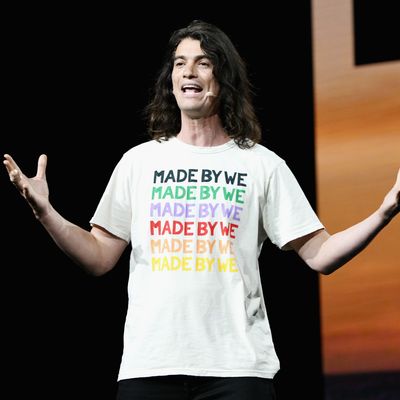

A luxury afforded to billionaires is that they don’t have to fade away no matter how spectacularly they fail, and Adam Neumann, who both co-founded and was exiled from running WeWork, is a prime example. When he was the CEO of the real-estate company, the footloose Silicon Valley entrepreneur marketed expensive shared office space by using a kind of spiritual gibberish. “Our mission is to elevate the world’s consciousness” was the infamous pitch to Wall Street investors in WeWork’s initial 2019 securities filing. The document attempted to explain the We parent company’s patchwork of seemingly unrelated companies, including wave pools and private schools. Why be a real-estate company when you can sell every aspect of a lifestyle? Some investors considered that a reasonable question — until it all exploded spectacularly, resulting in a delayed initial public offering and Neumann’s own ignominious and expensive severance from the company.

But now he’s back, baby! Neumann is behind a new company whose market is once again as expansive as life itself: the air we breathe and the environment we live in. Reuters reported Tuesday that he’s the force behind Flowcarbon, a trading platform that, in its own words, “operates at the intersection of the voluntary carbon market and Web3, leveraging blockchain to scale climate change solutions.” To translate: Companies can buy a credit on the lightly regulated carbon-offset market through a cryptocurrency called the Goddess Nature Token as a way to make it seem as if they are helping the environment. Great. In theory, this will make it easier and less costly to trade the credits on a market — all Neumann’s company wants in return is a 2 percent cut.

Here’s the thing about carbon offsets: They’re not going to save the environment. Under this system, companies that add more carbon into the atmosphere can pay — via the credits — for projects that in theory subtract carbon from the air somewhere else in the world. It’s also supposed to create an incentive for lowering emission overall. But in practice, it’s easy to game. According to Bloomberg, only 5 percent of the credits actually remove carbon from the atmosphere. In fact, a separate investigation by the news organization found that huge companies such as JPMorgan Chase, Disney, and BlackRock were working hand in glove with one of the world’s largest environmental groups, the Nature Conservancy, to buy up land that was not in any danger of getting destroyed — all as a way to make themselves look greener than they really were.

These kinds of accounting tricks have big implications. The rise of environmental, social, and governance investing — an increasingly influential investing philosophy that seeks to nudge corporations toward greener behavior — led to about $400 billion in funds as of last year. But the whole market is rife with stretched definitions of what counts as environmentally responsible, a problem that’s gotten so out of hand that the Securities and Exchange Commission is looking to reform it. Elon Musk railed against these funds as a “scam” because ExxonMobil counts as an ESG company for its efforts to reduce its carbon footprint to net zero by 2050 (a plan that relies in part on carbon offsets), while Tesla, the world’s largest maker of electric vehicles, does not. And even though he’s right, his own company makes billions by selling the carbon credits on the open market, essentially greenwashing the very companies Musk is criticizing.

Neumann’s company doesn’t really address any of this, but it does have backing from investors such as Andreessen Horowitz’s crypto arm, and the deck has input from McKinsey. Really, what he’s trying to do here is to make it cheaper and easier for the companies most likely to need carbon credits — like those in finance, insurance, and energy — to buy them. It’s entirely possible the market could develop into something that has more accountability to it. For now, though, Neumann doesn’t appear to be elevating the world’s consciousness as much as he is making the planet look greener than it really is.