blew up Wall Street.

By Michael Osinski Illustrations by Kagan McLeod Read the article »

My Manhattan Project

How I helped build the bomb that blew up Wall Street.

By Michael Osinski Illustrations by Kagan McLeod Read the article »