Illustration by Peter Arkle

It’s a truism now that money was an engulfing, distorting force of the boom years, particularly in New York. At the level of urban development, it skewed our economy; at the level of culture, it misshaped values; at the level of individual behavior, it corrupted habits and discolored thoughts: This is your brain on money.

It turns out there are people who study our brains on money. Kathleen Vohs, a consumer psychologist at the University of Minnesota’s Carlson School of Management, is preeminent among them, and for the sake of better understanding both the past and the future of our city, it’s useful to start by looking at what she’s found. Just thinking about money made her subjects less likely to help strangers struggling with their belongings. Just handling money made her subjects less sensitive to physical pain. My favorite experiment of hers, though, was one in which she divided her subjects into groups, one of which stared at a screensaver of floating dollar bills and another at a screensaver of exotic fish. Subjects were then asked whether they’d like to work on a task alone or with a partner. Eighty percent of those who’d been staring at the dollar bills chose to work alone. Eighty percent of those who’d been staring at the fish wanted to collaborate. (One wonders if the offices of AIG couldn’t have benefited from an aquarium or two.)

A few years ago, after Vohs presented some of her research at a conference, Daniel Kahneman, who won a Nobel Prize in economics in 2002, approached her and pointed out that her research had shown that money elicited archetypal American traits: self-sufficiency, self-absorption, individualism. More to the point, though, it seems like Vohs’s findings proved that money elicited archetypal New York City traits. The common thread in all of them is that money primes people to be “self-insulating,” as she likes to say, or prone to burrow deep within themselves, whether for self-protection or self-aggrandizement. And where else in the country are people such a powerful amalgam of self-involvement and motivation? Vohs acknowledges as much when I ask her about this. “Well, sure,” she says. “You know, If you can make it there … ”

If the ambient, unflagging presence of money fundamentally alters the way we think and behave, then it stands to reason that money’s sudden absence does the same. And right now, we’re a city of people staring at a screensaver of exotic fish. Not all of us, of course: Just as some New Yorkers danced their way through the Great Depression to the supper-club stylings of Cole Porter and Champagne send-offs on the Normandie, some will live through this historic recession by summering in Sagaponack and taking their suppers at Per Se. (As the historian Mike Wallace likes to say, “The first law of New York is that there is no single ‘New York,’ but rather a vast variety of New Yorks.”) But there’s no denying that something profound has taken place. The city that once revolved around the dollar has been temporarily tapped off its axis, severed from the usual forces and robbed of the usual lodestars that keep us oriented and earthbound. What will we be like without them—as private people, as public citizens, as a whole metropolis? How does a city in withdrawal behave?

Recently, Vohs has been looking at what happens when her subjects spend time reflecting on money they’ve lost. She believes it’s a fairly good proxy for a recession mentality. What she’s found so far, she says, is that they’re more sensitive to physical pain—and social rejection. “Though I haven’t yet done the research,” she continues, “it would follow that they’d be more cooperative.”

Writ large, this finding could have interesting ramifications. It could mean that a financial calamity would create a more neighborly, civic-minded city.

There may well be an element of wishful thinking in this hypothesis. But history shows that one effect of economic reversals of fortune can be to coax people beyond their own self-interest. “After the Depression,” says Jackson Lears, the Rutgers historian and editor of the Raritan Review, “there was a kind of celebration of the group over the individual. It might have had its conformist side, but it’s what ultimately fed the programs of the New Deal—they were attempts to systematize what was already happening locally.” (Indeed, many of the New Deal’s architects were New Yorkers, including Robert F. Wagner and Franklin Delano Roosevelt himself.)

I ask Lears whether he sees any evidence of a renewed community-minded ethos today.

“Well, yeah,” he says, after thinking for a moment. “What was the Obama campaign, if not a signal of a widespread longing for that kind of unity?”

