Conservative anger at President Obama’s immigration-relief plan was bound to burble up in the form of some kind of demand for revenge. That response has manifested itself, improbably enough, in a fight over tax cuts. Congress has erupted in a kind of sublimated class war that not only pitted the Republicans and Democrats against each other, but also the Democratic Party against itself.

The predicate for this unlikely conflict is that the tax code contains a bunch of breaks and deductions that were written as temporary, but that Congress usually decides to just renew every year. Most of those breaks benefit businesses — the main one being a tax break for research and development. Also included in that package are several tax breaks for low-income workers that Democrats passed into law in 2009. Traditionally, the two parties have agreed to extend all the tax cuts together at once. It was not exactly what either party wanted — Democrats didn’t like bleeding revenue from the Treasury every year, and Republicans didn’t like extending tax cuts to low-income workers — but the compromise suited both sides well enough that nobody cared to blow it up. Now it’s getting blown up.

Brian Faler and Rachel Bade report that Obama’s immigration relief plan is the proximate cause. Newly legalized workers will pay taxes, and thus be eligible for tax breaks. “If Republicans agreed to extend [those tax breaks] now,” Faler and Bade report, “it would look like they were voting to expand government benefits to illegal immigrants.”

The idea that tax breaks for low-income workers amounts to a form of welfare is itself a somewhat contested premise within the Republican party. Large elements of the conservative party have spent the Obama years simmering with rage at the insufficiently high tax rates paid by low-income workers. Mitt Romney’s candid rant against the 47% percent who (allegedly) pay no taxes merely recycled a right-wing meme. Since Romney’s defeat, some Republicans have gently urged their party to ease up of their campaign to force low-income workers to pay more taxes. But adding the cultural-legal panic to the preexisting class-war panic was apparently enough to turn the GOP’s grudging acceptance of the low-income tax breaks into full-scale opposition.

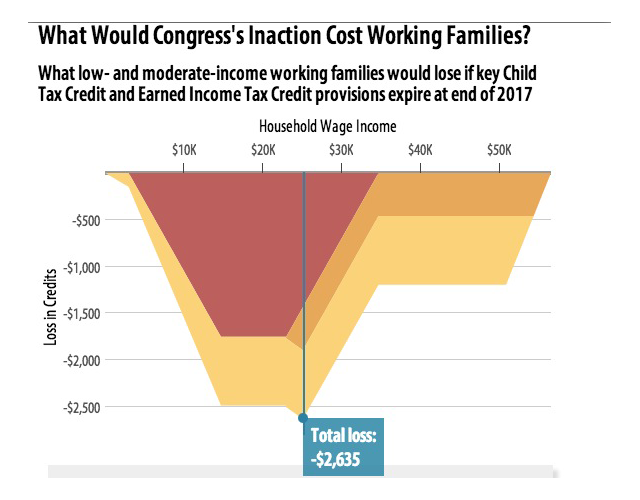

So first Republicans made the tax breaks for business permanent, while allowing the tax breaks for low-income workers to expire at the end of 2017. Since they would no longer be tied to tax breaks for the more affluent constituencies that have influence with Republicans, this would mean they would almost certainly expire. Families earning $10,000 to around $25,000 a year would lose nearly $2,500 a year — a punishing blow to the working class:

Amazingly, Democrats in the Senate like Harry Reid and Chuck Schumer agreed to this plan. Before Thanksgiving, Obama threatened a veto, causing Reid to beat a hasty retreat. The (not for long) Senate Majority Leader now promises to negotiate for the extension of low-income tax breaks.

Meanwhile, the CEO community is apoplectic at the standoff. Business leaders by and large have occupied a middle ground between the two parties (which is an indication of how far right the terms of the economic debate have shifted since Republicans took control of Congress). They share the GOP’s general ideological aims, but don’t share its willingness to blow things up in order to achieve them.