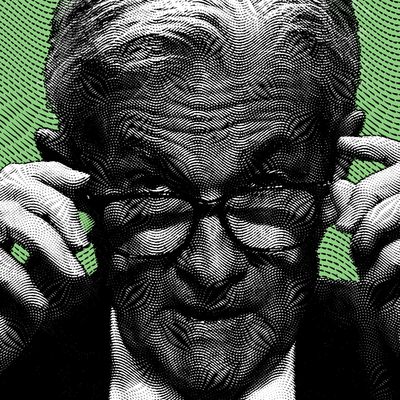

This week, the normally dour Federal Reserve chairman Jerome Powell started to sound kind of — could it be? — upbeat. The U.S. economy has made “a lot of progress” against rising prices, he said, after a crucial measure of inflation fell to 2.6 percent in May. (For those underwhelmed by this quote, it’s all relative; “a lot of progress” is as close to a rapturous statement as you could get from a Fed chair.) The upshot here is that with the inflation rate falling, the central bank is probably going to start cutting rates soon, maybe as early as September, which would lower borrowing costs and perhaps usher in a new era of cheaper money. Awesome, right? The stock market thought so — after Powell’s comments, it proceeded to soar above the all-time highs it had recently hit.

Mood — call it vibes, if you like — has taken on outsize importance since the post-pandemic inflation spike. Usually, the focus is on Americans’ mood as a whole. But Powell’s personal mood here is also important. The Fed chair is, of course, aware that Wall Street has been trying to figure out when rates are going to start coming down, just as he is aware of the flood of jobs and price data that inform his monetary decisions. (As of July 3, investors were betting there’s a 66 percent chance the Fed will cut during its September meeting — roughly nine percentage points higher than it was a week before.) When the Fed chair wants to tamp down on speculation, Powell comes out looking all grumpy and angry and makes speeches trying to discourage investors from getting ahead of themselves. That happened a lot last year, and unreasonably optimistic traders got burned. This time, though, Powell is taking the exact opposite approach. The vibes, finally, are on.

The change comes along with shifting conditions on the ground. In a broad sense, the economy is meaningfully slowing down. On Tuesday, one measure of business growth fell to its lowest since May 2020. Unemployment benefits have climbed for nine straight weeks, and revisions in jobs data show that openings have recently fallen to the lowest level in three years — far from the rosy picture of even a few months ago. ADP, the payroll company, reported a slowdown in private hiring, and also that most new jobs were in leisure and hospitality — a sign that the gains are low-paying, temporary gigs. That helps explain why the University of Michigan’s closely watched consumer-sentiment survey fell for the third straight month in June.

On Wednesday, the Fed released minutes of its June meeting, and it became clearer that the central bank’s officials were concerned about the employment rate deteriorating rapidly. “A number of participants remarked that monetary policy should stand ready to respond to unexpected economic weakness,” according to the minutes. “Several participants specifically emphasized that with the labor market normalizing, a further weakening of demand may now generate a larger unemployment response than in the recent past when lower demand for labor was felt relatively more through fewer job openings.” To translate: There are now fewer job openings to cushion layoffs, meaning that unemployment may rise higher than the current 4 percent rate. Should that happen, the Fed will be ready to cut rates to keep the economy from falling off a cliff.

We have been here before. At the end of 2023, the economic picture looked very similar, and Wall Street was certain that the central bank would soon loosen its monetary policy. Of course, that didn’t happen — inflation remained up, and the economy stayed too hot to lower rates Ever since Powell missed early warning signs for inflation in 2021, he has been very sensitive to making a similar misstep. Now, though, the Fed’s favorite inflation gauge has flattened, and the next headline inflation report is projected by the Cleveland Fed to fall. When you consider that the presidential election makes a cut in October or November untenable — Powell certainly doesn’t want to be accused of influencing this election — the choice narrows to cutting rates either slightly too soon (September) or possibly way too late (December). For Powell, that choice should be easy. He may have been too slow to counter the threat of inflation, but he doesn’t have to make the same mistake in the other direction.