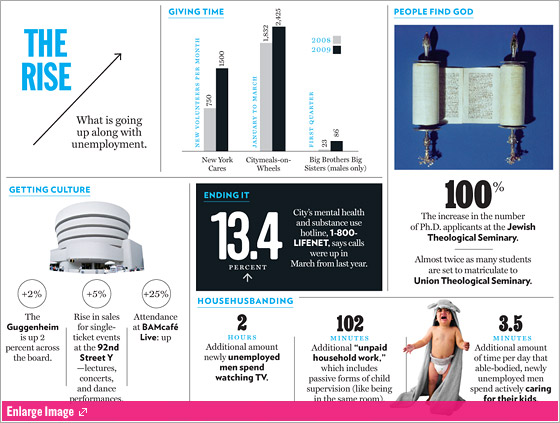

Lears is clearly onto something. Right now, in New York, volunteerism is booming. Compared with the first quarter of last year, Citymeals-on-Wheels, which delivers food to the elderly, has seen a 32 percent increase in its volunteers; God’s Love We Deliver, which distributes meals to those suffering from hunger or illness, has seen a 20 percent increase. New York Cares, which places people in charities around the city, trained twice as many people in February and March of 2009 as it did those same months the year before. “We actually had to start offering phone orientations,” says Michael Coughlin, the director of recruitment and outreach at the New York chapter of Big Brothers Big Sisters. “We just didn’t have any more room for people to come in.” He says more than twice as many men and women have stepped forward to become mentors as they had by this time last year.

This attitude doesn’t seem to be confined to the world of volunteering, either. Enrollments at divinity schools are up: The number of Ph.D. applicants to the Jewish Theological Seminary has doubled; almost twice as many students are set to matriculate at Union Theological Seminary. It’s true that graduate-school enrollments almost always spike during hard times—continuing one’s education is often easier than finding a job—but divinity school tends to be a mid-career choice. “Some of our applicants have lost jobs, but definitely not the majority,” says Alain Silverio, associate dean of academic administration at Union. “This moment has struck an ethical chord.”

From Obama on down, people are initiating public discussions that reevaluate the purpose of work—as if trying to remind us, after a long bender of risk-taking and creative economics, that there’s dignity in secure, generative labor. This June, as the economy was slowing, Drew Gilpin Faust, Harvard’s new president, used her baccalaureate address to discuss the complicated allure of Wall Street. Her closing thoughts contained both an entreaty and admonition: “If you don’t pursue what you think will be most meaningful, you will regret it.” (The Harvard Crimson later reported that 8 percent fewer graduates would be heading into the financial and consulting sectors than the year before.)

During the Great Depression, many men and women valued security over risk, pursuing careers in the civil service, teaching, police departments. They also invested much more conservatively in the stock market once it finally rebounded. It may have been a time for liberal politics, just as it is now. But it was a time of very conservative choices about how to make a living. While it’s too early to know what kinds of choices people are making today, we’re hearing rhetoric that encourages the same values of caution and productive work. (“Jobs are the new assets,” says Time magazine.) “It’s almost as if the flamboyant, arbitrary values of the boom economy made us reel in disorientation and then grope for something more solid,” says Lears. “So we reach for more familiar values that were supposed to guide us all along—the work-ethic-and-disciplined-achievement model, and all the modest expectations that went along with it.”

I’ll admit that there’s a part of me—a part that really ought to be cloaked in gray wool and a Pilgrim’s bonnet—that breathes a sigh of relief when I hear this talk. While I admire gamblers, the culture of risk of the nineties and aughts still looked a bit like a culture of shortcuts to me, even though it gave us Google as well as mortgage-backed securities. Risk-takers might keep the world hurtling forward. But secretly, I prefer the company of grinds. “I believe that security is more important to happiness than wealth,” says Barry Schwartz, a psychologist at Swarthmore. The problem, he says, is that during a time of high-risk, high-reward prosperity, the pursuit of security can seem dull. “Who cares about security?” he asks, channeling the voice of … well, lots of people during the boom. “Accountants care about security, and who wants to be an accountant? That’s what the low-fliers aspire to.” As a professor, Schwartz notes that he himself was once viewed as a man who’d made a low-flying choice. Job security, steady industry, autonomy—those were his values, not money. But now, in this recession, his profession is suddenly esteemed. “The thing is, it’s a false choice,” he says. “There’s plenty of room for joy in a low-flying life.”

