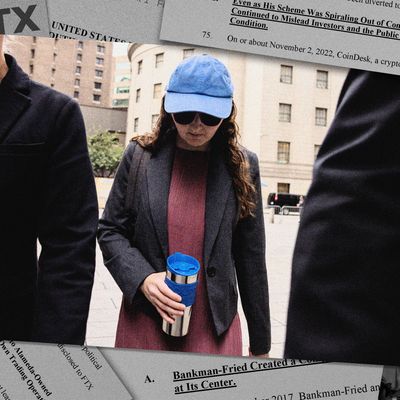

When the doors of Judge Lewis Kaplan’s courtroom opened just past noon on Tuesday to let in Caroline Ellison, most of those sitting in the gallery watched her with the intense focus they would give to a bride walking down the aisle. Sam Bankman-Fried, however, her former boss and boyfriend, seemed to barely tilt his head to look at her as she passed. It was the first time the two have seen each other since his crypto empire collapsed in a cloud of fraud last fall. Soon after, Ellison accepted a plea deal that set her up to be the government’s star witness at trial. When she took the stand and was asked to identify the defendant, she took a long look around the jurors and lawyers before pointing him out, almost as if to say, I almost forgot what you look like.

Ellison was not a polished witness, starting almost every answer with an uhh or umm, often before getting into highly technical subject matter from her time spent managing Bankman-Fried’s hedge fund. But her value lay in how close she had been to him when the government said he was busy committing multibillion-dollar fraud. Once, she said he had even confided in her that he had a 5 percent chance of being elected president. For over four hours, she provided damning levels of specificity on how Bankman-Fried had allegedly misled customers of his crypto exchange while he gambled away their deposits at a hedge fund he founded and she later ran. Put simply, she said, “He directed me to commit these crimes.”

The core of Ellison’s testimony focused on Alameda Research, the hedge fund owned by Bankman-Fried, which was supposed to be separate from FTX, his crypto exchange. Ellison joined Alameda in 2018 as a trader, and soon after, she and Bankman-Fried were a couple. The next year, he launched FTX to let people buy and sell crypto. She testified that the hedge fund was allowed to borrow unlimited amounts of money from FTX — a practice that was not disclosed to the company’s customers and investors.

By 2022, Ellison had become Alameda’s chief executive officer, just in time for it to suffer massive losses thanks to bad trades on stocks and crypto. In one brutal memo shown in court, Bankman-Fried blames Ellison for those losses, writing that she “is not a natural leader, and probably never will be.” Bankman-Fried has claimed the collapse of Alameda and FTX was, in reality, Ellison’s fault. He told biographer Michael Lewis that he learned Alameda was borrowing from FTX customers only after it was too late to do anything about it, and he has chalked up the problem to an $8 billion or so accounting error. Throughout the trial, former FTX and Alameda executives have testified that the opposite was true: Bankman-Fried directed a fraudulent crypto empire in which his hedge fund was secretly and purposely able to take money from unwitting customers, and he got caught when it was too late to stop it from crashing.

As the losses mounted, Alameda borrowed more and more money from FTX customers, peaking at $14 billion, which was used to pay for stadium naming rights, Super Bowl commercials, and — most crucial for the prosecution — investments in Bankman-Fried’s businesses. Sitting on Alameda’s balance sheet were so-called Sam Coins, sold by companies controlled or heavily influenced by Bankman-Fried. Probably the most important of the coins was FTT, the cryptocurrency of FTX, which gave holders a split of the company’s revenue. These were important because Alameda used the currencies, at a value that didn’t reflect reality, as collateral for other loans — which were then pumped into more of Bankman-Fried’s investments, businesses, and political donations. Keeping these values high was such a priority that, Ellison testified, Bankman-Fried would direct Alameda to buy more of them when their values fell. But this created a problem: If Alameda ever needed to sell these coins, it already had most of the market, and dumping them for others to buy would cause their value to drop precipitously, making the whole company’s value illusory.

Ellison’s testimony built to a crescendo just before 3 p.m. when U.S. Attorney for the Southern District of New York Damien Williams showed up to watch her on the stand. She guided the jury through internal Alameda spreadsheets and Google documents that she said showed Bankman-Fried had been directly involved in defrauding FTX’s customers and investors by plotting out the values of the coins in market crashes and had known exactly how much risk he was taking — some pieces of evidence had his edits and questions in the sidebars. These documents amounted to a kind of war-game scenario showing what would happen during a market catastrophe if markets fell by half and some investments went to zero. “Sam explicitly told me to calculate them,” Ellison said.

Despite the companies’ being more entangled than ever, Ellison testified that Bankman-Fried wanted “to separate Alameda and FTX optically” — even though it meant misleading customers further. Ellison said she knew this was wrong and had even raised the issue with Bankman-Fried, but their whole relationship was tangled and fraught. “The whole time we were dating, he was also my boss, which created a lot of awkward situations,” she said. While Ellison testified, Bankman-Fried’s mother, Barbara, appeared to cry, rubbing her eyes and covering her face.

The prosecution plans to keep Ellison on the stand through Wednesday, and she will likely be finished in the courtroom the following day.