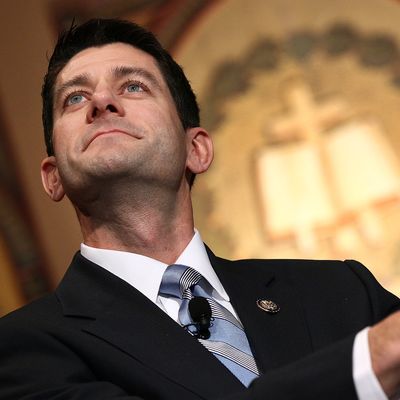

Paul Ryan did it. Despite President Trump’s promise to deliver a “middle-class tax cut” that would give no benefit to the rich; the utter lack of a plausible, policy rationale for slashing taxes on wealthy investors at a time of high inequality and a soaring stock market; the urgent need for new government spending on an opioid public-health emergency and a devastated Puerto Rico; and volumes of public opinion data showing mass opposition to the Republican plan, the Speaker still found a way to to raise taxes on the poor and slash them on plutocrats.

On Tuesday, the House passed sweeping, regressive changes to the American tax code, permanently slashing the corporate tax rate by 14 percentage points, while cutting taxes on the middle class in the short term — and raising ordinary Americans’ tax burdens in the long run. Ryan needed 218 votes to pass his tax overhaul. He got 227 — a remarkable feat given how unpopular this legislation is, and how vulnerable many of the GOP lawmakers who backed it will be in next year’s midterm elections.

Every House Democrat voted against the measure, along with 12 GOP lawmakers. Most of the Republican dissenters hail from high-tax states that stand to lose from the bill’s cap on the state-and-local tax deduction.

The bill is expected to pass the Senate tonight, and become law by Christmas. If it does, the corporate tax rate will fall from 35 to 21 percent, while the top marginal tax rate for individuals will drop from 39.6 to 37 percent. Middle-class families will see a higher child tax credit and standard deduction, giving most households a lighter tax burden until 2025.

After that year, the middle class’s benefits will phase out — while the bill’s subtle middle-class tax increases will remain. Should the bill be fully implemented in 2027, most Americans will pay higher taxes then they do today, while corporations and the superrich will save billions.