Oh. My. God.” Ande Sedwick, 24 and lithe as an orchid, pops out of the doorway of a third-floor walk-up on Carmine Street in the West Village, beckoning her boyfriend, Isaac Woofter, to come have a look around. They’ve been casing various one-bedrooms for the last hour or so, all nice, but all with deal-killing problems. Not this place. It has light. It has closet space. It has a kitchen separately defined by a wall. Oh. My. God.

Jacquelyn Leahy, their broker from Mark David & Co. real estate, gives them a triumphant look—What’d I tell you?—and then turns to me. “The difference between this year and last,” she says, “is that this year we can help people.” The list price for this apartment is $2,400 per month, but she’s pretty sure she can knock $100 off without the landlord protesting. In the spring of 2008, it’d have gone for $2,800.

If the market hadn’t crashed, Ande and Isaac would never have been able to conduct this search. They’re currently living with two roommates in West Chelsea, on a club-saturated block so loud that Ande can barely get to sleep at night. She’s a singer-songwriter, but makes most of her money from coaching figure-skating and tending bar; he, an aspiring actor, also makes most of his income pouring drinks. “We’d never have looked in this neighborhood, either, if it hadn’t been for the market,” says Isaac, as he admiringly looks around. Space! “Maybe we’d have heard from a friend—‘Oh, we’re moving out, do you want to take our lease?’ But that always happens when you don’t need it.”

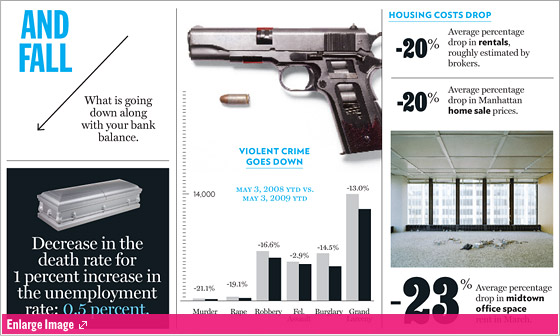

Dalton Conley, author of Elsewhere, U.S.A. and a sociologist at NYU, sometimes likes to compare New York to the United Arab Emirates. Wealthy people on a tiny island serviced by poor immigrants from neighboring countries—that’s what it is, essentially; it’s just that the island here is Manhattan, and the neighboring countries are … Queens. No one in their right mind would say that this recession will suddenly erase New York’s economic disparities. But one of its silver linings is that it might provide a brief window for people like Ande and Isaac to gain a toehold in this city. The middle class, long vanishing from New York but once its spine, has a chance to reclaim its place. Most brokers say their rentals are going for roughly 20 percent less this year. Manhattan home prices have fallen about the same. “And what that means,” says Jonathan Bowles, director of the Center for an Urban Future, “is that people will have the opportunity to buy apartments and homes in neighborhoods other than the far Rockaways.”

As a matter of gestalt, this city no longer belongs to those with large bonuses and expense accounts. The city is awash in deals on everything from clothing to furniture. It’s cheaper to join a gym. Even the city’s most upscale restaurants have been humbled. “When the economy goes sour,” says Danny Meyer, the impresario behind Union Square Café, Eleven Madison Park, and Shake Shack, among others, “there are three different kinds of restaurants that do well: the smaller-scale neighborhood restaurants that don’t ask much of you; those that have banked enormous goodwill by offering great value during the boom; and those with proven records of excellence, a sure thing.” I point out to him that two out of three of those types fall into the unpretentious category. “Well, yeah,” he says. “People aren’t going to want to go where they aren’t being hugged.”

