In the years since Donald Trump arrived in the Oval Office — and weeks since COVID-19 arrived on our shores — the New York Times has repeatedly bemoaned the collapse of public trust in objective reporting and professional expertise. And for good reason: to engage in rational deliberation over what should be, partisans must share a rough understanding of what is. And if good-faith arbiters of factual reality lose all authority, then voters lose the capacity to hold politicians accountable.

Which is why the Times’ recent reporting on the federal deficit is an abject disgrace.

Restoring the authority of mainstream journalism and credentialed expertise is a daunting task. But surely, one of the simplest things that a newspaper can do to advance that cause would be to forbid its reporters from presenting their own inexpert intuitions as objective fact. And yet, in an article headlined, “No Fighting Over Red Ink Now, but Virus Spending Will Force Tough Choices,” the Times’ Washington correspondent Carl Hulse does precisely this.

The problem with Hulse’s piece is not subtle. It is present right there in the headline, which asserts that Congress’s trillion-dollar investments in pandemic relief “will force” our elected leaders to make tough choices about how to reduce the deficit in the future.

Hulse reiterates this platitude throughout his report. “Just last month, Congress allocated and President Trump signed into law a series of bills that spent an estimated $2.6 trillion — the equivalent of twice the annual discretionary federal budget … Something will eventually have to give,” Hulse declares. Paragraphs later, we are told that “the bill will come due, as it always does,” and “There is no choice now, but tough decisions are ahead.”

At one point, Hulse devotes a full paragraph to his own editorializing:

The spending surge has implications beyond the usual deficit tug of war. It could prompt inflation, and it also leaves the nation far less prepared in the event of another emergency. The fiscal situation further endangers the nation’s health and retirement guarantees — already facing a grim financial outlook, with insolvency projected over the next two decades if nothing is done — and limits the ability to spend on other programs that have been on hold.

Nowhere in the piece does Hulse give his readers the slightest clue that any of these claims are controversial. In his account, the debate over America’s fiscal condition has exactly two poles: “those who argue that the answer to deficits is to reduce spending and those insisting that the solution is new revenue streams.”

Yet there are more than a few thinkers who reject this binary, along with most of Hulse’s other characterizations of America’s debt situation. Among them:

• An obscure economist named Paul Krugman who writes for a little-known rag called the New York Times.

• Olivier Blanchard, the former chief economist of an esoteric organization called the International Monetary Fund. In a paper released last year, Blanchard argued that nations should not make a priority of deficit reduction, so long as the interest rate they can borrow at is comfortably below their rate of GDP growth. Which is to say, if your capacity to service debt is growing faster than your debt, then your debt is not a big problem. And the United States can currently borrow money at near-zero interest rates. (If Hulse or his editors would like to learn more about Blanchard’s theory, they can read about it in the New York Times).

• Neil Irwin, a senior economics correspondent for Carl Hulse’s newspaper, who reported in 2019 that deficit alarmism has been so thoroughly discredited by the past two decades of economic developments, academic economists were moving toward a new, dovish consensus on public finance:

[M]acroeconomists are confronting the reality that the sky did not fall, even as the United States swung from a $236 billion surplus in the 2000 fiscal year to a $779 billion deficit in 2018. By their old theories, high deficits and debt should have caused interest rates and inflation to rise, and government borrowing should have “crowded out” capital from the private sector.

At a minimum, the old rules simply seem not to apply in a world that has free-flowing capital; an aging population; and stubbornly low inflation and interest rates. Or, more controversially, maybe those rules were never really an accurate description of how economics works in a country like the United States that can borrow in its own currency.

I could keep tossing out names of mainstream, New York Times–cited or –affiliated economists and commentators who believe that America’s national debt was not problematically high before the COVID-19 crisis arrived, and that deficit reduction should not be a policy priority after it passes. But the point should already be clear: This is not a marginal position among economic experts. Yet Carl Hulse and his editors felt comfortable not merely ignoring this perspective’s existence, but flatly contradicting its substance in a piece of purportedly nonideological reportage.

