The video-game-retail business ain’t what it used to be. It seems like yesterday that GameStop’s shares were among the most coveted on the market, with a single stake in the firm commanding more than $469. But a lot has changed since the halcyon days of January 2021. In today’s economy, most consumers download games directly onto their consoles, while a deadly pandemic exacerbates the woes of brick-and-mortar stores. As a result, GameStop shares are down more than 50 percent from their peak, trading at a mere $225 a pop at the closing bell Monday.

All right, cards on the table: That lede was more snark than substance. The long-term viability of GameStop’s business did not meaningfully change between last Thursday and today. The drop in GME’s share price was likely driven by retail investors trying to exit before the stock crashes back toward its start-of-year value of $17.25. Fortunately, those looking for a way to stick it to the large financial institutions — by bidding up the price of assets owned by large financial institutions — have a new cause to support: unfree silver.

Reddit’s GameStop bulls made world news (and small fortunes) by executing a “short squeeze”: Seeing that many hedge funds had bet that GME’s share price would fall, they coordinated to ensure that it rose instead, a development that forced these hedge funds to simultaneously take losses and bolster the absurd rally that had bruised them so badly (you can read more about the mechanics of the GameStop short squeeze here). Last week, a popular post on the website’s WallStreetBets forum suggested that the Redditors could notch a similar win by buying silver.

“Silver is probably the most (naked) shorted commodity on earth. The bullion banks are doing their best to short this thing into oblivion,” the post explained before exhorting Redditors to “crash JP Morgan, buy Silver!”

The idea that retail investors can bring Wall Street titans low by causing a shiny metal to be more expensive might make perfect sense in the abstract. But in practice, top money managers collectively hold a net-long position on silver — which is to say, when Redditors bid up the price of silver, they make the financial industry’s Goliaths a few centimeters taller. The market for silver is also much deeper than that for GameStop shares, which limits how big a splash small investors can collectively make: GameStop had a market capitalization of $1.4 billion in mid-January; by contrast, in London’s vaults alone, there’s about $32 billion worth of silver bars at current prices.

For Redditors, though, the biggest flaw in the silver strategy is that one of the money managers with large silver holdings is Citadel, a hedge fund that 1) provided cash to GameStop short seller Melvin Capital, 2) helps the stock-trading app Robinhood execute its orders, and thus 3) lies at the center of a conspiratorial account of why Robinhood has curtailed its users’ capacity to buy GameStop shares, thereby depressing the firm’s share price.

These realities have limited Redditors’ appetite for silver speculation. “CITADEL IS THE 5TH LARGEST OWNER OF SLV,” a WallStreetBets poster wrote Sunday, referencing the commodity’s ticker symbol. “IT’S IMPERATIVE WE DO NOT ‘SQUEEZE’ IT.”

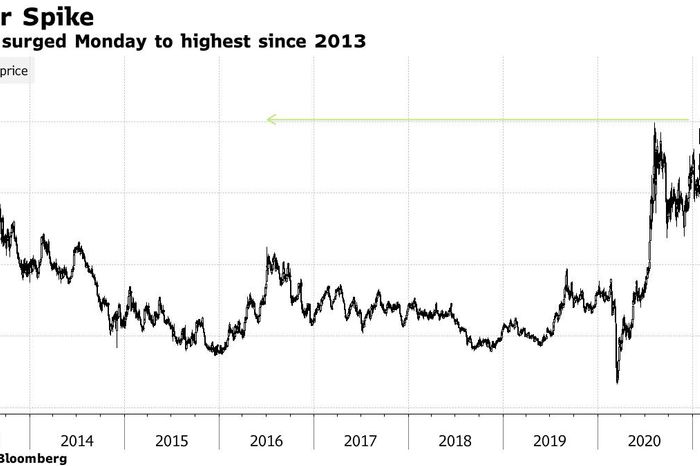

Nevertheless, a silver rally began, with the metal’s price hitting an eight-year high.

Unlike GameStop shares, silver is a physical object. And silver is every bit as hot in its concrete form as it is in its abstract one:

Retail sites for silver have been overwhelmed with demand for bars and coins, suggesting the frenzy that roiled commodities markets last week is spilling over into physical assets …

“Pretty much physical silver is almost all gone in terms of live inventory,” Tyler Wall, president and chief executive officer at SD Bullion, said in a Bloomberg TV interview. “Currently we’re seeing the premium — the price you pay over spot to get actual physical silver in your hands — is skyrocketing. Most stuff on our website’s at least 30% over spot and we can’t source it for much less than that right now from our wholesalers.”

As Bloomberg’s Matt Levine notes, silver has many appealing features for nihilism investors:

It honestly pains me to think about GameStop’s management and board of directors, trying to figure out what to do about being memed and rocketed. Silver has no management or board of directors. “You can fondle the cube, but it will not respond.” Silver doesn’t care what its price is, and there has always been a certain amount of crankishness and manipulation in the silver market, so why shouldn’t it be a Reddit thing?

… There’s so much more of that with a meme precious metal. You can buy the stock (of a silver ETF), or you can buy call options as a more leveraged way to push the stock up. You can buy silver futures, or options on futures.

Now, none of this necessarily means that silver is a safer meme asset than GameStop equities. But it does suggest that those who seek a balanced portfolio of semi-ironic investments would be well advised to split their holdings evenly between GME shares, silver coins, and subscriptions to New York Magazine.