And so Molly’s Shebeen, a Third Avenue pub with sawdust on the floor and a bow-tied Irish barkeep, is still doing a brisk business; Cru, which refers to its wine selection as its “wine program,” seems totally dead. The Upper West Side’s Kefi, a warmly appointed neighborhood spot that serves rustic Greek, is doing 500 to 600 covers on a Saturday night; Fiamma, which New York’s Adam Platt once described as “overwrought, fussy, and never comfortable in its own skin,” has closed; and Gilt and Adour, its spiritual twins, seem to be on life support.

There is still potential for a significant decline in our quality of life. Subway service is about to become both more expensive and less frequent. The city Parks Department budget is set to decrease. But the biggest fear about this recession—that it will return us to the days of seventies Babylon, of violent crime and Taxi Driver paranoia and fetid garbage pileups—seems unwarranted. Only about 23 percent of New Yorkers owned their places back then; now about 33 percent do. Times Square is squeaky clean. Policing methods have improved. According to the NYPD, violent crime has gone down in virtually every category this year compared to this same time last year: Murders by 21.1 percent; rapes by 19.1; robberies (which include muggings) by 17; assaults by 3. More surprising still, property crimes have gone down: fewer car thefts, fewer home and store burglaries. None of this evokes the seventies very much.

“I wouldn’t want to minimize the economic pain that many folks are experiencing,” says Conley. “But as a city, it is possible we’ll end up with the good parts of the seventies—a rich bohemian culture—and not the bad.”

In a recent issue of the Westchester WAG, Seema Boesky, ex-wife of Ivan, wrote a column that began with a curious declaration: “My boyfriend and I are watching our pennies, so we didn’t exchange gifts of value over the Christmas holidays and movies have been our primary source of entertainment.” This from a woman who got $80 million of her husband’s money in 1993, as well as their homes in Paris, Manhattan, and Hawaii. Was it posturing? Sure. But it revealed something essential about this moment: During a recession, no one wants to be Imelda Marcos. Colin Camerer, an economist who studies risk at Caltech, suspects human beings may even develop a biological revulsion to excess in leaner times. “My sense is that the same purchases that are glamorous and thrilling when times are good (Hummers, $2,000 handbags),” he writes in an e-mail, “are literally disgusting (i.e., activate disgust brain regions) when times are bad.” He might have added we develop a literal distaste too. During recessions, people get thinner. (Possibly because they’re eating more home-cooked meals.) They also cut down on cigarettes and alcohol. (They’re expensive.)

Even if we’re just paying lip service to the idea, the reemerging value of material restraint may be yet another silver lining to this downturn. As most economists and psychologists can tell you, the steady acquisition of gewgaws and appurtenances doesn’t make us happier once our basic needs are met. Some will go so far as to say that material acquisitions make us less happy. Schwartz puts it this way: “During the boom, people were by and large chasing the wrong stuff, because they were chasing stuff.” Psychologists like him have a term for our misplaced and unending hunger for more and more stuff: the hedonic treadmill.

New York, the land of the 24-hour gym, is the world capital of hedonic treadmills. The opportunity to covet new stuff presents itself in every shop window, on every street corner, on every wall in every window we glimpse as we’re wandering along Museum Mile. In The Paradox of Choice, Schwartz describes with vivid persuasiveness the problems that visit those of us who seek the best of everything, or “maximizers”: second-guessing, susceptibility to disappointment, an inability to savor. In study after study, they’re far more miserable than “satisficers,” or those who are willing to make do. “And my suspicion,” says Schwartz, “is that New York, because it offers so many consumer options, creates maximizers.”

Our own billionaire mayor, who lives just off Museum Mile, is the perfect embodiment of this form of excess. For the last two decades, he’s been acquiring portions of the townhouse next to his, though his Beaux Arts limestone already contains 7,500 square feet of space. (He’s now at 12,500 and counting.) And let’s not forget that third term he seeks, a prize he so badly covets he pushed through legislation to make it possible. In most cases—and most places—a political term isn’t a commodity, but Bloomberg turned it into one, spending $74 million of his personal fortune on his first election and $77 million on his second, and now gearing up to spend $80 to $100 million on his third.