It is unclear why the Times’ politics desk feels that Carl Hulse (who holds a BA in mass communications) has more authority on the macroeconomics of public debt than Paul Krugman (who boasts a Nobel Prize in economics). But this bizarre editorial judgement is not entirely surprising. The necessity of deficit reduction has long been a shibboleth of the D.C. press corps, for reasons that aren’t hard to discern. Both parties have historically paid lip service to the idea that balanced budgets are good and deficits are bad. A lot of very well-funded, nonpartisan advocacy organizations exist to empirically validate these sentiments. And Congress’s perennial failure to act on their own anti-deficit rhetoric provides view-from-nowhere journalists with a tailor-made morality tale: Clearly, both sides are letting their near-term electoral goals prevent them from acting in the nation’s long-term best interests. And if Democrats and Republicans insist on privileging their constituents’ myopic demands over the well-being of future generations, then it is the duty of the Fourth Estate to speak up for the latter. Thus, at the presidential debates in 2012 and 2016, ostensibly neutral moderators implored candidates to level with the American people about the urgent necessity of fixing the debt.

But in the estimation of many experts, as well as progressive bloviators like myself, the D.C. press corps’ conventional wisdom about debt and deficits is a pernicious superstition.

Our reasoning goes like this: Our government cannot run out of dollars because it can print them in unlimited quantities. For this reason, there is nothing inherently unsustainable or dangerous about Congress adding more dollars into the economy through public spending than it withdraws from the economy in taxes. We are not drawing down on a finite sum of dollars that our grandchildren will one day need.

Therefore, the fact that the national debt is now a very large number tells us very little about the long-term sustainability of existing spending and revenue patterns. There is no absolute limit on how much public debt that the United States can accrue. The genuine constraint on our fiscal capacity is inflation: If Congress injects too many dollars into the economy, then consumers and businesses could become so cash rich and eager to spend, that their demand for real resources outstrips the supply and a bidding war over scarce goods and commodities ensues. Profligate money printing could also theoretically weaken America’s currency relative to other nations’, raising the costs of imports for U.S. consumers and the interest rate that our government must offer to find buyers for its debt.

But there is no evidence that the United States is anywhere near breaching these constraints. Contra Carl Hulse, inflation is the least of our present worries. Since the 2008 crash, consumer price growth in the U.S. has been persistently lower than the Federal Reserve’s target rate. Now, amid the COVID-19 pandemic, deflation poses a far greater risk to our economy. Meanwhile, the dollar is not too weak on international markets, but too strong — and the United States can borrow money at near-zero interest rates. Unless or until these metrics drastically change, reducing the deficit should not be a priority of U.S. fiscal policy.

If this analysis is broadly correct — which is to say, if Paul Krugman actually has a better grasp of macroeconomics than Carl Hulse — then the Times’ decision to print the latter’s musing on fiscal policy in the straight-news section of the paper, while relegating Krugman’s to the op-ed page, is quite dangerous.

In 2009, the Obama administration ignored its own experts’ advice on the proper size of its stimulus proposal, out of deference to the concerns of deficit hawks. This, combined with the administration’s retreat to austerity following the Republican Party’s triumph in the 2010 midterms, led the United States to reduce annual spending between 2009 and 2016, even as private investment and spending remained inadequate for bringing America’s economic growth back in line with its prerecession trajectory.