Schwartz hardly regards this recession as a welcome development. But he hopes it will at least make people begin to recognize the value of experience over material accumulation. “There’s good evidence people get more pleasure from experiences than possessions,” he explains. “So constraining people materially might make them more satisfied with their lives.”

During the Great Depression, people definitely chose free and cheap forms of entertainment when money was scarce. They played board games, gathered around the radio, went to the movies, clustered in coffeehouses. And today, in New York, there’s evidence that something similar is happening. People seem to be looking for things to do, rather than things to buy. The volunteer boom is part of this trend. So is the widely reported uptick in moviegoing—and it’s not all to see action movies, either: Receipts at BAM Rose Cinemas are up 10.5 percent over what they were at this time last year, and receipts at BAMcinématek are up 15.5. Attendance at BAMcafé Live, the Brooklyn Academy of Music’s weekend program of drinks and free music, is up by roughly 25 percent, and sales for single-ticket events at the 92nd Street Y—lectures, concerts, dance performances—are up 5 percent. Though a dive in foreign tourism has dragged down overall attendance at our big museums, local attendance is up at many of them, especially those popular with families: The Children’s Museum has seen a 5 percent increase in its local patronage; the Natural History museum’s local traffic in January and February, while the same as last year’s (a record high), is up considerably from the same months of 2007 and 2006. The Frick Collection says it’s seen a notable increase in traffic on Sundays, when admission is pay-as-you-will from eleven to one. And the Guggenheim’s traffic is up 2 percent across the board.

A more affordable city, better attitudes toward work and leisure, finer civic mores—these are silver linings for culture and New York’s luckier people, the ones who are still working or have some other means to get through this crisis. But for those facing financial hardship, which is ultimately what recessions are all about, these improvements are minor consolations. We’ve heard a lot about bankers cast out to sea. But the unemployment rate among unskilled men, particularly African-Americans and Latinos, is disproportionately high. As Mike Wallace points out, a constrained job market often offers the least educated and poorest poor the fewest options. “During the Great Depression,” he notes, “when poor women lost garment-shop jobs, many turned to the street-corner ‘slave markets’ of Brooklyn and the Bronx, renting themselves out for a pittance as domestic laborers, or they resorted to sex trades ranging from taxi dancing to prostitution.”

No one is suggesting things will get that dire this time around. But recessions don’t tend to be moments when cities can expand their social safety nets, and this time is no exception: In order to close the budget gap, Bloomberg is proposing reductions across the board—including cuts in child-welfare centers, homelessness programs, and certain immigrant services. The Spanish-language press produces a steady stream of stories about the devastation of small businesses and the sharp decrease in wages sent back home. “In some cases, the flow of money has reversed direction,” says Alberto Vourvoulias, the executive editor of El Diario. “People are asking relatives at home to go into their savings and send money here. Employment has decreased, but costs of living here remain incredibly high.”

“It’s possible we’ll end up with the good parts of the seventies— a rich bohemian culture—and not the bad,” says NYU sociologist Dalton Conley.

Nor is it just the poorest poor who are suffering. This recession may provide a foothold for some middle-class New Yorkers, but it will just as surely squeeze out others. A fair number of families overleveraged themselves at the peak of the boom, assuming they’d have two incomes, and now find themselves in more precarious arrangements; those who didn’t own homes but are suddenly contending with lost jobs or lower wages are barely scraping by. And for New York families whose mothers stayed at home by choice, rather than necessity, it’s possible this downturn will force them to reconsider the consequences of that decision if their husbands are now unemployed. “The stronger a man’s attachment to breadwinning,” says Stephanie Coontz, author of Marriage, a History, “the more likely he is to salvage his male pride by refusing to do ‘women’s work.’ ” As a rule, able-bodied, unemployed men spend an average of just three and a half extra minutes per day actively caring for their kids, according to Jay Stewart, an economist at the Bureau of Labor Statistics. Most spend their extra time on sleep and “leisure activities” (including almost two extra hours of TV), though they do spend an extra hour and 42 minutes on “unpaid household work,” which includes passive forms of child supervision (like being in the same room).

It’s worth noting that joblessness isn’t just a financial problem. Most recent studies on the subject suggest that the psychological effect of unemployment is even greater than the loss of income that accompanies it. Andrew Oswald, an economist at the University of Warwick, has collected happiness data from hundreds of thousands of people both here and in the United Kingdom, and what he’s consistently seen is that people recover more quickly from becoming disabled, even widowed, than from the long-term loss of a job. “People may draw their benefits from the government,” he says, “but they don’t seem to psychologically acclimate.” Everyone tends to have a natural hedonic set-point, a zone within which their internal mood-thermostat tends to hover, just like their weight. Sustained unemployment is one of life’s few upsets that seems to permanently depress it. Even if this recession is shorter than pessimists predict, those who are laid off in this period will still pay a concrete, long-term price. “It’s what economists call ‘scarring,’ ” explains Oswald. “If I lose my job today, the evidence is that my wages will be 10 percent lower, even a decade from now. Your bad luck follows you.”

One could make the case that those fired during recessions were the least-productive employees anyhow. But the “scarring effect” dovetails with another finding that refutes this theory, and it’s a finding that every 21-year-old wearing a class of ’09 sweatshirt should keep in mind: Those who graduate from college during a recession make less money than those who do not, and these disparities don’t seem to completely erode with time. After looking at hundreds of white men who graduated from college between 1979 and 1989, Lisa Kahn, an assistant professor at the Yale School of Management, came up with an elegant and depressing formula: Each point on the unemployment rate at the time of graduation translates into a 6 percent decrease in starting salary. Specifically: Kids who graduated in 1988, when the unemployment rate was 5.5 percent, made 24 percent more their first year out of school than those who graduated in 1982 (even adjusted for inflation) because the unemployment rate was four points higher, at 9.5 percent. Fifteen years later, there was still a 10 percent differential between them.

Even well-meaning people with good educations, savings, and open minds may find their best intentions thwarted during this period. One can’t become a social worker if social programs are whittled down to nil. One can’t be an aide to the elderly if senior centers are closing. If the finance sector gears back up and proves the most remunerative option on the horizon—which, if history is any guide, it will—one can’t expect an entire generation to forsake its lures. When I e-mail Mike Wallace to ask whether downturns produce responses of lasting virtuousness, he replies with gimlet-eyed mercilessness: “At the values/ethics level there’s often a furious rejection of speculative gambling, and fervent vows to reform,” his note says, “but (a) there are certain dynamics built into a capitalist society that tend to reassert themselves, and (b) ours is not a culture that cultivates long memories.”

It’s a rainy Monday in May, and the construction liaison to the Alexandria Center, New York’s first bona fide biotech park, is walking me through the shell of the campus’s East Tower building, scheduled to open in January 2010. It’s still a construction site, a gray moonscape of concrete and dust, but already, there’s evidence that this isn’t an ordinary New York office building. “See the ceilings?” he asks. “They’re fourteen feet high.” Laboratories require the extra height for their extensive ventilation systems. He points to a thick pipe of cobalt blue. “For acid waste.” Then he points to the ceiling and notes that there’s a backup generator on the roof the size of a tractor-trailer. Maria Gotsch, the president and CEO of the New York City Investment Fund, chimes in to explain that one: “So that the minus-80-degree freezers don’t thaw,” she says, “and eight years of research plus $100 million don’t go down the drain.”