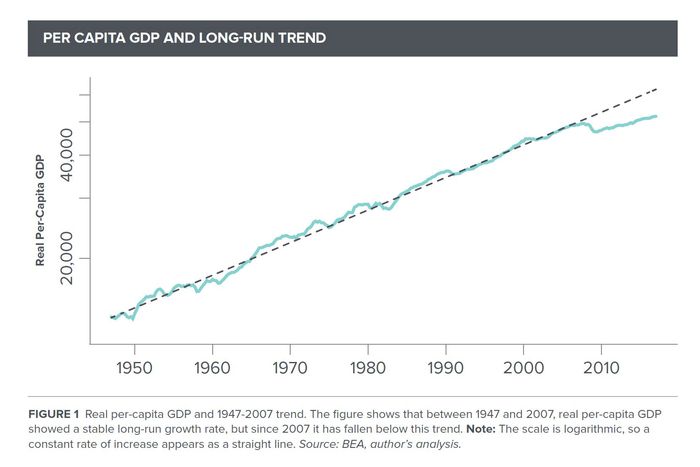

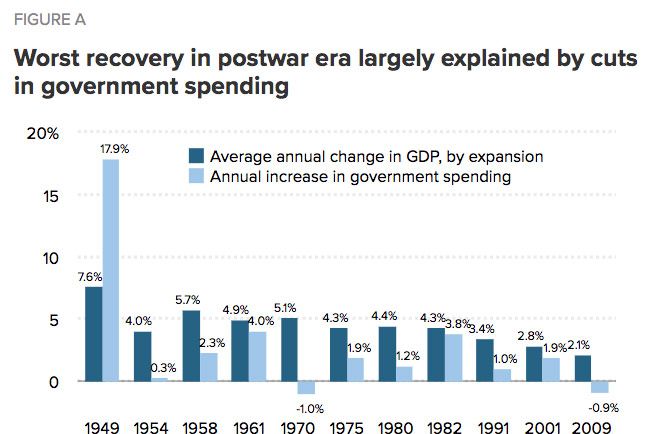

The significance of that last point is worth unpacking. Between 1947 and 2007, the U.S. economy fell into recession ten times. During each of these downturns, America’s GDP — the total value of goods and services produced by the economy — dipped far below the level it had been on pace to reach before the hard times set in. But none of those recessions permanently reduced our economy’s productive capacity. So when the recovery arrived, America always enjoyed a period of accelerated growth that allowed it to reach — and exceed — its prerecession potential. In all but one of these cases, the arrival of catch-up growth was abetted by a steady increase in government spending throughout the recovery period.

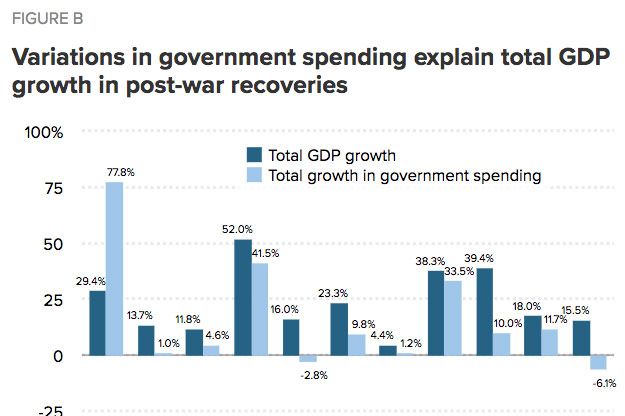

But we never caught up after 2008. And as the Economic Policy Institute persuasively argues, our government’s aberrant decision to cut spending is largely responsible for that fact. “If government spending had increased by 11.7 percent, as it did during the Bush recovery of 2001–2007, the present expansion, which was constrained by a 6.1 percent decline in government spending, would easily have exceeded the size of the Bush expansion,” EPI economist Robert E. Scott writes. “If government spending had increased by 33.5 percent, as it did during the Reagan recovery (1982–1990), then the Obama recovery would surely rank as one of the strongest on record.”

The costs of our government’s failure to expeditiously plug the giant demand hole that the Great Recession ripped into our economy were myriad and extravagant. They can be measured in trillions of dollars worth of lost output, and the incalculable psychological, emotional, and financial tolls that needless unemployment and underemployment took on America’s working people.

If the Carl Hulses of the world get their way, the United States will repeat its post-2008 failure. According to recent projections from the Congressional Budget Office, absent sustained fiscal stimulus, America’s unemployment rate is likely to remain above 9 percent at the end of 2021. Meanwhile, it is difficult to see how the United States can mount a response to climate change commensurate with the scale of threat that it poses without making large, deficit-financed investments in green infrastructure and technology.

For conservatives, deficit alarmism is a useful tool for constraining the ambitions of the federal government in general, and Democratic presidential administrations in particular. And Mitch McConnell is already making clear that his party’s tolerance for deficit spending won’t outlive the Trump presidency. Perhaps, the New York Times considers helping Mitch McConnell obstruct policies that promote full employment and carbon reduction to be more integral to its journalistic mission than accurately conveying expert opinion. But if that is not the case, then the paper should really stop letting its political reporters substitute their own intuitions about public debt for engagement with empirical research.