For twenty years, this city has been trying to start its own biotech park. That one is finally opening in the middle of a recession could be viewed as rotten luck. But Gotsch, who very frankly admits she has a stake in the outcome—the NYC Investment Fund has committed to invest up to $15 million in the project—says there’s another way to look at it. New York has always been long on Ph.D. talent. New Jersey, home to 60 percent of the country’s pharmaceutical companies, has always been long on clinical-trial talent, and pharmaceutical companies are merging now, leaving many of those people without jobs. “And with Wall Street downsizing,” she says, “people who were formerly biotech analysts for investment banks might be willing to go work for an early-stage biotech company. The opportunity-cost for everyone to explore other options just went down.”

This recession will be brutally painful for some household economies. But for the city as a whole, it presents rare possibilities. Economic diversity is good for cities—one need only look at decaying Detroit to see the perils of a one-industry town—and the super-dominance of Wall Street made diversifying ours much more difficult. “New York has never been hungry enough to build an economy that goes beyond Wall Street,” says Bowles. “I thought it might happen after 9/11, but even then, there was a widespread feeling that the finance sector would rescue the city.” He mentions that the Bloomberg administration just announced it’s starting two new incubators. “I’ve been writing about the need to spur entrepreneurship for ten years at the Center for an Urban Future,” he says. “And it just hasn’t been a sexy enough topic for City Hall under this or the previous administration until now.”

No one is saying that this recession will result in a seismic transformation akin to the shift from manufacturing to finance. Even if Wall Street is in a deep state of hibernation, it remains the core of New York’s economic infrastructure and will almost inevitably remain so for the foreseeable future. But while it’s dormant, it’s a good time for other businesses to come to life. Bowles points out that Silicon Alley got its start in the mid-nineties in part because of cheap real estate that lingered from the early-nineties recession, as well as a surplus of unemployed New Yorkers who’d previously worked in advertising and finance. (In 1995, the city unemployment rate was still 8.2 percent.) Silicon Alley didn’t last long. Indeed, it’s possible that Silicon Alley’s failure to thrive is a symptom of just how calcified we are in our old-economy ways. “But we need to lay the foundation for the next round of growth industries,” says Bowles, “whatever they are.” Video games, digital media, interactive advertising, financial software and other niche services—these are some of the things people think they might be. Gotsch says there’s no reason why we shouldn’t have a strong biotech sector: According to a 2001 report from her organization, New York receives more NIH funding than any other city besides Boston, and at least thirty biotech start-ups per year are based on the research from our institutions. Jerry Hultin, the president of Polytechnic University in Brooklyn, recently arranged to merge with NYU, hoping to create a topflight engineering school in New York, so that the creator of the next Google will come from a local university, rather than from MIT or Stanford. John Sexton, the president of NYU, is fond of pointing out that the finance, insurance, and real-estate sectors in New York City—collectively known by the acronym FIRE—were shedding jobs before the new millennium, just as they are now, while the city’s intellectual capital only continues to grow: New York has more college students per capita than any other American city; it has the highest concentration of postdocs in both arts and science. So the transformation he hopes for—and this is his nifty coinage—is an economy where FIRE counts for a bit less, and ICE (intellectual, cultural, and educational capital) counts for a bit more.

“How do you magnetize talent in a world where propinquity matters less?” asks Sexton. “Universities. World-class universities.” He acknowledges that our city and state budgets aren’t exactly skewed toward helping them; Fordham is not getting tax breaks like Bear Stearns. But one of the few new line items in this year’s state budget is the Higher Education Loan Program. “We should at least begin to use this as a social moment,” says Sexton, “to reunderstand what we once knew: that education is the ultimate public good.”

Indeed, we shouldn’t forget the political and cultural implications of a marginalized Wall Street. In her book, The Warhol Economy, Elizabeth Currid notes that the absolute number of people who toiled in the finance sector was the exact same number as those who worked in the arts, or 5 percent of the city’s workforce. If finance recedes as an economic engine in this city, it recedes as a cultural engine, too, allowing other sectors to reinsinuate themselves into the city’s Zeitgeist. In 1992, for instance, Seattle may have defined the sound of grunge, but New York enshrined its style, with Marc Jacobs producing a legendary grunge collection that reinvigorated the New York fashion world. Would his work have had the same cultural impact if Wall Street had been casting its long shadow? (And let’s not forget, his collection was about grunge, a recession-ready trend if ever there was one.) It’s hard to say. But it seems unlikely.

The reaction we most associate with periods of economic distress may be caution. But another, paradoxically, is to do what Jacobs did, and take risks. Entrepreneurs consider recessions a fine time to start new businesses. The Silicon Alley Insider recently published a list of companies that started during periods of negative GDP growth. They included Wang, Fairchild, CompuServe, Intel, Atari, Apple, Microsoft, Sun, Compaq, Cisco, 3Com, Genzyme, Amgen, Lotus, Adobe, AOL, Dell, and Cisco. Real estate and labor are cheap during recessions (hence Silicon Alley’s ability to colonize those empty buildings in the Flatiron district). Competition is low. As Gotsch points out in her observations about biotech, unemployment deepens the talent pool for small companies that want to recruit, and it liberates the unemployed to gamble on newer, looser ventures. And it’s not just businesspeople who take advantage of this opportunity to switch gears, either, but artists and craftspeople, too. “The upside of these downturns,” says Danny Meyer, “is that some chefs, having proven themselves with highly regarded cuisine, can now feel freer to do what they like, and fly in a more straightforward direction.” In his own life, he points out, the early nineties recession gave him and Tom Colicchio the chance to start a restaurant together, because Mondrian, where Colicchio had been executive chef, shut down. Gramercy Tavern opened in 1994.

There are all sorts of examples floating out there about hard-times conversations of lemons to lemonade. They’re part of recession and Depression lore. My favorite, though, comes from Suzanne Wasserman, director of the Gotham Center for New York City History at CUNY. She tells me that in 1929, a wealthy businessman named Yip Harburg, the co-owner of Consolidated Electrical Appliance Company, went deep into debt. Rather than dive off a building, he followed his dream and became a lyricist. Crazy, you say, but eventually, he did all the songs for The Wizard of Oz and Finian’s Rainbow. He also wrote the lyrics to “It’s Only a Paper Moon” and “April in Paris.” And, most apt, he collaborated with Jay Gorney to create the anthem of his day: “Brother, Can You Spare a Dime?”

In Capitalism, Socialism, and Democracy, the Austrian-born Harvard economist Joseph Schumpeter talked rhapsodically about creative destruction, a kind of Darwinian ecosystem of death and renewal in capitalist economies. You hear his name a lot now, Schumpeter. Recessions are perfect Schumpeterian moments of creative destruction. The trouble is, creative destruction doesn’t necessarily make us happy. “Creative destruction, Schumpeter said, thinking about entrepreneurs, requires people at ease about not reckoning the consequences of change, or not knowing what comes next,” writes Richard Sennett, an NYU sociologist, in The Corrosion of Character. “Most people, though, are not at ease with change in this nonchalant, negligent way.”

Here’s what’s interesting: Sennett wasn’t writing about people living through recessions. He was writing about people living in our modern boom economy. Yet that feeling of instability and painful uncertainty applies to both times. That’s what’s so odd about this moment: Today’s recession doesn’t feel all that different from the labile times preceding it. Instead, it just feels like a long-awaited manifestation of them.

But that’s probably no accident. The crash was an equal and opposite reaction to the times preceding it, yanking us down as low as the boom years propped us up. What will emerge when neither high-wire derivatives nor widespread unemployment dominates our lives isn’t clear yet. Maybe more instability and Wall Street excess. But maybe a glimmer of something new, too. New York will have its smattering of new businesses, and a few more pastors and a biotech park. Its citizens will have seen a few more paintings and donated a few more hours of their time to the needy. It’d be naïve to think we’ll become a metropolis of goody-goodies, our iPods reprogrammed to the choruses of our better angels. But possibly, we’ll remember that the Big Apple at its greenest was just that, green: not the end point of something, but on its way to becoming something else.